Betty Huang and Xia Le: What Do China’s Renewed Opening Efforts Imply for Foreign Banks?

2018-06-23 IMI- Remove the foreign ownership cap for banks and asset management companies, treating domestic and foreign capital equally.

- Lift the foreign ownership cap to 51% for securities companies, fund managers, futures companies, and life insurers, and remove the cap in three years.

- No longer require joint-funded securities companies to have at least one local securities company as a shareholder.

- Foreign insurance companies will no longer need to have a representative office in China for two consecutive years prior to establishing a subsidiary.

- Encourage foreign ownership in trust, financial leasing, auto finance, currency brokerage and consumer finance.

- Apply no cap to foreign ownership in financial asset investment companies and wealth management companies newly established by commercial banks.

- Lift restrictions on the business scope of foreign-invested insurance brokerage companies, treating them as equals of domestic companies.

- Allow foreign banks to set up branches and subsidiaries.

- Further improve the stock market connectivity between the mainland and Hong Kong by increasing the daily quota threefold.

- Allow eligible foreign investors to provide insurance agent and loss adjuster services in China.

- Substantially expand the business scope of foreign banks.

- Remove restrictions on the business scope of jointly-funded securities companies, treating domestic and foreign institutions equally.

- Launch the Shanghai-London Stock Connect.

Secondly, foreign banks will also be allowed to underwrite onshore treasury bonds in China without prior government approval but need to report such activities to the regulator within five days. The government bonds that foreign banks can sell include those issued by foreign investors in China - the Panda bonds; no specific license from regulator is required. As a result, this cuts the red tape procedure so that locally incorporated foreign banks only need to report after the transaction to CBRC for conducting treasury bonds underwriting business. Moreover, China will ease requirements on the size of assets for foreign banks to be qualified for the underwriting of bonds, including green bonds, short-term corporate bonds, and agriculture-related bonds.

Thirdly, the new measures open the green light for direct investment by foreign banks into onshore financial bank institutions, such as setting up “direct-selling” banks, asset management companies, credit card centers, and other onshore financial institutions (including equity investment). Locally incorporated foreign banks may invest in onshore banking financial institutions, on the condition that the relevant risks can be controlled. Based on the above, it seems that locally incorporated foreign banks are now able to participate in a series of tryouts, which are good for risk segregation and business innovation. Moreover, the procedure to launch branches has also been simplified. Banks need to obtain just one approval, instead of two as previously, if they want to set up new branches, the same requirement as for Chinese banks. The new measures also make it easier for foreign banks to go through regulatory formalities to appoint executives as well.

Fourthly, foreign banks are now permitted to proactively cooperate with their offshore parent groups to assist Chinese clients in their off-shore bond issuance, overseas capital raising, IPO (initial public offerings), M&A (mergers and acquisitions) and other financing activities in compliance with the PRC law. The new measures specify that foreign banks (including locally incorporated foreign banks and PRC branches of foreign banks) may explore business cooperation with their offshore parent bank groups, in compliance with the law, to provide comprehensive financial services to Chinese enterprises in offshore bond issuance, listing, acquisition and financing, by taking advantage of their global service networks. Such assistance provided by foreign banks in China may be expanded to include, client referral, client relationship maintenance, and onshore assistance in respect of financial services in relation to offshore bond issuance, listing, acquisition and financing.

Fifthly, foreign banks and their PRC branches will be freed from the obligation to obtain administrative pre-approval to conduct offshore wealth management services for clients and act as custodians for mutual fund or investing in stock markets, as long as they notify the regulator.

