Alberto Osnago, Nadia Rocha and Michele Ruta: Easing the Global Flow of Trade

2017-03-30 IMI Trends in production networks trade

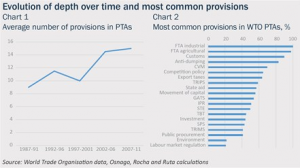

The recent wave of PTAs and the surge in offshoring have raised the question of how trade agreements relate to the international organisation of production. The key insight of the theoretical literature is that the ‘depth’ of trade agreements is associated with the international fragmentation of production. Econometric studies are scarce but suggest a positive relationship between production networks trade and deep integration. According to a 2014 paper, signing deep trade agreements increases trade in parts and components. At the same time, higher levels of trade in production networks increase the likelihood of signing deeper agreements.

In terms of the relationship between deep PTAs and offshoring within the boundaries of the firm, the key question is whether the depth of trade agreements between two countries is correlated with more vertical FDI. This relationship can go in both directions. Deep PTAs may stimulate the creation of global value chains by facilitating trade of intermediate goods and FDI flows between potential members of a production network. However, firms involved in intense vertical FDI may lobby for deeper trade agreements to secure and increase the profitability of investments in partner countries. Our research shows that signing deeper agreements can boost existing FDI links and create new ones.

Designing better trade agreements

A better grasp of the relationship between PTAs and offshoring is important in a world where countries are signing a growing number of trade agreements and firms increasingly seek to engage in international production networks. We have found new evidence to suggest that the content of PTAs is related to the mode of offshoring.

In particular, we found evidence that the positive link between the depth of PTAs and vertical FDI is driven by the provisions that improve the contractibility of inputs provided by foreign suppliers, such as regulatory provisions. While more work is needed, this line of research contributes to an understanding of how policy-makers can design trade agreements to support firms’ integration into global value chains.

Trends in production networks trade

The recent wave of PTAs and the surge in offshoring have raised the question of how trade agreements relate to the international organisation of production. The key insight of the theoretical literature is that the ‘depth’ of trade agreements is associated with the international fragmentation of production. Econometric studies are scarce but suggest a positive relationship between production networks trade and deep integration. According to a 2014 paper, signing deep trade agreements increases trade in parts and components. At the same time, higher levels of trade in production networks increase the likelihood of signing deeper agreements.

In terms of the relationship between deep PTAs and offshoring within the boundaries of the firm, the key question is whether the depth of trade agreements between two countries is correlated with more vertical FDI. This relationship can go in both directions. Deep PTAs may stimulate the creation of global value chains by facilitating trade of intermediate goods and FDI flows between potential members of a production network. However, firms involved in intense vertical FDI may lobby for deeper trade agreements to secure and increase the profitability of investments in partner countries. Our research shows that signing deeper agreements can boost existing FDI links and create new ones.

Designing better trade agreements

A better grasp of the relationship between PTAs and offshoring is important in a world where countries are signing a growing number of trade agreements and firms increasingly seek to engage in international production networks. We have found new evidence to suggest that the content of PTAs is related to the mode of offshoring.

In particular, we found evidence that the positive link between the depth of PTAs and vertical FDI is driven by the provisions that improve the contractibility of inputs provided by foreign suppliers, such as regulatory provisions. While more work is needed, this line of research contributes to an understanding of how policy-makers can design trade agreements to support firms’ integration into global value chains.