Caroline Stern, Mikko Mäkinen and Zongxin Qian: FinTechs in China – With a Special Focus on Peer to Peer Lending

2018-08-27 IMIAbstract

This paper studies the development of financial technology companies (FinTechs) in China. We describe the recent development of payment services and P2P lending and analyze empirically the determinants of P2P lending in different regions in China in 2014-2017. Our descriptive analysis shows that the surge in the number of the P2P platforms in China follows an inverted U-shaped phenomenon. However, the outstanding balances of P2P lenders is still increasing, while average yields of P2P lenders have sharply plunged. Our empirical findings indicate: (i) P2P lending is more extensive in region with more mobile phone subscriptions; (ii) outstanding balance of P2P lenders in region is negatively associated with the size of traditional banking sector; and (iii) the number of the P2P platforms in negatively related to the fixed assets investments in region, whereas average yield is a positively associated with the fixed assets investments.

Keywords: FinTechs; financial technology; P2P; peer to peer lending; China

1. Introduction

Digitalization in the banking sector got recently a new twist with the emergence of thousands of start-ups worldwide. These innovative financial technology companies, FinTechs, provide novel financial services, and some of these start-ups already grew to remarkable sizes like Alibaba, Amazon and Google. While a common perception is that business models of FinTech companies focus on payment services and lending, they also encompass personal financial advisory services, crowdfunding, virtual currencies, InsurTech, RegTech, BigData and security (e.g. cyber security). Moreover, FinTechs explore new business areas on a continuous basis, and some of these financial innovations may have the potential to disrupt the financial system as we know it. Traditional banks recognize this development in financial technology and have started their own digitalization projects.

It is also noteworthy that some of these new technologies seem to gain market shares in lending faster in emerging than in developed countries. One example is China, which is the country with most operating peer to peer (P2P) lending platforms (appr. 2,000) worldwide. In this paper, we provide an overview on FinTechs in China. We examine (i) why payment services and P2P lending are so popular in China and (ii) what are the determinants for the emergence of P2P lending platforms in different provinces in China.

This paper is organized as follows. Section 2 describes emerge of FinTechs globally. Section 3 provides a brief summary of China’s financial system. In Section 4 we look at FinTechs in China, with a special focus on payment services and P2P lending. Section 5 analyzes empirically the determinants of P2P lending in Chinese regions. The final section concludes.

2. FinTechs development globally

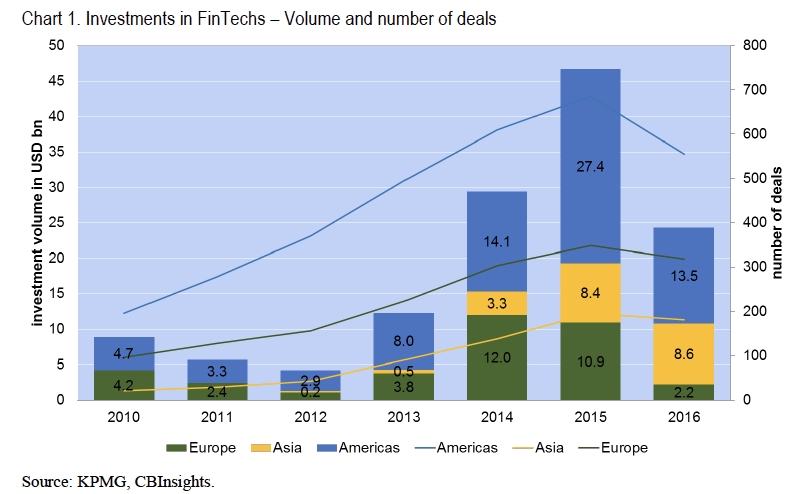

The emergence of FinTechs is a global phenomenon. Data provided by CBInsight and KPMG show that investments in FinTechs gained traction since 2013 whereas most investments were made in Americas (especially the US). However, investments in the Asian region increased since 2014 significantly. More than half of the investments in 2016 in Asia can be traced back to one deal in China with Ant Financial (USD 4.5 bn), a subsidiary of Alibaba. Whereas investments in FinTechs slowed down in 2016 in Europe and Americas, investments in the Asian region remained on their high level.

