Dong Jinyue and Xia Le: RMB Exchange Rate Outlook Under the Trade War Threat

2018-11-27 IMI

Drivers of the current RMB depreciation: Both domestic and external factors

at play

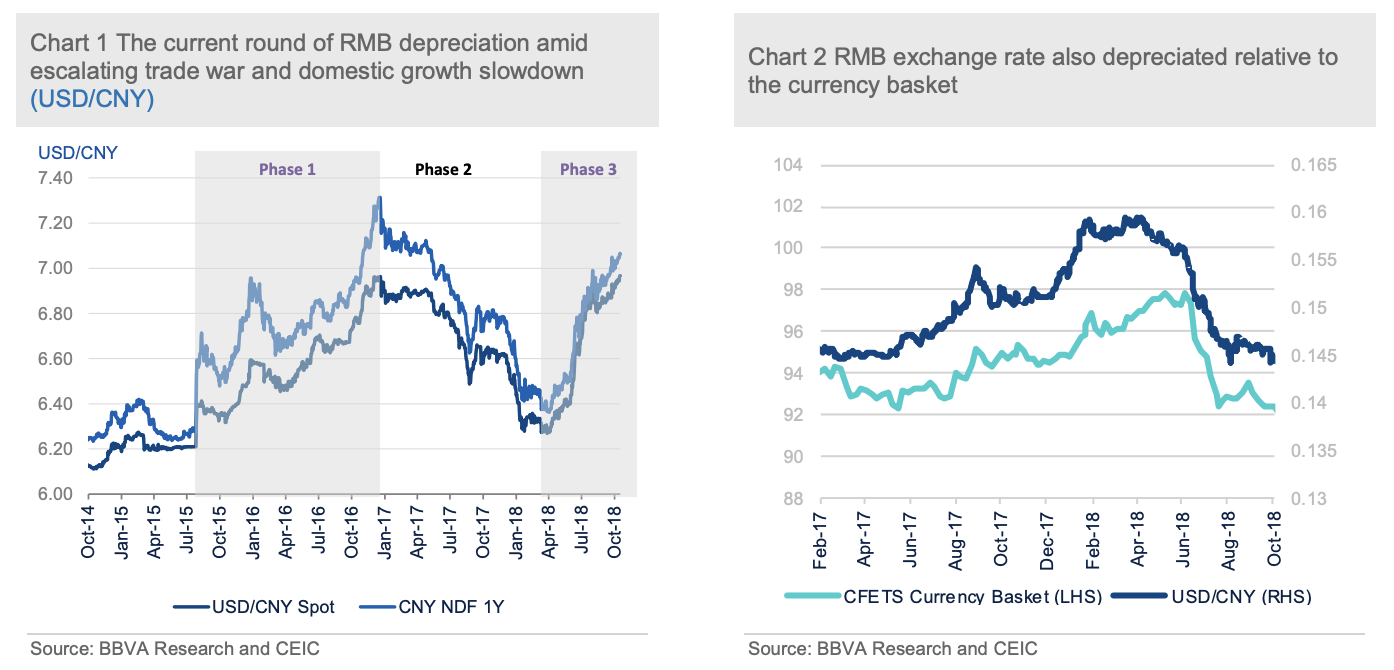

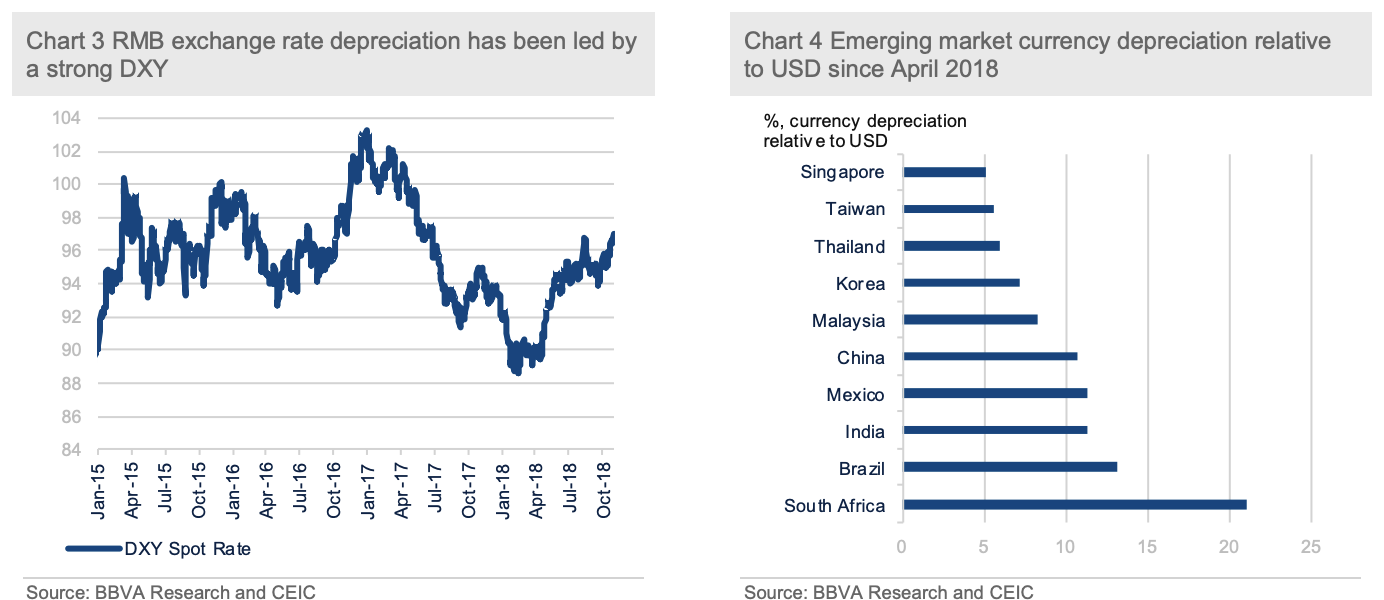

The current round of RMB depreciation happens in the context of an ever-strengthening USD thanks to the Fed’s monetary normalization. It is noted that the USD index (DXY) has rebounded by almost 9% from its low early this year. (Chart 3) However, relative to its emerging market peers, the magnitude of RMB depreciation is still sizeable. (Chart 4) We reckon that a confluence of factors contributed to the weak performance of the RMB on top of the USD strength:

First, escalating trade tensions with the US dominated the market sentiments at the current stage. On top of imposing 25% punitive tariffs on China’s exports of USD 50 billion, the US President Trump announced in September the imposition of 10% punitive tariff rate on China’s exports of USD 200 billion. Moreover, President Trump threated to increase the tariff rate to 25% from January 1st, 2019 if both sides fail to reach any agreement by then. Given that export sector has always been an important growth engine for China, the trade tensions with the US added more uncertainties to the country’s growth outlook and thereby deteriorated investors’ sentiments.

