Wonho Yeon: U.S.-China Technological Rivalry and Its Implications for Korea

2020-12-07 IMIThis article appeared in KIEP World Economy Brief on November 26, 2020.

Wonho Yeon, Associate Research Fellow, Chinese Economy and Trade Team.

I. Introduction

Recent developments in advanced technology are changing the concept of hegemonic competition. Classical theories in politics and history have explained that the hegemonic power always declines since its economic power gradually fell as it spends excessively on strengthening military power to maintain hegemony. However, the key feature of technologies in the 4th Industrial Revolution is dual-use. Emerging technologies such as 5G, AI, big data, robotics, aerospace, supercomputers, and quantum computer-related technologies can be used for both civilian and military purposes. The more you invest in the development of advanced technologies, the closer you will be to economic and military hegemony. Therefore, it is no wonder that the U.S. harbors great concerns facing the rise of China in these advanced technologies.

China’s rise in science and technology did not happen overnight. China established the Chinese Academy of Science (CAS) in November 1949, only a month after the People’s Republic of China was founded, and devoted its efforts to the development of science and technology. Considering that the Korea Advanced Institute of Science and Technology (KIST) was established in 1966,1 we can see how quickly China realized the importance of science and technology. In the early days of its founding, China accelerated the development of basic science, defense science, and aerospace technologies for the development of nuclear bombs, hydrogen bombs, and satellites (or intercontinental ballistic missiles) under the goal of “Two Bombs, One Satellite.” Especially after China’s reform and opening, as economic construction became the central task of the country, science and technology have been perceived as “productive power.”

The recent Xi Jinping government continues to place emphasis on science and technology, and aims to build China as a world-leading “Innovative Powerhouse.” This is also reflected in various statistics.

II. The Rise of China

China is currently the world’s largest country in terms of the size of the economy (PPP based GDP), trade volume, the number of R&D researchers, and international patent applications. Above all, to understand the technology gap between the US and China, this study examined the R&D Input, R&D Output, and innovation productivity which is the relationship between R&D Input and R&D Output.

Regarding R&D Input, R&D expenditures in China have been growing rapidly. Chinese government’s immediate goal is to increase R&D expenditure to 2.5% of GDP. The total number of R&D researchers has already surpassed the United States since 2011, becoming the world’s number one country. Some experts say the number of researchers per population matters. However, science and technology are public goods, which typically create positive externalities. When someone succeeds in development, it eventually spreads out and everyone will share it. Therefore, the absolute number of re- searchers is more important. Regarding R&D Output, we looked at the number of articles published in Science Citation Indexed (SCI) journals and the number of international patent (PCT) applications. In both aspects, China has recently surpassed the United States to become the world’s number one country.

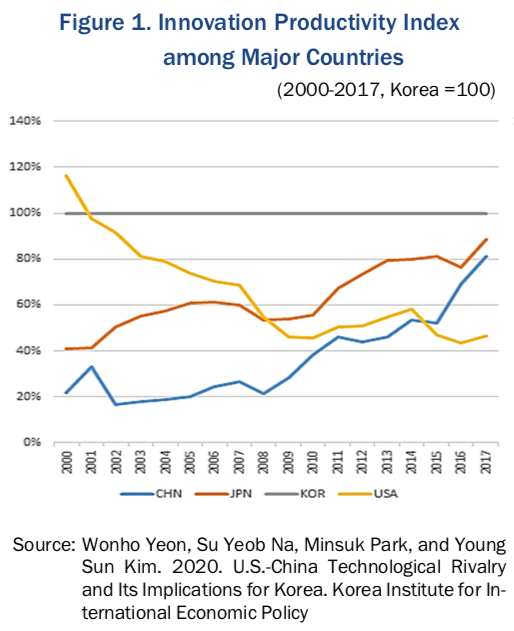

More importantly, to estimate and compare the innovation productivity of the U.S. and that of China, this study constructs a structural estimation model in which each country produces international patents using R&D expenditures and R&D researchers. Empirical results have presented novel findings indicating that China’s innovation productivity has surpassed that of the U.S. since 2015 (Figure 1). In other words, since 2015, China has been filing more international patents than the U.S. with fewer researchers and less R&D expenditure. It is no coincidence that there has been a series of aggressive external strategies implemented around the same time: China’s “Belt and Road Initiative (2013),” proposal of “Made in China 2025 (2015),” “New Type of Great Power Relations (2013),” and THAAD retaliation against Korea (2016). This is one of the major reasons why the U.S. is wary of China’s rise.