Nowadays a number of small financial technology companies offer financial services, which are usually provided by traditional banks. In contrast to traditional banks, however, FinTechs in most cases do not hold a banking license. Some FinTechs already rose to a critical size and started to offer additional financial services, which made it necessary for them to be licensed as a bank/credit institution (e.g. Alibaba in China and N26 in Germany). Still, most FinTechs are small start-ups arguing that they have a competitive advantage in comparison to traditional banks as they offer new and unique innovative financial services whereas at the same time they are much more flexible to adapt to new market situations in comparison to big traditional banks. In fact, in comparison to traditional banks FinTechs usually offer only one specific financial service. As a rule, FinTechs offer financial services that can be standardized and therefore provided with very low variable costs. (see also Stern, 2017)

While many newspaper articles and scientific studies regarding FinTechs focus on developed countries (e.g. the UK and the US), there are also remarkable developments in some emerging countries. As mentioned, China is the market with most peer to peer lending platforms, amounting to around 2,300 as of March 2017 with a lending volume of CNY 9,210 bn according to website wdzj.com. In Africa, Kenya is a country where two thirds of adults use their mobile phone to send and receive payments. They use services provided by telecommunication companies like e.g. M-Pesa. Consequently, there is also a discussion if FinTechs could bring a significant improvement with regard to financial inclusion in many especially emerging countries. (see, e.g., Stern (2017) on developments in CESEE region). A report by McKinsey Global Institute (2016) constitutes that FinTechs could also boost economic growth in emerging economies. For China they calculate a possible 4.2% increase in GDP until 2025 due to digital financial services.

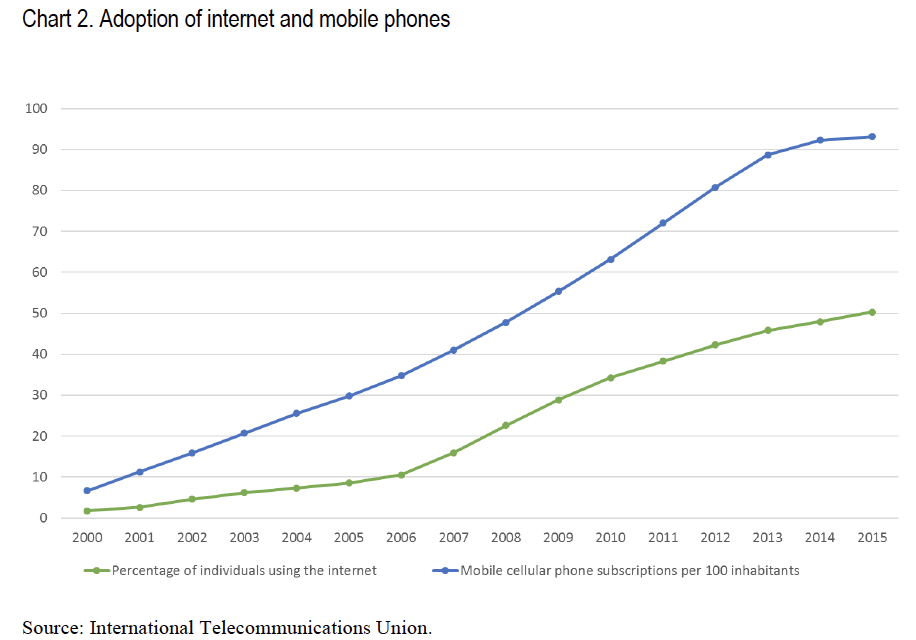

However, all of these new financial services are based on the requirement that the customers have access to the Internet and/or possess a mobile phone. The next chart shows that half of China’s population already uses the Internet. Mobile phone subscription stood at 93 per 100 inhabitants as of 2015. However, this figure does not mean than 90% of the people living in China own a mobile phone as one person may use more than one mobile phone. Nevertheless, data from the World Bank Global Findex Survey indicate that 98% of respondents aged 15+ have access to a mobile phone or the Internet at home.

3. China’s financial system

China’s financial system is still dominated by a banking sector of which the main participants are big state-owned banks. By March 2017, the assets of five biggest commercial banks still account for 36% of the total assets of all banking institutions in China. Together with other 12 joint-stock banks, their assets account for 55% of the total assets of all banking institutions in China. China’s total social financing amounts to RMB 2,120 billion by March 2017. RMB denominated bank loan accounts for 55% of the total social financing. Bank loan from big banks favors big state-owned enterprises and listed companies. Firth et al. (2008) find that the banks in China impose fewer restrictions on state-owned firms’ capital expenditure, which leads to an overinvestment bias. As a result, in the past, the most successful part of China’s financial system was actually the informal sector (Allen et al., 2005). Some of China’s nonfinancial firms solve this issue by owning shares of the banks. Lu et al. (2012) find evidence that firms which hold shares in the banks have better access to bank loan. Actually, an obvious trend in China’s financial sector is the integration between the industrial sector and the financial sector. Resolving financing problem is just one of the reasons for this trend. Other reasons include the searching for yield motive and diversification motive.

China has a separated regulatory system in which regulations on banking, securities and insurance are separated. Recent development of China’s shadow banking sector is a result of regulatory arbitrage (Sheng and Soon, 2015). By cooperating with trust companies, securities companies and insurance companies, the Chinese banks circumvent various regulations which limit their loan supply. Many wealth management products and trust contracts are created to facilitate the regulatory arbitrage. The rapid growth of the shadow banking sector partly reflects the high credit demand in the real sector. However, due to the lack of regulations, the development of the shadow banking sector causes excessive risk taking and the accumulation of systemic risk. The informal sector has similar problems. Being aware of those risks, the Chinese government decided to further reform its financial system in its 13th five year plan. Parts of that plan include the development of the financial market and new financial institutions, particularly smaller sized financial institutions which specialize in providing financial services to small firms and customers with limited collateral and financial records. The most noticeable trend in the development of China’s financial market is the development of the corporate bond market. The unpaid balance of China’s corporate bond increased by 210% from 2007 to 2016.