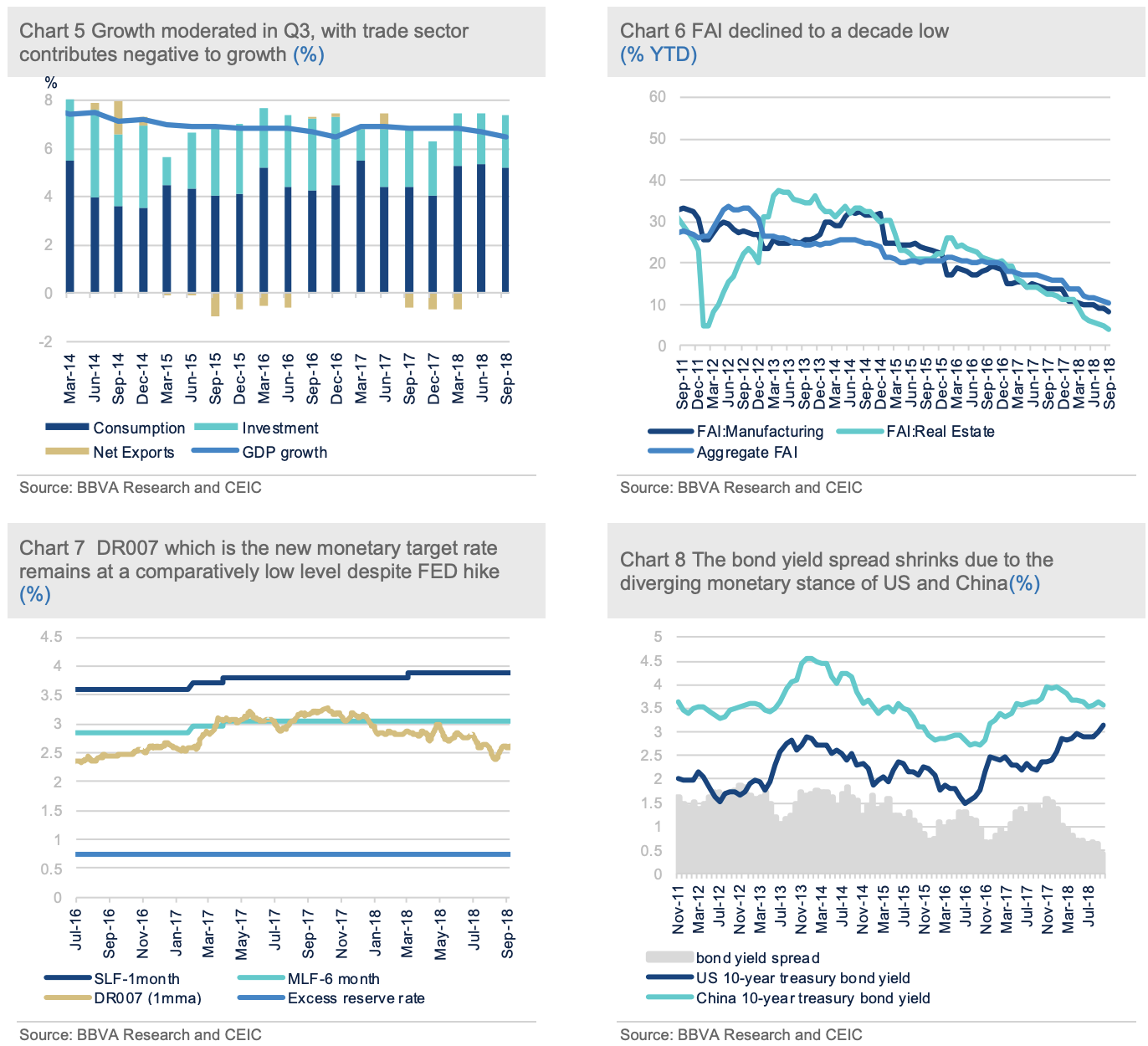

Second, domestic economic slowdown leads to weak macro-fundamentals to RMB exchange rate. The 2018 Q3 GDP outturn moderated to 6.5% y/y from the previous reading at 6.7%. (Chart 5) The lackluster performance of Q3 economy is broad-based, amid ever-intensifying headwinds from both cyclical forces related to previous financial deleveraging campaign and the escalated trade tensions with the US. In particular, investment bore the brunt of dampened confidence. In September, the growth rate of China’s Urban Fixed Asset Investment (FAI) decelerated to 5.4% ytd, y/y, lowest for the past decade. (Chart 6).

Last but not the least, the divergence of US and China’s monetary policy stance puts additional pressure on RMB exchange rate. China’s authorities are now attempting to counter with headwinds from cyclical factors as well as external trade tensions by loosening its monetary policy. (Chart 7) At the same time, the US Fed, encouraged by good economic performance, is steadfastly advancing its normalization of monetary policy by hiking interest rates. As a result, the diverging policy directions of the two central banks have led to a narrowing of 10-year Treasury Bond yields between China and the US. (Chart 8).

Drivers of the current RMB depreciation: Both domestic and external factors

at play

The current round of RMB depreciation happens in the context of an ever-strengthening USD thanks to the Fed’s monetary normalization. It is noted that the USD index (DXY) has rebounded by almost 9% from its low early this year. (Chart 3) However, relative to its emerging market peers, the magnitude of RMB depreciation is still sizeable. (Chart 4) We reckon that a confluence of factors contributed to the weak performance of the RMB on top of the USD strength:

First, escalating trade tensions with the US dominated the market sentiments at the current stage. On top of imposing 25% punitive tariffs on China’s exports of USD 50 billion, the US President Trump announced in September the imposition of 10% punitive tariff rate on China’s exports of USD 200 billion. Moreover, President Trump threated to increase the tariff rate to 25% from January 1st, 2019 if both sides fail to reach any agreement by then. Given that export sector has always been an important growth engine for China, the trade tensions with the US added more uncertainties to the country’s growth outlook and thereby deteriorated investors’ sentiments.