III. Innovation vs. Invention: Are There Any Weaknesses in China’s Rise?

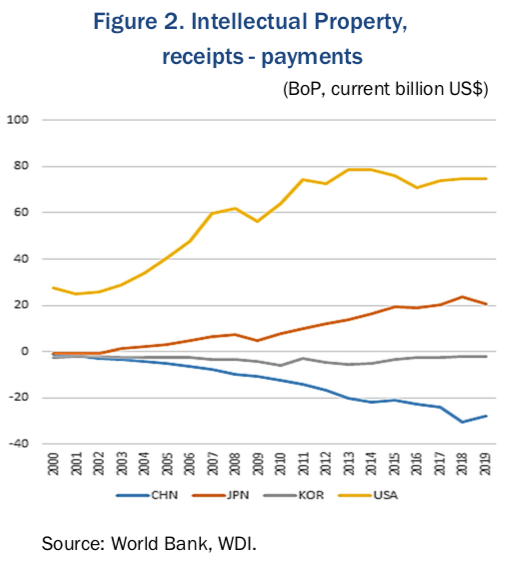

The intellectual property balance graph immediately reveals China’s weaknesses (Figure 2). While the U.S. has the world’s largest intellectual property surplus and keeps expanding it, China’s intellectual property deficit has been growing every year.

Given the two contradictory facts – China’s high innovation productivity and low intellectual property balance – we can conclude that China is strong at “innovation” but weak at “invention.” In other words, China’s state-led science and technology development strategy is quite effective in producing applied technologies using existing technologies, but it does not seem effective in securing fundamental technologies. The rise of China so far has been highly dependent on foreign core technologies, materials, parts, and equipment. China’s national strategies like “Made in China 2025” and “The Thousand Talents Plan” are not showing their strength but weakness that they are trying to overcome. Knowing this, the U.S. eventually began to target this vulnerability. This is the U.S.’ Tech-Decoupling strategy.

IV. U.S. Pressure on China

The U.S. views China as not adhering to the principles of market-based trade and investment systems, rather utilizing a form of state-led mercantilism following its accession to the WTO in 2001. Based on the perception that China has used illegally and unfairly acquired U.S. technologies to undermine the national security and foreign policy interests of the U.S., the U.S. is strengthening trade and investment sanctions against China. In specific, the U.S. has been utilizing the Export Control Reform Act (ECRA), Section 889 of the 2019 National Defense Authority Act, and the Foreign Investment Risk Review Modernization Act (FIRRMA).

