Dong Jinyue and Xia Le: China Economic Outlook 3rd Quarter 2018

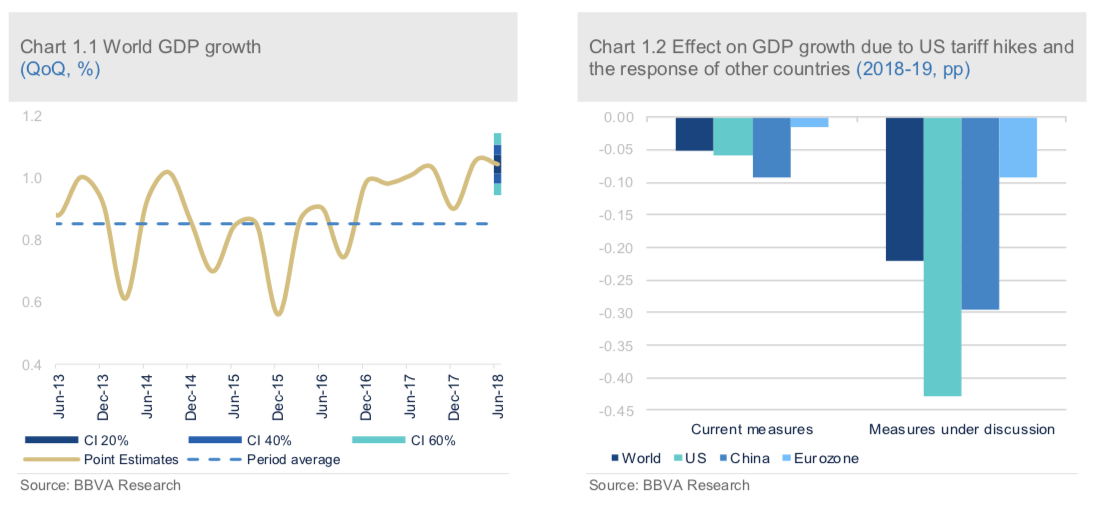

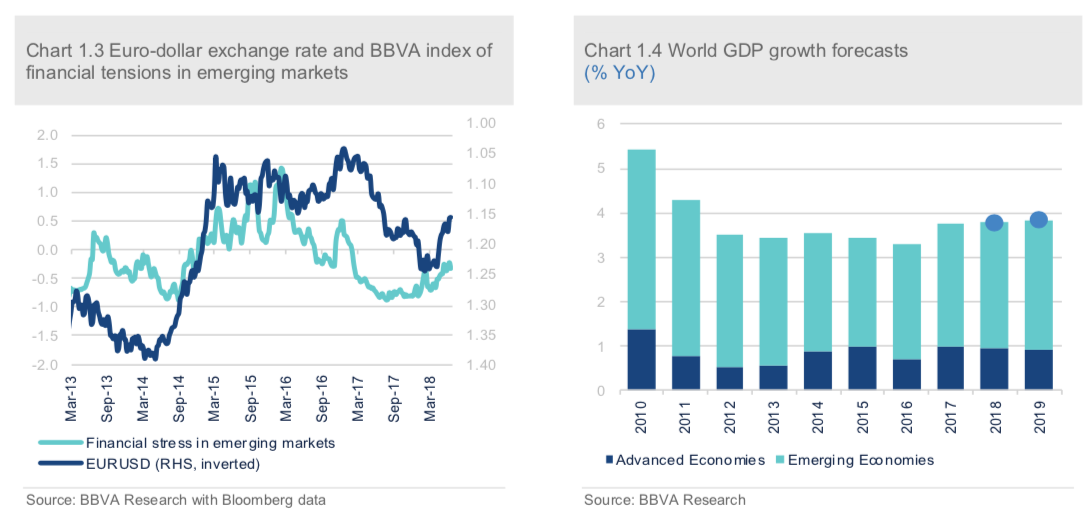

2018-07-23 IMI The increased growth of the US economy, driven by fiscal measures and the recovery of global trade at the beginning of the year, continues to sustain the strength of the global recovery. However, some of the supports to growth have been fading in the last few years, while uncertainty has increased.

The increased growth of the US economy, driven by fiscal measures and the recovery of global trade at the beginning of the year, continues to sustain the strength of the global recovery. However, some of the supports to growth have been fading in the last few years, while uncertainty has increased.

World growth forecasts remain unchanged, supported by solid US growth despite the slowdown in other areas

The global forecasts for the next two years remain at 3.8% (see Chart 1.4). Nevertheless, the lower degree of synchronization observed recently is reflected in a downward revision in the growth expected for 2018-19 for both the Eurozone and South America (mainly Argentina and Brazil), while we maintain the forecasts for the coming years in US and China, after recording a good economic performance in the first part of the year and with the fundamentals still being solid for domestic demand.

In the Eurozone, after the negative surprise in GDP growth in the first quarter, we now expect a faster convergence towards more moderate growth rates. In particular, we revised the growth forecast for 2018 downwards by 0.3 pp to 2%, while we continue to expect a moderation of the cyclical momentum in 2019, reaching 1.7%. This downward revision in the forecasts is mainly explained by lower trade and higher inflation (due to the rise in the price of oil), to which we must add the growing political uncertainty. However, despite the above, domestic demand will continue to contribute to growth both this year and next, supported by employment growth, a still accommodative monetary policy, and a slightly expansive fiscal policy.

2. Growth moderation in Q2 amid trade war and domestic deleveraging

2018 Q2 GDP moderated to 6.7% y/y amid the trade war and domestic deleveraging, down from the previous reading at 6.8% y/y and in line with the market consensus. In particular, the outturns of trade, industrial production and investment are all below the market expectations and the previous readings. Growth headwinds are mainly from domestic deleveraging initiatives and trade war with the US externally. That being said, the growth is most likely to moderate through the rest of the year. Thus, we maintain our 2018 growth projection of 6.3% y/y, compared with the official target growth rate at 6.5% and the Bloomberg consensus at 6.5%.

Facing two battles at the same time, the authorities fine-tuned their previously tightening monetary policy in order to support growth. These fine-tuned policies included cutting the reserve requirement ratio, expanding the range of pledged assets for commercial banks to apply for Mid-term lending facilities (MLF) from the PBoC and delaying the release of new regulations for banks’ wealth management products (WMPs). In addition, Chinese authorities also announced a series of new opening-up policies amid the trade war risk.

Fiscal policy will remain expansionary to offset the financial tightening and capacity reduction as well as the trade war. Several tax cut schemes were announced recently, including making interest payments on mortgage loans, and education as well as training and medical expenses tax deductible, lowering tax for manufacturing and some other industries, etc. However, the government announced to reduce fiscal budget to a certain degree so that fiscal budget to GDP ratio will be around 2.6%, which is 0.4% lower than the previous arrangement in 2017.

The trade-war between the US and China finally exploded, adding more uncertainties on China’s economic growth. The US President Trump finally implemented a series of tariff on China’s exports to the US and China also stroke back with levying tariff on imports from the US.

We predict that the China-US trade war will last for the following months until the mid-term election of the US because the political conflicts among the US top politicians play an important role in the length and the depth of this war. On the other hand, although the trade war between the two largest economies will not end soon, a full-blown China-US trade war is not our baseline scenario, in other words, we believe the trade war will be still at a manageable level.

Altogether, in our baseline scenario, we generally forecast a 0.2-0.3% GDP declining will be for China this year while a much less growth impact on the US which is almost ignorable. However, if the trade war escalated to a full-blown level, it will have much larger impact on the economy in both countries and have a negative spillover effect to other regions on the global value chain. Thus, we expect China and the US will eventually reach an agreement to avert a trade war between the two largest economies.