Capital account liberalization brings about more opportunities

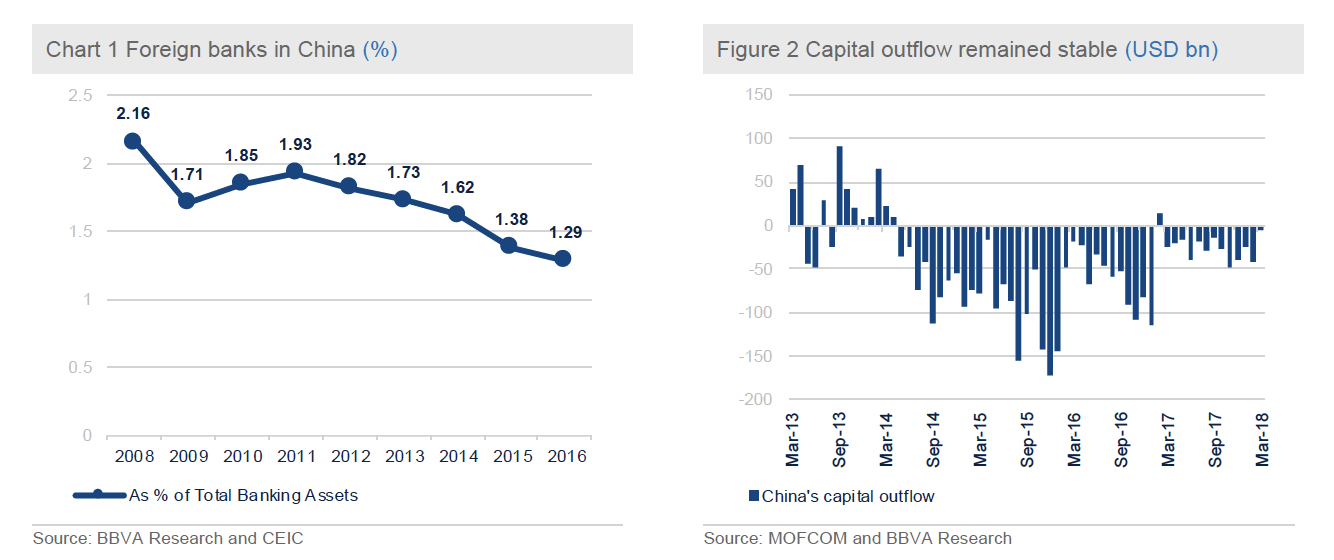

With the financial liberalization process (See our previoius report: China's Financial Liveralization: Time to Restart), China gained experience in fighting capital outflow after the 2015 stock market crash that triggered large capital flight (Chart 2).Now it is the right time for China to gradually push up the capital account liberalization.

Foreign investors could invest in onshore securities through various channels put in place such as the Qualified Domestic Institutional Investor (QDII) program, Qualified Foreign Institutional Investors (QFII), the Renminbi Qualified Foreign Institutional Investor (“R-QFII”) scheme, the Shanghai-Hong Kong and Shenzhen-Hong Kong stock connect programs (the “Stock Connect”) and the China Interbank Bond Market (“CIBM”) Direct Access scheme. These channels were developed to provide financial institutions with quotas for outbound and inbound investments. Besides, the Sate Administration of Foreign Exchange (SAFE) has launched the Qualified Domestic Limited Partnership (QDLP), program in Shanghai in 2012, and the Qualified Domestic Investment Enterprise (QDIE) program in Shenzhen in 2014 to actively support domestic firms to conduct various types of outbound investment, including investments in offshore securities, hedge funds, private equity funds, real estate funds, and other types of investments. Both schemes permit qualified domestic investors to invest overseas and allow Chinese savers to diversify their holdings.

To further simplify management, facilitate operations, and further expand opening up, the Central Bank of China and SAFE recently released a new round of foreign exchange management reforms on 12th June. The reform measures are mainly concentrated on three aspects: Firstly, the 20% cap of QFII monthly fund remittance is lifted; Secondly, the QFII and RQFII principal lock period requirements are cancelled so that QFII and RQFII can remit the principal according to the investment; Thirdly, the authorities allow QFII and RQFII investors to hedge their exchange rate risks to its domestic investment.

The new policies regarding QFII and RQFII have eased main concerns of foreign investors in participating in these programs. Meanwhile, allowing QFII and RQFII to conduct FX hedging in China’s domestic market can also help to expand the onshore FX market. The move is seen as a critical step in the opening up of China’s capital market, helping to promote RMB internationalization, as well as the development of both Shanghai as a global financial center, and Hong Kong as an offshore RMB hub and destination for mainland investors.

Moreover, the SAFE has steadily advanced the QDLP and QDIE programs since early this year on a pilot basis in Shanghai and Shenzhen respectively. Under these programs, the investors in these two cities are allowed to make overseas investment with a quota of US 5 billion each.