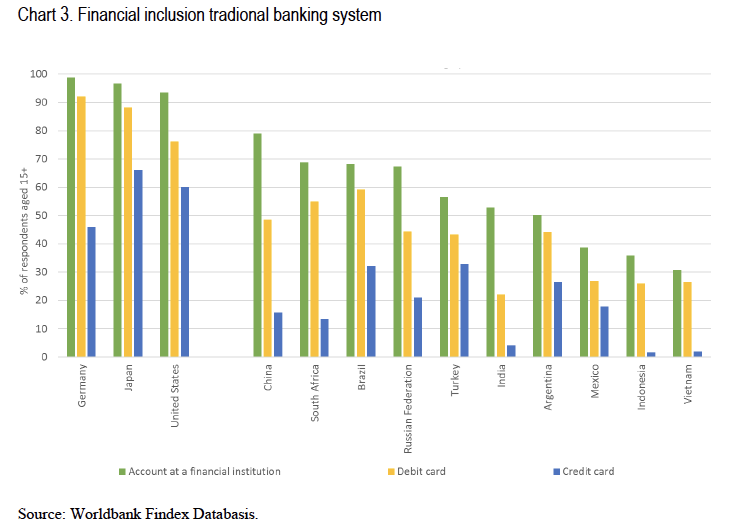

In terms of financial inclusion of private persons in China, the chart below gives a geographical comparison of the situation in China in comparison to other emerging and developed countries. About 80% of respondents in China indicated that they have an account at a financial institution, which is the highest value in comparison to other emerging countries displayed on the chart. However, less than half of the respondents indicated that they have a debit card and less than 20% possess a credit card. The emerging FinTechs in China may have the potential to change the Chinese financial sector significantly.

4. FinTechs in China

Payment services

With regard to electronic payment services, we can differentiate between payment services, which need a bank account to be performed, and those, which work without the ownership of a bank account (mostly e-money). Most FinTech companies offer their services without requiring a bank account; payments are transferred via the Internet or mobile phone. However, there are also FinTechs offering faster transactions between bank accounts like instant payment services.

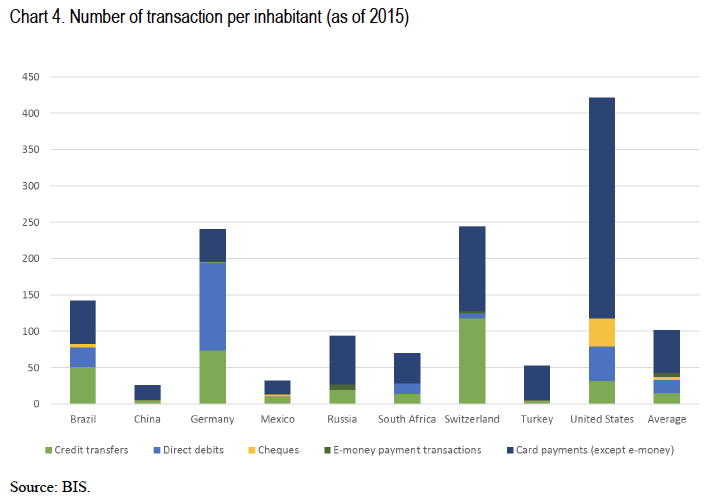

The chart above shows the number of electronic payments per capita by payment method in China and other countries. The chart indicates that traditional bank account based payment methods (i.e. credit transfers, direct debits and card payments) are not widespread in China. The BIS payment service database, however, does not include direct debits and e-money payment transactions for China.