Moreover, China is expected to push forward deleveraging in over-capacity industries as well as in the financial sector. However, facing the two battles both domestically and externally; Chinese authorities also need to balance the policies to stimulate growth and to continue the domestic deleveraging. Other important items on China’s reform agenda including SOE reforms, financial regulatory framework etc. to strengthen the domestic demand in the long term.

Q2 activity indicators point to a growth moderation

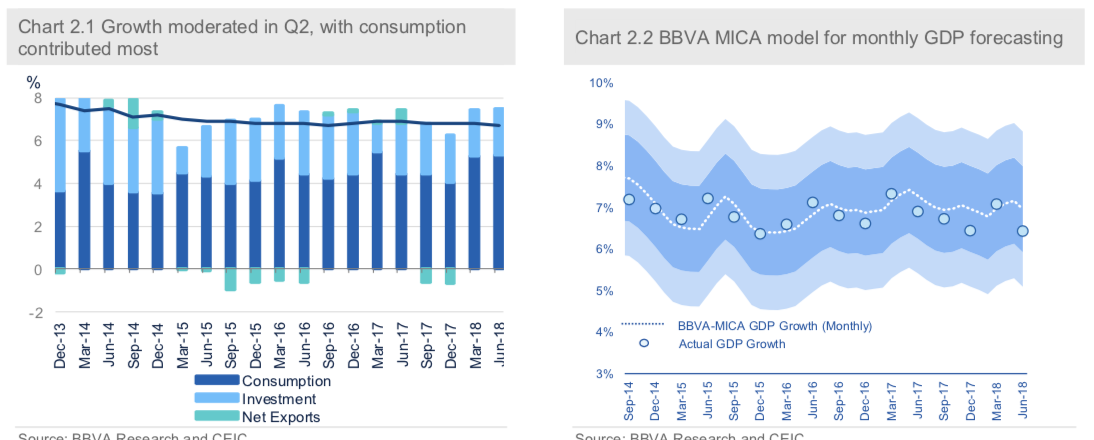

The 2018 Q2 GDP outturn moderated to 6.7% y/y, in line with the market expectation and below the previous quarter’s reading at 6.8% y/y. Sequentially, GDP expanded at 1.8% q/q, compared with 1.6% q/q in the first quarter. By category, the contribution of consumption to GDP growth reached 5.34%, dominating the investment’s contribution at 2.14% and net exports’ at -0.67%. The net exports make a negative contribution to the total GDP growth amid the trade war with the US, indicating a deteriorate external balance. Altogether, it suggested the structural upgrading of growth is on the way. (Figure 2.1)

Our MICA model yields a monthly GDP estimate at 6.7% which moderated from its last month’s prediction at 6.8%, basically in line with the Q2 GDP outturn. (Figure 2.2)

Q2 economic indicators were mostly below the market expectations and the previous readings. In particular, the outturns of trade, industrial production and investment moderated. The lackluster performance of Q2 economy indicated that growth headwinds remain in place, mainly from domestic deleveraging initiatives and trade war with the US. That being said, the growth is most likely to moderate through the rest of the year. Thus, we maintain our 2018 growth projection of 6.3% y/y, compared with the official target growth rate at 6.5% and the Bloomberg consensus at 6.5%.

World growth forecasts remain unchanged, supported by solid US growth despite the slowdown in other areas

The global forecasts for the next two years remain at 3.8% (see Chart 1.4). Nevertheless, the lower degree of synchronization observed recently is reflected in a downward revision in the growth expected for 2018-19 for both the Eurozone and South America (mainly Argentina and Brazil), while we maintain the forecasts for the coming years in US and China, after recording a good economic performance in the first part of the year and with the fundamentals still being solid for domestic demand.

In the Eurozone, after the negative surprise in GDP growth in the first quarter, we now expect a faster convergence towards more moderate growth rates. In particular, we revised the growth forecast for 2018 downwards by 0.3 pp to 2%, while we continue to expect a moderation of the cyclical momentum in 2019, reaching 1.7%. This downward revision in the forecasts is mainly explained by lower trade and higher inflation (due to the rise in the price of oil), to which we must add the growing political uncertainty. However, despite the above, domestic demand will continue to contribute to growth both this year and next, supported by employment growth, a still accommodative monetary policy, and a slightly expansive fiscal policy.

2. Growth moderation in Q2 amid trade war and domestic deleveraging

2018 Q2 GDP moderated to 6.7% y/y amid the trade war and domestic deleveraging, down from the previous reading at 6.8% y/y and in line with the market consensus. In particular, the outturns of trade, industrial production and investment are all below the market expectations and the previous readings. Growth headwinds are mainly from domestic deleveraging initiatives and trade war with the US externally. That being said, the growth is most likely to moderate through the rest of the year. Thus, we maintain our 2018 growth projection of 6.3% y/y, compared with the official target growth rate at 6.5% and the Bloomberg consensus at 6.5%.

Facing two battles at the same time, the authorities fine-tuned their previously tightening monetary policy in order to support growth. These fine-tuned policies included cutting the reserve requirement ratio, expanding the range of pledged assets for commercial banks to apply for Mid-term lending facilities (MLF) from the PBoC and delaying the release of new regulations for banks’ wealth management products (WMPs). In addition, Chinese authorities also announced a series of new opening-up policies amid the trade war risk.

Fiscal policy will remain expansionary to offset the financial tightening and capacity reduction as well as the trade war. Several tax cut schemes were announced recently, including making interest payments on mortgage loans, and education as well as training and medical expenses tax deductible, lowering tax for manufacturing and some other industries, etc. However, the government announced to reduce fiscal budget to a certain degree so that fiscal budget to GDP ratio will be around 2.6%, which is 0.4% lower than the previous arrangement in 2017.

The trade-war between the US and China finally exploded, adding more uncertainties on China’s economic growth. The US President Trump finally implemented a series of tariff on China’s exports to the US and China also stroke back with levying tariff on imports from the US.

We predict that the China-US trade war will last for the following months until the mid-term election of the US because the political conflicts among the US top politicians play an important role in the length and the depth of this war. On the other hand, although the trade war between the two largest economies will not end soon, a full-blown China-US trade war is not our baseline scenario, in other words, we believe the trade war will be still at a manageable level.

Altogether, in our baseline scenario, we generally forecast a 0.2-0.3% GDP declining will be for China this year while a much less growth impact on the US which is almost ignorable. However, if the trade war escalated to a full-blown level, it will have much larger impact on the economy in both countries and have a negative spillover effect to other regions on the global value chain. Thus, we expect China and the US will eventually reach an agreement to avert a trade war between the two largest economies.

Moreover, China is expected to push forward deleveraging in over-capacity industries as well as in the financial sector. However, facing the two battles both domestically and externally; Chinese authorities also need to balance the policies to stimulate growth and to continue the domestic deleveraging. Other important items on China’s reform agenda including SOE reforms, financial regulatory framework etc. to strengthen the domestic demand in the long term.

