Fernando Bolívar, Sumedh Deorukhkar, Álvaro Ortiz, Tomasa Rodrigo, Xia Le and Chenlu Wu: A Big Data Approach to Gauge Trade-war Fears in Asia

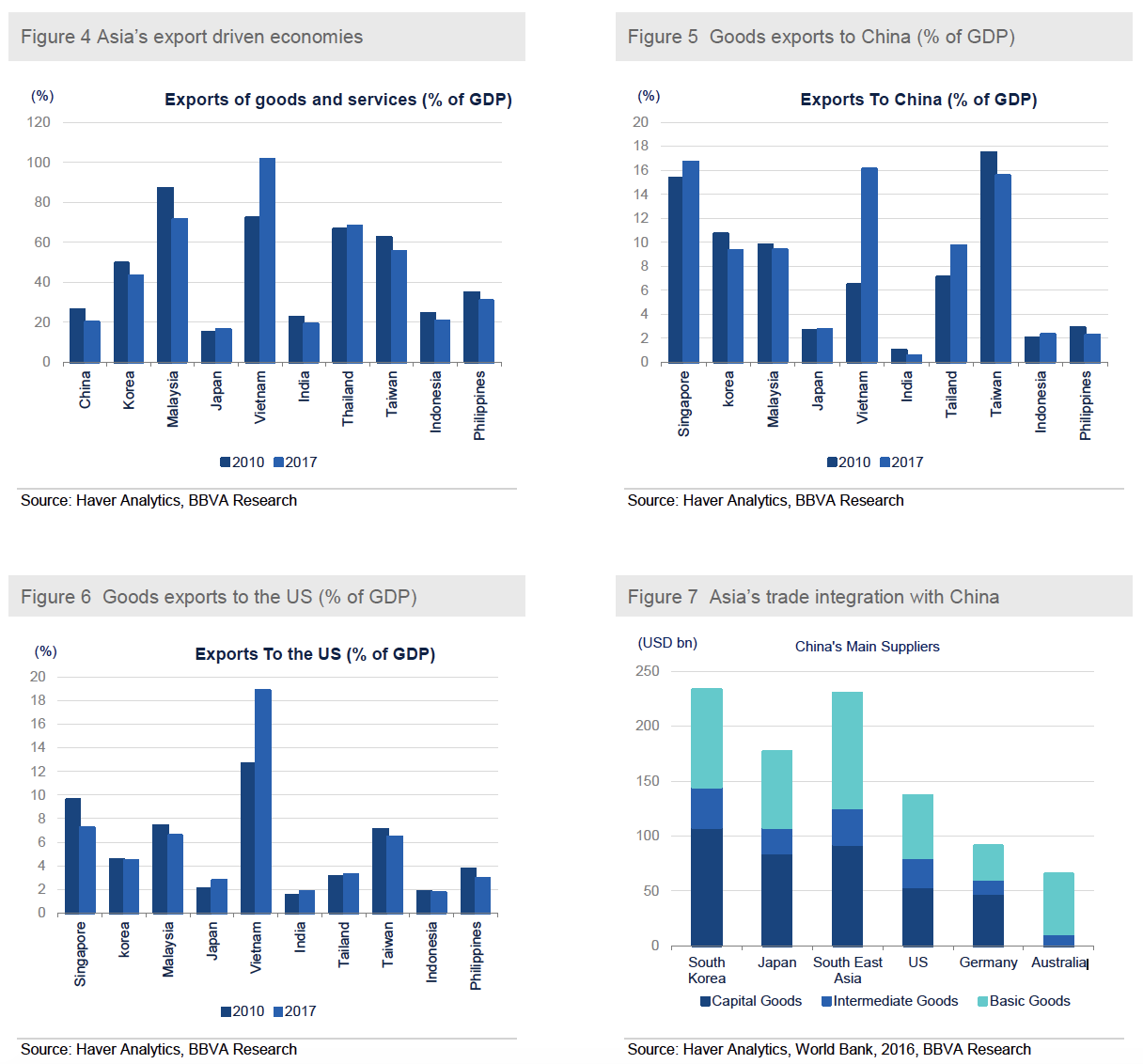

2018-09-26 IMI Our media trade support sentiment index for China had peaked two months prior to Trump’s first executive order authorizing investigations into Chinese trade practices on 14th August 2017 (Figure 1 and 2). Since then, sentiment has continued worsening. During this period, there are some remarkable events like the US imposition of tariffs on washing machines and solar cell imports from China on 22nd January, the signing of steel tariffs on 9th March, sanctions on Chinese telecom major ZTE on 25th May as well as Trump’s nod for imposing tariffs on $50 billion in Chinese exports on 29th May. As recently as yesterday, 17th September, US unveiled plans to impose 10% tariffs on $200 billion Chinese goods effective 24th September 2018, while threatening to raise the tariff rate to 25% starting next year. President Trump further threatened China of additional tariffs on rest of Chinese exports of $267 billion if China retaliated. The latest round of US trade aggression risks scuttling upcoming high level trade talks between the US and China. Evidently, the Trump administration has belied market expectations that US threat of punitive tariffs on China and its other trading partners are nothing more than just a negotiating tactic to open foreign markets for US companies. The US trade aggression, coupled with a clampdown on high-tech Chinese companies and Chinese investments into the US on grounds of national security risk suggests that Trump has a relatively high risk tolerance for trade protectionism. The tit-for-tat tariff retaliation, which has ensued over the course of this year, threatens the stability of the international rule-based trading system, while fueling capital outflows from emerging markets, including across Asia.