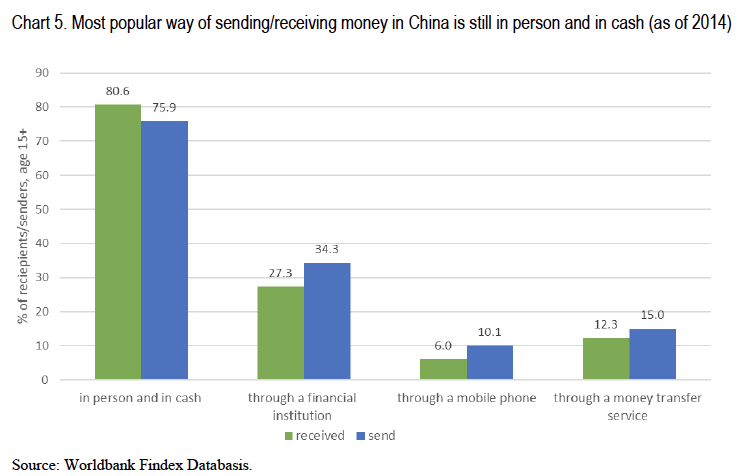

According to the Peoples Bank of China annual report, 13.8 bn mobile payment transactions have been made in China as of 2015 (PBOC, 2016). This equals 10.1 transactions per inhabitant. Taking this number into account, China is the country with most mobile payment transactions per inhabitant in the chart above. Furthermore, data from the World Bank Findex database (see Demirguc-Kunt et al. (2014)) indicates that mobile payments are already becoming an alternative for sending remittances within China, 6.0% and 10.1% of respondents indicated that they received/send domestic remittances using a mobile phone, though the most popular way of sending remittances is still in person and in cash.

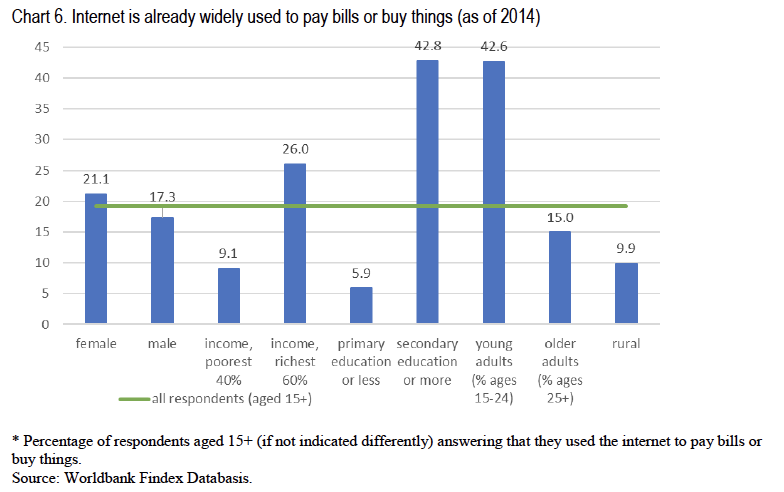

On the other side, the chart below shows, that the Internet is already widely used in China to pay bills or buy things. About 20% of all respondents indicated that they pay bills or buy things using the Internet. It is worth mentioning that when it comes to young adults or respondents who have secondary education or higher more than 40% indicate that they use the Internet to pay bills or buy things. All these data show that, mobile payments may become a real alternative to traditional payment methods where a bank account is required.

Peer to peer lending

Innovative forms of lending, offered by FinTechs, are very often in the form of so-called marketplace lending. This means that potential borrowers seeking for a loan apply via a platform (P2P lending platform) on the Internet. The platform rates the borrowers and assigns them to different categories based on their risk profile. The data used for this may be very traditional as normal banks would use (e.g. pay slip of the borrower) but can also be more innovative data like activities on social media sites. Once the borrower is accepted by the P2P lending platform, the borrowers’ loan application is placed on the P2P lending platform and opened for potential investors to invest. Investors can be private or judicial persons. One individual investor can finance all or part of the loan. Usually, one investor only finances a small fraction of a loan. In contrast to traditional banks, the P2P lending platform does not bear the credit risk of the loan. The credit risk is borne by the investor(s).

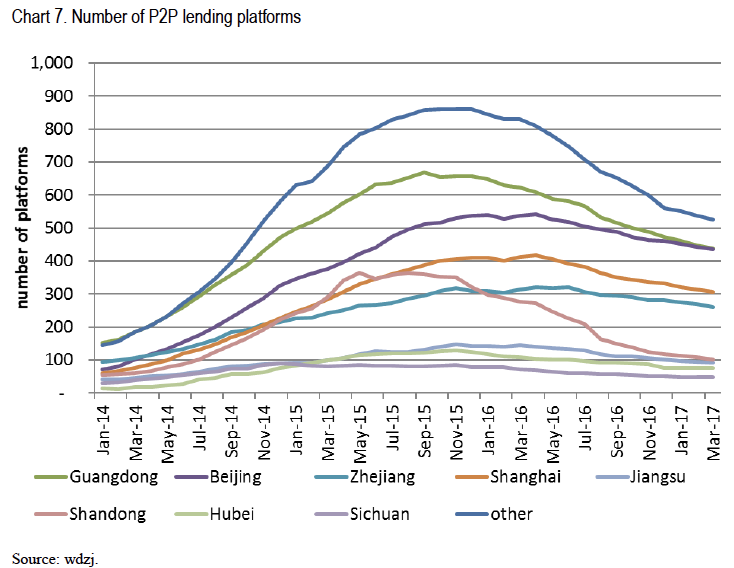

This form of lending skyrocketed in China over the last years. The Chart below shows the number of operating P2P lending platforms in China since January 2014 for different provinces. The biggest expansion in the number of platform was until year-end 2015 up to 3,477 operating in the country. Most platforms were established in the provinces Guangdong, Beijing, Shanghai, Shandong and Zhejiang. Since year-end 2015 the total number of P2P lending platforms is decreasing. The sharpest decline can be observed in the province Shandong. Many of these platforms collapsed also because of fraudulent activities (e.g. Ponzi schemes). This is also the reason why stricter rules on P2P lenders were imposed in 2016. Moreover, also academics like Shen (2016) and Zhou et.al. (2016) find that more regulations in China’s P2P lending market is necessary.