Besides, the recent inclusion of large cap China A-shares in the MSCI Emerging Markets Index and the MSCI ACWI Index on June 1, 2018 also gave global investors greater access to China. After the potential full inclusion implemented with the continuing opening up, which is anticipated to be done in 5 years in September 2023, China A-shares will represent 17% in the while Emerging Markets Index.

Implications for Chinese and foreign financial institutions

We expect the relaxation will enable China’s financial system to receive an influx of foreign capital and expertise, with some foreign banks increasing their presence and penetration in high-growth markets around the world, especially for those that need to launch RMB businesses or to increase their current shareholdings in financial businesses in China. The regulator will encourage foreign banks to conduct more diversified business, especially in the areas of asset management and institutional banking, in which they have competitive advantages.

However, even in the absence of market-access or regulatory controls, very limited branch networks foreign banks will struggle to gain market share. Acquiring a troubled city bank or joint commercial bank would be one possible shortcut. Many of China’s smaller banks have strong growth prospects but weak balance sheets and poor risk management and they were substantially more exposed to risks from shadow banking, and significantly more reliant on high-cost wealth management products for funding. Banks with weak balance sheets, but strong branch networks and growth potential, could be the focus for foreign firms looking to enter the market.

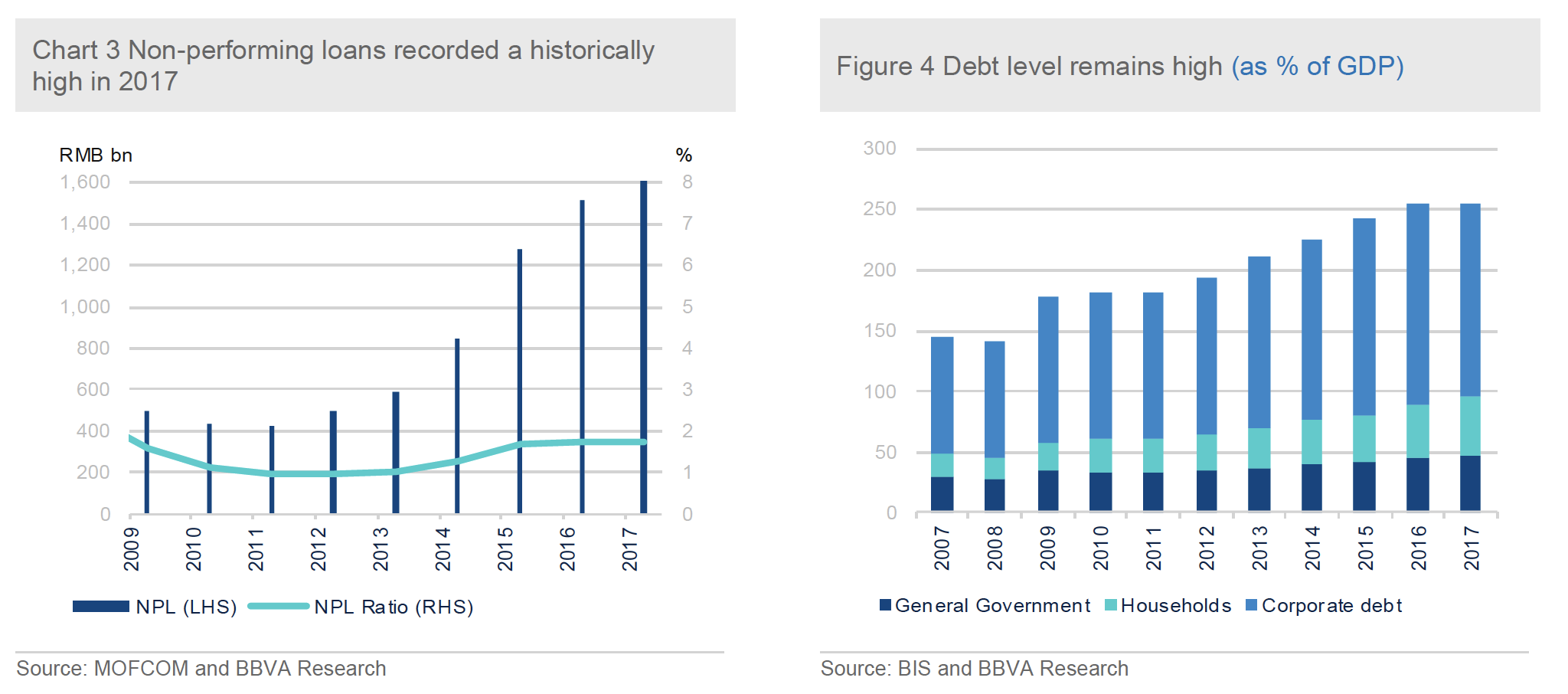

The rising NPLs in China’s banking sector could deter many foreign financial institutions in the near term. According to the China Banking and Insurance Regulatory Commission (Chart 3), the bad debt in Chinese commercial banks at the end of 2017 recorded the highest since 2005, and stood at 1.7 trillion yuan ($270 billion). The high debt level of China (256% of GDP) also adds uncertainties to the outlook of China’s banking sector (Chart 4).

Moreover, all these reforms need to be proceeded with a measured approach. Although the authorities are well aware that structural reforms in the financial sector are the best solution to systemic risks in the long run, some domestic and external factors could also exert adverse impact on the momentum in financial liberalization and even slow its progress. Now China is pushing forward a campaign of financial deleveraging with the aim to reduce debt level of both financial and corporate sectors. If the deleveraging process goes smoothly, financial liberalization could accelerate as well. If not, the authorities will likely slow their pace for stability consideration.

