Steve Wang: The Guangdong-HK-Macau Greater Bay Area: Mapping out the Region’s Listed Companies

2019-04-23 IMI1.Public Listed Companies as an Economic DevelopmentIndicator

Given the fact that a public listed company generally commands a relatively more visible brand name, better finance flexibility and higher enterprise value, pursuing public listing of their home-based enterprises has always been an economic development policy for Chinese local governments and municipalities. The enhanced fund-raising capacity and public commitment from a listed company should generally serve well for the local governments in terms of employment, tax revenue, city profile, and other economic synergies. In further details, a listed company has the power to utilise its stocks as a financing vehicle for quick fund raising and asset acquisitions that, in the end, could benefit local business investment and financial position. The wealth effect from a company go listing can also be an important boost to local economy, as the monetisation of share holdings through public listing often creates instant wealth effect from the owners of the listed company, including share-holding senior managers and other employees with stock incentives. In many cases, public floating has become the quickest way for many of the stakeholders of the company to materialise wealth and rise in the wealth rank.2. Mapping the Public Listed Companies in the Greater BayArea (GBA)

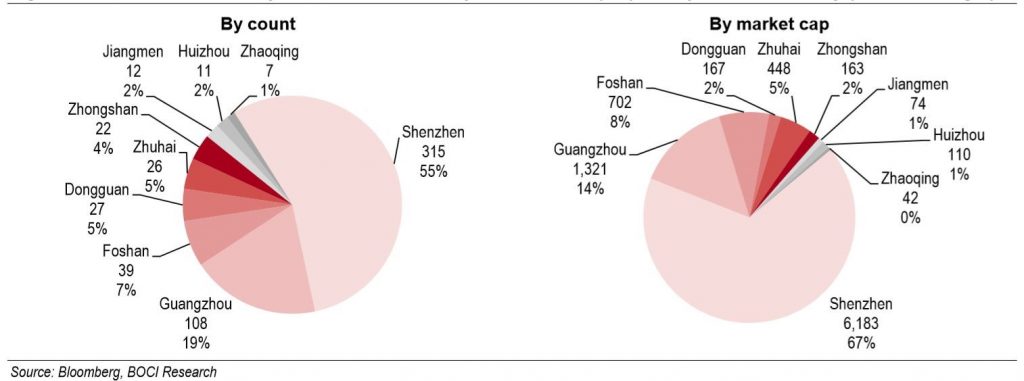

The Guangdong-HK-Macau Greater Bay Area boasts a high concentration of listed companies (based on the corporate registration location). They are either listed on the domestic exchanges (Shanghai or Shenzhen Exchanges) or overseas international exchanges (such as HK Exchange, NY exchanges, Singapore Exchange). In some cases, a company may be dual- or multiple listed on different exchanges. A total of 557 firms from GBA are listed on the domestic exchanges, but none are from HK or Macau since domestic exchanges are not yet opened to overseas corporations (see Figure 1). On the other hand, a total of 1,843 GBA firms are listed on the international exchanges, including a total of 1,630 from HK registered firms (see Figures 2&3). Figure 1. Domestic Listed Companies from the GBA: by Total Number (left) and by Total Market Cap (in RMB bn, right) For the domestic listed firms from the GBA, Shenzhen holds a dominant position with a 55% share in total, followed by Guangzhou (19%), Foshan (7%), Dongguan (5%), Zhuhai (5%), Zhongshan (4%), Jiangmen (2%), Huizhou (2%) and Zhaoqing (1%). By market cap, Shenzhen enjoys a position even more prominent, making up 67% of the total, followed by Guangzhou (14%), Foshan (8%), Zhuhai (5%), Zhongshan (2%) and others smaller than 2%. Obviously, the average size of Shenzhen listed firms (RMB19.6bn) by market cap is larger than the rest of the GBA (RMB12bn).