Rest of Asia is feeling the heat of rising protectionist trade policy globally

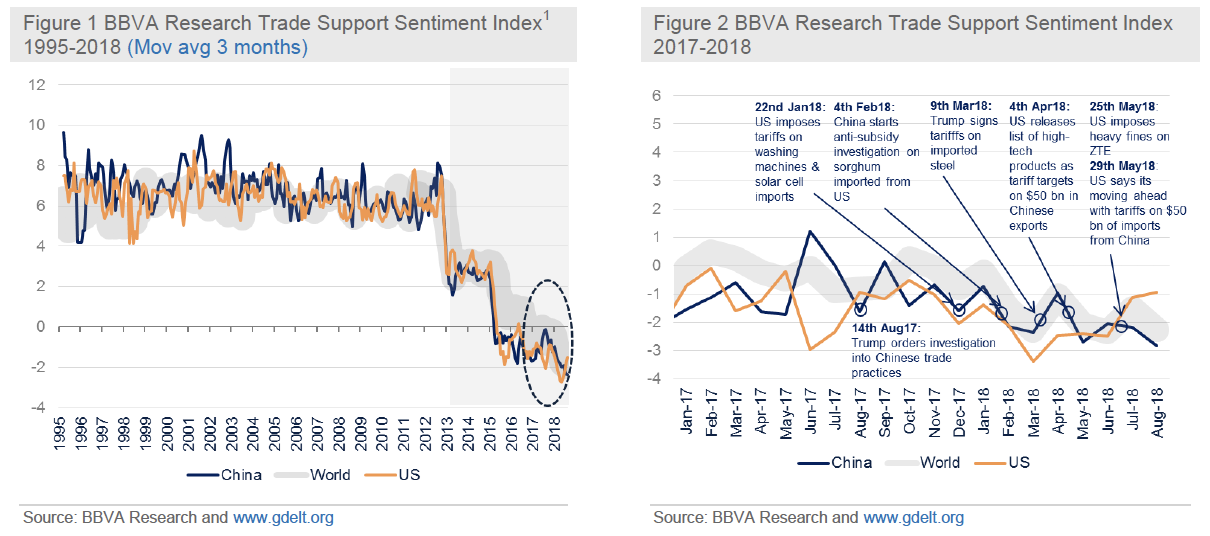

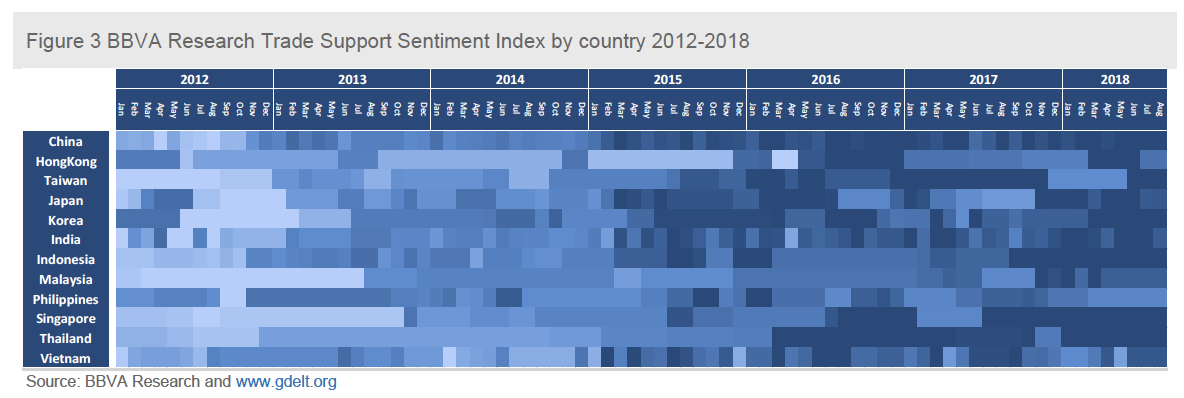

Spillover effects through the trade, investments and confidence channels of protectionist trade policy globally have upended a generally robust growth outlook for Asia. Figure 3 reflects the media sentiment evolution on our trade support index for each Asian country. There is a generalized worsening of sentiment in 2013 y once again in 2015 until nowadays. It reflects the concerns of the Asian economies, particularly between emerging markets, which have featured prominently amongst the shock transmitters of ongoing trade conflict, and the Asia’s predominantly export driven economies with strong trade links to China and the US (Figures 4 to 6). These include Vietnam, Malaysia, Singapore, Hong Kong, Taiwan, and Korea. Vietnam’s exports constituted 101% share of GDP in 2017 with China and the US together accounting for 34%. Malaysia’s goods and services exports contributes 65% of its annual GDP with China and G3 economies accounting for more than 40% of total exports in 2017. For South Korea, exports account for 50% of GDP, China and the US account for 25% and 12% of total exports, respectively.

Our media trade support sentiment index for China had peaked two months prior to Trump’s first executive order authorizing investigations into Chinese trade practices on 14th August 2017 (Figure 1 and 2). Since then, sentiment has continued worsening. During this period, there are some remarkable events like the US imposition of tariffs on washing machines and solar cell imports from China on 22nd January, the signing of steel tariffs on 9th March, sanctions on Chinese telecom major ZTE on 25th May as well as Trump’s nod for imposing tariffs on $50 billion in Chinese exports on 29th May. As recently as yesterday, 17th September, US unveiled plans to impose 10% tariffs on $200 billion Chinese goods effective 24th September 2018, while threatening to raise the tariff rate to 25% starting next year. President Trump further threatened China of additional tariffs on rest of Chinese exports of $267 billion if China retaliated. The latest round of US trade aggression risks scuttling upcoming high level trade talks between the US and China. Evidently, the Trump administration has belied market expectations that US threat of punitive tariffs on China and its other trading partners are nothing more than just a negotiating tactic to open foreign markets for US companies. The US trade aggression, coupled with a clampdown on high-tech Chinese companies and Chinese investments into the US on grounds of national security risk suggests that Trump has a relatively high risk tolerance for trade protectionism. The tit-for-tat tariff retaliation, which has ensued over the course of this year, threatens the stability of the international rule-based trading system, while fueling capital outflows from emerging markets, including across Asia.