Q2 activity indicators point to a growth moderation

The 2018 Q2 GDP outturn moderated to 6.7% y/y, in line with the market expectation and below the previous quarter’s reading at 6.8% y/y. Sequentially, GDP expanded at 1.8% q/q, compared with 1.6% q/q in the first quarter. By category, the contribution of consumption to GDP growth reached 5.34%, dominating the investment’s contribution at 2.14% and net exports’ at -0.67%. The net exports make a negative contribution to the total GDP growth amid the trade war with the US, indicating a deteriorate external balance. Altogether, it suggested the structural upgrading of growth is on the way. (Figure 2.1)

Our MICA model yields a monthly GDP estimate at 6.7% which moderated from its last month’s prediction at 6.8%, basically in line with the Q2 GDP outturn. (Figure 2.2)

Q2 economic indicators were mostly below the market expectations and the previous readings. In particular, the outturns of trade, industrial production and investment moderated. The lackluster performance of Q2 economy indicated that growth headwinds remain in place, mainly from domestic deleveraging initiatives and trade war with the US. That being said, the growth is most likely to moderate through the rest of the year. Thus, we maintain our 2018 growth projection of 6.3% y/y, compared with the official target growth rate at 6.5% and the Bloomberg consensus at 6.5%.

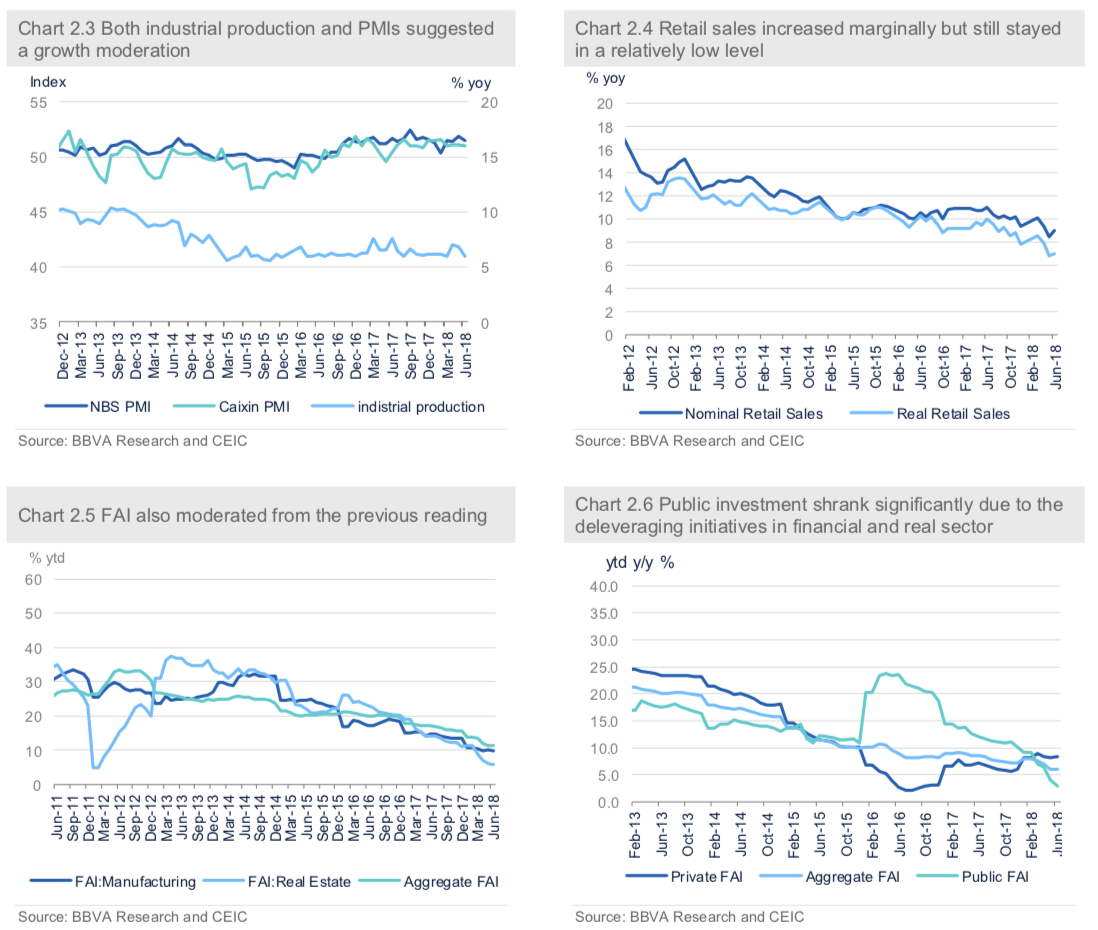

On the supply side, activity indicators suggested a growth moderation in Q2. Industrial production slowed down significantly to 6% y/y from 6.8% y/y of the previous month (consensus: 6.5% y/y). Meanwhile, the different indicators of producers’ sentiment of June also hinted growth moderation. China’s official manufacturing PMI decreased to 51.5 in June from 51.9 in the previous month (Consensus: 51.6), while the Caixin China Manufacturing PMI, which includes a survey sample tilting toward SMEs and exporters, moderated to 51 in June (versus consensus 51.1) from 51.1 in the previous month (Figure 2.3). The slowdown of both the official PMI and Caixin PMI reflected headwinds to China’s export sector amid the trade war with the US as well as the lackluster domestic demand.

The demand side was also subdued in June. Retail sales growth, although increased to 9% y/y from the previous month’s reading of 8.5% y/y, still remained at a relatively low level compared with the H1 2018 and the performance of the previous year. (Figure 2.4) The slowdown was led by auto sales growth, which had a negative expansion at -7% y/y in June due to the expiration of fiscal subsidy for passenger car purchase. The silver lining is the rapid growth of online sales, surging 29.8% y/y in the first half of this year, substantially surpassing the aggregate retail sales growth at 9.4% in H1, indicating that the rising new economy leads growth.

Meanwhile, fixed Asset Investment declined to 6% ytd y/y from 6.1% ytd y/y (consensus: 6% ytd y/y), indicating investment growth also moderated amid the external trade war and the domestic deleveraging measures. (Figure 2.5) In addition, the growth of public investment shrank significantly to 3% ytd y/y in June from 7.1% ytd y/y in the previous quarter, suggesting the deleveraging initiatives in financial sector also dragged on public FAI. On the other hand, private FAI also declined to 8.4% ytd y/y from 8.9% ytd y/y of the last quarter, implying a more passive sentiments among the private enterprises in the growth moderation. (Figure 2.6)

On the supply side, activity indicators suggested a growth moderation in Q2. Industrial production slowed down significantly to 6% y/y from 6.8% y/y of the previous month (consensus: 6.5% y/y). Meanwhile, the different indicators of producers’ sentiment of June also hinted growth moderation. China’s official manufacturing PMI decreased to 51.5 in June from 51.9 in the previous month (Consensus: 51.6), while the Caixin China Manufacturing PMI, which includes a survey sample tilting toward SMEs and exporters, moderated to 51 in June (versus consensus 51.1) from 51.1 in the previous month (Figure 2.3). The slowdown of both the official PMI and Caixin PMI reflected headwinds to China’s export sector amid the trade war with the US as well as the lackluster domestic demand.

The demand side was also subdued in June. Retail sales growth, although increased to 9% y/y from the previous month’s reading of 8.5% y/y, still remained at a relatively low level compared with the H1 2018 and the performance of the previous year. (Figure 2.4) The slowdown was led by auto sales growth, which had a negative expansion at -7% y/y in June due to the expiration of fiscal subsidy for passenger car purchase. The silver lining is the rapid growth of online sales, surging 29.8% y/y in the first half of this year, substantially surpassing the aggregate retail sales growth at 9.4% in H1, indicating that the rising new economy leads growth.