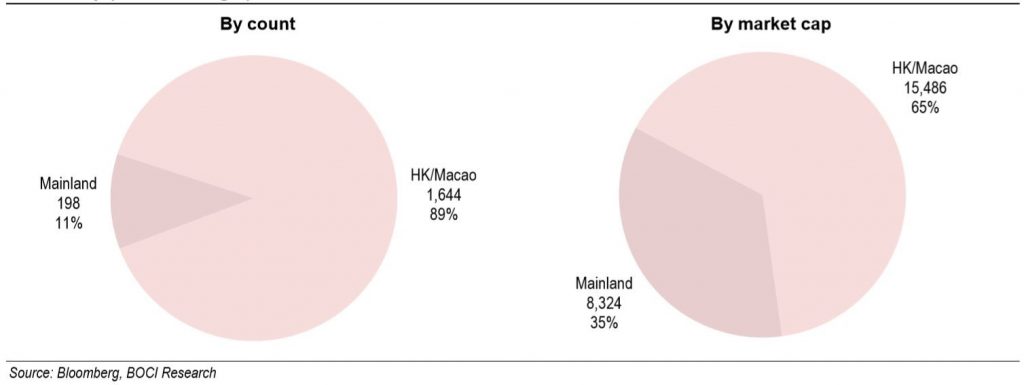

For the overseas listed firms from the GBA (including dual listed ones), Hong Kong/Macau registered companies dominate the table (see Figure 2). A majority of these HK/Macau registered firms are HK locally-brewed enterprises (about 1,263), as compared to about 411 firms with parents based in the mainland (mainland background). Although the locally registered HK/Macau firms account for 88% of the total listed stocks in number, they only make up 63% of the pool by market cap. Again, this demonstrates the average market cap of the mainland firms listed on the overseas exchanges (HK$42bn) is larger than that of the HK/Macau firms (HK$9bn).

Figure 2. Overseas Listed Companies from the GBA (Mainland vs. HK/Macau Firms): by Total Number (left) and by Total Market Cap (in HK$ bn, right)

For the domestic listed firms from the GBA, Shenzhen holds a dominant position with a 55% share in total, followed by Guangzhou (19%), Foshan (7%), Dongguan (5%), Zhuhai (5%), Zhongshan (4%), Jiangmen (2%), Huizhou (2%) and Zhaoqing (1%). By market cap, Shenzhen enjoys a position even more prominent, making up 67% of the total, followed by Guangzhou (14%), Foshan (8%), Zhuhai (5%), Zhongshan (2%) and others smaller than 2%. Obviously, the average size of Shenzhen listed firms (RMB19.6bn) by market cap is larger than the rest of the GBA (RMB12bn).

For the overseas listed firms from the GBA (including dual listed ones), Hong Kong/Macau registered companies dominate the table (see Figure 2). A majority of these HK/Macau registered firms are HK locally-brewed enterprises (about 1,263), as compared to about 411 firms with parents based in the mainland (mainland background). Although the locally registered HK/Macau firms account for 88% of the total listed stocks in number, they only make up 63% of the pool by market cap. Again, this demonstrates the average market cap of the mainland firms listed on the overseas exchanges (HK$42bn) is larger than that of the HK/Macau firms (HK$9bn).

Figure 2. Overseas Listed Companies from the GBA (Mainland vs. HK/Macau Firms): by Total Number (left) and by Total Market Cap (in HK$ bn, right)