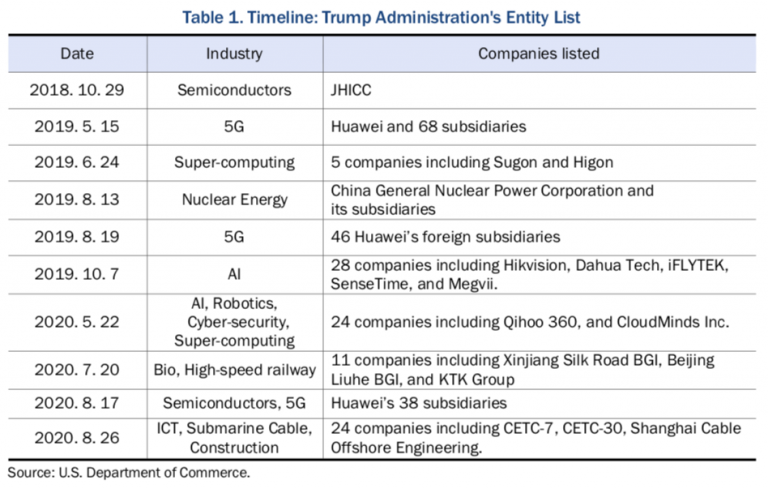

Regarding the list of export controls related to China (Table 1), it can be seen that even though the two countries signed the Phase One Trade Agreement in January 2020, the U.S.’ sanctions against Chinese tech companies have expanded, not stopped. In May, July, and August 2020, Chinese AI, robotics, cyber-security, super- computing, bio, high-speed railway, semiconductors, and 5G-related companies continued to be added on the U.S. export control list.

On August 13, 2020, the second-stage measures of the 2019 National Defense Authorization Act Section 889 were also implemented. The first step, implemented a year ago on August 13, 2019, was to prevent U.S. government agencies from procuring products and services from Huawei, ZTE, Dahua Technology, and Hytera. The second step goes further which prevents U.S. government agencies from entering into contracts even with companies that use these five companies’ products and services.

Furthermore, the U.S. Department of Commerce revised its Export Administration Regulations (EAR) twice in May and August 2020 to significantly tighten its sanctions to prevent Huawei from receiving any kind of semiconductors without permission from the U.S. government.

Regarding the investment regulations, the Foreign Investment Risk Review Modernization Act of 2018 (FIRRMA) strengthened CFIUS’ (the Committee on Foreign Investment in the United States) authority to deliberate on non- dominant investments in relation to critical technologies, critical infrastructure, and sensitive personal data. Accordingly, there have been cases in which the U.S. regulates Chinese companies’ investments and operations in the U.S. even though they are not directly related to M&A transactions. For example, the U.S. government ordered Beijing Shiji Information Tech to sell StayNTouch in March 2020 for collecting personal and financial information that might pose a threat to national security. In April 2020, China Telecom was not allowed to do business in the U.S., and in August 2020, an administrative order was issued to ban TikTok and WeChat’s business in the U.S. based on the accusation that all these Chinese companies collect sensitive personal data of U.S. citizens.

V. China’s Response: The New Long March and Dual-Circulation

In return, China is responding to the U.S. sanctions with the new “Long March” strategy rather than a tit-for-tat strategy. In May 2019, when the U.S.-China trade war was at its height, President Xi Jinping visited Jiangxi Province, where the Red Army and Mao Zedong took the first steps of the 1934 Long March. In his speech, Xi Jinping underlined the legacy of Long March and declared, “We are now embarking on a new Long March, and we have to start all over again.” President Xi’s words and actions clearly show how China sees the conflict between the U.S. and China. China is not hungry for short-term results but for achieving its long-term goals. In other words, China has been setting long-term aims and responding to the U.S. sanctions by improving institutional arrangements, refining industrial policies, and developing its own technologies.

In May and June 2020, Chinese leaders including President Xi started to refer to a “dual-circulation” strategy that is a new development master plan to mutually promote both internal and external circulation of the economy. This development strategy also can be understood as an ex- tension of the Long March strategy. Dual-circulation emphasizes cutting its dependence on overseas markets and technology in its long-term development. That is to say, China decided to establish a self-reliant supply chain within China encountering intensifying friction with the U.S.

China’s “New Infrastructure Plan” that was announced at the National People’s Congress in May 2020 is directly connected to the establishment of its own industrial chain in China. Many people believe that China’s New Infrastructure Plan was created to overcome the economic recession owing to COVID-19. However, China’s discussion on its New Infrastructure Plan was first raised at the Central Economic Work Conference in December 2018, long before the COVID-19 pandemic, to cope with the trade friction with the U.S. and aggravated backlash against Chinese high-tech companies such as Huawei.

