Dong Jinyue and Xia Le: Will the Current RMB Appreciation Sustainable?

2017-08-28 IMI

What drives the recent RMB appreciation?

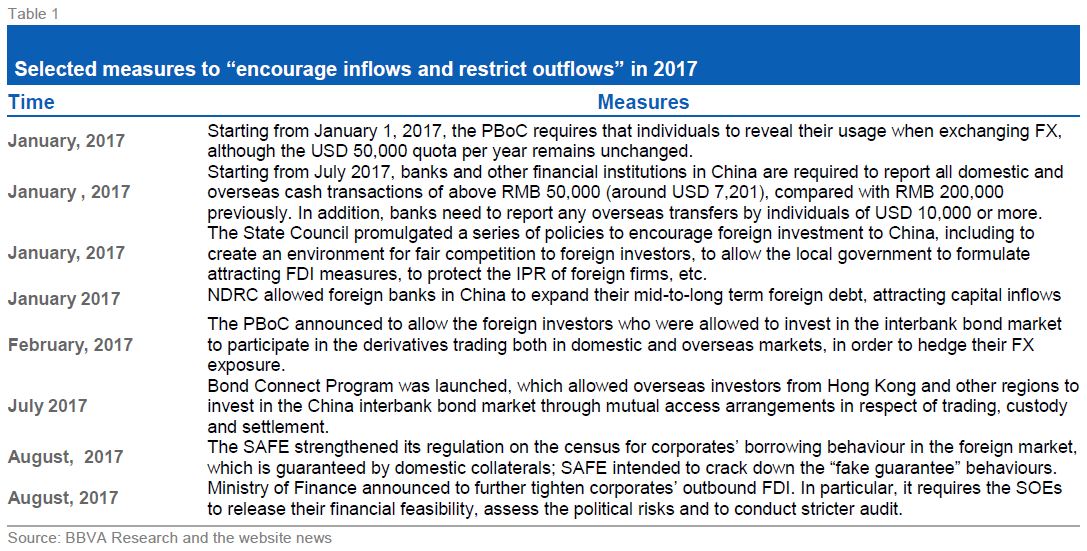

A confluence of factors has contributed to the strong performance of the RMB:

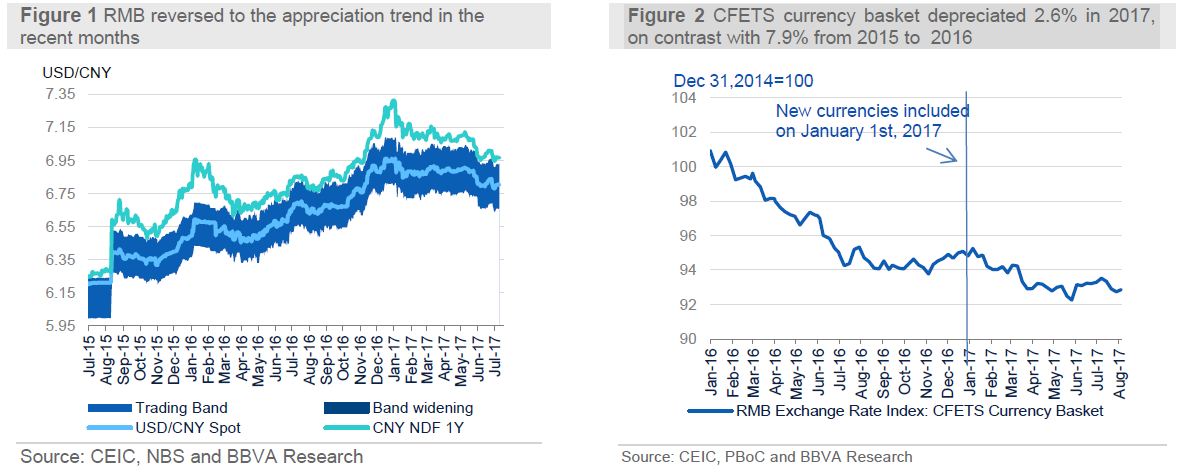

First, the USD has registered significant depreciation against other major developed and emerging market currencies as the “Trump trade”, which boosted the USD last year, have lost its magic. (Figure 4) Indeed, investors have given concerns of the possibility that President Trump is unable to put his ambitious plan of economic reforms on tax cut, financial deregulation and infrastructure investment into practice. As a consequence, the RMB has appreciated against the USD while continue to depreciate against other currencies. Since January 1st, the RMB has still depreciated against the CFETS currency basket by 2.5%.

Second, the stronger-than-expected growth momentum in China provides a solid economic fundamental support to the RMB exchange rate. Notwithstanding the authorities’ stepped-up efforts to cool down the property market and curb shadow banking activities, growth in Q1 and Q2 rebounded to 6.9% y/y. Now it is increasingly likely that this year’s growth could surpass the official target of 6.5%. Moreover, boosted by the campaign of eliminating over-capacity, upstream industries led the profit rise for corporate sector. In the first half of the year, the growth rate of industrial enterprise profit amounted to 22%, which is very helpful for firms to repair their balance sheets and has largely reduced the tail risk to the macro economy.