Secondly, foreign banks will also be allowed to underwrite onshore treasury bonds in China without prior government approval but need to report such activities to the regulator within five days. The government bonds that foreign banks can sell include those issued by foreign investors in China - the Panda bonds; no specific license from regulator is required. As a result, this cuts the red tape procedure so that locally incorporated foreign banks only need to report after the transaction to CBRC for conducting treasury bonds underwriting business. Moreover, China will ease requirements on the size of assets for foreign banks to be qualified for the underwriting of bonds, including green bonds, short-term corporate bonds, and agriculture-related bonds.

Thirdly, the new measures open the green light for direct investment by foreign banks into onshore financial bank institutions, such as setting up “direct-selling” banks, asset management companies, credit card centers, and other onshore financial institutions (including equity investment). Locally incorporated foreign banks may invest in onshore banking financial institutions, on the condition that the relevant risks can be controlled. Based on the above, it seems that locally incorporated foreign banks are now able to participate in a series of tryouts, which are good for risk segregation and business innovation. Moreover, the procedure to launch branches has also been simplified. Banks need to obtain just one approval, instead of two as previously, if they want to set up new branches, the same requirement as for Chinese banks. The new measures also make it easier for foreign banks to go through regulatory formalities to appoint executives as well.

Fourthly, foreign banks are now permitted to proactively cooperate with their offshore parent groups to assist Chinese clients in their off-shore bond issuance, overseas capital raising, IPO (initial public offerings), M&A (mergers and acquisitions) and other financing activities in compliance with the PRC law. The new measures specify that foreign banks (including locally incorporated foreign banks and PRC branches of foreign banks) may explore business cooperation with their offshore parent bank groups, in compliance with the law, to provide comprehensive financial services to Chinese enterprises in offshore bond issuance, listing, acquisition and financing, by taking advantage of their global service networks. Such assistance provided by foreign banks in China may be expanded to include, client referral, client relationship maintenance, and onshore assistance in respect of financial services in relation to offshore bond issuance, listing, acquisition and financing.

Fifthly, foreign banks and their PRC branches will be freed from the obligation to obtain administrative pre-approval to conduct offshore wealth management services for clients and act as custodians for mutual fund or investing in stock markets, as long as they notify the regulator.

Capital account liberalization brings about more opportunities

With the financial liberalization process (See our previoius report: China's Financial Liveralization: Time to Restart), China gained experience in fighting capital outflow after the 2015 stock market crash that triggered large capital flight (Chart 2).Now it is the right time for China to gradually push up the capital account liberalization.

