Steve H. Hanke: Crude Oil’s Relentless Price Climb

2018-07-23 IMI Just what forces kicked in to start crude’s relentless price climb and force the oil-gold price ratio to revert back to its mean? Well, at bargain basement prices, the quantity of crude demanded increased. And, on the supply side, the major oil companies slashed capital expenditures for drilling and exploration. The majors reined in their capital spending appetites by 40-50%. Indeed, now few mega projects are on the drawing boards. Not surprisingly, oil and gas field discoveries are at a 60-year low. So, the disturbance of the homeostatis set in motion supply-demand forces to restore the status quo.

To understand the adjustment, consider my old Professor Ken Boulding’s Bathtub Theorem: If production (the flow from the faucet) is less than consumption (the flow down the drain), it is clear that the oil in inventory (the economic bathtub) must fall. That’s just what’s been going on as the oil-gold price ratio re-establishes itself and reverts towards its homeostatis.

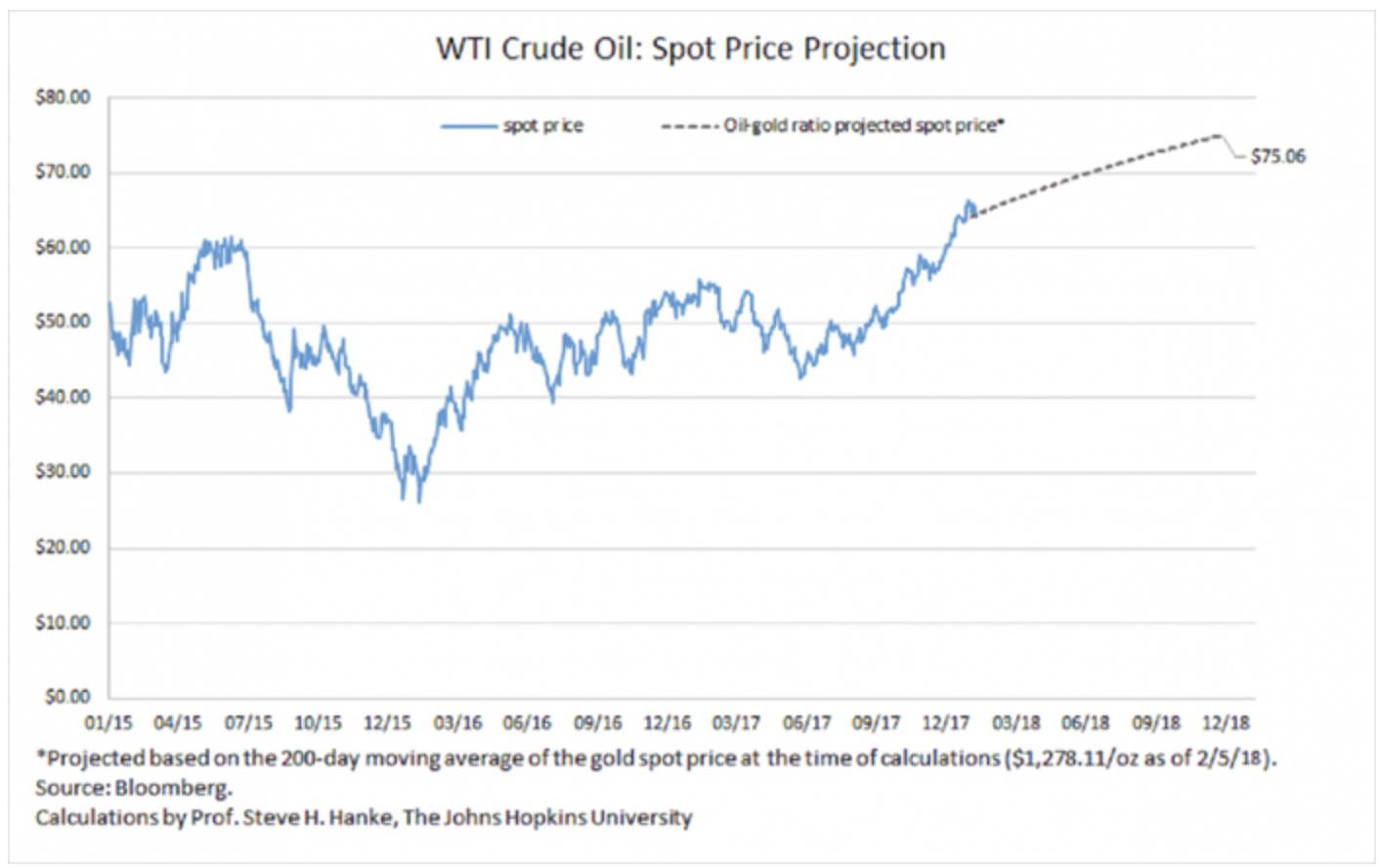

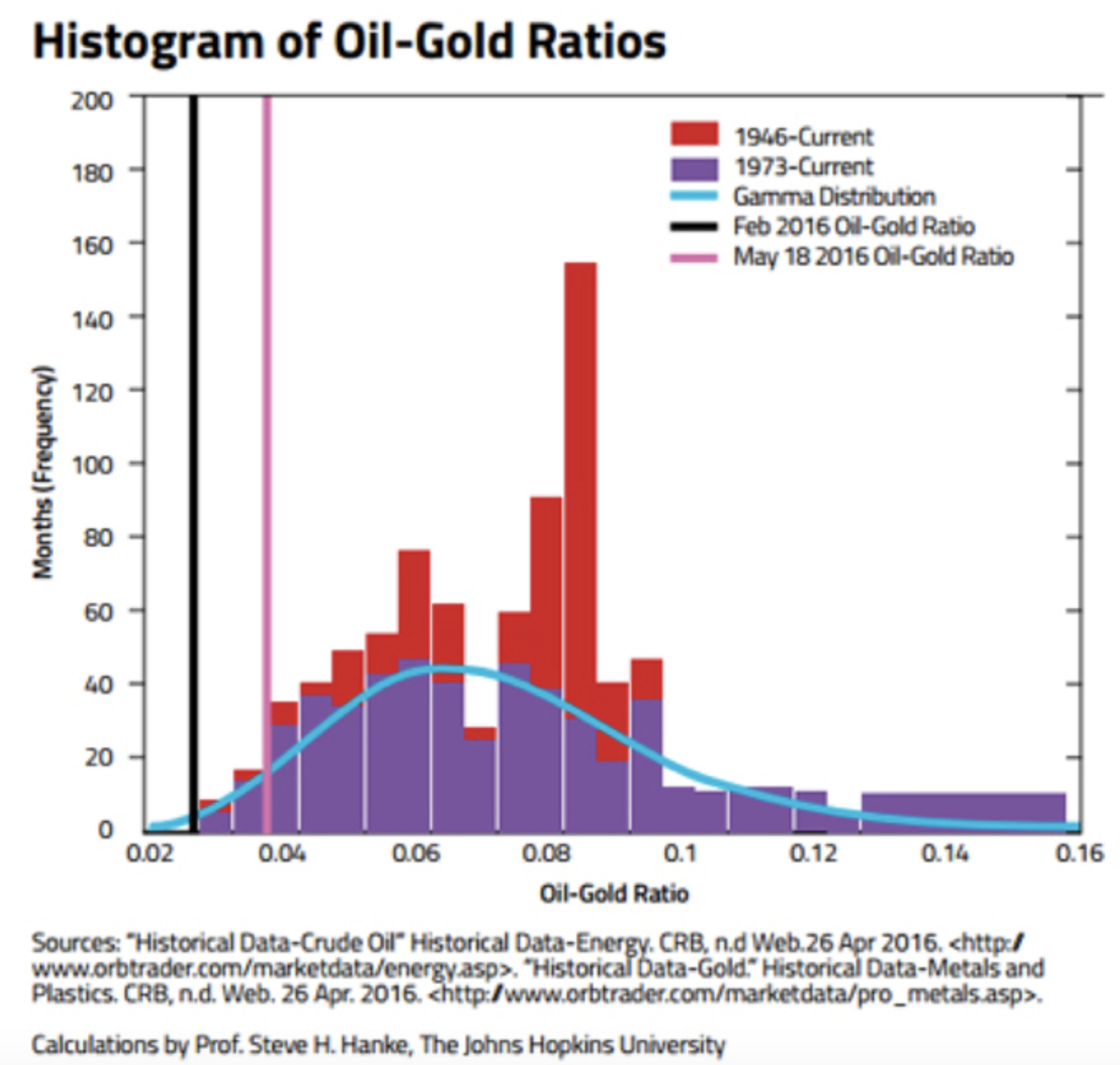

But, how long will it take for the ratio to mean revert? My calculations (based on post-1972 data) are that a 50 percent reversion of the ratio will occur in 12.3 months. This translates into a price per barrel of WTI of $75 by January 2019. It is worth noting that, like Jastram, I find that oil prices have reverted to the long-run price of gold, rather than the price of gold reverting to that of oil. So, the oil-gold price ratio primarily reverts to its mean via changes in the price of oil.

At present, the oil-gold price ratio is 0.05581 ($69.59/$1247=0.05581), suggesting that oil’s relentless bull market has a ways to run, as the chart below shows.