The new rules announced on P2P lending stipulate amongst other measures that individual borrowers can only get a loan of max. CNY 200,000 per platform and a maximum of CNY 1 million across all platforms. For legal persons caps of CNY 1 million and CNY 5 million apply.

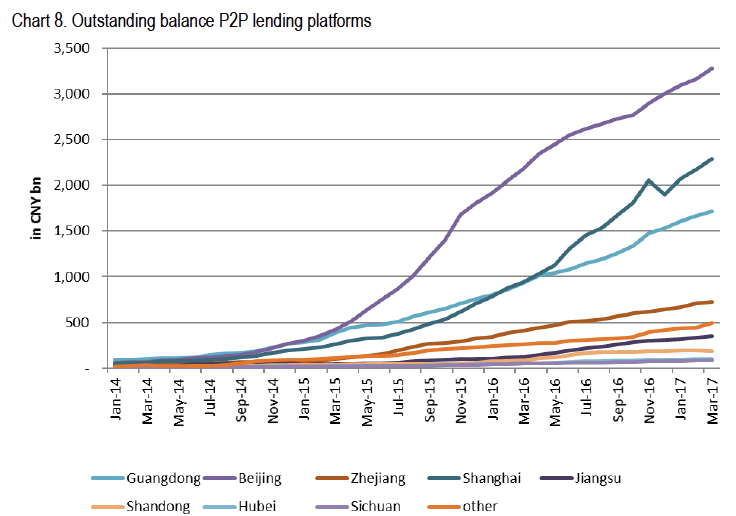

Still, the development of outstanding loan balance of the P2P platforms in China is impressive. The volume increased from January 2014 to March 2017 by 29 times to CNY 9,210 bn (appx. USD 1,340 bn). The leading provinces in terms of outstanding loan volume are Beijing, Shanghai and Guangdong.

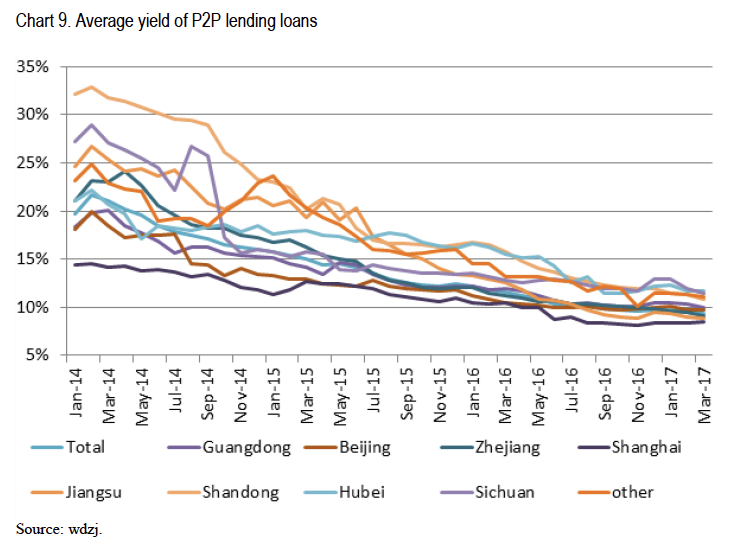

Although the outstanding balance of P2P lenders is still increasing, the average yield of P2P loans is decreasing significantly. China’s average yields decreased more than 50% since January 2014 down to 9.4% as of March 2017. It seems that provinces where many P2P lenders are operating experienced below average reductions of loan yields (e.g. Guangdong, Beijing and Shanghai). However, these provinces also have the lowest yields of all provinces. This may has to be seen in connection with the fact that in these provinces most P2P platforms are operating, causing enhanced competition, which reduces loan yields. The three provinces with the highest loan yields are Shandong, Hubei and Sichuan, which are also provinces were fewer P2P lending platforms are operating.

