Steve H. Hanke: Argentina Should Scrap the Peso and Dollarize

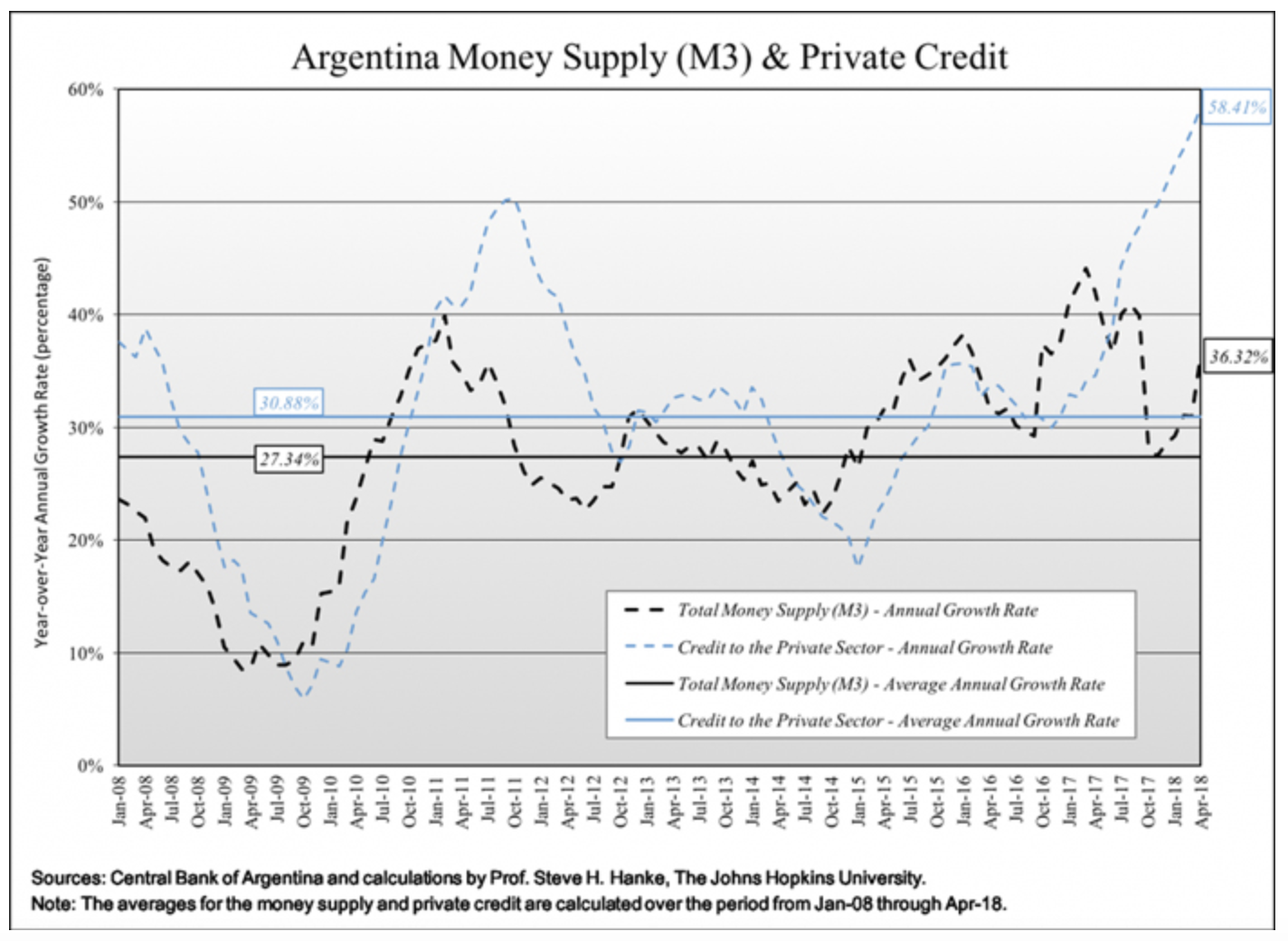

2018-07-06 IMI Why the peso rout? To answer that question, just take a look at the chart below. Note the surge in the growth rate of Argentina’s broad money since late 2017 and the explosion in private credit growth. These surging growth rates are not consistent with the objective of hitting Argentina’s inflation target of 10-15%/yr. Nor are they consistent with a stable peso. Markets can figure out those inconsistences faster than you can snap your fingers. And they did.

Why the peso rout? To answer that question, just take a look at the chart below. Note the surge in the growth rate of Argentina’s broad money since late 2017 and the explosion in private credit growth. These surging growth rates are not consistent with the objective of hitting Argentina’s inflation target of 10-15%/yr. Nor are they consistent with a stable peso. Markets can figure out those inconsistences faster than you can snap your fingers. And they did.