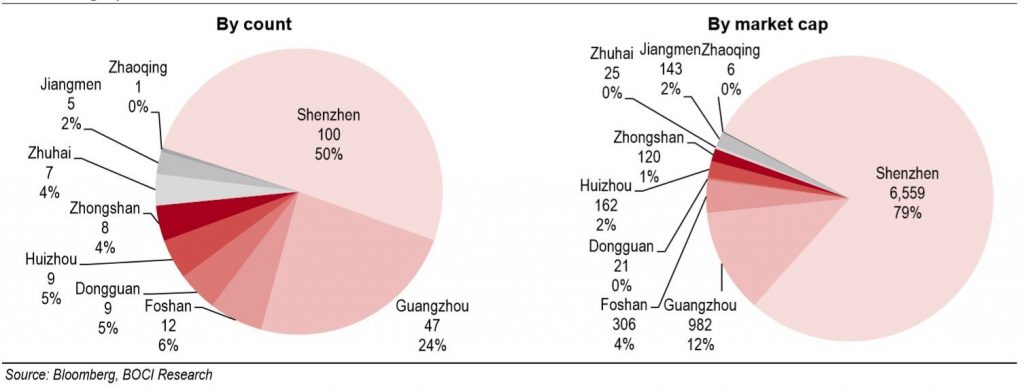

To further illustrate the detailed characteristics of the mainland firms listed on the overseas exchanges, we exclude the HK/Macau listed firms from the data set to redraw the geographic distribution profiles (see Figure 3). Again, Shenzhen dominates the table. By total number, Shenzhen makes up 50% of the group, followed by Guangzhou (24%), Foshan (6%), Dongguan (5%), Huizhou (5%), etc. By market cap, Shenzhen makes up 79%, Guangzhou 12%, Foshan 4%, Huizhou 2%, etc. In other words, Shenzhen not only dominates in the total number of overseas listed firms but also boasts a much larger average size in market cap. We will show this point again later in the discussion of Fortune Global 500 Firms from the GBA, as Shenzhen has more Fortune 500 firms than any of the other GBA cities.

To further illustrate the detailed characteristics of the mainland firms listed on the overseas exchanges, we exclude the HK/Macau listed firms from the data set to redraw the geographic distribution profiles (see Figure 3). Again, Shenzhen dominates the table. By total number, Shenzhen makes up 50% of the group, followed by Guangzhou (24%), Foshan (6%), Dongguan (5%), Huizhou (5%), etc. By market cap, Shenzhen makes up 79%, Guangzhou 12%, Foshan 4%, Huizhou 2%, etc. In other words, Shenzhen not only dominates in the total number of overseas listed firms but also boasts a much larger average size in market cap. We will show this point again later in the discussion of Fortune Global 500 Firms from the GBA, as Shenzhen has more Fortune 500 firms than any of the other GBA cities.