Meanwhile, fixed Asset Investment declined to 6% ytd y/y from 6.1% ytd y/y (consensus: 6% ytd y/y), indicating investment growth also moderated amid the external trade war and the domestic deleveraging measures. (Figure 2.5) In addition, the growth of public investment shrank significantly to 3% ytd y/y in June from 7.1% ytd y/y in the previous quarter, suggesting the deleveraging initiatives in financial sector also dragged on public FAI. On the other hand, private FAI also declined to 8.4% ytd y/y from 8.9% ytd y/y of the last quarter, implying a more passive sentiments among the private enterprises in the growth moderation. (Figure 2.6)

PPI increased again while CPI remained tame

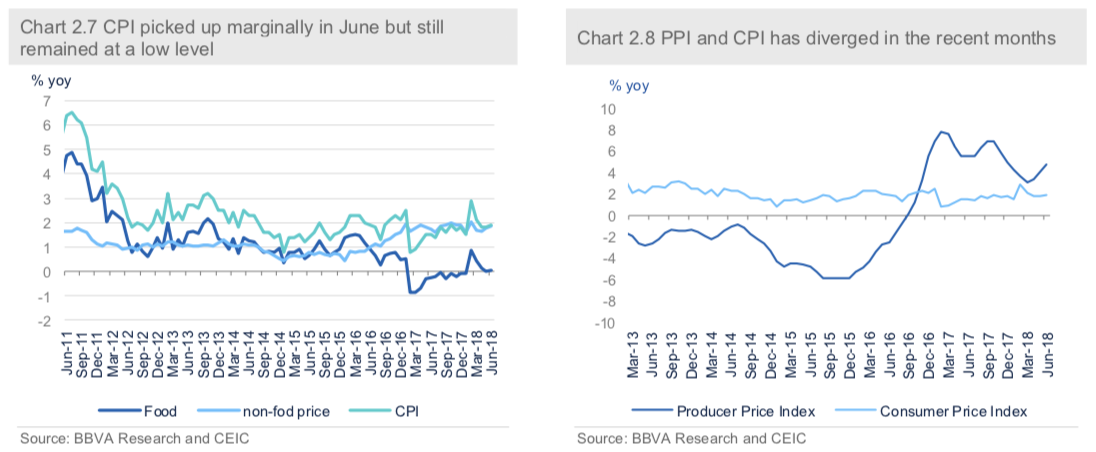

Headline CPI inflation picked up marginally to 1.9% y/y in June from 1.8% in the previous month, still in the comparatively low territory which is in line with the market consensus. The low level of CPI is mainly due to the recent economic slowdown amid the external shock and domestic growth headwinds. In particular, the low CPI inflation was driven by low food prices growth which only increased by 0.3% y/y, although the non-food price growth reached 2.2% y/y in June. (Figure 2.7) From the positive perspective, low CPI growth provides much policy room for the authorities to fine-tune their monetary policy to support growth.

On the other hand, PPI increased significantly to 4.7% y/y in June from 4.1% in the previous month (Consensus: 4.5%), as the disruption from supply-side deleveraging continues which pushed up the upstream industrial prices. (Figure 2.8) That being said, the diverging pattern of CPI and PPI might last for the following months.

However, in the medium to long term, CPI is expected to trend up gradually after the food-prices rebound from the previous low level. Meanwhile, the PPI will gradually slow its pace as the supply-side reform dissipates. Thus, supply-side shocks caused by overcapacity elimination are likely to have diminishing marginal impact on price levels as investors have already factored it into their expectations.

PPI increased again while CPI remained tame

Headline CPI inflation picked up marginally to 1.9% y/y in June from 1.8% in the previous month, still in the comparatively low territory which is in line with the market consensus. The low level of CPI is mainly due to the recent economic slowdown amid the external shock and domestic growth headwinds. In particular, the low CPI inflation was driven by low food prices growth which only increased by 0.3% y/y, although the non-food price growth reached 2.2% y/y in June. (Figure 2.7) From the positive perspective, low CPI growth provides much policy room for the authorities to fine-tune their monetary policy to support growth.

On the other hand, PPI increased significantly to 4.7% y/y in June from 4.1% in the previous month (Consensus: 4.5%), as the disruption from supply-side deleveraging continues which pushed up the upstream industrial prices. (Figure 2.8) That being said, the diverging pattern of CPI and PPI might last for the following months.

However, in the medium to long term, CPI is expected to trend up gradually after the food-prices rebound from the previous low level. Meanwhile, the PPI will gradually slow its pace as the supply-side reform dissipates. Thus, supply-side shocks caused by overcapacity elimination are likely to have diminishing marginal impact on price levels as investors have already factored it into their expectations.

The authorities fine-tuned the previous tightening monetary policy amid the trade war and domestic deleveraging

In front of the growth moderation amid the trade war and domestic deleveraging, the authorities fine-tuned their monetary policy to support the economic growth.

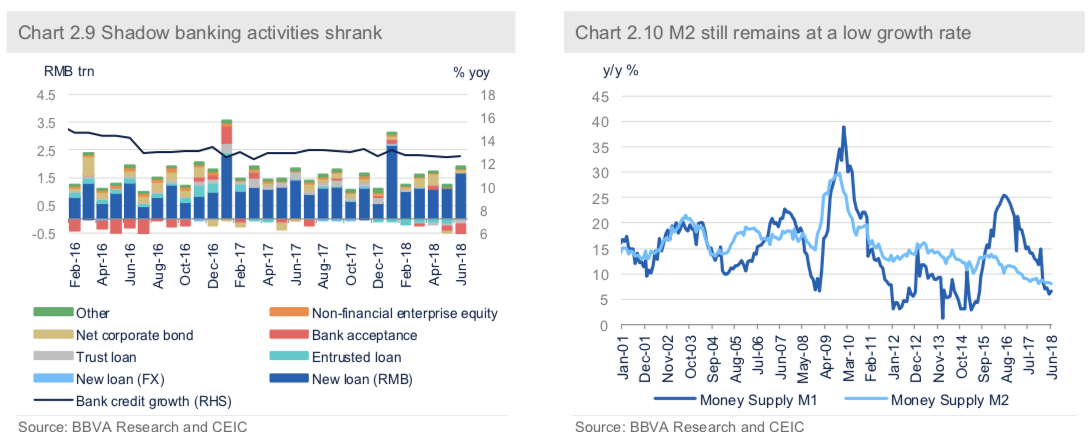

In particular, the growth of new loans and total social financing expanded in June: total social financing increased to RMB 1,180 billion (prior: RMB 760.8 billion; consensus: RMB 1,400 billion) in June and New yuan loans also expanded to RMB 1,840 bn (prior: RMB 1,150 billion; consensus: RMB 1,535 billion). (Figure 2.9) However, as the prudent monetary policy stance remains, M2 growth declined to 8% y/y from 8.3% y/y in the previously month (consensus: 8.4% YoY), which remains at a low level. (Figure 2.10)

The credit data in June also reflected the effect of financial sector deleveraging as banks were forced to move their off- balance-sheet back to the balance sheet. For instance, trust loan, entrusted loan and bank acceptance all dipped to a negative y/y growth. (Figure 2.9) Meanwhile, enterprises and household also had lower capital demand due to the ongoing corporate deleveraging and housing market tightening measures. We predict M2 growth will maintain at a moderated level in 2018 as the financial deleveraging continues this year.