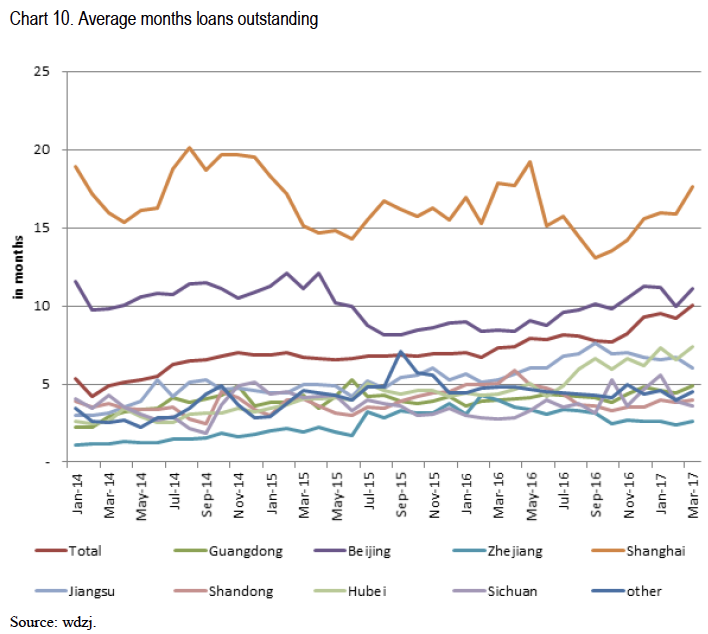

P2P loans have usually a relatively short duration. For example, on average China’s P2P loans are ten months, whereas the term of the loans doubled since January 2014 (5.4 months). P2P loans have the longest duration in Shanghai (17.6 months as of March 2017) and Beijing (11.08 months as of March 2017), again the provinces with most P2P lending platforms operating. By contrast, loans of P2P lending platforms in the provinces Zhejiang and Sichuan are on average less than four months.

All this data shows that there is an enormous dynamic in the development of P2P lending in China. However, in parallel we observe that developments between the provinces differ substantially. Based on the above data, we next analyze empirically the determinants of P2P lending across different provinces in China.

5. Empirical analysis: the determinants of P2P lending in China

Setup and data

This section analyses the determinants of the P2P lending in China. We base our analysis on the fact that there is a substantial regional disparity in China (e.g. Démurger 2001; Démurger et al. 2002; Wei 2007; Zhang and Zou 2012). We hypothesize that this social and economic heterogeneity across Chinese regions has, among other things, important bearings on the formation of P2P lending.

In analyzing the relationship between the P2P lending and regional characteristics in China, we focus on the three angles of P2P lending: the determinants of (i) the number of P2P platforms, (ii) the lenders’ average yield from P2P loans, and (iii) the outstanding balance of P2P lenders. Due to availability of P2P lending data at wdjz.com, we focus on the following eight regions: Beijing, Shanghai, Guangdong, Zhejiang, Jiangsu, Shandong, Hubei and Sichuan.

Our regional explanatory variables are extracted from the CEIC database. The regional data at the CEIC database restricts our empirical analysis to 2013-2015. Due to relatively small sample size, we base our analysis on a pooled OLS regression model with time fixed effects.

Research hypotheses

Following previous research on the determinants of emerge of the financial technology (e.g. Haddad and Hornuf (2016)), we establish four hypothesis. First, we conjecture that the size of traditional banking sector3 in region can be either positively or negatively related to P2P firms’ formation in region. For one thing, a larger traditional banking sector provides an easier access to capital for P2P households and entrepreneurs to fund their business. In a similar vein, the larger traditional banking sector in a region, the better risk-absorbing capacity it has, which enhances incentives of the incumbent banks to fund novel P2P entrepreneurs. Also, as discussed in Section 2, assuming that P2P firms have a competitive edge with a more flexible operations and lower operating costs than traditional banks in region, the large banking sector in region may allure P2P entrepreneurs to compete with the incumbent banks. Contrast to this positive association view, traditional banking sector may also be negatively related to the P2P lending in region; for example, the growth of P2P lending is likely to erode the incumbent banks’ returns from traditional banking business.

Hypothesis 1: P2P lending in region may be positively or negatively associated with the size of traditional banking sector in region.

Second, in several emerging countries the penetration of mobile money exceeds the number of bank accounts (GSMA 2015; PricewaterhouseCoopers 2016) as mobile and smart phone usage provides consumers with a direct access to digital banking services such as mobile payment and lending. As P2P platforms largely rely on advanced novel technologies, we hypothesize that the number of mobile phone subscriptions in region is positively associated with the P2P lending in region.

Hypothesis 2: P2P lending is more extensive in regions with more mobile phone subscriptions.

Third, in general the larger the population size in region, the more heterogeneity in labor supply in region. Empirical evidence supports the view that the size of the population is positively correlated with entrepreneurial supply in region; for example, the countries experiencing population growth have a larger share of entrepreneurs (ILO 1990). To take into account the effects of supply of labor on the potential number of P2P entrepreneurs, we hypothesize that the P2P formation in region is positively related to the population size in region.

Hypothesis 3: The number of P2P lending is positively related to the size of population in region.

