Eric Hu, Ye Bingnan and Steve Wang: The Money Tracks

2017-04-27 IMI

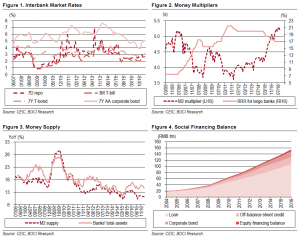

In terms of impact of monetary policy on asset prices, we reiterate our view that stocks tend to outperform bonds at the early stage of reflation and interest rate up-cycles. The shift of monetary policy is still smooth currently and the economic recovery momentum may last in the short term, boosting market sentiment about the fundamental prospect.

Meanwhile, property market tightening may guide some fund flows into the stock market. China is likely to continue to see YoY growth of M2 supply at above 10% this year. Huge incremental money is expected to support the asset performance as the growth opportunity in the real sector is still restrained by some uncertainty in the economic restructuring and transition process. With the property market speculation strictly restrained this year, some investors may pay more attention to the stock market.

Large Southbound Net Inflows Continue in 2017

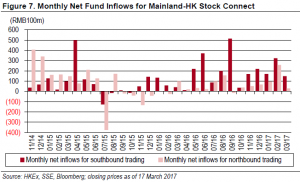

We have noted still-strong mainland investor appetite for HK-listed stocks via mainland-HK southbound trading YTD. Month to 17 March, southbound trading reported a net inflow of RMB14.9bn. In February, southbound trading reported a net inflow of RMB32.4bn, which exceeded net inflow of RMB17.1bn for January and RMB21.9bn in December, RMB17.0bn in November and RMB3.6bn in October, but still lower than RMB51.4bn in September (the largest monthly net inflow since the launch of the SH-HK stock connect in November 2014). Better still, southbound trading has reported a net inflow in each of the last 15 months. As of 17 March, the aggregate volume of mainland-HK southbound trades came to RMB378.9bn, compared to RMB212.9bn for northbound trades.

Insurance Fund Entry via Stock Links Bodes Well for HK Market

The China Insurance Regulatory Commission (CIRC) issued on 8 September 2016 the “Regulatory Guidelines on Insurance Funds to Participate in Shanghai-Hong Kong Stock Connect”, which officially allows domestic insurance companies to invest in Hong Kong stocks via the Shanghai-Hong Kong Stock Connect programme. Before the announcement of the guidelines, mainland insurance funds had been able to invest in overseas markets through the Qualified Domestic Institutional Investor (QDII) programme, overseas subsidiaries and mutual investment funds, which require regulatory approval. However, prior to the announcement of the latest guidelines, the CIRC had not made it clear whether insurance companies could invest in Hong Kong stocks via the SH-HK Stock Connect. As of end-2016, the total assets of China’s insurance industry had reached RMB15.1trn, of which about RMB339bn (2.3% of total) had been invested in overseas markets. According to the CIRC, insurance companies’ overseas investments can amount to 15% of total assets as of the previous year. Thus, in theory, RMB2.26trn of insurance funds can be invested in overseas markets, including HK.

We have noted still-strong mainland investor appetite for HK-listed stocks via mainland-HK southbound trading YTD. Month to 17 March, southbound trading reported a net inflow of RMB14.9bn. In February, southbound trading reported a net inflow of RMB32.4bn, which exceeded the net inflow of RMB17.1bn for January and RMB21.9bn for December, RMB17.0bn for November and RMB3.6bn for October, but still lower than the RMB51.4bn for September (the largest monthly net inflow since the launch of the SH-HK Stock Connect in November 2014). Better still, southbound trading has reported a net inflow in each of the last 15 months. As of 17 March, the aggregate volume of mainland-HK southbound trades came to RMB378.9bn, compared to RMB212.9bn for northbound trades.

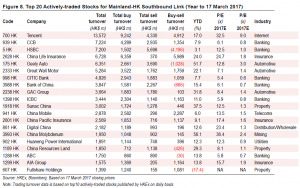

Investment behaviour data in 2016 show that, in general, southbound investors focus on high-yield blue-chip stocks, indicating that mainland institutional investors (e.g. mutual funds) make up the majority of them. We note that the six large Chinese commercial banks and HSBC (5 HK) are among the top 10 actively-traded stocks for mainland-HK southbound link. Meanwhile, investment behaviour data year to 17 March 2017 show that southbound investors started to pay attention to some undervalued auto, insurance and property stocks. Looking ahead, along with the steady development of the mainland-HK stock connect programmes, we believe mainland Chinese investors will gradually step up in trading HK-listed stocks and eventually become the major players in the HK market over the medium to long run.

