Sumedh Deorukhkar, Dong Jinyue and Xia Le: Reignited China-US Trade War and its Implication on Global Value Chain

2018-06-11 IMI

Reignited trade war risk between China and the US

Fears of a trade-war between the US and China have been escalating recently as the White House announced on May 29th that it will move forward with its threat to apply an additional 25% punitive tariff rate on USD 50 billion in goods imported from China that “contain industrially significant technology". The move came on the heels of a joint statement by the US and Chinese trade delegations in which both sides agreed to put the punitive trade measures “on hold” and solve bilateral disputes via negotiation.

The capricious attitude of US administration regarding these trade issues, which might stem from deep-rooted division within President Trump’s trade policy team, could intensify confrontation between the two sides in the near future. This could, in turn, cause one or both sides to launch certain punitive measures against each other.

Fortunately, China has thus far refrained from announcing any retaliation measures against the US new tariff move. At the same time, China’s domestic propaganda continues to claim that it is in China’s own interest to lower import tariff and further open domestic market. That being said, China still anticipates to solve the bilateral trade dispute through negotiations.

Evaluate the impact of US new punitive tariff from a perspective of global value chain

We attempt to evaluate the impact of the newly announced 25% tariff on Chinese imports of USD 50 billion from the perspective of global value chain. Indeed, deepening globalization over the past several decades has already formed a complete supply chain centering on China through which all the actions affecting Chinese exports could be quickly spilled over to other economies in the value chain.

Although Chinese enterprises have made important progress on climbing up along the global value chain, a considerable share of contents in these high-tech Chinese exports is still made outside China. For example, China is highly dependent on electronic chips produced in Japan, South Korea, Taiwan and even the US when they produce and export mobile phones and electronic home appliance to other countries.

However, the flows of goods within these global production chains are not always reflected in conventional measures of international trade. Towards this end, we use the information from the joint OECD – WTO Trade in Value-Added (TiVA) database, which decomposes the value of final goods or services into the value added by each country. By definition, “trade in value added” (TiVA) is a statistical approach that estimates the sources (by country and industry) of the value that is added in the production of goods and services for exports.

Our strategy of estimation goes in two steps. First, by applying the elasticity estimates provided by the World Bank, we estimate to what extent this 25% additional tariff will affect China’s exports. Indeed, the US administration announced a list of Chinese exports (1,333 products) with a total value of around USD 50 billion on May 20th on which they threatened to impose punitive tariff tax. But the US administration decided to put it on hold after the Chinese delegation visited the US and announced a joint statement.

After checking the details of the previous list, we expect that the new product list to be released on June 15th shouldn’t make a big difference with the previous one since both of them focus on Chinese exports with high-tech contents and those related to the program of “Made in China 2025”.

We then match these products to the HS8 categories and find their corresponding elasticity of each category from the World Bank database. As such, we estimate that an additional 25% tariff targeting on USD 50 billion Chinese imports will reduce Chinese exports to the US by USD 11.1 billion.

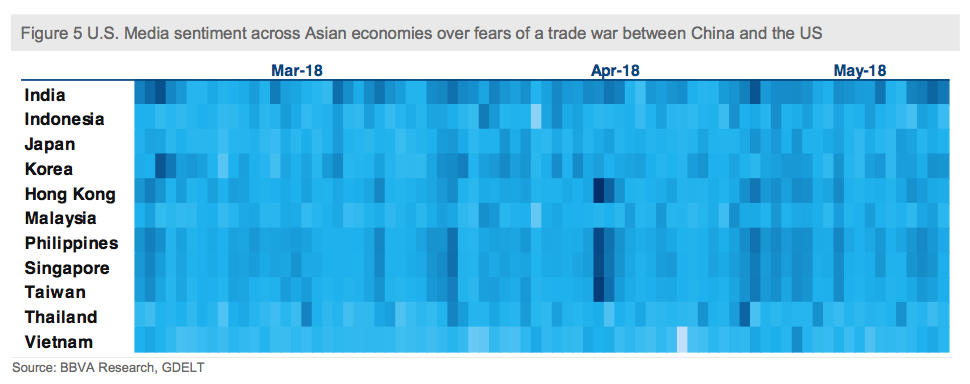

In the second step, we classified Trump’s list of 1,333 products into several groups according to the classification of TiVA. We found that 48.8% of the listed products are machinery and equipment, 32.5% are electronic machinery and apparatus, 15.2% are electronic machinery and apparatus, among others. (Figure 1) Then, we calculate the percentage of each country that contributes to the final products in these categories. We finally calculated the weighted average of each country’s contribution to each category of the listed final products.

Based on our decomposition, we find that among the affected USD 11.1 billion of China’s exports to the US, China actually only accounts for around 59.9% (equivalent to USD 6.65 billion) from the value-added perspective. Among the other countries in the global value chain which take around 27.7%, 8.5% (USD 0.95 billion) goes to the EU, 6.8% (USD 0.76 billion) goes to Japan, while the US itself takes around 3.4% (USD 0.37 billion). ASEAN countries and Korea account for 3.2% (USD 0.36 billion) respectively. (Figure 2)