- Industry Profile of GBA Listed Firms

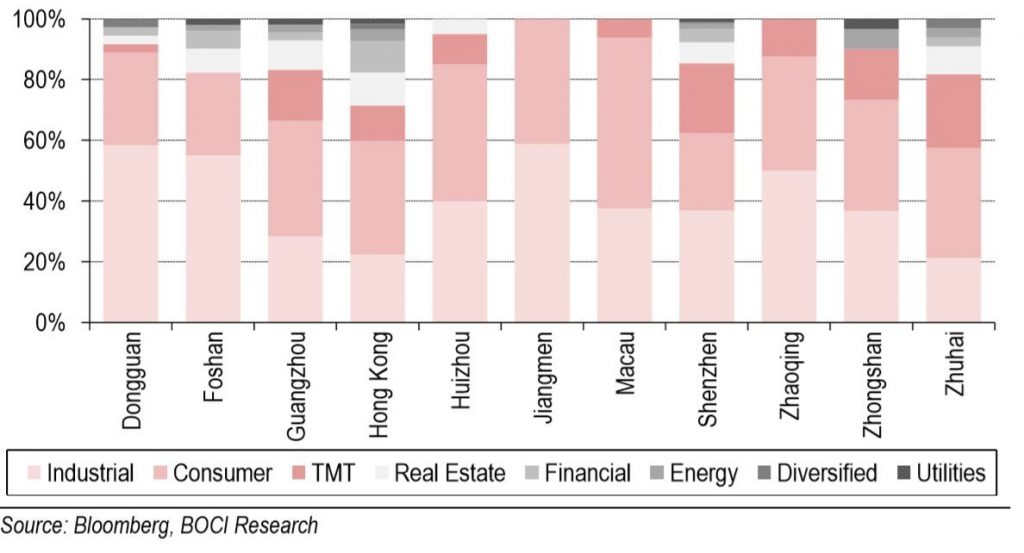

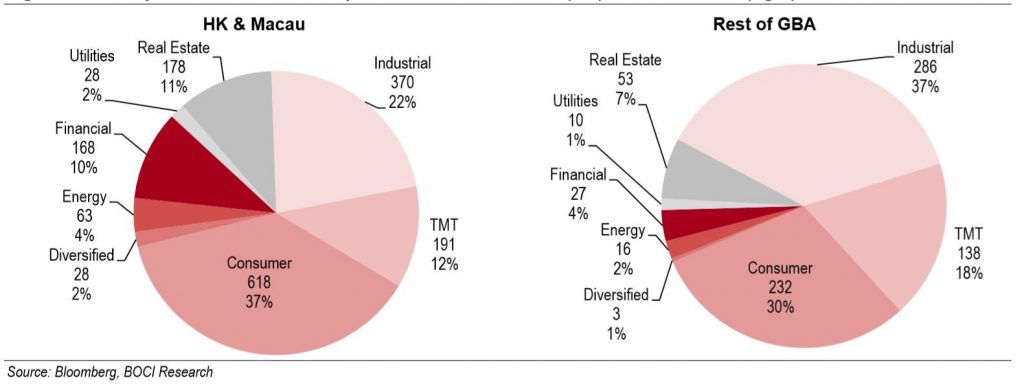

Figure 4. Industry Distribution of Listed Firms from the GBA

Figure 4. Industry Distribution of Listed Firms from the GBA

- What are the Listed Firms Telling Us?

- The Top Listed GBA Firms

Figure 7. Top 20 HK Listed Firms from HK & Macau (as of 11 March 2019)

Figure 7. Top 20 HK Listed Firms from HK & Macau (as of 11 March 2019)

