Herbert Poenisch: Contribution by Chinese Banks to RMB Internationalization

2016-09-19 IMI Looking at the cross-border offshore RMB business, Chinese banks reported liabilities of USD 436bn, matched by claims of only USD 58 bn. At large this reflects the deposits of non-Chinese residents with banks outside China which in turn deposited with banks on the mainland. These offshore RMB originate from Chinese imports or FDI paid in RMB, deposited in other banks and channeled back to Chinese banks. But why are assets in RMB so low and liabilities in RMB declining compared to the USD business?

While the data are welcome, they give rise to more questions. How do they square with the data provided by SAFE, the China Development Bank (CDB) and Import-Export Bank of China alone who claimed to have outstanding loans to the rest of the world of USD 700 bn at the end of 2014? Bank of China (BoC) and Industrial and Commercial Bank of China (ICBC) reported trade financing claims of over USD 100bn each already in 2010. Where are RMB deposited other than Hong Kong, which published RMB deposits in its territory of only USD 150bn? How does the offshore listing of Chinese banks affect their overall external claims and liabilities?

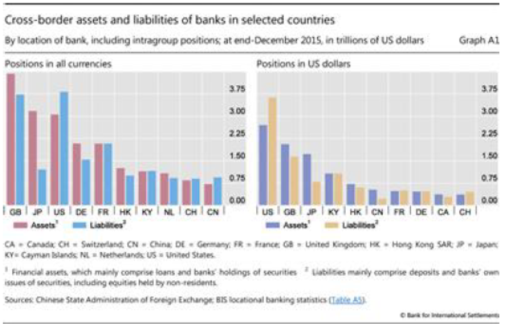

At the end of 2015 the funding Chinese banks’ cross-border business at USD 944bn exceeds the total cross-border assets of USD 722bn by USD 222bn (see left hand graph above). On the contrary, banks in Hong Kong which include subsidiaries of Chinese banks had cross-border claims of USD 1254bn exceeding their liabilities of USD 1004bn, thus using domestic currency to fund cross-border lending. The direction of lending of banks residing in Hong Kong has also changed since the Global Financial Crisis from lending the bulk to the rest of the world to lending to emerging Asia. Chinese banks could be part of this picture.

Chinese banks have been asked by Chinese leaders to support the ‘going abroad of Chinese enterprises’, ‘the one belt one road’ strategy, and the ‘internationalization of the RMB’. In addition the policy banks pursue their objectives, such as trade financing by the Import-Export Bank of China and project financing by the CDB.

While Chinese banks have set up branches and subsidiaries in many EME, their funding at the outset might be intergroup financing from the head office (included in the above graph) as local funding has not yet been sufficiently developed.

What activities have Chinese banks financed in their cross-border business? First and foremost, Chinese foreign trade, secondly, Chinese foreign direct investment and thirdly, mergers and acquisitions abroad, involving Chinese companies.

It seems that Chinese banks, financing Chinese trade and FDI prefer to use USD over RMB. A BIS study on trade finance states that ‘in China, trade finance loans are denominated twice as often in US dollars than in RMB’. For example, a Chinese exporter is being prefinanced by a Chinese bank in USD which shows a USD claim on a foreign importer of Chinese goods. Similarly, Chinese projects in EME financed by the China Development Bank produce a claim in USD rather than RMB.

What might be the reasons for this development out of step of a greater push for internationalization of RMB?

Chinese state owned banks play a double role, they are an instrument of government policy but at the same time they are encouraged to work on commercial lines, make profits, or at least avoid losses.

The first main reason is the gradual weakening of the RMB versus the USD (as witnessed in recent years), having one’s assets in a strong currency such as the USD while building up liabilities in depreciating RMB would make sense.

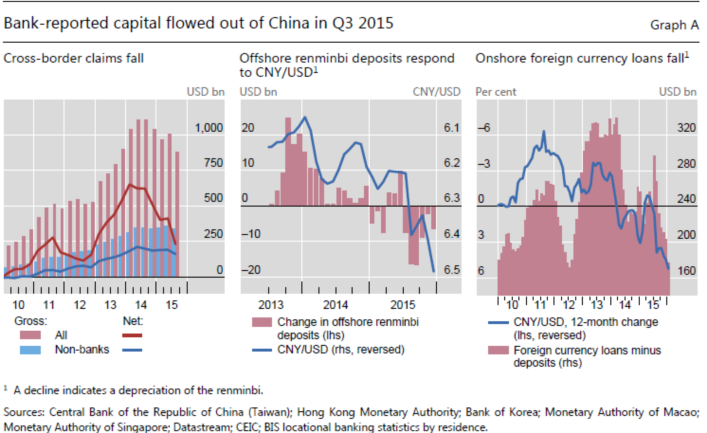

The second reason, linked to the RMB/USD exchange rate are the capital outflows from China, on the USD component as well as on the RMB component (see graph below).