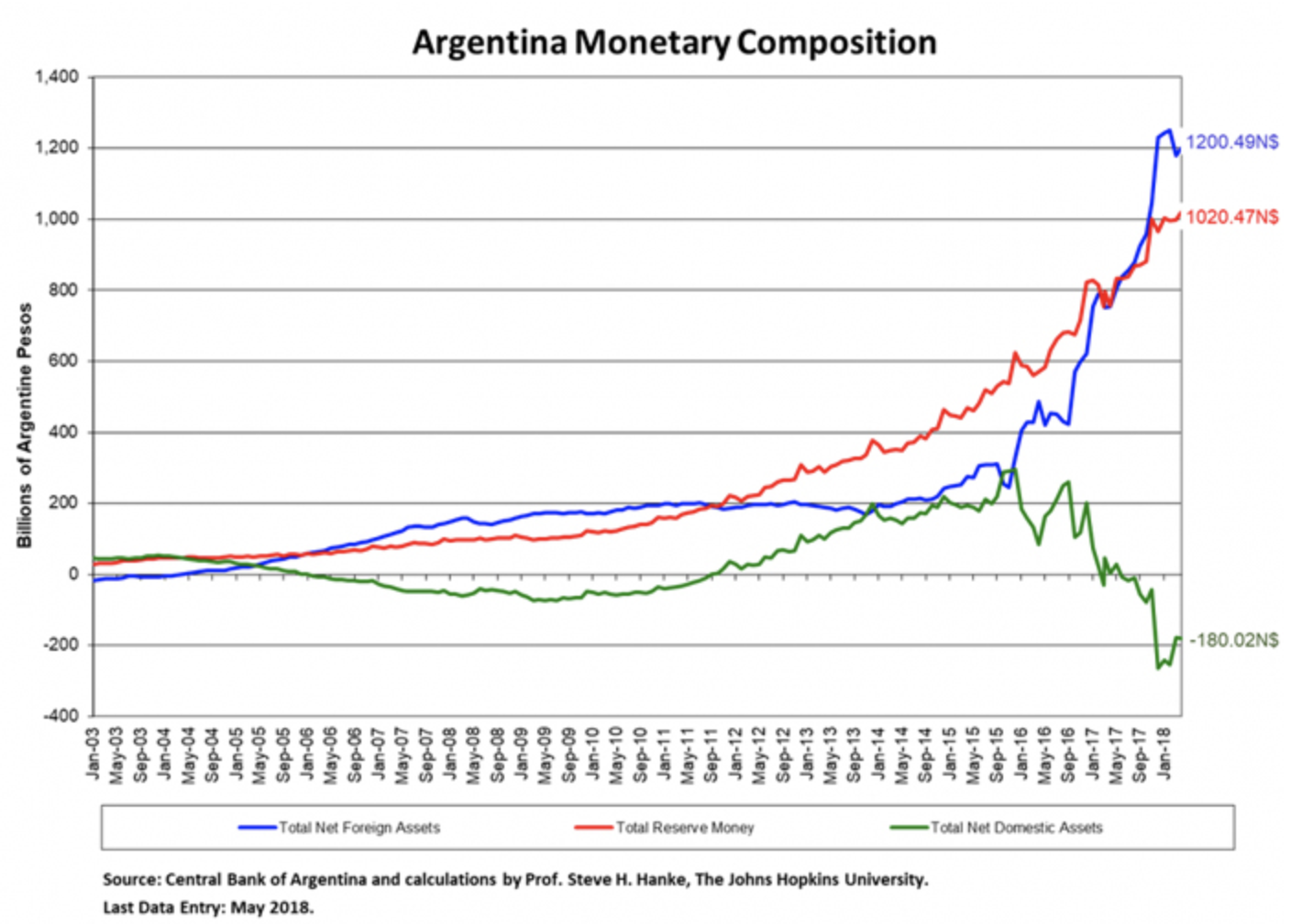

Another aspect of the BCRA’s monetary mischief is not so obvious, but it’s every bit as real. The BCRA has been surreptitiously financing the government’s deficit spending. It does this through the sterilization of increases in the net foreign asset component of Argentina’s monetary base. This is done via the sale of bonds issued by the BCRA (LEBACS). The sterilization (and financing of the government’s deficit) has been on a massive scale. In the January 2017—May 2018 period, the BCRA sterilized 50% of the total increase in the foreign asset component of the monetary base (see chart below). In consequence, the BCRA has been the largest source of finance for Argentina’s sizable primary fiscal deficit. These monetary-fiscal shenanigans are a formula for a currency disaster.

Another aspect of the BCRA’s monetary mischief is not so obvious, but it’s every bit as real. The BCRA has been surreptitiously financing the government’s deficit spending. It does this through the sterilization of increases in the net foreign asset component of Argentina’s monetary base. This is done via the sale of bonds issued by the BCRA (LEBACS). The sterilization (and financing of the government’s deficit) has been on a massive scale. In the January 2017—May 2018 period, the BCRA sterilized 50% of the total increase in the foreign asset component of the monetary base (see chart below). In consequence, the BCRA has been the largest source of finance for Argentina’s sizable primary fiscal deficit. These monetary-fiscal shenanigans are a formula for a currency disaster.

To end Argentina’s never-ending monetary nightmare, the BCRA, along with the peso, should be mothballed and put in a museum. The peso should be replaced with the U.S. dollar. Argentina should do officially what all Argentines do in times of trouble: dollarize. It’s time for President Macri to face reality. He must drive a stake in the heart of Gradualism. Dollarization would do just that. And with that, confidence would be established; and as John Maynard Keynes put it: “The state of confidence, as they term it, is a matter to which practical men pay the closest and most anxious attention.”

To end Argentina’s never-ending monetary nightmare, the BCRA, along with the peso, should be mothballed and put in a museum. The peso should be replaced with the U.S. dollar. Argentina should do officially what all Argentines do in times of trouble: dollarize. It’s time for President Macri to face reality. He must drive a stake in the heart of Gradualism. Dollarization would do just that. And with that, confidence would be established; and as John Maynard Keynes put it: “The state of confidence, as they term it, is a matter to which practical men pay the closest and most anxious attention.”