Hong Hao:Who's Buying? Who's Next?

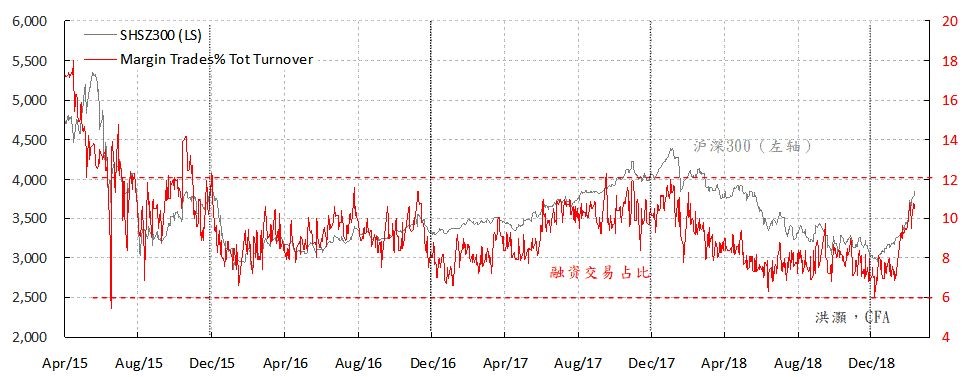

2019-03-19 IMIFigure 1: Margin trades as a percentage of turnover stays elevated and close to its limits since late 2015.