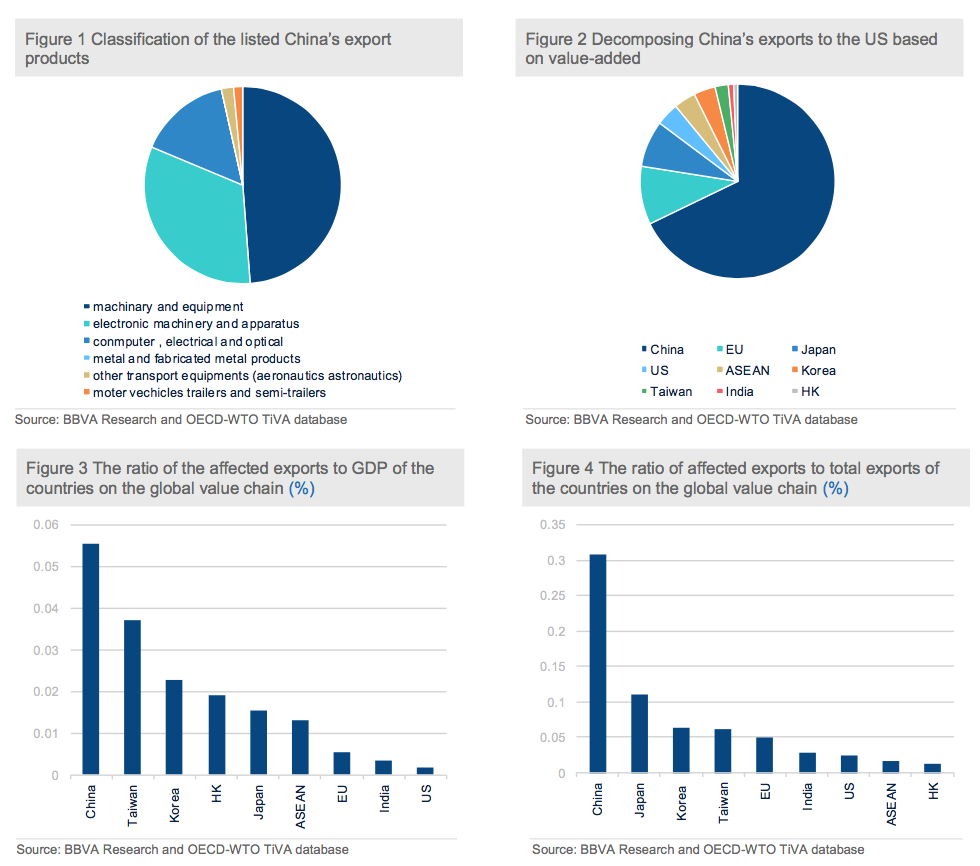

Figure 3 and 4 further calculate the ratio of the affected exports to total exports and total GDP of these countries or regions. They show that the newly proposed punitive measure from the US side can have limited impact on China’s growth and exports, even to a much less extent on other countries on the same global value chain. Relatively, a number of Asian economies including Taiwan, Korea, Hong Kong and Japan tend to have larger exposure to any shock to Chinese exports.

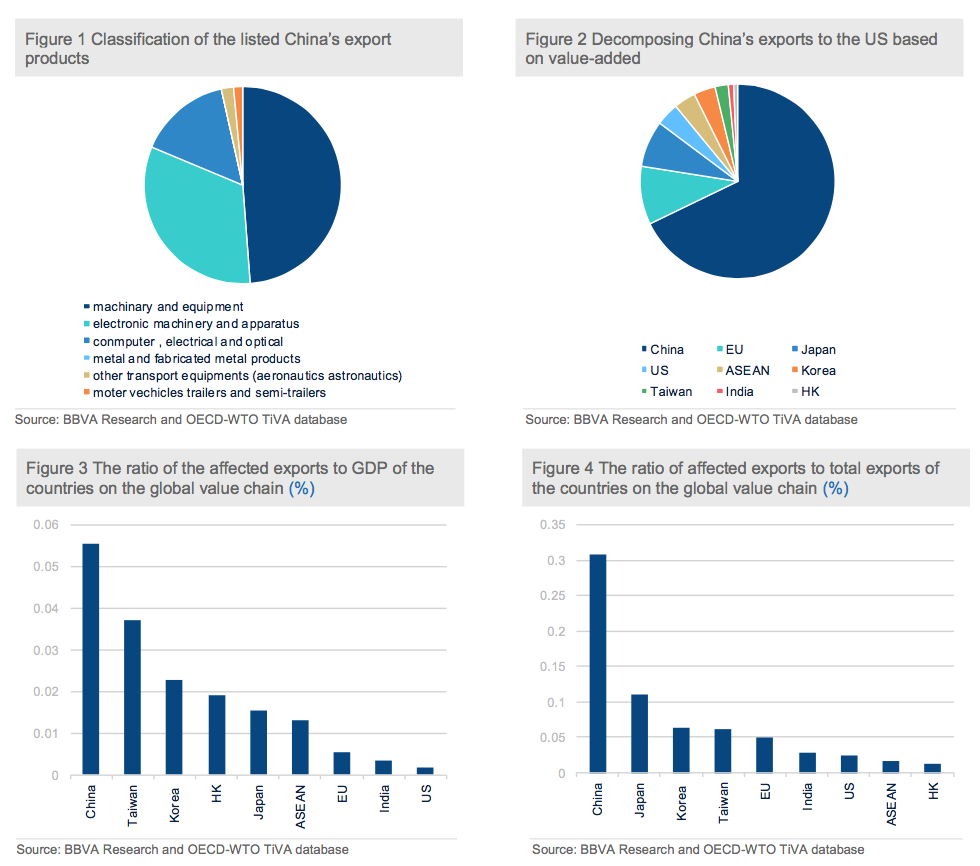

The limited impact of the US newly announced tariff increase also reflects on the relatively muted media sentiment across rest of Asia. In this respect, we use Big Data to gauge media sentiment in Asian economies over fears of a trade war between China and the US. Media sentiment across most Asian economies suggests that fears of a trade war have either receded or held steady at more moderate levels since their peak in mid-April (See Figure 5). Such muted reactions to reignited risks of a trade war are particularly evident in Indonesia, Japan, Malaysia, Thailand and Vietnam.