David Marsh: How Migrants, UK's exit and Negative Interest Rates Are All Connected

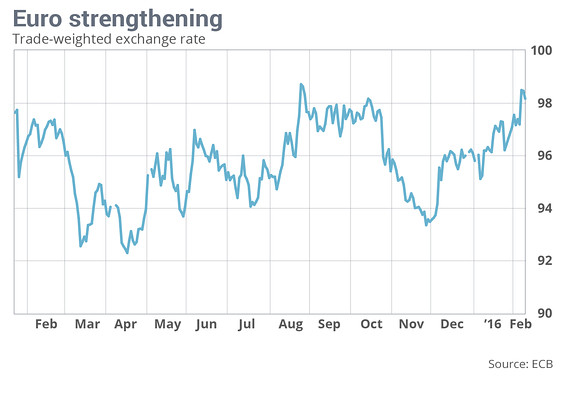

2016-03-25 IMI The euro has been strengthening in recent weeks, and is now as strong as it was when the European Central Bank moved to negative interest rates a year ago.

The third conflict — over the ECB’s plans for further cuts in negative interest rates and higher quantitative easing monthly bond purchases from €60 billion to €80 billion to combat low inflation — is furthest from the headlines but could be the most explosive. Pressure is building within the ECB’s governing council to head off expected easing at the next policy meeting on March 10 in view of widespread feeling that low inflation is predominantly due to weak world oil prices that the ECB cannot control.

Opposition to Draghi’s stated policy of sticking closely to the ECB’s mandate of achieving near-2% inflation over the medium term is led by the German and Dutch central banks, but appears to be growing among the 19 euro members.

Although the hawks are still well short of a council majority, they are sharpening their talons. The opposition focuses on the outlook that, in March 2017, the ECB and its constituent central banks will own more than 25% of all eurozone government debt, subverting the Maastricht treaty ban on monetary financing and reducing pressure on governments to curb borrowing.

The three thorny issues are interlinked.

The countries most worried about a British exit are largely from the Northern, Central and Eastern European states that are most hawkish about interest rates and migration curbs. In view of these interlinkages, a breakthrough on one set of questions could exacerbate Europe’s North-South creditor-debtor divide.

Doubts about the ECB’s commitment to further easing, as well as signs that the U.S. will be less aggressive in interest rate hikes, have led to the euro strengthening this year against the dollar. This is highly unwelcome to the ECB, which informally reckons the main impact of QE lies in weakening the currency — part of a worldwide trend towards competitive devaluations that forms one of the gravest weaknesses of the world economy.

The euro has been strengthening in recent weeks, and is now as strong as it was when the European Central Bank moved to negative interest rates a year ago.

The third conflict — over the ECB’s plans for further cuts in negative interest rates and higher quantitative easing monthly bond purchases from €60 billion to €80 billion to combat low inflation — is furthest from the headlines but could be the most explosive. Pressure is building within the ECB’s governing council to head off expected easing at the next policy meeting on March 10 in view of widespread feeling that low inflation is predominantly due to weak world oil prices that the ECB cannot control.

Opposition to Draghi’s stated policy of sticking closely to the ECB’s mandate of achieving near-2% inflation over the medium term is led by the German and Dutch central banks, but appears to be growing among the 19 euro members.

Although the hawks are still well short of a council majority, they are sharpening their talons. The opposition focuses on the outlook that, in March 2017, the ECB and its constituent central banks will own more than 25% of all eurozone government debt, subverting the Maastricht treaty ban on monetary financing and reducing pressure on governments to curb borrowing.

The three thorny issues are interlinked.

The countries most worried about a British exit are largely from the Northern, Central and Eastern European states that are most hawkish about interest rates and migration curbs. In view of these interlinkages, a breakthrough on one set of questions could exacerbate Europe’s North-South creditor-debtor divide.

Doubts about the ECB’s commitment to further easing, as well as signs that the U.S. will be less aggressive in interest rate hikes, have led to the euro strengthening this year against the dollar. This is highly unwelcome to the ECB, which informally reckons the main impact of QE lies in weakening the currency — part of a worldwide trend towards competitive devaluations that forms one of the gravest weaknesses of the world economy.