Second, domestic economic slowdown leads to weak macro-fundamentals to RMB exchange rate. The 2018 Q3 GDP outturn moderated to 6.5% y/y from the previous reading at 6.7%. (Chart 5) The lackluster performance of Q3 economy is broad-based, amid ever-intensifying headwinds from both cyclical forces related to previous financial deleveraging campaign and the escalated trade tensions with the US. In particular, investment bore the brunt of dampened confidence. In September, the growth rate of China’s Urban Fixed Asset Investment (FAI) decelerated to 5.4% ytd, y/y, lowest for the past decade. (Chart 6).

Last but not the least, the divergence of US and China’s monetary policy stance puts additional pressure on RMB exchange rate. China’s authorities are now attempting to counter with headwinds from cyclical factors as well as external trade tensions by loosening its monetary policy. (Chart 7) At the same time, the US Fed, encouraged by good economic performance, is steadfastly advancing its normalization of monetary policy by hiking interest rates. As a result, the diverging policy directions of the two central banks have led to a narrowing of 10-year Treasury Bond yields between China and the US. (Chart 8).

The authorities’ attitude toward the RMB depreciation: From “ride-on-the-wave” to “lean-against-the-wind”

At the early stage, Chinese authorities didn’t react to the depreciation with market intervention as witnessed during the 2015-2016 devaluation. On the contrary, the PBoC intentionally allowed market forces to lead the exchange rate to go weaker, partially because they would like to harness the market-driven depreciation to offset the adverse impact of trade tensions with the US on exports.

However, as the currency depreciation became steeper, the authorities started to worry about that the ever-weakening trend of the RMB could lead to a vicious cycle of currency depreciation and capital outflows. Given that China’s financial system is still suffering from the previously implemented deleveraging measures, a sharp depreciation could dampen people’s confidence and pose a material threat to the financial stability. Starting from August, the authorities have implemented a series of measures to support RMB exchange rate, including:

(i) Imposed a 20% reserve requirements on sales of FX forward contracts to raise the costs of shorting the RMB exchange rate;

(ii) Resumed the counter-cyclical factor in the pricing formula of the daily opening exchange rate of the RMB;

(iii) Restricted banks in free trade zones from lending the RMB to foreign banks to tighten the offshore RMB liquidity;

(iv) Tightened restrictions under the capital account to curb overseas investment of Chinese firms;

(v) Issued central bank bills in the offshore RMB market of Hong Kong to soak up the RMB liquidity in support of the currency’s offshore exchange rate.

To date, the authorities’ efforts have proved to be effective. The USDCNY has been kept below 7 despite increasing market volatility. The authorities also improved their communication with the market to anchor investors’ expectations and avert large-scale capital outflows.

RMB exchange rate outlook: hinging on a meeting between President Trump

and Xi

Looking ahead, some factors such as a strong USD and the divergence between the US and China’s monetary policy will continue to weigh on the RMB exchange rate. Nevertheless, there is a chance that trade tensions between the US and China will improve after the scheduled meeting between President Trump and Xi during the G20 meeting in Argentina at the end of November. It is reported that both sides will send their delegations of trade negotiation to strike a deal, which is very relevant for the outlook of the RMB exchange rate.

The authorities’ attitude toward the RMB depreciation: From “ride-on-the-wave” to “lean-against-the-wind”

At the early stage, Chinese authorities didn’t react to the depreciation with market intervention as witnessed during the 2015-2016 devaluation. On the contrary, the PBoC intentionally allowed market forces to lead the exchange rate to go weaker, partially because they would like to harness the market-driven depreciation to offset the adverse impact of trade tensions with the US on exports.

However, as the currency depreciation became steeper, the authorities started to worry about that the ever-weakening trend of the RMB could lead to a vicious cycle of currency depreciation and capital outflows. Given that China’s financial system is still suffering from the previously implemented deleveraging measures, a sharp depreciation could dampen people’s confidence and pose a material threat to the financial stability. Starting from August, the authorities have implemented a series of measures to support RMB exchange rate, including:

(i) Imposed a 20% reserve requirements on sales of FX forward contracts to raise the costs of shorting the RMB exchange rate;

(ii) Resumed the counter-cyclical factor in the pricing formula of the daily opening exchange rate of the RMB;

(iii) Restricted banks in free trade zones from lending the RMB to foreign banks to tighten the offshore RMB liquidity;

(iv) Tightened restrictions under the capital account to curb overseas investment of Chinese firms;

(v) Issued central bank bills in the offshore RMB market of Hong Kong to soak up the RMB liquidity in support of the currency’s offshore exchange rate.