The authorities also took measures to fine-tune their previously tightening monetary policy as the authorities sought to ensure the market has enough liquidity to support growth. In particular, the PBoC cut Reserve Requirement Rate (RRR) to maintain the market liquidity recently. In addition, the PBoC also expanded the range of pledged assets for commercial banks to apply for Mid-term lending facilities (MLF) from the PBoC. Moreover, the authorities may delay the release of new regulations for banks’ wealth management products (WMPs) as part of a broader push to curb financial sector risk because of recent market turmoil.

The authorities fine-tuned the previous tightening monetary policy amid the trade war and domestic deleveraging

In front of the growth moderation amid the trade war and domestic deleveraging, the authorities fine-tuned their monetary policy to support the economic growth.

In particular, the growth of new loans and total social financing expanded in June: total social financing increased to RMB 1,180 billion (prior: RMB 760.8 billion; consensus: RMB 1,400 billion) in June and New yuan loans also expanded to RMB 1,840 bn (prior: RMB 1,150 billion; consensus: RMB 1,535 billion). (Figure 2.9) However, as the prudent monetary policy stance remains, M2 growth declined to 8% y/y from 8.3% y/y in the previously month (consensus: 8.4% YoY), which remains at a low level. (Figure 2.10)

The credit data in June also reflected the effect of financial sector deleveraging as banks were forced to move their off- balance-sheet back to the balance sheet. For instance, trust loan, entrusted loan and bank acceptance all dipped to a negative y/y growth. (Figure 2.9) Meanwhile, enterprises and household also had lower capital demand due to the ongoing corporate deleveraging and housing market tightening measures. We predict M2 growth will maintain at a moderated level in 2018 as the financial deleveraging continues this year.

The authorities also took measures to fine-tune their previously tightening monetary policy as the authorities sought to ensure the market has enough liquidity to support growth. In particular, the PBoC cut Reserve Requirement Rate (RRR) to maintain the market liquidity recently. In addition, the PBoC also expanded the range of pledged assets for commercial banks to apply for Mid-term lending facilities (MLF) from the PBoC. Moreover, the authorities may delay the release of new regulations for banks’ wealth management products (WMPs) as part of a broader push to curb financial sector risk because of recent market turmoil.

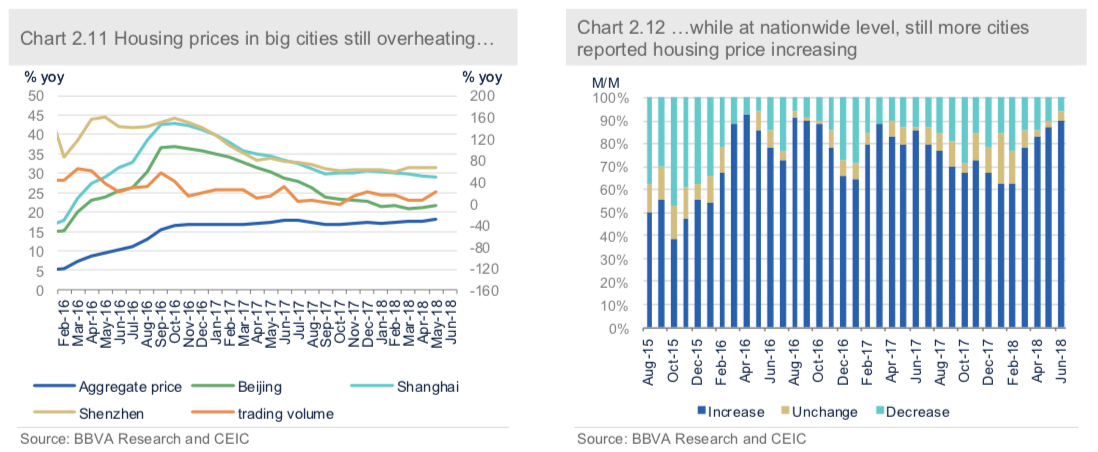

Housing markets still overheating in big cities

Housing price in big cities tend to accelerate.1 Due to the government’s intervention, the reported transaction prices cannot correctly trace the market situation. (Figure 2.11) On the other hand, there are still much more cities reporting housing price increasing than the cities reporting decreasing, mainly are smaller cities. (Figure 2.12) In particular, by categories, in June, housing prices in big cities were mostly stable, but still in a high territory, while the second-tier cities’ price went up and the third-tier cities’ still in the expansionary trend. Thus, the authorities, especially local government, consider taking more tightening measures to contain the further run-up in housing market.

On top of imposing home purchase restrictions, the authorities also use financial tools to contain housing bubbles, such as increasing the interest rate of mortgage loans. Moreover, the authorities particularly forbid home buyers from borrowing short-term loans to pay for their down payment, in a bid to keep household leverage at a manageable level. Altogether, although the housing market tightening measures helped to ease housing bubble and maintain financial stability, we believe that housing market cooling down will drag on growth this year.

Housing markets still overheating in big cities

Housing price in big cities tend to accelerate.1 Due to the government’s intervention, the reported transaction prices cannot correctly trace the market situation. (Figure 2.11) On the other hand, there are still much more cities reporting housing price increasing than the cities reporting decreasing, mainly are smaller cities. (Figure 2.12) In particular, by categories, in June, housing prices in big cities were mostly stable, but still in a high territory, while the second-tier cities’ price went up and the third-tier cities’ still in the expansionary trend. Thus, the authorities, especially local government, consider taking more tightening measures to contain the further run-up in housing market.

On top of imposing home purchase restrictions, the authorities also use financial tools to contain housing bubbles, such as increasing the interest rate of mortgage loans. Moreover, the authorities particularly forbid home buyers from borrowing short-term loans to pay for their down payment, in a bid to keep household leverage at a manageable level. Altogether, although the housing market tightening measures helped to ease housing bubble and maintain financial stability, we believe that housing market cooling down will drag on growth this year.

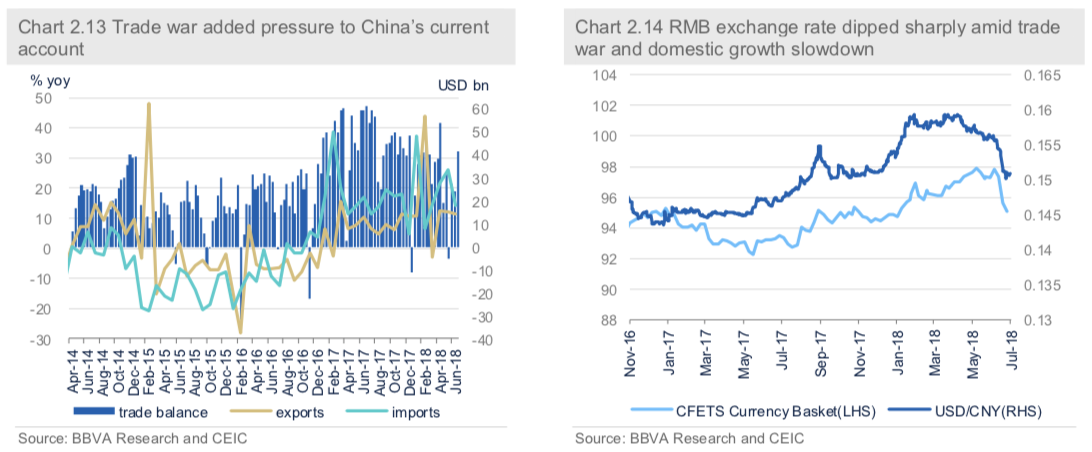

Both exports and imports slowed down amid the trade war

The ongoing trade war has brought China’s current account pressure as exports slowed its expansionary pace. In addition, the domestic growth moderation also weighs on imports. In particular, the growth of exports (in USD terms) declined to 11.3% y/y (versus consensus: 9.5% y/y) from the previous reading of 12.6% in May, while imports significantly dropped to a year-on-year growth of 14.1% from previously 26% y/y (versus consensus: 21.3% y/y). As a result, the balance of trade expanded to USD 41.61 billion in June from USD 24.23 billion in the previous month. (Figure 2.13)

Market participants believe that the reason that we did not see a sharp decreasing of exports is because exporters accelerated to send out their exported goods before the Trump administration implemented the first round of tariff on July 6th, which helped to hold the exports in June. However, the exploration of the trade war between China and the US has projected more uncertainties to the prospect of the external sector in the near future. The only silver line is that the recent depreciation of the RMB exchange rate might help to maintain the exports in the following months, although it has negative effects on importers.