In terms of impact of monetary policy on asset prices, we reiterate our view that stocks tend to outperform bonds at the early stage of reflation and interest rate up-cycles. The shift of monetary policy is still smooth currently and the economic recovery momentum may last in the short term, boosting market sentiment about the fundamental prospect.

Meanwhile, property market tightening may guide some fund flows into the stock market. China is likely to continue to see YoY growth of M2 supply at above 10% this year. Huge incremental money is expected to support the asset performance as the growth opportunity in the real sector is still restrained by some uncertainty in the economic restructuring and transition process. With the property market speculation strictly restrained this year, some investors may pay more attention to the stock market.

Large Southbound Net Inflows Continue in 2017

We have noted still-strong mainland investor appetite for HK-listed stocks via mainland-HK southbound trading YTD. Month to 17 March, southbound trading reported a net inflow of RMB14.9bn. In February, southbound trading reported a net inflow of RMB32.4bn, which exceeded net inflow of RMB17.1bn for January and RMB21.9bn in December, RMB17.0bn in November and RMB3.6bn in October, but still lower than RMB51.4bn in September (the largest monthly net inflow since the launch of the SH-HK stock connect in November 2014). Better still, southbound trading has reported a net inflow in each of the last 15 months. As of 17 March, the aggregate volume of mainland-HK southbound trades came to RMB378.9bn, compared to RMB212.9bn for northbound trades.

Insurance Fund Entry via Stock Links Bodes Well for HK Market

The China Insurance Regulatory Commission (CIRC) issued on 8 September 2016 the “Regulatory Guidelines on Insurance Funds to Participate in Shanghai-Hong Kong Stock Connect”, which officially allows domestic insurance companies to invest in Hong Kong stocks via the Shanghai-Hong Kong Stock Connect programme. Before the announcement of the guidelines, mainland insurance funds had been able to invest in overseas markets through the Qualified Domestic Institutional Investor (QDII) programme, overseas subsidiaries and mutual investment funds, which require regulatory approval. However, prior to the announcement of the latest guidelines, the CIRC had not made it clear whether insurance companies could invest in Hong Kong stocks via the SH-HK Stock Connect. As of end-2016, the total assets of China’s insurance industry had reached RMB15.1trn, of which about RMB339bn (2.3% of total) had been invested in overseas markets. According to the CIRC, insurance companies’ overseas investments can amount to 15% of total assets as of the previous year. Thus, in theory, RMB2.26trn of insurance funds can be invested in overseas markets, including HK.

We have noted still-strong mainland investor appetite for HK-listed stocks via mainland-HK southbound trading YTD. Month to 17 March, southbound trading reported a net inflow of RMB14.9bn. In February, southbound trading reported a net inflow of RMB32.4bn, which exceeded the net inflow of RMB17.1bn for January and RMB21.9bn for December, RMB17.0bn for November and RMB3.6bn for October, but still lower than the RMB51.4bn for September (the largest monthly net inflow since the launch of the SH-HK Stock Connect in November 2014). Better still, southbound trading has reported a net inflow in each of the last 15 months. As of 17 March, the aggregate volume of mainland-HK southbound trades came to RMB378.9bn, compared to RMB212.9bn for northbound trades.

Investment behaviour data in 2016 show that, in general, southbound investors focus on high-yield blue-chip stocks, indicating that mainland institutional investors (e.g. mutual funds) make up the majority of them. We note that the six large Chinese commercial banks and HSBC (5 HK) are among the top 10 actively-traded stocks for mainland-HK southbound link. Meanwhile, investment behaviour data year to 17 March 2017 show that southbound investors started to pay attention to some undervalued auto, insurance and property stocks. Looking ahead, along with the steady development of the mainland-HK stock connect programmes, we believe mainland Chinese investors will gradually step up in trading HK-listed stocks and eventually become the major players in the HK market over the medium to long run.

Disclaimer: This article is for information only and does not constitute investment advice. Neither BOCI Macro and Strategy Research nor the authors themselves are responsible for any losses.

Disclaimer: This article is for information only and does not constitute investment advice. Neither BOCI Macro and Strategy Research nor the authors themselves are responsible for any losses.