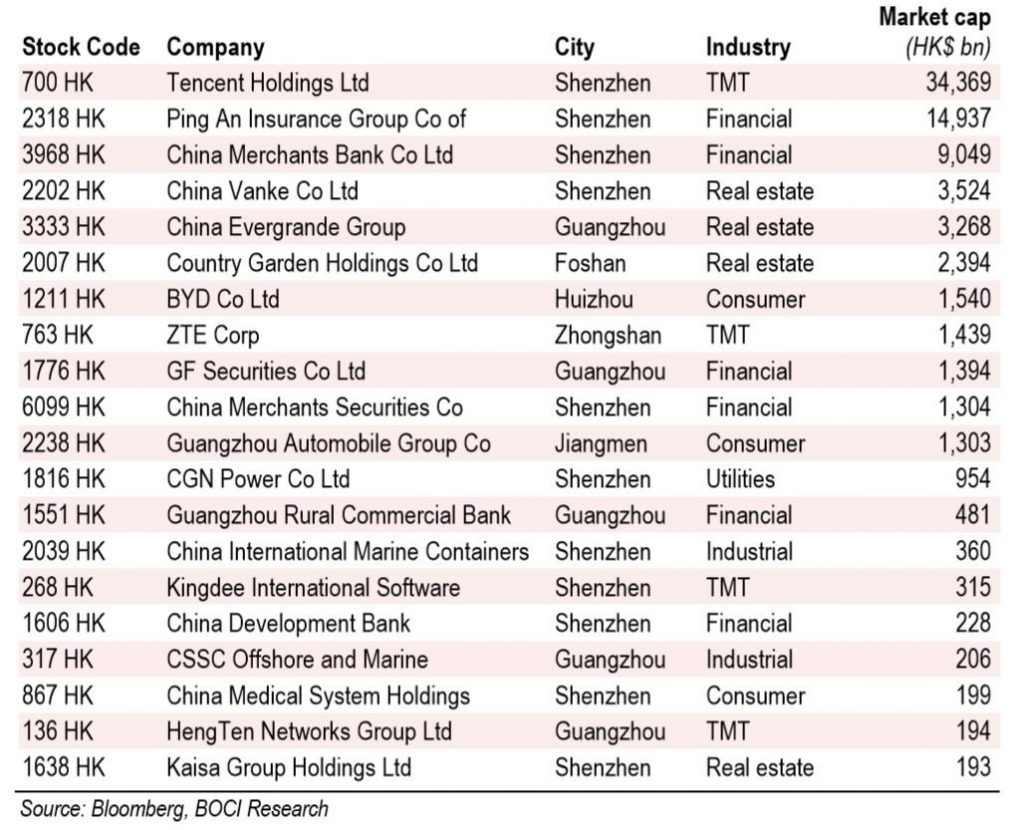

Figure 8. Top 20 HK Listed Firms from the GBA excluding HK & Macau (as of 11 March 2019)

Figure 8. Top 20 HK Listed Firms from the GBA excluding HK & Macau (as of 11 March 2019)

- The Fortune Global 500 Firms from GBA

7.The Case for Each of the GBA cities

Although the public listed companies do not necessarily represent the whole picture of the business and economic status and state of a local municipality, the importance of this subgroup of business and enterprises does offer us some insights into the areas of strength and competitiveness of a city (see Figure 10).

Being an international financial centre and a key capital raising hub for both HK and mainland enterprises, HK is expected to continue to be a world-class business centre attracting companies seeking to list in HK and to set up home base in the city. By this token, HK is expected to continue its leading position in the GBA in having a high congregation of listed firms under its roof. These list firms will continue to span over a wide spectrum of the industry scope, but with a relatively sizable percentage in the financial sector.

Macau is expected to remain a niche and unique player focusing on gaming and entertainment services that offer world-class consumer experience for tourists from China and around the world.

Next in line is Shenzhen, which also has a sizable concentration of listed companies only after HK, thanks to its advantage as the first Chinese special economic zone, the home for China’s second largest stock exchange, the Shenzhen Stock Exchange, and a highly opened market. Shenzhen’s meteoric economic rise in modern Chinese history has greatly benefited from, not only the preference policies as a special economic zone, but also from a combination of other important reasons, such as its close proximity to HK, early experience from this neighbour city, the inter-city flows through economic, capital, investment and citizen exchanges between Shenzhen and HK.

Shenzhen has already demonstrated its power base in both financial and TMT industries, as the city features more Fortune Global 500 firms in these two industries than any of the other GBA cities does, including HK. We expect Shenzhen, among the GBA cities, will continue to lead in the technology-eccentric TMT industry, as well as other high-tech industries (AI, semi, healthcare, etc.), to become a world high-tech centre in the future, while also building up a regional financial centre complementing HK.

Guangzhou is expected to further develop into a key regional business and metro hub for the GBA and the southern China with its strengths in manufacturing, consumer, high-techs and real estate.

Zhuhai, plus its satellite neighbour Zhongshan, is expected to develop into a regional business hub complementing and servicing the city of Macau,

For the rest of GBA cities, most of them are expected to become high-end manufacturing bases for both China and the world, with increasing focuses on the high-value end of the supply chain and the downstream end closer to consumers.

Figure 10. Future Perspective for the GBA Cities

7.The Case for Each of the GBA cities

Although the public listed companies do not necessarily represent the whole picture of the business and economic status and state of a local municipality, the importance of this subgroup of business and enterprises does offer us some insights into the areas of strength and competitiveness of a city (see Figure 10).

Being an international financial centre and a key capital raising hub for both HK and mainland enterprises, HK is expected to continue to be a world-class business centre attracting companies seeking to list in HK and to set up home base in the city. By this token, HK is expected to continue its leading position in the GBA in having a high congregation of listed firms under its roof. These list firms will continue to span over a wide spectrum of the industry scope, but with a relatively sizable percentage in the financial sector.

