Zhang Zhixiang: Meeting with AMRO

2015-06-09 IMI A.10 plus 3 together with other Asian nations can really play an important role in pushing

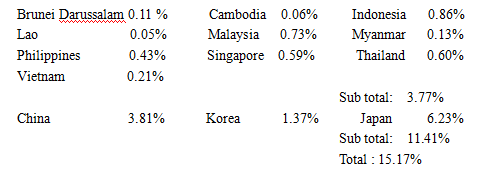

forward the international monetary system reform. On the issue of seeking an early completion of decision for reform of international monetary system agreed upon in 2010, all the member countries of 10 plus 3 reached the consensus supporting the call for early completion and the time limit has been set to the end of the current year. At this juncture, I wish to mention that among some 3,000 international staff working for IMF, staff , especially staff of higher level in the institution, staff from 10 plus 3 countries are of very small percentage. With rise of EMDCs in the world economy, it is very necessary and important to have staff of all levels working in the IMF from EMDCs, so that demand and aspiration as well as interests of EMDCs can be well represented. The IMF has been criticized for using same formula to handle all economic issues in various countries. It should be emphasized that more qualified staff especially staff of higher levels from EMDCs are recruited in the international financial institutions.

B.Serving as 2nd best, 10 plus 3 together with other Asian countries could take lead to work out viable and efficient regional arrangement. The 1997 Asian financial crisis has definitely provided profound lessons and experiences for all of us, which has given rise to the Qingmai Initiative followed by the birth of AMRO and other arrangement such as efforts to build Asian bond market. As exchange rate and capital flow are the essential elements for promoting stable economic growth, 10 plus 3 have also made great efforts to build financial safety net. However, it is equally significant if further efforts can be made to seek great unity of financial and monetary collaboration among 10 and 3, even in Asian area.

C.China has joined hands with a number of 10 plus 3 countries to build up currency swap arrangements which can provide not only a safety net but also a mechanism for stable exchange management to promote trade and economic development. Following is a incomplete table showing the currency swap arrangements between China and a number of 10 plus 3 countries.

Thailand 2 billion US dollars swap agreement signed in December 2001

Japan 3.1 billion US dollars , swap arrangement signed in March 2002

Korea 2 billion US dollars, swap arrangement signed on June 24,2002

Malaysia 180billon RMByuan/40billion Ringgit, signed on Feb.8,2009

Indonesia 100billion RMByuan/175trillion Indonesian rupee, signed on 23 March 2009

Singapore 300billion Rmbyuan/60 billion Singapore dollar, signed on 7 March, 2013

Korea 360billionRMB yuan/64trillion Korea won, signed on 26 Oct.2011

Thailand 70billionRMByuan/320billionThai Baht signed on 23 Dec.2011

It is believed that stronger financial collaboration among 10 plus 3 countries can not only provide stable environment for economic development in our region but also form a positive factor to promote international monetary system reform. Thus, we wish to commend AMRO for its efforts and greater achievement in its future endeavors.

A.10 plus 3 together with other Asian nations can really play an important role in pushing

forward the international monetary system reform. On the issue of seeking an early completion of decision for reform of international monetary system agreed upon in 2010, all the member countries of 10 plus 3 reached the consensus supporting the call for early completion and the time limit has been set to the end of the current year. At this juncture, I wish to mention that among some 3,000 international staff working for IMF, staff , especially staff of higher level in the institution, staff from 10 plus 3 countries are of very small percentage. With rise of EMDCs in the world economy, it is very necessary and important to have staff of all levels working in the IMF from EMDCs, so that demand and aspiration as well as interests of EMDCs can be well represented. The IMF has been criticized for using same formula to handle all economic issues in various countries. It should be emphasized that more qualified staff especially staff of higher levels from EMDCs are recruited in the international financial institutions.

B.Serving as 2nd best, 10 plus 3 together with other Asian countries could take lead to work out viable and efficient regional arrangement. The 1997 Asian financial crisis has definitely provided profound lessons and experiences for all of us, which has given rise to the Qingmai Initiative followed by the birth of AMRO and other arrangement such as efforts to build Asian bond market. As exchange rate and capital flow are the essential elements for promoting stable economic growth, 10 plus 3 have also made great efforts to build financial safety net. However, it is equally significant if further efforts can be made to seek great unity of financial and monetary collaboration among 10 and 3, even in Asian area.

C.China has joined hands with a number of 10 plus 3 countries to build up currency swap arrangements which can provide not only a safety net but also a mechanism for stable exchange management to promote trade and economic development. Following is a incomplete table showing the currency swap arrangements between China and a number of 10 plus 3 countries.

Thailand 2 billion US dollars swap agreement signed in December 2001

Japan 3.1 billion US dollars , swap arrangement signed in March 2002

Korea 2 billion US dollars, swap arrangement signed on June 24,2002

Malaysia 180billon RMByuan/40billion Ringgit, signed on Feb.8,2009

Indonesia 100billion RMByuan/175trillion Indonesian rupee, signed on 23 March 2009

Singapore 300billion Rmbyuan/60 billion Singapore dollar, signed on 7 March, 2013

Korea 360billionRMB yuan/64trillion Korea won, signed on 26 Oct.2011

Thailand 70billionRMByuan/320billionThai Baht signed on 23 Dec.2011

It is believed that stronger financial collaboration among 10 plus 3 countries can not only provide stable environment for economic development in our region but also form a positive factor to promote international monetary system reform. Thus, we wish to commend AMRO for its efforts and greater achievement in its future endeavors.