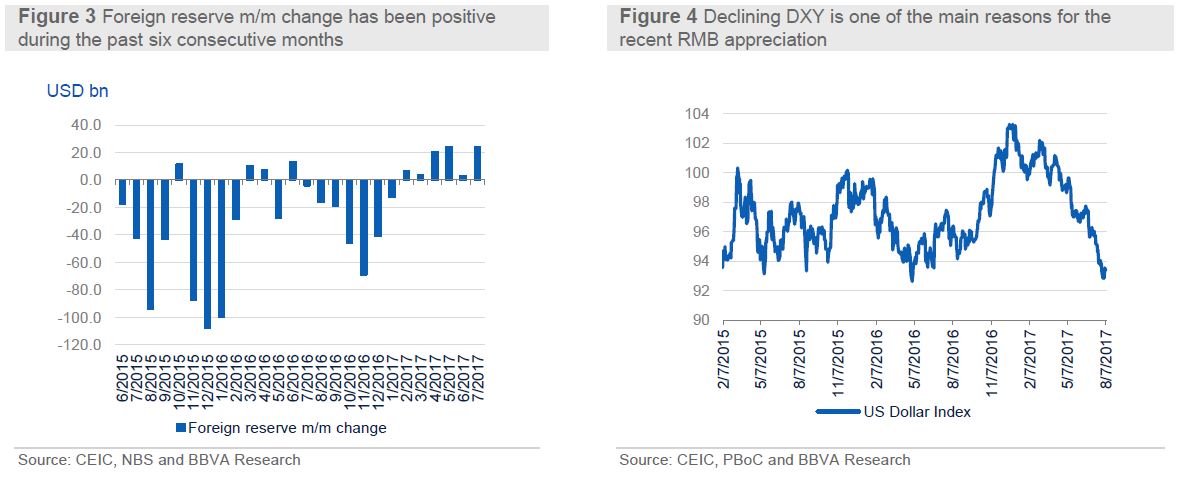

Last but not least, Chinese authorities have implemented a series of initiatives to “promote capital inflows and limit outflows” this year, while measures of the last year continued their effects, which enabled them to have a tighter grip of exchange rate stability. (Table 1) In particular, the PBoC has been beefing up their efforts to enforce the existing regulations on outbound FDI. It is recently reported that some regulators have prevented some large private enterprises from investing in overseas assets. As a result, China’s outbound FDI in the first six months of 2017 declined by -46% compared to that over the same period of the last year. On top of these measures, the authorities also try to attract more capital inflows by opening domestic bond market to potential foreign investors. In addition, the PBoC introduced some “counter-cyclical factors” into the RMB fixing price mechanism in May 2017, strengthening their control of the RMB exchange rate.

What drives the recent RMB appreciation?

A confluence of factors has contributed to the strong performance of the RMB:

First, the USD has registered significant depreciation against other major developed and emerging market currencies as the “Trump trade”, which boosted the USD last year, have lost its magic. (Figure 4) Indeed, investors have given concerns of the possibility that President Trump is unable to put his ambitious plan of economic reforms on tax cut, financial deregulation and infrastructure investment into practice. As a consequence, the RMB has appreciated against the USD while continue to depreciate against other currencies. Since January 1st, the RMB has still depreciated against the CFETS currency basket by 2.5%.

Second, the stronger-than-expected growth momentum in China provides a solid economic fundamental support to the RMB exchange rate. Notwithstanding the authorities’ stepped-up efforts to cool down the property market and curb shadow banking activities, growth in Q1 and Q2 rebounded to 6.9% y/y. Now it is increasingly likely that this year’s growth could surpass the official target of 6.5%. Moreover, boosted by the campaign of eliminating over-capacity, upstream industries led the profit rise for corporate sector. In the first half of the year, the growth rate of industrial enterprise profit amounted to 22%, which is very helpful for firms to repair their balance sheets and has largely reduced the tail risk to the macro economy.

Last but not least, Chinese authorities have implemented a series of initiatives to “promote capital inflows and limit outflows” this year, while measures of the last year continued their effects, which enabled them to have a tighter grip of exchange rate stability. (Table 1) In particular, the PBoC has been beefing up their efforts to enforce the existing regulations on outbound FDI. It is recently reported that some regulators have prevented some large private enterprises from investing in overseas assets. As a result, China’s outbound FDI in the first six months of 2017 declined by -46% compared to that over the same period of the last year. On top of these measures, the authorities also try to attract more capital inflows by opening domestic bond market to potential foreign investors. In addition, the PBoC introduced some “counter-cyclical factors” into the RMB fixing price mechanism in May 2017, strengthening their control of the RMB exchange rate.

The authorities are in no hurry to give full flexibility to the RMB

The on-going RMB appreciation provides some policy room for the authorities to push forward RMB exchange rate reform. We expect that the authorities will further expand the RMB to USD daily trading band (the current range is +-2%) by reducing the market intervention; also the authorities might introduce more market participants into the RMB FX market and to further expand the domestic FX market trading time, etc.