Rest of Asia is feeling the heat of rising protectionist trade policy globally

Spillover effects through the trade, investments and confidence channels of protectionist trade policy globally have upended a generally robust growth outlook for Asia. Figure 3 reflects the media sentiment evolution on our trade support index for each Asian country. There is a generalized worsening of sentiment in 2013 y once again in 2015 until nowadays. It reflects the concerns of the Asian economies, particularly between emerging markets, which have featured prominently amongst the shock transmitters of ongoing trade conflict, and the Asia’s predominantly export driven economies with strong trade links to China and the US (Figures 4 to 6). These include Vietnam, Malaysia, Singapore, Hong Kong, Taiwan, and Korea. Vietnam’s exports constituted 101% share of GDP in 2017 with China and the US together accounting for 34%. Malaysia’s goods and services exports contributes 65% of its annual GDP with China and G3 economies accounting for more than 40% of total exports in 2017. For South Korea, exports account for 50% of GDP, China and the US account for 25% and 12% of total exports, respectively.

A direct consequence of a full-fledged US-China trade war for Asian economies would be a pullback in demand for intermediate goods from China (Figure 7). Several Asian economies export intermediate goods to China, which then assembles those into finished products for shipment to final destinations such as the US. In aggregate, intermediate goods account for two thirds of South Korea’s exports and one-third of Japan’s exports. Also, domestic value added accounts for 82% of Japan’s exports. Escalating trade tensions pose upside risk to the cost of intermediate and investment imports for Asian economies, in turn leading to higher production costs back home. This would translate to a further pick-up in inflation, loss of competitiveness and finally weigh on the growth outlook.

Looking ahead, a key concern for Asian economies such as Japan, South Korea and Thailand is the US threat of tariffs on automobile exports. Japan’s exports of automobiles and related equipment constitute 40% of its exports to the US. In terms of domestic value added, such shipments account for 1% of Japan’s GDP. For Thailand, automobile exports constitute 15% of total goods exports, 9% of which are shipped to the US. In addition, the outlook for domestic media sentiment in the region remain clouded by heightened market anxiety, which has triggered capital outflows, leading to sharp currency depreciation against the US dollar. This has amplified the challenges in navigating domestic policy coordination. To stem capital flight as the US dollar strengthens and fight rising inflation pressures, emerging market economies are compelled to raise interest rates, which in turn would weigh on domestic growth. Meanwhile, weaker external demand alongside a pickup in crude oil prices is weighing on current account balances of Asian economies, particularly oil importers such as India. Tighter global liquidity conditions and financial market uncertainty poses risks to Asian economies with high external funding exposure, such as Indonesia and Malaysia, in turn weighing on sentiment in the region.

A direct consequence of a full-fledged US-China trade war for Asian economies would be a pullback in demand for intermediate goods from China (Figure 7). Several Asian economies export intermediate goods to China, which then assembles those into finished products for shipment to final destinations such as the US. In aggregate, intermediate goods account for two thirds of South Korea’s exports and one-third of Japan’s exports. Also, domestic value added accounts for 82% of Japan’s exports. Escalating trade tensions pose upside risk to the cost of intermediate and investment imports for Asian economies, in turn leading to higher production costs back home. This would translate to a further pick-up in inflation, loss of competitiveness and finally weigh on the growth outlook.

Looking ahead, a key concern for Asian economies such as Japan, South Korea and Thailand is the US threat of tariffs on automobile exports. Japan’s exports of automobiles and related equipment constitute 40% of its exports to the US. In terms of domestic value added, such shipments account for 1% of Japan’s GDP. For Thailand, automobile exports constitute 15% of total goods exports, 9% of which are shipped to the US. In addition, the outlook for domestic media sentiment in the region remain clouded by heightened market anxiety, which has triggered capital outflows, leading to sharp currency depreciation against the US dollar. This has amplified the challenges in navigating domestic policy coordination. To stem capital flight as the US dollar strengthens and fight rising inflation pressures, emerging market economies are compelled to raise interest rates, which in turn would weigh on domestic growth. Meanwhile, weaker external demand alongside a pickup in crude oil prices is weighing on current account balances of Asian economies, particularly oil importers such as India. Tighter global liquidity conditions and financial market uncertainty poses risks to Asian economies with high external funding exposure, such as Indonesia and Malaysia, in turn weighing on sentiment in the region.