The New Infrastructure Plan is largely divided into three parts: 1 information-based infrastructure (5G, Internet of Things), 2 converged infrastructure (upgrading the existing infrastructure using AI), and 3 innovative infrastructure (developing fundamental science and technology). China Center for Information Industry Development (CCID) predicts that the Chinese government will invest $1.4 trillion in new infrastructure investments by 2025. This new infrastructure investment is not only done by the central government, but also by local governments and private sectors such as high-tech companies including Huawei, Hikvision, Alibaba will also participate. These include autonomous vehicles, smart factories, and 5G net- work equipment for large-scale surveillance, AI software development, and data center construction.

VI. Implications and Conclusion

An international environment without conflict between the U.S. and China is the best for Korea in terms of both national security and economic growth. This is because South Korea has to strengthen cooperation with China based on a solid ROK-U.S. alliance for security and economic development. The more the conflict between the U.S. and China intensifies, the fewer policy choices and room for profits are left to Korea.

However, the conflict between China and the U.S. is expected to be prolonged due to several reasons including China’s unfair practices, bipartisan anti-Chinese sentiment in the U.S., the institutionalization of tensions, China’s strong response to the U.S. measures, and most importantly the fact that nature of the U.S.-China conflict is structural competition for technological supremacy.

In the short run, it seems important for Korea to pay attention to the negative impacts that might occur due to the expansion of U.S. sanctions against China, rather than expecting the benefits that might be brought by the U.S. sanctions to delay China’s technological progress. In particular, it is important for Korean companies not to be subject to secondary sanctions by the U.S. measures. Due to the amendment of the U.S. government’s Export Administration Regulations (EAR), which was done twice in 2020, TSMC, a Taiwanese semiconductor foundry suspended new transactions with Huawei in May and the Korean semiconductor industry gave up supplying chips to Huawei in September 2020.

Recently, there are signs of the U.S. sanctions against China even further expanding the scope to financial sectors. On May 13, 2020, the White House blocked the federal retirement fund from investing in Chinese stocks for national security reasons. On May 20, the Senate unanimously passed a bill prohibiting Chinese companies which do not comply with U.S. audit regulations from listing in the U.S. stock market. Currently, the number of foreign companies affected by the law is 224, of which 213 are Chinese companies. Finally, when the Chinese government enforced the Hong Kong National Security Law2 in June, the U.S. government enacted the Hong Kong Autonomy Act in July and revoked Hong Kong’s special status, which also might have an effect as a financial sanction. Considering Hong Kong has been serving as a gateway for Chinese mainland firms to foreign capital, if Hong Kong’s special status is completely deprived, it will be much more difficult for Chinese companies to finance foreign capital.

Ironically, increasing pressure from the U.S. is expected to further strengthen China’s R&D capabilities in advanced technology and accelerate its competitiveness in emerging industries. With the onset of the 4th Industrial Revolution, China is rapidly closing the quality gap and technology gap in major industries where Korea has a comparative advantage. If Korea does not adequately respond to changes, it may be difficult to maintain a comparative advantage over China. Thus, now that U.S.-China tensions are intensifying, Korea is facing a pivotal moment in determining the future path of its economy.

Moreover, the greater the conflict rises between the U.S. and China, the likelihood increases of pressure being applied on Korea to choose between one or the other. However, as the recent China-Japan relations imply, if you have what the other country needs, it is possible to secure strategic autonomy to realize national interests. Facing the 4th Industrial Revolution, “what other country needs” is “technological power.” We must keep in mind that a cooperative partnership with others and respect from other countries can only be guaranteed when Korea maintains global competitiveness in innovation capacity.

References

Wonho Yeon, Su Yeob Na, Minsuk Park, and Young Sun Kim. 2020. U.S.-China Technological Rivalry and Its Implications for Korea[in Korean]. Korea Institute for International Economic Policy.

Wonho Yeon. 2020. “How China Sees the U.S.- China Technological Rivalry.” 2021 Economic Trends and Keywords[in Korean]. book21.