Looking at the cross-border offshore RMB business, Chinese banks reported liabilities of USD 436bn, matched by claims of only USD 58 bn. At large this reflects the deposits of non-Chinese residents with banks outside China which in turn deposited with banks on the mainland. These offshore RMB originate from Chinese imports or FDI paid in RMB, deposited in other banks and channeled back to Chinese banks. But why are assets in RMB so low and liabilities in RMB declining compared to the USD business?

While the data are welcome, they give rise to more questions. How do they square with the data provided by SAFE, the China Development Bank (CDB) and Import-Export Bank of China alone who claimed to have outstanding loans to the rest of the world of USD 700 bn at the end of 2014? Bank of China (BoC) and Industrial and Commercial Bank of China (ICBC) reported trade financing claims of over USD 100bn each already in 2010. Where are RMB deposited other than Hong Kong, which published RMB deposits in its territory of only USD 150bn? How does the offshore listing of Chinese banks affect their overall external claims and liabilities?

At the end of 2015 the funding Chinese banks’ cross-border business at USD 944bn exceeds the total cross-border assets of USD 722bn by USD 222bn (see left hand graph above). On the contrary, banks in Hong Kong which include subsidiaries of Chinese banks had cross-border claims of USD 1254bn exceeding their liabilities of USD 1004bn, thus using domestic currency to fund cross-border lending. The direction of lending of banks residing in Hong Kong has also changed since the Global Financial Crisis from lending the bulk to the rest of the world to lending to emerging Asia. Chinese banks could be part of this picture.

Chinese banks have been asked by Chinese leaders to support the ‘going abroad of Chinese enterprises’, ‘the one belt one road’ strategy, and the ‘internationalization of the RMB’. In addition the policy banks pursue their objectives, such as trade financing by the Import-Export Bank of China and project financing by the CDB.

While Chinese banks have set up branches and subsidiaries in many EME, their funding at the outset might be intergroup financing from the head office (included in the above graph) as local funding has not yet been sufficiently developed.

What activities have Chinese banks financed in their cross-border business? First and foremost, Chinese foreign trade, secondly, Chinese foreign direct investment and thirdly, mergers and acquisitions abroad, involving Chinese companies.

It seems that Chinese banks, financing Chinese trade and FDI prefer to use USD over RMB. A BIS study on trade finance states that ‘in China, trade finance loans are denominated twice as often in US dollars than in RMB’. For example, a Chinese exporter is being prefinanced by a Chinese bank in USD which shows a USD claim on a foreign importer of Chinese goods. Similarly, Chinese projects in EME financed by the China Development Bank produce a claim in USD rather than RMB.

What might be the reasons for this development out of step of a greater push for internationalization of RMB?

Chinese state owned banks play a double role, they are an instrument of government policy but at the same time they are encouraged to work on commercial lines, make profits, or at least avoid losses.

The first main reason is the gradual weakening of the RMB versus the USD (as witnessed in recent years), having one’s assets in a strong currency such as the USD while building up liabilities in depreciating RMB would make sense.

The second reason, linked to the RMB/USD exchange rate are the capital outflows from China, on the USD component as well as on the RMB component (see graph below).

Foreign banks reported a reduction of USD deposits (left hand graph; which is a capital outflow for China) with banks in China since the end of 2013. Similarly, offshore RMB deposits with mainland banks declined markedly since mid-2015 (centre graph, also a capital outflow) closely related to the RMB/USD exchange rate.

The increase in cross-border USD dollar claims by Chinese banks supports the official ‘going out’ strategy but at the same time represents a capital outflow. If this strategy reflects a reduction in holding of USD assets this would fit into the strategy of reducing China’s dependence on the USD and as such would be commendable. If it is only a substitution between official holdings of USD assets to USD banking claims the net effect would not be achieved.

Concluding these short remarks on the first official data on cross border business by Chinese banks and the internationalization of RMB by Chinese banks, leads one to the conclusion, that Chinese banks are only a vehicle for this role. The final decision lies with the holders of offshore RMB, whether banks, firms or private individuals. After all, an international currency does not only offer denomination of trade, settlement of trade but also store of value. A lot needs to be done to make RMB a truly international currency.

Foreign banks reported a reduction of USD deposits (left hand graph; which is a capital outflow for China) with banks in China since the end of 2013. Similarly, offshore RMB deposits with mainland banks declined markedly since mid-2015 (centre graph, also a capital outflow) closely related to the RMB/USD exchange rate.

The increase in cross-border USD dollar claims by Chinese banks supports the official ‘going out’ strategy but at the same time represents a capital outflow. If this strategy reflects a reduction in holding of USD assets this would fit into the strategy of reducing China’s dependence on the USD and as such would be commendable. If it is only a substitution between official holdings of USD assets to USD banking claims the net effect would not be achieved.

Concluding these short remarks on the first official data on cross border business by Chinese banks and the internationalization of RMB by Chinese banks, leads one to the conclusion, that Chinese banks are only a vehicle for this role. The final decision lies with the holders of offshore RMB, whether banks, firms or private individuals. After all, an international currency does not only offer denomination of trade, settlement of trade but also store of value. A lot needs to be done to make RMB a truly international currency.