External shock and domestic pressure weigh on the RMB exchange rate

The RMB exchange rate experienced a sharp depreciation recently against the pickup of US Dollar index. Accumulatively, the RMB has depreciated by 6.5% against the USD its strongest level in March and by 3% since the beginning of this year. It is also noted that the RMB depreciation during this period is not only against the USD but also against the CFETS currency basket, which was introduced in November 2015 as a benchmark of the RMB exchange rate. (Figure 2.14)

In addition to the strong performance of the USD, the depreciation of the RMB exchange rate is mainly due to the exploration of the trade war with the US as well as the US interest rate hike. In addition, domestic growth slowdown also weighs on the exchange rate.

Some market participants believe that the current RMB depreciation should

be one of the authorities’ retaliatory measures for the US trade war. However, we do not consider the Yuan exchange rate as a suitable weapon for trade war. Its side effect could be too painful. As we witnessed in 2015-2016, a sharp currency depreciation could lead to large-scale capital outflows and pose material threats to the financial stability. We don’t think the authorities will risk financial stability for retaliating the US punitive tariff. Moreover, at the current stage China has no appetite to escalate the trade war to a currency war with the US. It is in China’s interest to keep this trade tension at a limited scale.

The PBoC has already taken efforts to intervene the FX market to maintain the exchange rate of RMB. We expect the Yuan exchange rate will maintain a weak trend in the coming months. But the authorities will ensure that it won’t depreciate too sharply. The Yuan exchange rate could get strong support at the level of 6.75 in Q3. By the end of the year, it could rebound back to 6.50 when trade tension between China and the US eases.

Both exports and imports slowed down amid the trade war

The ongoing trade war has brought China’s current account pressure as exports slowed its expansionary pace. In addition, the domestic growth moderation also weighs on imports. In particular, the growth of exports (in USD terms) declined to 11.3% y/y (versus consensus: 9.5% y/y) from the previous reading of 12.6% in May, while imports significantly dropped to a year-on-year growth of 14.1% from previously 26% y/y (versus consensus: 21.3% y/y). As a result, the balance of trade expanded to USD 41.61 billion in June from USD 24.23 billion in the previous month. (Figure 2.13)

Market participants believe that the reason that we did not see a sharp decreasing of exports is because exporters accelerated to send out their exported goods before the Trump administration implemented the first round of tariff on July 6th, which helped to hold the exports in June. However, the exploration of the trade war between China and the US has projected more uncertainties to the prospect of the external sector in the near future. The only silver line is that the recent depreciation of the RMB exchange rate might help to maintain the exports in the following months, although it has negative effects on importers.

External shock and domestic pressure weigh on the RMB exchange rate

The RMB exchange rate experienced a sharp depreciation recently against the pickup of US Dollar index. Accumulatively, the RMB has depreciated by 6.5% against the USD its strongest level in March and by 3% since the beginning of this year. It is also noted that the RMB depreciation during this period is not only against the USD but also against the CFETS currency basket, which was introduced in November 2015 as a benchmark of the RMB exchange rate. (Figure 2.14)

In addition to the strong performance of the USD, the depreciation of the RMB exchange rate is mainly due to the exploration of the trade war with the US as well as the US interest rate hike. In addition, domestic growth slowdown also weighs on the exchange rate.

Some market participants believe that the current RMB depreciation should

be one of the authorities’ retaliatory measures for the US trade war. However, we do not consider the Yuan exchange rate as a suitable weapon for trade war. Its side effect could be too painful. As we witnessed in 2015-2016, a sharp currency depreciation could lead to large-scale capital outflows and pose material threats to the financial stability. We don’t think the authorities will risk financial stability for retaliating the US punitive tariff. Moreover, at the current stage China has no appetite to escalate the trade war to a currency war with the US. It is in China’s interest to keep this trade tension at a limited scale.

The PBoC has already taken efforts to intervene the FX market to maintain the exchange rate of RMB. We expect the Yuan exchange rate will maintain a weak trend in the coming months. But the authorities will ensure that it won’t depreciate too sharply. The Yuan exchange rate could get strong support at the level of 6.75 in Q3. By the end of the year, it could rebound back to 6.50 when trade tension between China and the US eases.

Capital outflows accelerated in the run-up of the trade war

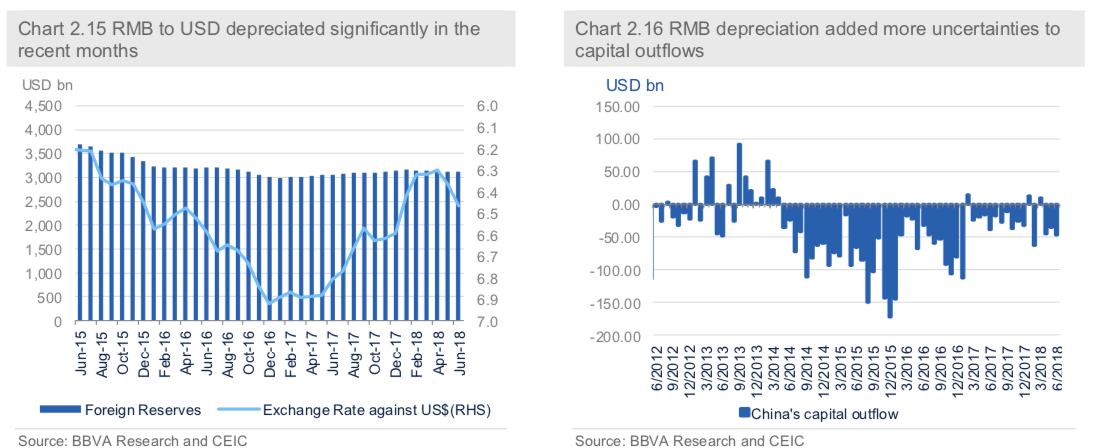

Foreign reserves marginally increased to USD 3,112.13 billion in June from USD 3,110.62 billion in the previous month. (Figure 2.15) Based on the trade balance, valuation effect and the foreign reserve data, we estimate that capital outflows amounted to USD 42.7 billion in June, compared with USD 62.5 billion in the previous month. (Figure 2.16)

The depreciating RMB exchange rate will add more risks for capital outflows. First is because the depreciating RMB will lead to the diversification behavior of investors to allocate more of their assets to safe heaven assets, thus, capital flight is unavoidable. Second, the yuan slide is also together with the current account shrink amid the trade war risk at the current stage, further leading to capital outflow.