Source: CEIC, BOCOM Int'l

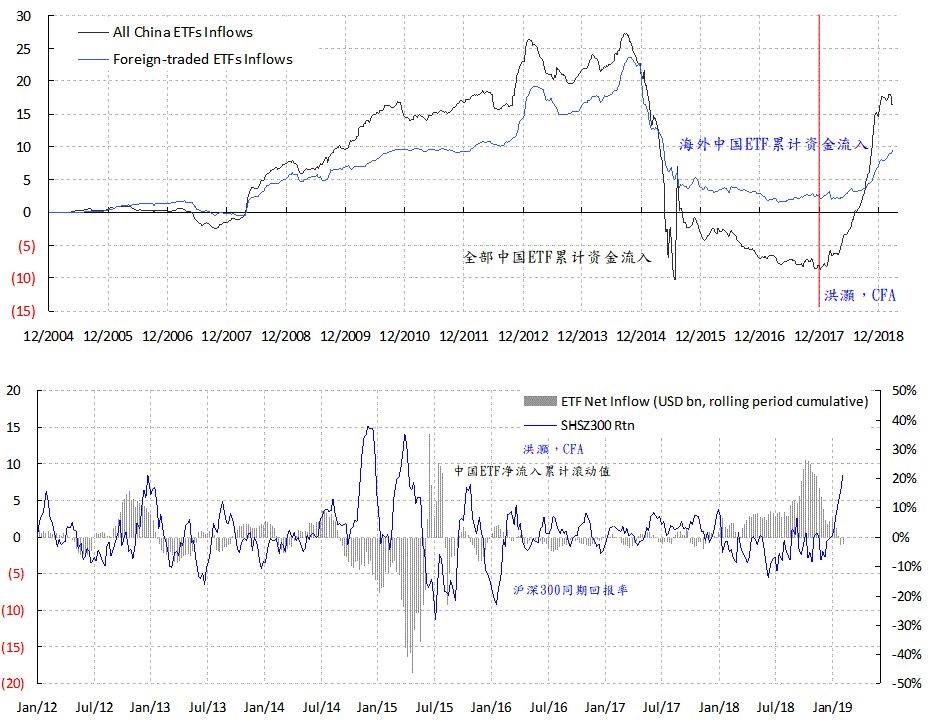

These recent developments are consistent with past experiences as the percentage approached its upper limit. Going forward, we can apply this measure as a proxy of regulatory scrutiny, and as an alert of looming market resistance. When this percentage significantly penetrates its upper limit, it would suggest that regulators’ attitude towards margin trades is shifting, and it would be constructive to risk appetite – or even a repeat of the 2015 bubble. But the calculation of this percentage is a dynamic process – as more and more cash trades crowd into the market, the percentage turnover in margin trades will decline, and the trajectory of the staggering surge will likely decelerate. As such, we need to investigate who else have been buying the rally. ETF Inflows Consensus also believes that it is the foreign inflows into China-focused funds that have been buying, implying that these buying has been pushing up the market. But the evidence in data is inconclusive. We note that these China-focused funds tend to be early in their buying, and slow the accumulation or even reduce stakes in the Chinese market as the indices rise. For instance, the cumulative inflows of these ETFs climaxed in late 2014 – just before the Chinese market was about to soar. Then, the pace of buying started to decelerate, and later turned into net outflow as the market crashed (Figure 2, upper panel). Such behavioral patterns are most likely to be caused by investor’s planned fixed investments over time, as well as heavy redemptions as the market falls. When comparing shorter-term, rolling periodical cumulative ETF inflows with the market return for the corresponding period, we can show that the speed of these funds’ inflow is a contrarian indicator of these funds’ return (Figure 2, lower panel). Given this historical relation between periodical return and cumulative inflow has been strong and persisting, and the market has been surging of late, we will likely see net outflows from these funds – opposite to the trend in the past few months. As such, these inflows, even if their buying has been supportive for the market, they are unlikely to continue to be as supportive for the market in the near term.Figure 2: Inflows of China-focused ETFs, a contrarian indicator of return, are waning.

Source: Bloomberg, BOCOM Int'l

Strategic Investors (Industrial Capital) Consensus also observes that strategic investors have been cutting their stakes amid this rally. In general, this is believed to be a bearish sign, as these monies tend to be long-term strategic partners with intertwining relationship with all facets of the listed companies. If they depart, it is assumed that retailed investors will be left holding the bag. Once again, data evidence does not support such popular belief. Indeed, strategic investors have been reducing stakes all the way up or down, as seen by the close correlation between the cumulative reduction of stakes and the capitalization of the market (Figure 3). That is, as the natural long-only of the market after accumulating stakes in public companies, strategic investors could only reduce their stakes as the market rises. Their selling suggests quite little, but their buying may indeed suggest a market with value.Figure 3: Industrial Capital, the natural longs, has been reducing its stakes regardless of market conditions.

Source: Bloomberg, Wind, BOCOM Int'l

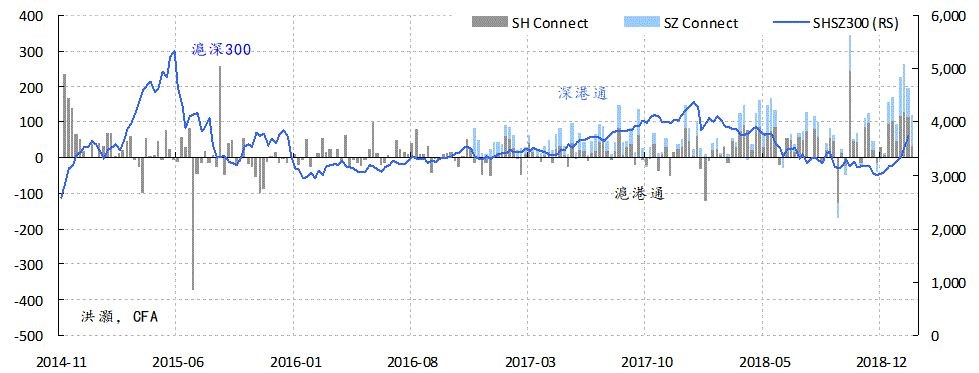

Connect Schemes Can the strong inflows from Hong Kong through the Connect Schemes be the drivers of the current rally? Weekly inflow data of the schemes show that these monies are not very good market timers – they tend to buy regardless of market directions (Figure 4). As such, the connotation of their buying for the market is also inconclusive. That said, there is evidence that margin traders borrowing from Hong Kong at a very cheap interest rate, and then going through the schemes into the mainland market. It is difficult to gauge the magnitude of these trades. But given the interest spread between the mainland and Hong Kong, as well as the prospects of handsome gains, the motive for such trades is strong. If so, this type of margin trades from Hong Kong will be an additional source of market volatility in the near future.Figure 4: Buying through connect schemes has been surging, but it has little market timing power.

