Tao Xiang International Financial Lectures (No. 14): Business Operation and Management of Overseas Chinese Banks

2018-11-12 IMI First, President Li Biao explained the development of overseas Chinese banks. They focus on wholesale business, including like deposits, loans, international settlement, trade financing, capital transactions, RMB clearing and investment consultancy. Some engage in retail business. In the early stage, domestic business took up to 80% to 90%. In recent years, the banks expand and localize their overseas business steadily. Localization enables Chinese-funded enterprises to compete with local banks in a level playing field and raises higher requirements for the enterprises- “going global” and RMB internationalization.

Second, President Li Biao shared his business management and management in three countries and introduced Asian and European corporate cultures, especially differences in corporate governance and culture. For example, Chinese managers want obedient employees, but it may be unrealistic in Western countries because employees want challenging work and thinking patterns. President Li Biao shared vivid cases and challenges of corporate governance, cultural differences, business operation & management and financial supervision in Korea, Germany and the United Kingdom.

First, President Li Biao explained the development of overseas Chinese banks. They focus on wholesale business, including like deposits, loans, international settlement, trade financing, capital transactions, RMB clearing and investment consultancy. Some engage in retail business. In the early stage, domestic business took up to 80% to 90%. In recent years, the banks expand and localize their overseas business steadily. Localization enables Chinese-funded enterprises to compete with local banks in a level playing field and raises higher requirements for the enterprises- “going global” and RMB internationalization.

Second, President Li Biao shared his business management and management in three countries and introduced Asian and European corporate cultures, especially differences in corporate governance and culture. For example, Chinese managers want obedient employees, but it may be unrealistic in Western countries because employees want challenging work and thinking patterns. President Li Biao shared vivid cases and challenges of corporate governance, cultural differences, business operation & management and financial supervision in Korea, Germany and the United Kingdom.

President Li Biao put forward his views on Brexit and the future of Europe. He also reviewed and envisioned the internationalization of RMB. In addition, he mentioned the attitude of the British government and business community towards RMB internationalization and the promotion and practice of it on the part of Chinese banks in the UK. Up to now, the London branch of China Construction Bank has achieved a clearing volume of 30 trillion yuan. It has been the largest RMB clearing bank outside Asia for three consecutive years. London is the most developed financial center in the world. The extensive use of RMB and its internationalization will greatly enhance its status as an offshore financial hub. This is also what London anticipates the most at this time.

President Li Biao put forward his views on Brexit and the future of Europe. He also reviewed and envisioned the internationalization of RMB. In addition, he mentioned the attitude of the British government and business community towards RMB internationalization and the promotion and practice of it on the part of Chinese banks in the UK. Up to now, the London branch of China Construction Bank has achieved a clearing volume of 30 trillion yuan. It has been the largest RMB clearing bank outside Asia for three consecutive years. London is the most developed financial center in the world. The extensive use of RMB and its internationalization will greatly enhance its status as an offshore financial hub. This is also what London anticipates the most at this time.

In the Q&A session, President Li Biao answered students’ questions on future employment, knowledge structure and reserves, capacity development, career design, key points and difficulties in RMB internationalization and cross-cultural management. He also mentioned that overseas work experience would be a golden opportunity for personal development and one’s career. He hoped and encouraged more students to join the overseas talent team.

In the Q&A session, President Li Biao answered students’ questions on future employment, knowledge structure and reserves, capacity development, career design, key points and difficulties in RMB internationalization and cross-cultural management. He also mentioned that overseas work experience would be a golden opportunity for personal development and one’s career. He hoped and encouraged more students to join the overseas talent team.

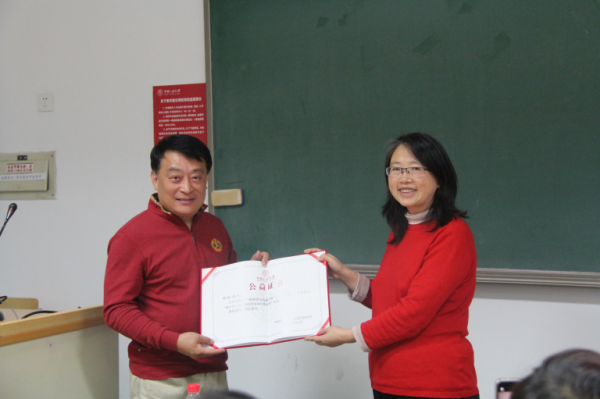

After this session, Tu Yonghong presented the honorary certificate of “Tao Xiang International Financial Lecture” to President Li Biao and sincerely invited President Li Biao to return to his alma mater to communicate with students. According to Professor Tu, “Tao Xiang International Financial Lecture” was jointly initiated by the School of Finance and the International Monetary Institute of Renmin University of China in response to the proposal of the graduates majoring in international finance at this university on the 10th anniversary of Professor Tao Xiang’s death.

The “Lecture” is held 12 times a year. Based on general finance and featuring case study, it covers a variety of sectors in international finance, including international economic policies, international financial organizations, international banking supervision, RMB internationalization, international banking development strategy, international financial risk management, cross-border mergers and acquisitions, international fund operations, derivatives trading, international financial leasing, multinational bank consortium, asset securitization and Internet finance. The “Lecture” hires elites and leaders in the international financial industry to teach professional knowledge, aiming to contribute to Renmin University of China’s cultivation of talent with solid theoretical basis and superb ability to manage international finance in the 21st century.

After this session, Tu Yonghong presented the honorary certificate of “Tao Xiang International Financial Lecture” to President Li Biao and sincerely invited President Li Biao to return to his alma mater to communicate with students. According to Professor Tu, “Tao Xiang International Financial Lecture” was jointly initiated by the School of Finance and the International Monetary Institute of Renmin University of China in response to the proposal of the graduates majoring in international finance at this university on the 10th anniversary of Professor Tao Xiang’s death.

The “Lecture” is held 12 times a year. Based on general finance and featuring case study, it covers a variety of sectors in international finance, including international economic policies, international financial organizations, international banking supervision, RMB internationalization, international banking development strategy, international financial risk management, cross-border mergers and acquisitions, international fund operations, derivatives trading, international financial leasing, multinational bank consortium, asset securitization and Internet finance. The “Lecture” hires elites and leaders in the international financial industry to teach professional knowledge, aiming to contribute to Renmin University of China’s cultivation of talent with solid theoretical basis and superb ability to manage international finance in the 21st century.