It is noted that all the above-mentioned measures only bear symbolic meanings. For a giant economy like China, it is imperative to have a “clean’ floating exchange rate regime so that the authorities to retain the independence of monetary policy and to cushion external shocks.

However, such a shift to a “clean float” is unlikely to happen soon. The recently concluded National Financial Work Conference has already set the tone for domestic financial regulations and policy in the next five years. According to the Conference, the authorities’ focus should be addressing a number of domestic financial vulnerabilities including shadow banking activities and corporate indebtedness. Under such a circumstance, the authorities could be reluctant to make any important change to the existing exchange rate policy regime before domestic financial vulnerabilities have been defused.

RMB exchange rate outlook

Although the RMB to USD exchange rate has been appreciating for the past couple of months, whether it is sustainable in the rest of this year and the next year is still questionable. Actually, several factors might bring some headwinds to RMB exchange rate in the short to medium term. For instance, from the US side, the DXY might reverse its current depreciation trend as the FED speeds up its interest rate hike process and the US economy picks up. In addition, the potential risk of Sino-US trade war, although its probability becomes low after President Xi’s visit to US, still remains.

From the domestic perspective, it is still uncertain that the current better-than-expected economy is sustainable given the on-going financial deleveraging and credit slowdown, as the credit shrink might have some time lag on growth. In addition, as the current external demand has been offsetting the adverse effect from financial deleveraging and credit growth slowdown, the authorities might not want to maintain an appreciating RMB. Moreover, the 50,000 USD quota per year for each individual to change RMB to foreign currencies, which is released at the beginning of the next year, will urge households to diversify their portfolio, bringing downward pressure of RMB exchange rate.

Based on the above factors, we predict that RMB to USD exchange rate will reach around 6.85 to 6.9 at end of this year. That being said, compared with the RMB exchange rate at 6.95 the beginning of the year, RMB will display some soft appreciation throughout the year; while compared with the current value, RMB will moderately depreciate in the rest of the year. However, we do not expect the RMB to go into the constant appreciation territory before the US FED ends its interest rate hike cycle. Overall, while predicting RMB will be generally stable in this year and the following year, we predict more volatile two-way movements of the RMB in the remainder of the year, as the authorities push forward the RMB exchange rate reform and financial liberalization.

The authorities are in no hurry to give full flexibility to the RMB

The on-going RMB appreciation provides some policy room for the authorities to push forward RMB exchange rate reform. We expect that the authorities will further expand the RMB to USD daily trading band (the current range is +-2%) by reducing the market intervention; also the authorities might introduce more market participants into the RMB FX market and to further expand the domestic FX market trading time, etc.

It is noted that all the above-mentioned measures only bear symbolic meanings. For a giant economy like China, it is imperative to have a “clean’ floating exchange rate regime so that the authorities to retain the independence of monetary policy and to cushion external shocks.

However, such a shift to a “clean float” is unlikely to happen soon. The recently concluded National Financial Work Conference has already set the tone for domestic financial regulations and policy in the next five years. According to the Conference, the authorities’ focus should be addressing a number of domestic financial vulnerabilities including shadow banking activities and corporate indebtedness. Under such a circumstance, the authorities could be reluctant to make any important change to the existing exchange rate policy regime before domestic financial vulnerabilities have been defused.

RMB exchange rate outlook

Although the RMB to USD exchange rate has been appreciating for the past couple of months, whether it is sustainable in the rest of this year and the next year is still questionable. Actually, several factors might bring some headwinds to RMB exchange rate in the short to medium term. For instance, from the US side, the DXY might reverse its current depreciation trend as the FED speeds up its interest rate hike process and the US economy picks up. In addition, the potential risk of Sino-US trade war, although its probability becomes low after President Xi’s visit to US, still remains.

From the domestic perspective, it is still uncertain that the current better-than-expected economy is sustainable given the on-going financial deleveraging and credit slowdown, as the credit shrink might have some time lag on growth. In addition, as the current external demand has been offsetting the adverse effect from financial deleveraging and credit growth slowdown, the authorities might not want to maintain an appreciating RMB. Moreover, the 50,000 USD quota per year for each individual to change RMB to foreign currencies, which is released at the beginning of the next year, will urge households to diversify their portfolio, bringing downward pressure of RMB exchange rate.

Based on the above factors, we predict that RMB to USD exchange rate will reach around 6.85 to 6.9 at end of this year. That being said, compared with the RMB exchange rate at 6.95 the beginning of the year, RMB will display some soft appreciation throughout the year; while compared with the current value, RMB will moderately depreciate in the rest of the year. However, we do not expect the RMB to go into the constant appreciation territory before the US FED ends its interest rate hike cycle. Overall, while predicting RMB will be generally stable in this year and the following year, we predict more volatile two-way movements of the RMB in the remainder of the year, as the authorities push forward the RMB exchange rate reform and financial liberalization.