Macau is expected to remain a niche and unique player focusing on gaming and entertainment services that offer world-class consumer experience for tourists from China and around the world.

Next in line is Shenzhen, which also has a sizable concentration of listed companies only after HK, thanks to its advantage as the first Chinese special economic zone, the home for China’s second largest stock exchange, the Shenzhen Stock Exchange, and a highly opened market. Shenzhen’s meteoric economic rise in modern Chinese history has greatly benefited from, not only the preference policies as a special economic zone, but also from a combination of other important reasons, such as its close proximity to HK, early experience from this neighbour city, the inter-city flows through economic, capital, investment and citizen exchanges between Shenzhen and HK.

Shenzhen has already demonstrated its power base in both financial and TMT industries, as the city features more Fortune Global 500 firms in these two industries than any of the other GBA cities does, including HK. We expect Shenzhen, among the GBA cities, will continue to lead in the technology-eccentric TMT industry, as well as other high-tech industries (AI, semi, healthcare, etc.), to become a world high-tech centre in the future, while also building up a regional financial centre complementing HK.

Guangzhou is expected to further develop into a key regional business and metro hub for the GBA and the southern China with its strengths in manufacturing, consumer, high-techs and real estate.

Zhuhai, plus its satellite neighbour Zhongshan, is expected to develop into a regional business hub complementing and servicing the city of Macau,

For the rest of GBA cities, most of them are expected to become high-end manufacturing bases for both China and the world, with increasing focuses on the high-value end of the supply chain and the downstream end closer to consumers.

Figure 10. Future Perspective for the GBA Cities Certifications and Important Disclosure

All views expressed in this material reflect the personal views of each analyst about any and all of the subject securities or issuers. In addition, no part of the analyst’s compensation was, is, or will be directly or indirectly related to the specific recommendations or views expressed in this material.

Except as disclosed herein, each analyst declares that (i) neither he/she nor his/her associate has any financial interests in relation to the issuer reviewed by the analyst, and (ii) neither he/she nor his/her associate serves as an officer of the issuer reviewed by the analyst. For the purposes of these certifications, the term “associate” includes members of the analyst’s household as defined by FINRA.

Accordingly, none of the issuers reviewed or any third party has provided or agreed to provide any compensation or other benefits in connection with this material to any of the analysts, BOCI Research Limited and BOC International Holdings Limited and any of their respective subsidiaries and affiliates (collectively, the “BOCI Group”). Analysts receive compensation based upon the overall revenue and profitability of the BOCI Group, including revenues derived from its investment banking business.

Member companies of the BOCI Group confirm that they, whether individually or as a group do not own financial interests in an aggregate amount equal to or more than 1% of the market capitalization in any of the issuers reviewed.

Certain non-US member companies of BOCI Group are involved in making a market in the securities of CK Hutchison Holdings Ltd, AIA Group Ltd, Sands China Ltd, Ping An Insurance Group Co, BOC Hong Kong (Holdings) Ltd, Galaxy Entertainment Group Ltd, Hong Kong Exchanges & Clearing, China Merchants Bank Co Ltd, MTR Corp Ltd, Tencent Holdings Ltd, China Unicom Hong Kong Ltd and China Mobile Ltd. Certain member companies of BOCI Group have an individual employed by or associated with BOCI Group serving as an officer of Hong Kong Exchanges & Clearing. Certain member companies of BOCI Group have managed or co-managed a public offering for Sands China Ltd, China Vanke Co Ltd, China Overseas Land & Investment, Ping An Bank Co Ltd and Shenzhen Mindray Bio-Medical within the preceding 12 months. Certain member companies of BOCI Group have an investment banking relationship with and have received compensation or mandate for investment banking services from Swire Pacific Ltd, Sands China Ltd, China Vanke Co Ltd, China Merchants Bank Co Ltd, China Overseas Land & Investment, Ping An Bank Co Ltd and Shenzhen Mindray Bio-Medical within the preceding 12 months. Certain member companies of BOCI Group expect to receive or intend to seek compensation for investment banking services from Kaisa Group Holdings Ltd, Swire Pacific Ltd, China Merchants Bank Co Ltd, Ping An Bank Co Ltd and Foxconn Industrial Internet Co in the next 3 months.