Fourth, the importance of traditional manufacturing and construction industries in region may hinder the formation of novel P2P platforms. For example, the major share of investments in region absorbed into manufacturing and construction sectors can erode the available funding resources for the P2P entrepreneurs. Similarly, the size of fixed assets investments in region is a proxy for the importance of manufacturing and construction sectors in region. Hence, we hypothesize that the P2P lending is negatively related to the size of fixed assets investments in region.

Hypothesis 4: The number of P2P platforms is negatively related to the size of fixed assets investments in region.

Empirical results

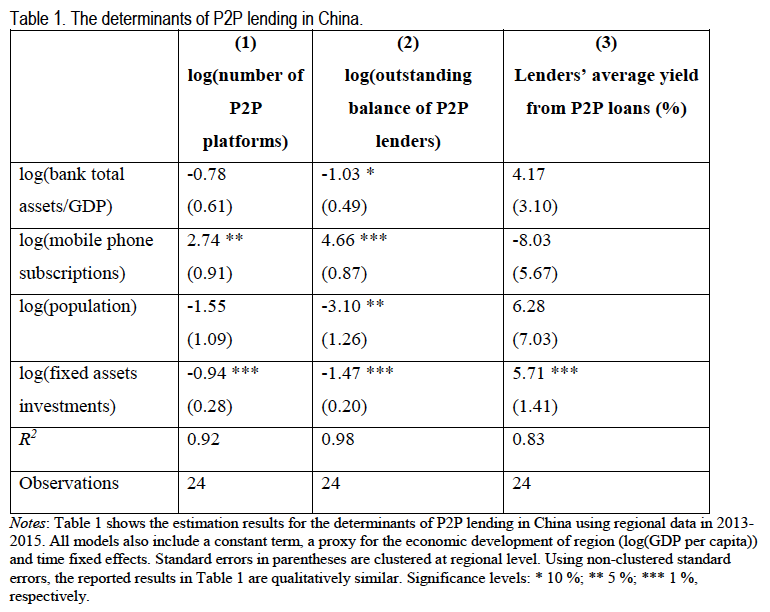

Table 1 shows the estimation results for the determinants of P2P lending in China. We base our analyses on a pooled OLS regression model with time fixed effects and in all models we control for the level of economic development in region by including log(GDP per capita).

In column (1), where we use the log-log specification, we focus on the determinants of the number of P2P platforms in region. First, we do not find statistical support for our first hypothesis. The estimated coefficient on the association between the size traditional banking sector, measured by log(bank total assets/GDP), and the number of P2P platforms is negative but statistically clearly insignificant.

Concerning our second hypothesis, the number of mobile phone subscriptions in region is positively related to the number of P2P platforms in region at 5 % significance level. The estimated coefficient suggests that a 1 % increase in the number of mobile phone subscriptions is estimated to correspond to a 2.7 % increase in the number of P2P platforms.

We do not find, however, support for our third hypothesis. While the estimated coefficient of the size of population is negative, it is visibly insignificant. Fourth, we do find that the magnitude of fixed assets investments in region is negatively significant (-0.94) at 1 % level. The coefficient suggests that a 1 % increase in the size of fixed assets investments in region is estimated to correspond to a 0.9 % decrease in the number of P2P platforms.

In column (2) of Table 1 we examine the determinants of outstanding balance of P2P lenders using the log-log specification. First, we find the estimated coefficient on the association between the size of traditional banking sector and the number of P2P platforms is -1.03 and is significant at 10% level. This supports our first hypothesis suggesting that the sizeable traditional banking sector in region would diminish the P2P lending in region.

Second, as in column (1), we continue to find that the number of mobile phone subscriptions in region is positively associated with the number of P2P platforms. The estimated coefficient (4.66) is significant at 1% level. This would suggests that a 1 % increase in the number of mobile phone subscriptions is estimated to correspond to a 4.7 % increase in the balance of P2P lenders.

Contrary to our third hypothesis, however, we find that the size of population is negatively related to the P2P lending at 5% level. This finding suggests that a 1 % increase in the size of population in region is estimated to correspond to a 3.1 % decrease in the balance of P2P lenders in region.

Fourth, we continue to find that the magnitude of fixed assets investments in region is negatively significant (-1.57) at 1 % level, suggesting that a 1 % increase in the size of fixed assets investments in region is associated with a 1.6 % decrease in the balance of P2P lenders in region.

Column (3) of Table 1 shows the estimation results for the lenders’ average yield (%) from P2P loans. In contrast to columns (1) and (2), where we use the log-log model, in column (3) we use the linear-log model as our dependent variable is in percentages. While most of our explanatory variables are insignificant, we do find that the magnitude of fixed assets investments in region is significantly associated with the P2P lending in region. The positive coefficient (5.71) is significant at 1 % level.

6. Conclusions

China is a country where mobile payments and P2P lending are already very popular and are about to gain market shares rapidly. This paper shows that mobile payments are already a real alternative to other electronic payments and cash. The widespread usage of the Internet and mobile phones support this development.