To date, the authorities’ efforts have proved to be effective. The USDCNY has been kept below 7 despite increasing market volatility. The authorities also improved their communication with the market to anchor investors’ expectations and avert large-scale capital outflows.

RMB exchange rate outlook: hinging on a meeting between President Trump

and Xi

Looking ahead, some factors such as a strong USD and the divergence between the US and China’s monetary policy will continue to weigh on the RMB exchange rate. Nevertheless, there is a chance that trade tensions between the US and China will improve after the scheduled meeting between President Trump and Xi during the G20 meeting in Argentina at the end of November. It is reported that both sides will send their delegations of trade negotiation to strike a deal, which is very relevant for the outlook of the RMB exchange rate.

In the run-up to the Trump-Xi meeting, there is no doubt that China’s authorities would like to maintain the RMB exchange rate at a relatively stable level. Apart from preventing a vicious cycle of currency depreciation and capital outflows, China’s authorities also want to send signals of goodwill to the US side so as to lay a good foundation for the two leaders’ meeting. Indeed, the US administration is very concerned with the deprecation of the RMB and repeatedly threatened to label China as a currency manipulator. A stable RMB could help both sides to break the ice in the incoming round of negotiation.

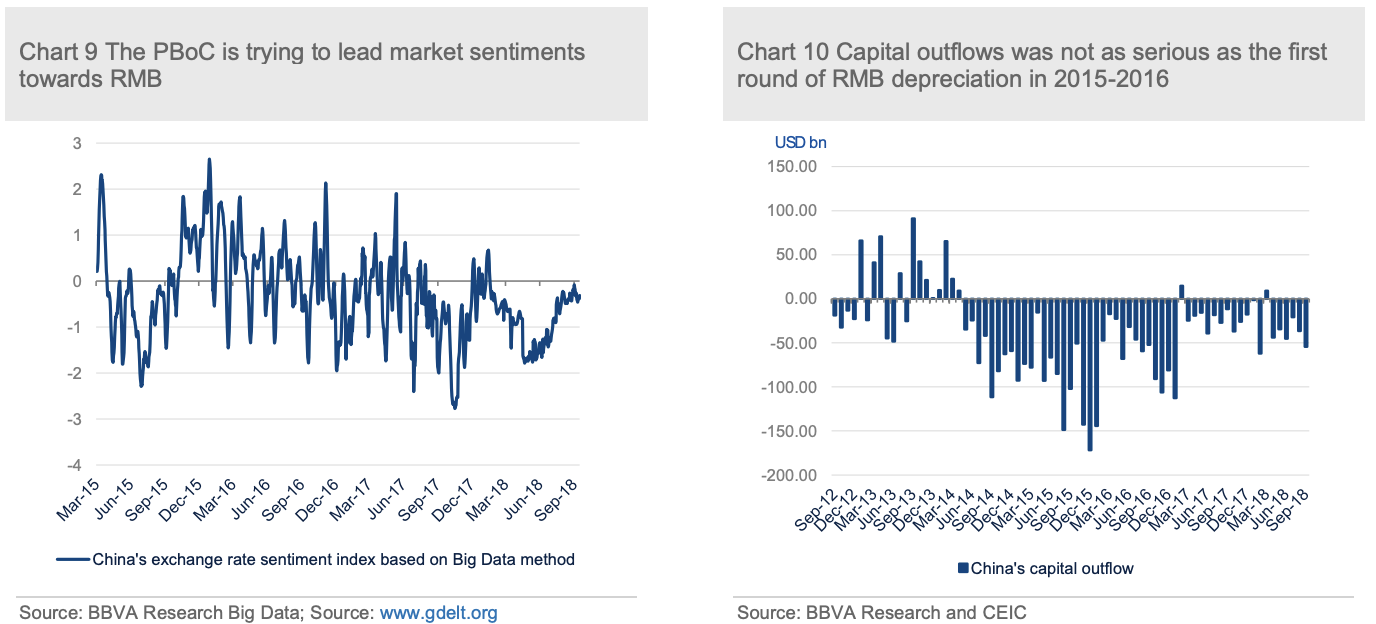

We are confident that China’s central bank has the capacity to achieve this stabilizing goal over the short term as the previously implemented measures and communications have helped to stabilize investors’ sentiment and contain capital outflows. (Chart 9 & 10).