This disclosure statement is made pursuant to paragraph 16 of the “Code of Conduct for Persons Licensed by or Registered with the Securities and Futures Commission” and is updated as of 12 March 2019. Waiver has been obtained by BOC International Holdings Limited from the Securities and Futures Commission of Hong Kong to disclose any interests the Bank of China Limited and its subsidiaries and affiliates may have in this material.

Certifications and Important Disclosure

All views expressed in this material reflect the personal views of each analyst about any and all of the subject securities or issuers. In addition, no part of the analyst’s compensation was, is, or will be directly or indirectly related to the specific recommendations or views expressed in this material.

Except as disclosed herein, each analyst declares that (i) neither he/she nor his/her associate has any financial interests in relation to the issuer reviewed by the analyst, and (ii) neither he/she nor his/her associate serves as an officer of the issuer reviewed by the analyst. For the purposes of these certifications, the term “associate” includes members of the analyst’s household as defined by FINRA.

Accordingly, none of the issuers reviewed or any third party has provided or agreed to provide any compensation or other benefits in connection with this material to any of the analysts, BOCI Research Limited and BOC International Holdings Limited and any of their respective subsidiaries and affiliates (collectively, the “BOCI Group”). Analysts receive compensation based upon the overall revenue and profitability of the BOCI Group, including revenues derived from its investment banking business.

Member companies of the BOCI Group confirm that they, whether individually or as a group do not own financial interests in an aggregate amount equal to or more than 1% of the market capitalization in any of the issuers reviewed.

Certain non-US member companies of BOCI Group are involved in making a market in the securities of CK Hutchison Holdings Ltd, AIA Group Ltd, Sands China Ltd, Ping An Insurance Group Co, BOC Hong Kong (Holdings) Ltd, Galaxy Entertainment Group Ltd, Hong Kong Exchanges & Clearing, China Merchants Bank Co Ltd, MTR Corp Ltd, Tencent Holdings Ltd, China Unicom Hong Kong Ltd and China Mobile Ltd. Certain member companies of BOCI Group have an individual employed by or associated with BOCI Group serving as an officer of Hong Kong Exchanges & Clearing. Certain member companies of BOCI Group have managed or co-managed a public offering for Sands China Ltd, China Vanke Co Ltd, China Overseas Land & Investment, Ping An Bank Co Ltd and Shenzhen Mindray Bio-Medical within the preceding 12 months. Certain member companies of BOCI Group have an investment banking relationship with and have received compensation or mandate for investment banking services from Swire Pacific Ltd, Sands China Ltd, China Vanke Co Ltd, China Merchants Bank Co Ltd, China Overseas Land & Investment, Ping An Bank Co Ltd and Shenzhen Mindray Bio-Medical within the preceding 12 months. Certain member companies of BOCI Group expect to receive or intend to seek compensation for investment banking services from Kaisa Group Holdings Ltd, Swire Pacific Ltd, China Merchants Bank Co Ltd, Ping An Bank Co Ltd and Foxconn Industrial Internet Co in the next 3 months.

This disclosure statement is made pursuant to paragraph 16 of the “Code of Conduct for Persons Licensed by or Registered with the Securities and Futures Commission” and is updated as of 12 March 2019. Waiver has been obtained by BOC International Holdings Limited from the Securities and Futures Commission of Hong Kong to disclose any interests the Bank of China Limited and its subsidiaries and affiliates may have in this material.