Dong Jinyue and Xia Le:Economic Moderation Continues

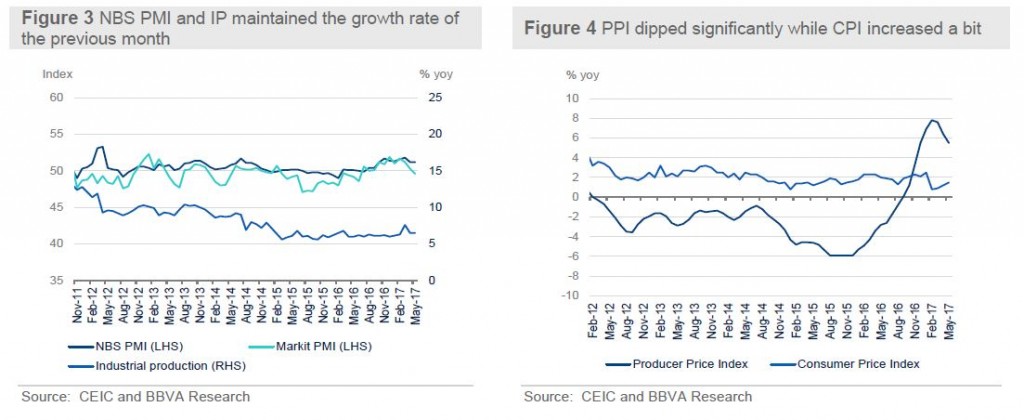

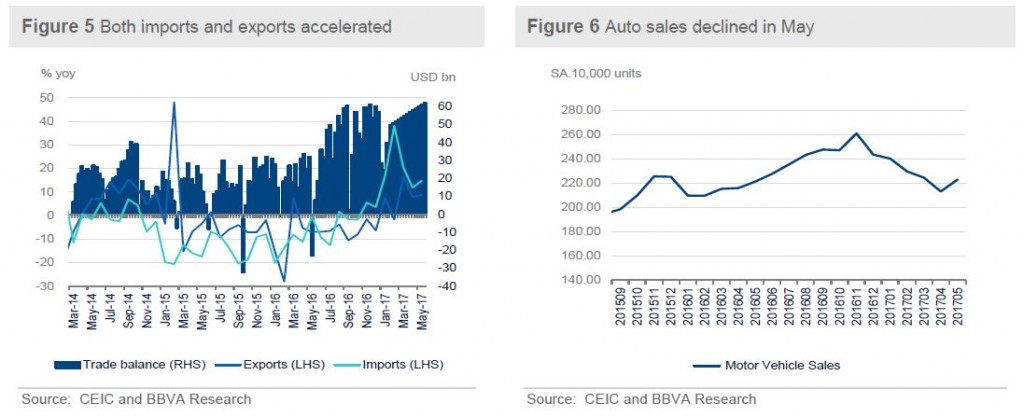

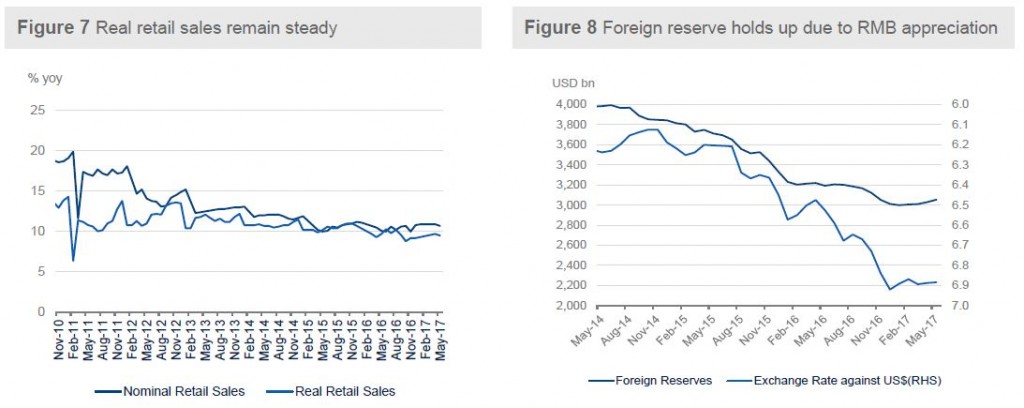

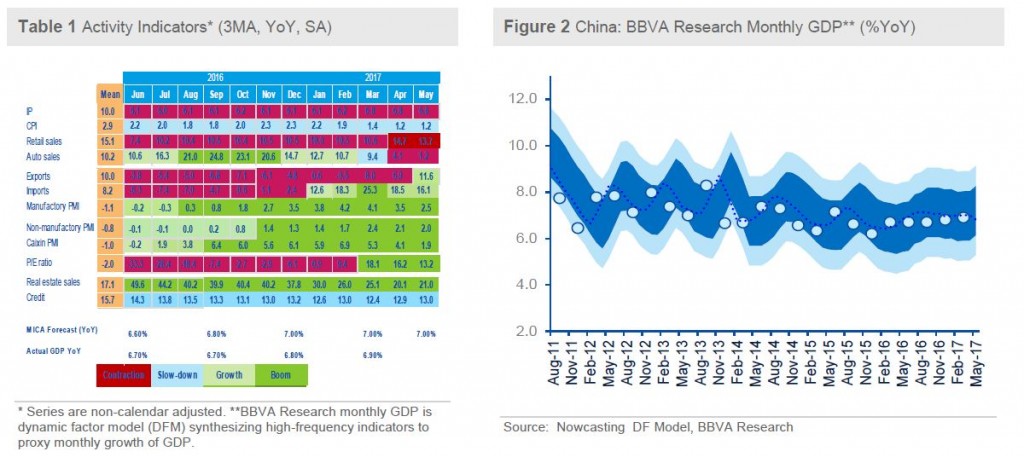

2017-06-16 IMI Monetary tightening effects caused by regulatory enhancement haven’t fully translated into the real economy yet. That being said, growth moderation is expected to persist in the rest of the year. Investment is likely to bear the brunt of regulatory stress as it tends to raise firms’ financing costs. Meanwhile, the improved external environment could partially offset the downtrend of investment by boosting exports and the consumption still remains steady.

Monetary tightening effects caused by regulatory enhancement haven’t fully translated into the real economy yet. That being said, growth moderation is expected to persist in the rest of the year. Investment is likely to bear the brunt of regulatory stress as it tends to raise firms’ financing costs. Meanwhile, the improved external environment could partially offset the downtrend of investment by boosting exports and the consumption still remains steady.