Just what forces kicked in to start crude’s relentless price climb and force the oil-gold price ratio to revert back to its mean? Well, at bargain basement prices, the quantity of crude demanded increased. And, on the supply side, the major oil companies slashed capital expenditures for drilling and exploration. The majors reined in their capital spending appetites by 40-50%. Indeed, now few mega projects are on the drawing boards. Not surprisingly, oil and gas field discoveries are at a 60-year low. So, the disturbance of the homeostatis set in motion supply-demand forces to restore the status quo.

To understand the adjustment, consider my old Professor Ken Boulding’s Bathtub Theorem: If production (the flow from the faucet) is less than consumption (the flow down the drain), it is clear that the oil in inventory (the economic bathtub) must fall. That’s just what’s been going on as the oil-gold price ratio re-establishes itself and reverts towards its homeostatis.

But, how long will it take for the ratio to mean revert? My calculations (based on post-1972 data) are that a 50 percent reversion of the ratio will occur in 12.3 months. This translates into a price per barrel of WTI of $75 by January 2019. It is worth noting that, like Jastram, I find that oil prices have reverted to the long-run price of gold, rather than the price of gold reverting to that of oil. So, the oil-gold price ratio primarily reverts to its mean via changes in the price of oil.

At present, the oil-gold price ratio is 0.05581 ($69.59/$1247=0.05581), suggesting that oil’s relentless bull market has a ways to run, as the chart below shows.