Capital outflows accelerated in the run-up of the trade war

Foreign reserves marginally increased to USD 3,112.13 billion in June from USD 3,110.62 billion in the previous month. (Figure 2.15) Based on the trade balance, valuation effect and the foreign reserve data, we estimate that capital outflows amounted to USD 42.7 billion in June, compared with USD 62.5 billion in the previous month. (Figure 2.16)

The depreciating RMB exchange rate will add more risks for capital outflows. First is because the depreciating RMB will lead to the diversification behavior of investors to allocate more of their assets to safe heaven assets, thus, capital flight is unavoidable. Second, the yuan slide is also together with the current account shrink amid the trade war risk at the current stage, further leading to capital outflow.

3. Trade war and domestic deleveraging: two battles at the same time

Intensified growth headwinds are likely to moderate growth

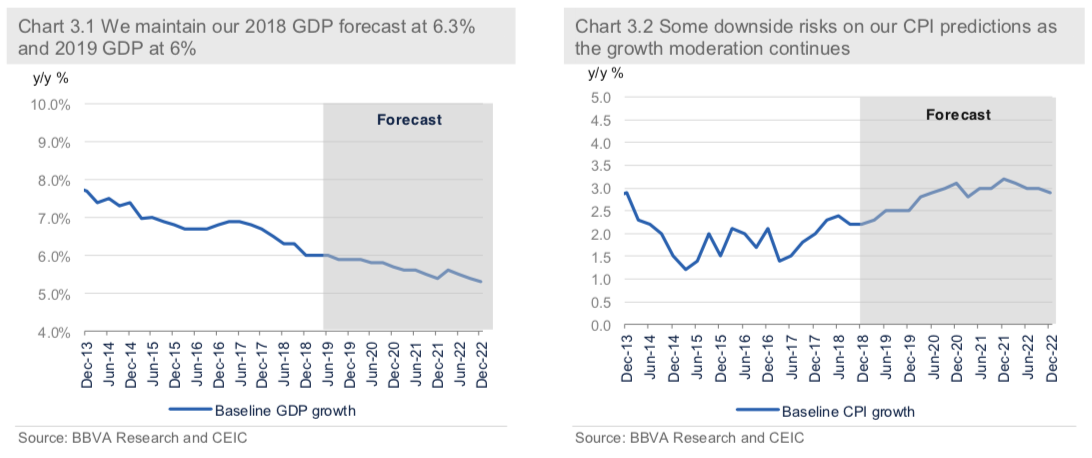

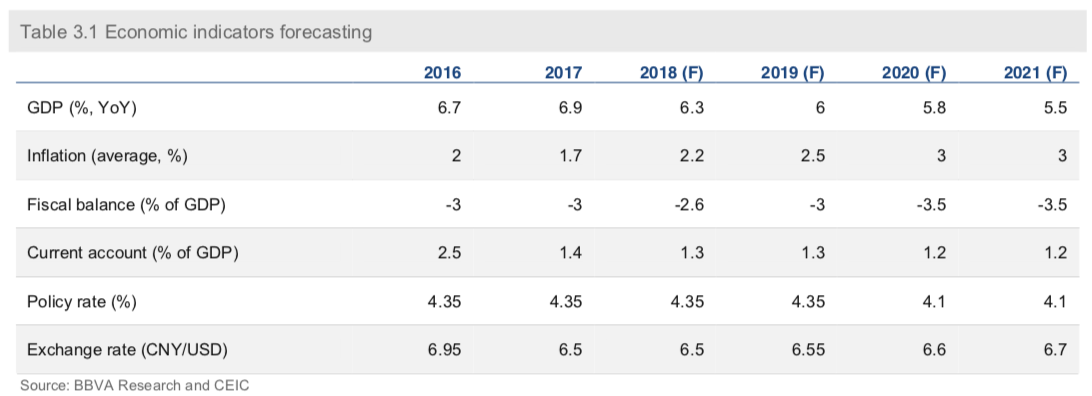

Due to the trade war and the domestic deleveraging, signs of growth moderation appeared in Q2, which is in line with our expectations. We maintain 2018 GDP growth projection at 6.3%, which is lower than the Bloomberg consensus at 6.5% and the official target of 6.5%.

In particular, we predict that growth moderation will continue in the rest of this year due the two battles that Chinese authorities face. One is the continuing domestic deleveraging, including monetary prudence stance and regulatory efforts to curb shadow banking activities and overheating property market, together with the de-capacity in the real sector. The other is the trade war with the US, as the starting of the trade war with the US will weigh on growth and the market sentiments in the following months.

Nevertheless, we anticipate that the authorities broadly maintain the policy mix this year over the concern of financial stability, in particular, a prudent monetary policy and a comparatively easing fiscal policy. On the other hand, the authorities also fine-tuned their monetary policy to support growth and to maintain sufficient liquidity in the market.

Regarding inflation, we maintain our 2018 projection of CPI at 2.2% in 2018 and 2.5% in 2019 (Bloomberg: 2.1% for 2018 and 2.2% for 2019). The ongoing growth slowdown and the concern of deflation might have some downside risk to our forecasts (Figure 3.2) Looking ahead, the CPI and PPI will finally converge in the long term. CPI is expected to trend up gradually after the food-prices rebound from the current low level. Meanwhile, the PPI will gradually slow its pace as the supply-side reform dissipates. That being said, supply-side shocks caused by overcapacity elimination are likely to have diminishing marginal impact on price levels as investors gradually factor it into their expectations.

3. Trade war and domestic deleveraging: two battles at the same time

Intensified growth headwinds are likely to moderate growth

Due to the trade war and the domestic deleveraging, signs of growth moderation appeared in Q2, which is in line with our expectations. We maintain 2018 GDP growth projection at 6.3%, which is lower than the Bloomberg consensus at 6.5% and the official target of 6.5%.

In particular, we predict that growth moderation will continue in the rest of this year due the two battles that Chinese authorities face. One is the continuing domestic deleveraging, including monetary prudence stance and regulatory efforts to curb shadow banking activities and overheating property market, together with the de-capacity in the real sector. The other is the trade war with the US, as the starting of the trade war with the US will weigh on growth and the market sentiments in the following months.

Nevertheless, we anticipate that the authorities broadly maintain the policy mix this year over the concern of financial stability, in particular, a prudent monetary policy and a comparatively easing fiscal policy. On the other hand, the authorities also fine-tuned their monetary policy to support growth and to maintain sufficient liquidity in the market.

Regarding inflation, we maintain our 2018 projection of CPI at 2.2% in 2018 and 2.5% in 2019 (Bloomberg: 2.1% for 2018 and 2.2% for 2019). The ongoing growth slowdown and the concern of deflation might have some downside risk to our forecasts (Figure 3.2) Looking ahead, the CPI and PPI will finally converge in the long term. CPI is expected to trend up gradually after the food-prices rebound from the current low level. Meanwhile, the PPI will gradually slow its pace as the supply-side reform dissipates. That being said, supply-side shocks caused by overcapacity elimination are likely to have diminishing marginal impact on price levels as investors gradually factor it into their expectations.

China-US trade war: a prolonged process but still manageable

The trade war with the US finally exploded on July 6th when the US actually imposed 25% tariff on China’s imports with the total target of USD 34 billion while China retaliated back with the same tariff rate on the same amount of the US imports.

To retrospect, on May 20th, only ten days after the bilateral trade statement for “no trade war”, the US decided to impose tariffs on about USD 50 billion in Chinese imports. After the US announcement, China retaliated by announcing to impose same rate of tariff on the same amount of imports from the US. Right after that, Trump threatened to impose another 10% on China’s USD 200 billion goods, which marks the escalation of the trade war between China and the US. Apparently, it has made it impossible for China to implement a similar retaliatory measure since China’s total exports to the US only amounted to USD 150 billion last year. To a certain extent, the Trump’s move is drawing a new deadline for China and the US to reach an agreement.