Source: Bloomberg, Wind, BOCOM Int'l

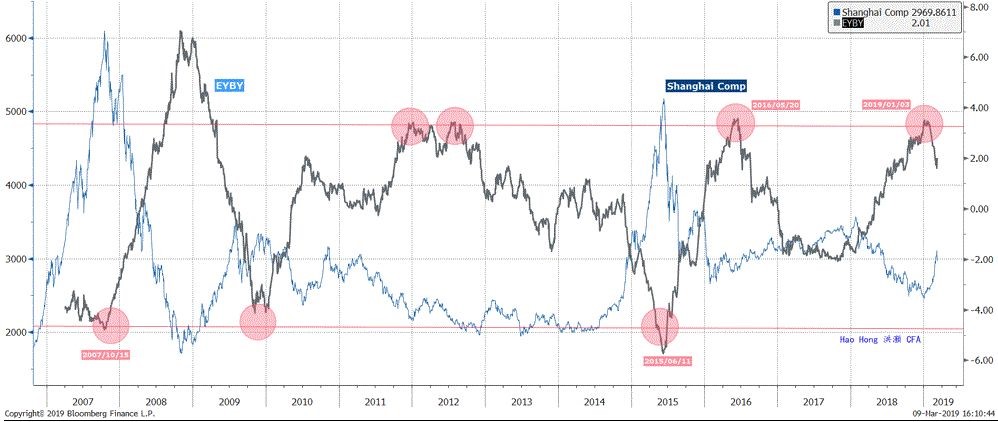

Market Outlook In one of his classics “A Short History of Financial Euphoria”, John Kenneth Galbraith observed two further factors contributing to and supporting the financial euphoria, besides some radical new idea capturing the crowd’s imagination and new instruments for easy financial leverage. “The first is extreme brevity of the financial memory,” he wrote. “In consequence, financial disaster is quickly forgotten. In further consequence, when the same or closely similar circumstances occur again, sometimes in only a few years, they are hailed by a new, often youthful, and always supremely self-confident generation as a brilliantly innovative discovery in the financial and larger economic world. There can be few fields of human endeavor in which history counts for so little as in the world of finance. Past experience, to the extent that it is part of memory at all, is dismissed as the primitive refuge of those who do not have the insight to appreciate the incredible wonders of the present.” The story about the chitchats in the elevator we recounted at the beginning of the story suddenly rings rather familiar. It is difficult to argue against the foundation of the recent rally. After all, our long-term allocation models, based on cycles, relative valuation and market technical, have all turned just prior to this rally (Figure 5). We have discussed these model results in our outlook report “Outlook 2019: Turning a Corner” and a follow-up report “Turning a Corner: Teachings from the ‘Dog’”.Figure 5: Our proprietary EYBY model suggests long-term allocation value towards A-shares.

Source: Bloomberg, BOCOM Int'l

In the near term, however, we believe that the margin trades could get even more rampant before the regulator tolerance towards these trades is known. We would use the percentage of total market turnover in margin trades as a quantitative proxy of the regulator’s attitude. We believe that it would be more constructive for the market if the activities of these trades are to be regulated and monitored closely. But as an avid student of financial history, we are also reminded not to have too much faith in human greed. Further, margin trades done on lower interest rates via the Connect Schemes have strong motive to persist due to the interest spread and the prospects of handsome gains. And these funds will likely to continue to target the technology stocks and the ChiNext Board in Shenzhen that are benefiting from a re-rating spillover from the coming launch of the new tech board. The presence of these leveraged trades will aggravate market volatility in the near term, and short-term traders will be shaken out of their positions, as long-term investors take over. The changing of guards between traders and investors will likely skew the risk-to-reward ratio as well in the near future. But we believe that long-term trend trumps short-term volatility.