Steve H. Hanke: On Measuring Greenness-A New Enabling Metric, Please

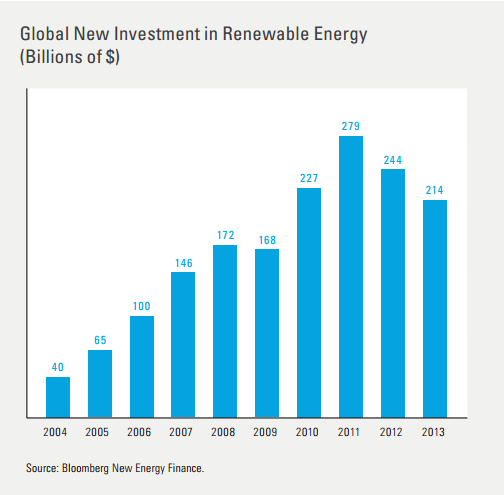

2015-05-03 IMI When we turn to the growth of green investments, annual investments in renewable energy serve as a useful proxy. Chart 1 shows the picture from 2004–2013. In a decade, these investments have exploded, increasing more than fivefold.

Even the Oracle of Omaha, Warren Buffett, has touted green and jumped on the bandwagon. Indeed, Berkshire Hathaway, through its subsidiary MidAmerican Energy, is heavily invested in renewable energy, and Buffett wrote in a recent letter to shareholders that MidAmerican’s total investment in renewable energy will surge to $15 billion, when current projects are completed (Buffett 2013).

MEASURING GREEN

With investors favoring green, and investment flows being earmarked as green, the obvious question arises: “How does an investment qualify for the coveted green designation?” The two generic methodologies used to determine what constitutes the so-called green investment grade are screening methodologies and green theme investing. Screening methodologies are ones that allow only the greenest companies through the screen. Screen processes result in all the green companies being lumped together, without any differentiation for the wide variety of screens that are used. This is an important flaw in the screening methodology, because the screening methodologies range from those that evaluate a company’s balance sheet to determine the green, non-green composition of a company’s assets to a simple classification of a company’s business activities into different so-called green categories – such as wind, solar, and so forth. With screening, two companies with a green designation would be grouped together, regardless of the fact that one company’s green assets are ten times larger than another company in the same class. The green theme methodology is even cruder than screening. An investment is deemed green only if it fits into a pre-defined green designation.

THE ENABLING GREENNESS RATIO

In order to firm up the green investment house’s foundation, we propose a methodology that is simple, transparent, and one that can be objectively replicated. Our metric is determined by starting at the origin of the supply chain. It is from that starting point that we measure the amount of greenness ultimately enabled by the production of a socalled green enabler.

For example, the reduction in CO2 is a green good. If a company produces graphite that enables the production of more efficient insulation, which results in lower demand for energy required for heating and cooling, then the graphite producer is a net supplier of a green good – the net reduction in CO2. In short, the enabler of the production of the green good is the supplier of graphite. So, the source of greenness resides at the very beginning of the supply chain. When it comes to the measurement of greenness, this enabling notion leads to simplicity and transparency, as well as an objective measure of the amount of greenness associated with each supplier that is enabling the production of green goods.

Therefore, the green theme methodology results in little more than a loose, nominal – but important – designation. Yes, if a company can obtain a green designation, no matter how it is determined, that recognition of greenness enhances the firm’s attractiveness to investors.

The current methods of measuring green fail to meet rudimentary standards of measurement. The most basic principal of measurement is replication. However, the current methods are, for the most part, subjective and opaque (Kennedy 2012 and Inderst 2012). In consequence, they fail to meet the replication test. This leaves a multi-trillion dollar green investment house wobbling on stilts, rather than a sound foundation.

To operationalize the enabling concept in the context of CO2 emissions, the following transparent and replicable formulation for measuring greenness with precision can be used: Enabling Greenness Ratio = Net CO2 Reduction / Total Assets, where the Net CO2 Reduction is the net CO2 reduced by a company, and Total Assets is the total assets as listed on a company’s balance sheet. The enabling greenness ratio equates to the net CO2 reduced by the level of invested capital in a company. Because this metric is divided by total assets, it provides net CO2 reduction relative to a company’s size. This is analogous to the traditional accounting measure – return on assets.

When we turn to the growth of green investments, annual investments in renewable energy serve as a useful proxy. Chart 1 shows the picture from 2004–2013. In a decade, these investments have exploded, increasing more than fivefold.

Even the Oracle of Omaha, Warren Buffett, has touted green and jumped on the bandwagon. Indeed, Berkshire Hathaway, through its subsidiary MidAmerican Energy, is heavily invested in renewable energy, and Buffett wrote in a recent letter to shareholders that MidAmerican’s total investment in renewable energy will surge to $15 billion, when current projects are completed (Buffett 2013).

MEASURING GREEN

With investors favoring green, and investment flows being earmarked as green, the obvious question arises: “How does an investment qualify for the coveted green designation?” The two generic methodologies used to determine what constitutes the so-called green investment grade are screening methodologies and green theme investing. Screening methodologies are ones that allow only the greenest companies through the screen. Screen processes result in all the green companies being lumped together, without any differentiation for the wide variety of screens that are used. This is an important flaw in the screening methodology, because the screening methodologies range from those that evaluate a company’s balance sheet to determine the green, non-green composition of a company’s assets to a simple classification of a company’s business activities into different so-called green categories – such as wind, solar, and so forth. With screening, two companies with a green designation would be grouped together, regardless of the fact that one company’s green assets are ten times larger than another company in the same class. The green theme methodology is even cruder than screening. An investment is deemed green only if it fits into a pre-defined green designation.