Foreign investors could invest in onshore securities through various channels put in place such as the Qualified Domestic Institutional Investor (QDII) program, Qualified Foreign Institutional Investors (QFII), the Renminbi Qualified Foreign Institutional Investor (“R-QFII”) scheme, the Shanghai-Hong Kong and Shenzhen-Hong Kong stock connect programs (the “Stock Connect”) and the China Interbank Bond Market (“CIBM”) Direct Access scheme. These channels were developed to provide financial institutions with quotas for outbound and inbound investments. Besides, the Sate Administration of Foreign Exchange (SAFE) has launched the Qualified Domestic Limited Partnership (QDLP), program in Shanghai in 2012, and the Qualified Domestic Investment Enterprise (QDIE) program in Shenzhen in 2014 to actively support domestic firms to conduct various types of outbound investment, including investments in offshore securities, hedge funds, private equity funds, real estate funds, and other types of investments. Both schemes permit qualified domestic investors to invest overseas and allow Chinese savers to diversify their holdings.

To further simplify management, facilitate operations, and further expand opening up, the Central Bank of China and SAFE recently released a new round of foreign exchange management reforms on 12th June. The reform measures are mainly concentrated on three aspects: Firstly, the 20% cap of QFII monthly fund remittance is lifted; Secondly, the QFII and RQFII principal lock period requirements are cancelled so that QFII and RQFII can remit the principal according to the investment; Thirdly, the authorities allow QFII and RQFII investors to hedge their exchange rate risks to its domestic investment.

The new policies regarding QFII and RQFII have eased main concerns of foreign investors in participating in these programs. Meanwhile, allowing QFII and RQFII to conduct FX hedging in China’s domestic market can also help to expand the onshore FX market. The move is seen as a critical step in the opening up of China’s capital market, helping to promote RMB internationalization, as well as the development of both Shanghai as a global financial center, and Hong Kong as an offshore RMB hub and destination for mainland investors.

Moreover, the SAFE has steadily advanced the QDLP and QDIE programs since early this year on a pilot basis in Shanghai and Shenzhen respectively. Under these programs, the investors in these two cities are allowed to make overseas investment with a quota of US 5 billion each.

Besides, the recent inclusion of large cap China A-shares in the MSCI Emerging Markets Index and the MSCI ACWI Index on June 1, 2018 also gave global investors greater access to China. After the potential full inclusion implemented with the continuing opening up, which is anticipated to be done in 5 years in September 2023, China A-shares will represent 17% in the while Emerging Markets Index.

Implications for Chinese and foreign financial institutions

We expect the relaxation will enable China’s financial system to receive an influx of foreign capital and expertise, with some foreign banks increasing their presence and penetration in high-growth markets around the world, especially for those that need to launch RMB businesses or to increase their current shareholdings in financial businesses in China. The regulator will encourage foreign banks to conduct more diversified business, especially in the areas of asset management and institutional banking, in which they have competitive advantages.

However, even in the absence of market-access or regulatory controls, very limited branch networks foreign banks will struggle to gain market share. Acquiring a troubled city bank or joint commercial bank would be one possible shortcut. Many of China’s smaller banks have strong growth prospects but weak balance sheets and poor risk management and they were substantially more exposed to risks from shadow banking, and significantly more reliant on high-cost wealth management products for funding. Banks with weak balance sheets, but strong branch networks and growth potential, could be the focus for foreign firms looking to enter the market.

The rising NPLs in China’s banking sector could deter many foreign financial institutions in the near term. According to the China Banking and Insurance Regulatory Commission (Chart 3), the bad debt in Chinese commercial banks at the end of 2017 recorded the highest since 2005, and stood at 1.7 trillion yuan ($270 billion). The high debt level of China (256% of GDP) also adds uncertainties to the outlook of China’s banking sector (Chart 4).

Moreover, all these reforms need to be proceeded with a measured approach. Although the authorities are well aware that structural reforms in the financial sector are the best solution to systemic risks in the long run, some domestic and external factors could also exert adverse impact on the momentum in financial liberalization and even slow its progress. Now China is pushing forward a campaign of financial deleveraging with the aim to reduce debt level of both financial and corporate sectors. If the deleveraging process goes smoothly, financial liberalization could accelerate as well. If not, the authorities will likely slow their pace for stability consideration.