Hong Hao: Markets in Crisis

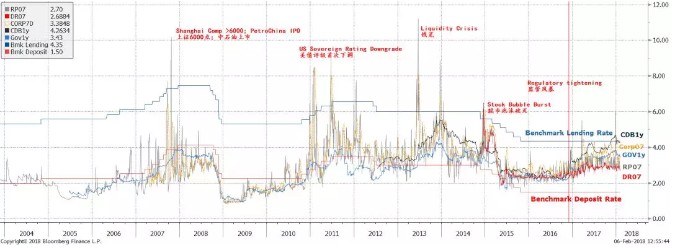

2018-03-12 IMI Surging interest rates due to China’s deleverage campaign portends market risks.In our 2018 outlook report titled “View from the Peak” on 4 December 2017, we discussed how China’s deleveraging campaign had triggered a general rise in market interest rates in the domestic Chinese bond market. Indeed, the sell-off of bonds in November and December at times has been epic. And for the first time in history, the CDB one-year yield surged above the one-year benchmark lending rate.

Such occurrences tended to herald market crises in the past, as we wrote in our 2018 outlook report (Exhibit 2). In the same 2018 outlook report “View from the Peak”, we foresaw an investment style change sometime during the first quarter, and posited that the market would look very different before and after the first quarter.

Exhibit 2: Surging Chinese bond yields above benchmark lending rate portended market crisis in the past.

Surging interest rates due to China’s deleverage campaign portends market risks.In our 2018 outlook report titled “View from the Peak” on 4 December 2017, we discussed how China’s deleveraging campaign had triggered a general rise in market interest rates in the domestic Chinese bond market. Indeed, the sell-off of bonds in November and December at times has been epic. And for the first time in history, the CDB one-year yield surged above the one-year benchmark lending rate.

Such occurrences tended to herald market crises in the past, as we wrote in our 2018 outlook report (Exhibit 2). In the same 2018 outlook report “View from the Peak”, we foresaw an investment style change sometime during the first quarter, and posited that the market would look very different before and after the first quarter.

Exhibit 2: Surging Chinese bond yields above benchmark lending rate portended market crisis in the past.

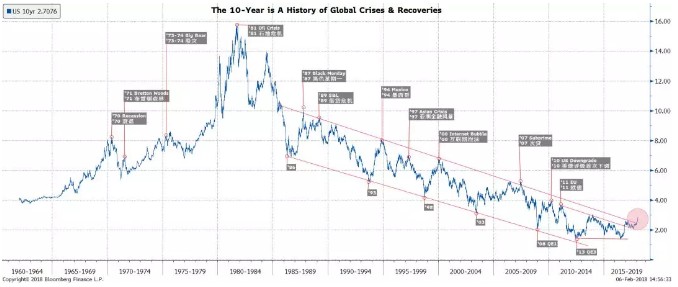

Surging long yield in the US also portends market risks. We believe that this latent development has been largely overlooked by pundits. Of course, the surging US ten-year yield is an easy candidate to blame. After all, it has pierced its long-term downward channel. And every time it happened, somewhere in the world there was a market crisis (Exhibit 3). And this time there is no exception. Surging interest rates in both the US and China seem to hint at a more systemic risk at play.

Exhibit 3: Whenever US 10yr yield pierced its long-term downward channel historically, a market crisis broke out.

Surging long yield in the US also portends market risks. We believe that this latent development has been largely overlooked by pundits. Of course, the surging US ten-year yield is an easy candidate to blame. After all, it has pierced its long-term downward channel. And every time it happened, somewhere in the world there was a market crisis (Exhibit 3). And this time there is no exception. Surging interest rates in both the US and China seem to hint at a more systemic risk at play.

Exhibit 3: Whenever US 10yr yield pierced its long-term downward channel historically, a market crisis broke out.