When it comes to lending markets in China we can observe a very special situation where the financial market is dominated by large state owned banks. The undersupply of enterprises and private households with loans lead to the development of a shadow banking system. In this environment, P2P lending platforms started to mushroom in China. The number of platforms operating in the country

peaked year-end 2015 with 3,477. Due to various reasons (e.g. fraud) numerous platforms failed. Consequently, the Chinese regulator imposed stricter rules on P2P lenders in 2016.

We test four hypotheses on the development of P2P lending in different regions across China. For the first hypothesis, P2P lending in region may be positively or negatively associated with the size of traditional banking sector in region, we could not find a statistically significant relationship for all dependent variables, except outstanding balance.

In contrast, we find for our second hypothesis (P2P lending is more extensive in regions with more mobile phone subscriptions) significant positive coefficients for the number of platforms and outstanding balance. However, the relationship is not statistically significant with regard to the average yield. Hypothesis number three is that P2P lending is positively related to the size of population in region. However, we only find a negative statistically significant relationship with regard to outstanding balance.

The fourth hypothesis constitutes that the number of P2P platforms is negatively related to the size of fixed assets investments in region. This relationship seems to be true for the number of lending platforms and the outstanding balance. However, the relationship is also statistically significant for the average yield but with a positive relationship.

We conclude from the above results that there is evidence that mobile phone subscriptions have a positive relationship with the number of P2P lending platforms and the outstanding balance. Moreover, fixed assets investments have a negative relationship with the number of platforms and outstanding balance. Indicating, that in regions with high manufacturing and construction sector the financing potential is already absorbed by these enterprises not leaving room for P2P lenders.

Surprisingly, the size of the population is not positively related with the number of P2P platforms. Quite the contrary, there is a negative relationship between the size of the population and the outstanding balance. Also the size of the traditional banking sector in the respective region has no statistically significant influence on the emergence of P2P lending platforms.

References

Allen, Franklin, Jun Qian and Meijun Qian (2005): Law, finance, and economic growth in China, Journal of financial economics, 77, 57-116.

Demirguc-Kunt, Asli, Leora Klapper, Dorothe Singer, and Peter Van Oudheusden (2014):The Global Findex Database 2014: Measuring Financial Inclusion around the World, World Bank, Policy Research Working Paper 7255.

Démurger, Sylvie (2001): Infrastructure Development and Economic Growth: An Explanation or Regional Disparities in China? Journal of Comparative Economics, 29(1), 95-117.

Démurger, Sylvie, Jeffrey D. Sachs, Wing Thye Woo, Shuming Bao, Gene Chang and Andrew Mellinger (2002): Geography, Economic Policy, and Regional Development in China. Asian Economic Papers, 1(1), 146-197.

Firth, Michael, Chen Lin and Sonia M.L. Wong (2008): Leverage and investment under a state-owned bank lending environment: Evidence from China, Journal of corporate finance, 14, 642-653.

GSMA (2015): State of the industry report on Mobile Money. Available at: http://www.gsma.com/mobilefordevelopment/wp-content/uploads/2016/04/SOTIR_2015.pdf

Haddad, Christian, Lars Hornuf (2016): The Emergence of the Global Fintech Market: Economic and Technological Determinants. CESifo Working Paper No. 6131.

International Labour Organization (1990): The promotion of self-employment. Available at: http://staging.ilo.org/public/libdoc/ilo/1990/90B09_69_engl.pdf.

McKinsey Global Institute (2016): Digital finance for all: powering inclusive growth in emerging economies. September 2016.

PricewaterhouseCoopers (2016): Emerging markets driving the payments transformation. Available at: https://www.pwc.com/gx/en/financial-services/publications/assets/pwc-emerging-markets-12-July.pdf

Shen, Wei (2016): Designing optimal regulation for financial innovation in capital raising – regulatory options for China’s Peer-to-Peer lending sector. Banking & Finance Law Review, 539-572.

Sheng, Andrew, Ng Chow Soon (2015): Bringing Shadow Banking into the Light: Opportunity for Financial Reform in China, FGI report.

Stern, Caroline (2017): FinTechs and their emergence in CESEE. Forthcoming.

The People’s Bank of China (2016): Annual Report 2015.

Wei, Yehua Dennis (2007): Regional Development in China: Transitional Institutions, Embedded Globalization, and Hybrid Economies. Eurasian Geography and Economies, 48(1), 16-36.

Zhang Qinghua and Heng-fu Zou (2012): Regional Inequality in Contemporary China. Annals of Economics and Finance, 13(1), 113-137.

Lu, Zhengfei, Jigao Zhu and Weining Zhang (2012): Bank discrimination, holding bank ownership, and economic consequences: Evidence from China, Journal of Banking and Finance, 36, 341-354.

Zhou, Weihuan, Douglas W. Arner and Ross P. Buckley (2016): Regulation of digital financial services in China: last mover advantage? Tsinghua China Law Review, 25-62.