The trajectory of the RMB beyond the Trump-Xi meeting will largely hinge on the outcome of the meeting. In our baseline scenario to which we assign a probability of 70%, we expect the incoming Trump-Xi meeting to make certain progress towards solving bilateral trade disputes. After the US midterm election, both sides have a stronger incentive to come back to the negotiation table to make a deal. More importantly, on the major topics of trade negotiation including forced technique transfer, market accession and protection of intellectual properties, China has room to make concessions to the US.

Definitely the trade negotiations involved a lot of technical issues which can hardly be solved through one meeting between the national leaders. A more realistic scenario is that President Trump and Xi reach an agreement on certain principles through their meeting which lay a good foundation for the deepening of bilateral negotiations. Moreover, the two sides would hold fire and refrain from escalating their confrontations in the trade area until they reach a more comprehensive agreement.

All in all, we hold a conservatively optimistic view toward the Trump-Xi meeting. If things go as we expect, the RMB to USD exchange rate will regain its momentum and bounce back to 6.85 at end-2018 and then float in a range of 6.6-7 in 2019 which we believe approaches to our estimated equilibrium exchange rate.

In our risk scenario with a chance of 30%, the Trump-Xi meeting during G20 fails to yield any positive result, which is likely to prompt the RMB exchange rate to exceed the level of 7 quickly. To maintain financial stability, the authorities will increase their intervention to the market to make sure that the pace of depreciation is not too steep to cause market panic. Even so, the USDCNY will likely go towards the level of 7.3 by the end of 2018. The pressure of depreciation will last afterwards until China and the US find another opportunity to reopen bilateral negotiation which is likely to be in the second quarter of 2019.

In sum, the incoming Trump-Xi meeting will largely determine the trend of the RMB over next 3-4 months. Given the vast uncertainty surrounding the meeting, investors need to be prepared for all the possible outcomes.

In the run-up to the Trump-Xi meeting, there is no doubt that China’s authorities would like to maintain the RMB exchange rate at a relatively stable level. Apart from preventing a vicious cycle of currency depreciation and capital outflows, China’s authorities also want to send signals of goodwill to the US side so as to lay a good foundation for the two leaders’ meeting. Indeed, the US administration is very concerned with the deprecation of the RMB and repeatedly threatened to label China as a currency manipulator. A stable RMB could help both sides to break the ice in the incoming round of negotiation.

We are confident that China’s central bank has the capacity to achieve this stabilizing goal over the short term as the previously implemented measures and communications have helped to stabilize investors’ sentiment and contain capital outflows. (Chart 9 & 10).

The trajectory of the RMB beyond the Trump-Xi meeting will largely hinge on the outcome of the meeting. In our baseline scenario to which we assign a probability of 70%, we expect the incoming Trump-Xi meeting to make certain progress towards solving bilateral trade disputes. After the US midterm election, both sides have a stronger incentive to come back to the negotiation table to make a deal. More importantly, on the major topics of trade negotiation including forced technique transfer, market accession and protection of intellectual properties, China has room to make concessions to the US.

Definitely the trade negotiations involved a lot of technical issues which can hardly be solved through one meeting between the national leaders. A more realistic scenario is that President Trump and Xi reach an agreement on certain principles through their meeting which lay a good foundation for the deepening of bilateral negotiations. Moreover, the two sides would hold fire and refrain from escalating their confrontations in the trade area until they reach a more comprehensive agreement.

All in all, we hold a conservatively optimistic view toward the Trump-Xi meeting. If things go as we expect, the RMB to USD exchange rate will regain its momentum and bounce back to 6.85 at end-2018 and then float in a range of 6.6-7 in 2019 which we believe approaches to our estimated equilibrium exchange rate.

In our risk scenario with a chance of 30%, the Trump-Xi meeting during G20 fails to yield any positive result, which is likely to prompt the RMB exchange rate to exceed the level of 7 quickly. To maintain financial stability, the authorities will increase their intervention to the market to make sure that the pace of depreciation is not too steep to cause market panic. Even so, the USDCNY will likely go towards the level of 7.3 by the end of 2018. The pressure of depreciation will last afterwards until China and the US find another opportunity to reopen bilateral negotiation which is likely to be in the second quarter of 2019.

In sum, the incoming Trump-Xi meeting will largely determine the trend of the RMB over next 3-4 months. Given the vast uncertainty surrounding the meeting, investors need to be prepared for all the possible outcomes.