China’s pro-forma annual interest burden can potentially outweigh its incremental nominal GDP; capital efficiency could be declining. The average interest rate on China’s financing is estimated to be ~7%. At an M2 of RMB 168 trillion, China’s pro-forma interest burden should be around RMB 12 trillion. This is compared with RMB 8-9 trillion incremental nominal GDP added annually, calculated at 10% nominal growth on RMB 82 trillion GDP in 2017. That is, China’s annual pro-forma interest burden can be higher than its nominal GDP growth, due to the significant debt burden. Please note that these are very rough estimates.

As such, China’s marginal capital efficiency, although may be improving due to the success of supply-side reform and SOE reform, must be rising slower than its interest rate burden. Meanwhile, credit per unit of GDP has surged, suggesting that capital efficiency could be outright declining. Our rough estimates have demonstrated the urgency of the deleveraging campaign.

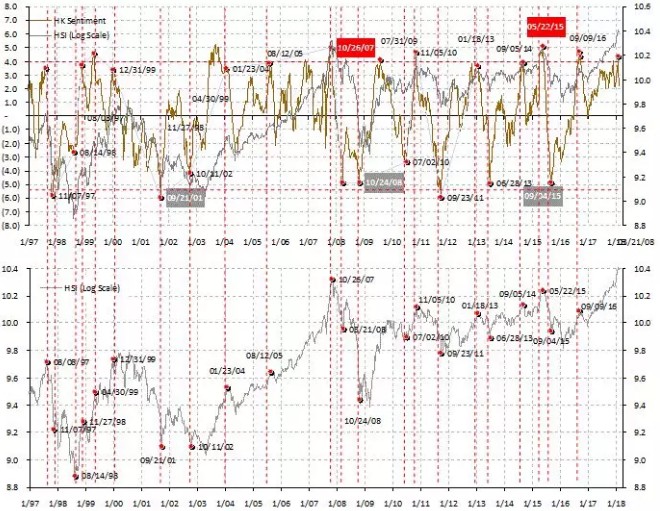

As Keynes posits in his magnum opus “General Theory”, it is because of marginal capital efficiency rising significantly slower than interest rate that will trigger a market crisis. This is either because marginal capital efficiency is collapsing, or interest rate is rising too fast, or both,. Not just because of rising interest rates. At the current juncture, with the global market correction unravelling, the Hang Seng’s return is still at a similar level that coincided with market peaks in the past. Keynes’s words some eighty years ago appear ever so prescient (Exhibit 4).

Exhibit 4: Overseas retail sentiment remains elevated; HSI return is at similar levels prior to previous market corrections

China’s pro-forma annual interest burden can potentially outweigh its incremental nominal GDP; capital efficiency could be declining. The average interest rate on China’s financing is estimated to be ~7%. At an M2 of RMB 168 trillion, China’s pro-forma interest burden should be around RMB 12 trillion. This is compared with RMB 8-9 trillion incremental nominal GDP added annually, calculated at 10% nominal growth on RMB 82 trillion GDP in 2017. That is, China’s annual pro-forma interest burden can be higher than its nominal GDP growth, due to the significant debt burden. Please note that these are very rough estimates.

As such, China’s marginal capital efficiency, although may be improving due to the success of supply-side reform and SOE reform, must be rising slower than its interest rate burden. Meanwhile, credit per unit of GDP has surged, suggesting that capital efficiency could be outright declining. Our rough estimates have demonstrated the urgency of the deleveraging campaign.

As Keynes posits in his magnum opus “General Theory”, it is because of marginal capital efficiency rising significantly slower than interest rate that will trigger a market crisis. This is either because marginal capital efficiency is collapsing, or interest rate is rising too fast, or both,. Not just because of rising interest rates. At the current juncture, with the global market correction unravelling, the Hang Seng’s return is still at a similar level that coincided with market peaks in the past. Keynes’s words some eighty years ago appear ever so prescient (Exhibit 4).

Exhibit 4: Overseas retail sentiment remains elevated; HSI return is at similar levels prior to previous market corrections