THE ENABLING GREENNESS RATIO

In order to firm up the green investment house’s foundation, we propose a methodology that is simple, transparent, and one that can be objectively replicated. Our metric is determined by starting at the origin of the supply chain. It is from that starting point that we measure the amount of greenness ultimately enabled by the production of a socalled green enabler.

For example, the reduction in CO2 is a green good. If a company produces graphite that enables the production of more efficient insulation, which results in lower demand for energy required for heating and cooling, then the graphite producer is a net supplier of a green good – the net reduction in CO2. In short, the enabler of the production of the green good is the supplier of graphite. So, the source of greenness resides at the very beginning of the supply chain. When it comes to the measurement of greenness, this enabling notion leads to simplicity and transparency, as well as an objective measure of the amount of greenness associated with each supplier that is enabling the production of green goods.

Therefore, the green theme methodology results in little more than a loose, nominal – but important – designation. Yes, if a company can obtain a green designation, no matter how it is determined, that recognition of greenness enhances the firm’s attractiveness to investors.

The current methods of measuring green fail to meet rudimentary standards of measurement. The most basic principal of measurement is replication. However, the current methods are, for the most part, subjective and opaque (Kennedy 2012 and Inderst 2012). In consequence, they fail to meet the replication test. This leaves a multi-trillion dollar green investment house wobbling on stilts, rather than a sound foundation.

To operationalize the enabling concept in the context of CO2 emissions, the following transparent and replicable formulation for measuring greenness with precision can be used: Enabling Greenness Ratio = Net CO2 Reduction / Total Assets, where the Net CO2 Reduction is the net CO2 reduced by a company, and Total Assets is the total assets as listed on a company’s balance sheet. The enabling greenness ratio equates to the net CO2 reduced by the level of invested capital in a company. Because this metric is divided by total assets, it provides net CO2 reduction relative to a company’s size. This is analogous to the traditional accounting measure – return on assets.

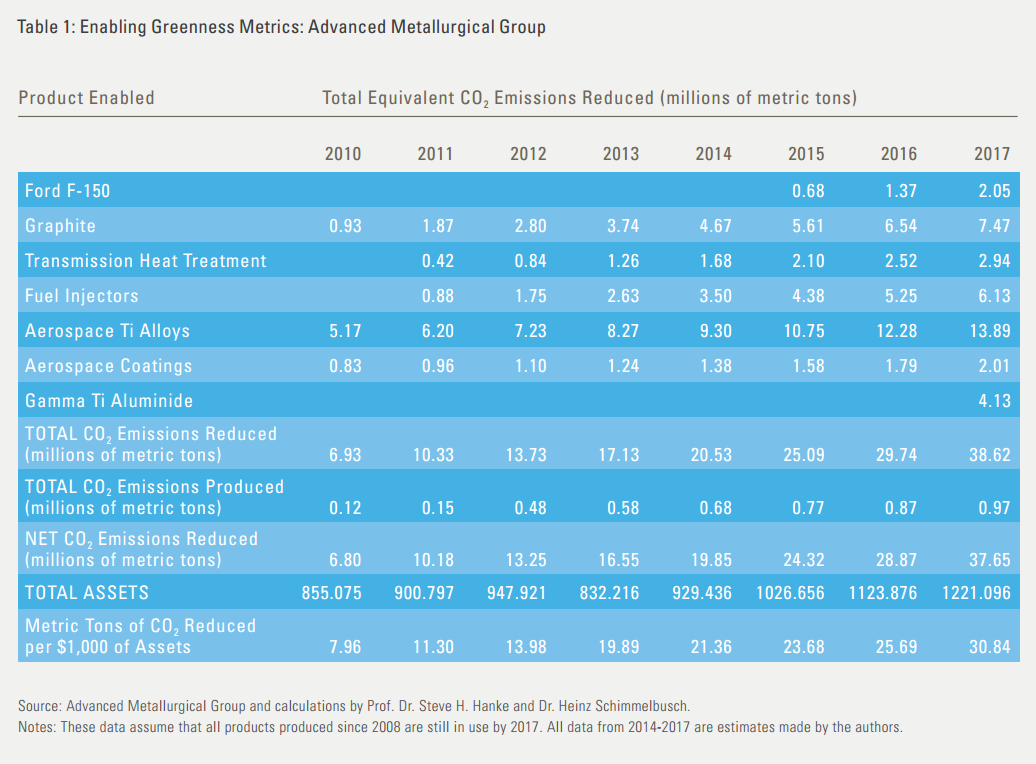

Our suggested methodology can be applied with precision. We use the Advanced Metallurgical Group (AMG) to illustrate. Table 1 contains our results.

Over the past four years AMG has produced products that have enabled a net CO2 reduction of 46.78 million metric tons. Very green, indeed. However, that’s not the end of the story. Reliable projections indicate that AMG will enable the reduction of an additional 110.69 million metric tons, an increase of 137 percent, over the next four years. And yes, there’s more, due to the cumulative nature of supplying raw materials that enable the production of green goods, AMG’s greenness enabling ratio soars over time – indicating that AMG’s green rate of return is growing rapidly.

Our suggested methodology can be applied with precision. We use the Advanced Metallurgical Group (AMG) to illustrate. Table 1 contains our results.

Over the past four years AMG has produced products that have enabled a net CO2 reduction of 46.78 million metric tons. Very green, indeed. However, that’s not the end of the story. Reliable projections indicate that AMG will enable the reduction of an additional 110.69 million metric tons, an increase of 137 percent, over the next four years. And yes, there’s more, due to the cumulative nature of supplying raw materials that enable the production of green goods, AMG’s greenness enabling ratio soars over time – indicating that AMG’s green rate of return is growing rapidly.