We predict that the China-US trade war will last for the following months, especially it will be last at least until the mid-term election of the US because the political conflicts among the US top politicians play an important role in the length and the depth of this war. On the other hand, although the trade war between the two largest economies will not end soon, a full-blown China-US trade war is not our baseline scenario, in other words, we believe the trade war will be still at a manageable level.

Altogether, in our baseline scenario, we generally forecast a 0.2-0.3% GDP declining will be for China this year while a much less growth impact on the US which is almost ignorable. Moreover, based on our recent China Economic Watch: Reignited China-US trade war and its implication on global value chain, by calculating the value-added part of China’s exports to the US using the OECD-WTO ViTA database, we estimate that among the USD 50 billion amount of China’s exports to the US which are subject to Trump’s tariff imposing in the first round, around USD 30 billion are value-added production in China (other USD 20 billion are from the upstream countries which have supply chain with China). This will lead to around 0.06% GDP (or 0.32% of total exports) decreasing, given the elasticity by categories of the exported goods provided by the World Bank database. Moreover, the additional USD 200 billion of Trump’s second round announcement will lead to around 0.24% GDP decreasing based on this value-added methodology.

From China’s perspective, after reviewing a number of methods which China could use in the escalating trade dispute with the US (please see our China Economic Watch: What will be China’s weapon in the trade war arsenal?), we find that China’s policy options to counter the US tariff measures are limited. We expect that the authorities will implement the methods such as restricting on US business in China, targeting service trade such as education and tourism as well as adopting the retaliatory tariff measure, but are unlikely to dump the US Treasury bond or guide currency depreciation. More importantly, with time going these retaliatory measures tend to have increasingly negative impact on China itself. For the positive side, the reality could make China actively seek for a solution through bilateral negotiation rather than escalating confrontation with the US. We expect that the two sides will restart the negotiation soon after the initial stage of the trade-war.

Finally, as the seesaw battle between the US and China seems to have continued for several months starting from the beginning of the year, the market looks like to have priced in the effect of trade war already, leading to a less volatile financial markets after the trade war started. For instance, we did not see a sharp dip of the S&P stock index in July, so is the Done Jones Industrial Average index. However, the market reflection in China’s stock market seems more significant as a larger stock market drop was found in China’s Shanghai Stock Exchange Composite index, which is a 22.6% decreasing from this year’s peak at the beginning of the year.

Monetary and fiscal policy are shifting to the easing side

The trade war with the US, together with the domestic deleveraging, makes Chinese authorities facing two battles at the same time. Amid the external and internal growth headwinds, economic activities slowed down in Q2, forcing the authorities to fine tune their previous tightening policy stance to support the economic growth. The fine-tuned policies include the following perspectives:

First, the authorities fine-tuned their tightening monetary policy stance to offset the external shock and domestic deleveraging. In particular, the PBoC cut Reserve Requirement Rate (RRR) to maintain the market liquidity recently. In addition, the PBoC also expanded the range of pledged assets for commercial banks to apply for Mid-term lending facilities (MLF) from the PBoC. More importantly, the PBoC did not follow the US FED to hike the interest rate, namely, to increase the DR-007, sending a signal of policy easing.

Second, the authorities also maintain expansionary fiscal policy stance. In particular, several tax cut schemes were announced recently, including: (i) Raising workers’ monthly personal allowance to 5,000 yuan from 3,500 yuan; (ii) Making interest payments on mortgage loans, and education, training and medical expenses tax deductible. (iii) Starting from May 1, the tax rate will be lowered from 17% to 16% for manufacturing and some other industries, and from 11% to 10% for transportation, construction, basic telecommunication services, and farm produce.

Third, more opening-up policies are announced amid the trade war. Recently, China’s National Development and Reform Commission (NDRC) announced the 2018 “negative list” for foreign investment. Compared to its 2017 version, the new negative list features a significant reduction in the restrictions of foreign investment. In particular, China’s authorities dropped many restrictions of foreign investment in a number of sectors including finance, automotive, aviation etc. Moreover, China is actively cooperating with the EU for the bilateral investment, namely to seek to sign the Bilateral Investment Treaty (BIT) as well as to reform the rules of WTO. We expect that China will accelerate the progress of opening the market to other countries amid the trade war with the US.

Fourth, the authorities also temporarily implemented regulatory forbearance. In particular, China may delay the release of new regulations for banks’ wealth management products (WMPs) as part of a broader push to curb financial sector risk because of recent market turmoil. The new rules were expected to be announced between late June and early July, however, regulators have opted to hold off on releasing the new guidelines and wait for a

“while” because of the recent market volatility caused by increasing concerns over a protracted trade war.

Altogether, escalating trade war risk has forced the authorities to shift their monetary and fiscal policy to the easing side.

The recent RRR cut signaled that policy stance will shift back to neutral from the previous one with tightening bias. On the front of policy interest rate, we are afraid that the PBoC won’t do any adjustment at the current stage under the newly established corridor system. In particular, an interest rate hike following the US will slow down the economy to a further extent while an interest rate cut might further depreciate RMB exchange rate and to stimulate shadow banking growth again. Thus, RRR cuts might be a better tool to maintain a sufficient liquidity in the market. In the meantime, we expect that the regulatory tightening will maintain to curb the shadow banking activities and contain financial risks.

From the perspective of fiscal policy, we expect more easing measures will be announced to offset the external shock and the domestic deleveraging. The authorities might finally add more deficits through the extra budget. Moreover, more tax cuts might be implemented later this year.

4. Growth risks intensified

Domestic deleveraging and the trade war with the US are the two battles Chinese authorities are facing at the current stage. Reflected by the Q2 growth moderation, it seems like the growth headwinds are intensifying now.

Domestically, the on-going deleveraging in the real economy and financial sector, with its original intention of mitigating the over-capacity and financial instability respectively, might drag on growth in the medium term. These policy measures mainly include supply-side deleveraging as well as cooling down the housing market and shadow banking.

Altogether, the authorities need to find a balance and choose an appropriate pace between pushing forward the deleveraging progress and maintaining a sustainable growth momentum. In this respect, market participants should guard against the risk of over-tightening stemming from the overconfidence of policymakers or the uncoordinated policy conduct among monetary, fiscal and supply-side policy initiatives.

Some other risks at the current stage also include the persisting financial risks. In particular, bond default risk is on the rise amid financial tightening. Until now, at least 15 corporate bond defaults this year, worth more than USD 2 billion. Additional bond defaults are likely among property developers and local-government financing vehicles which have relied on shadow banking vehicles for their funding.

Regarding the exploded trade war with the US, although the further rounds of negotiations have not been settled at the current stage, China has indeed taken some efforts to avoid the further escalation of the battle. For instance, China has shown their willingness to narrow its surplus against the US in the previous rounds of negotiation. China also announced that they are going to increase protection of intellectual properties and set out to establish intellectual property courts around the country. Now it seems that China’s authorities are ready to scrap their ambitious plan of “Made in China 2025” and even downplay the “One Belt One Road” initiatives.

Now China is trying to ally with the EU and Japan to fight against the US. Unfortunately, the EU has rejected China’s demand to publish an anti-US joint statement in the forthcoming Sino-European Summit. According to the media report, the EU is sharing almost every US concern with China although they don’t agree to US practice of unilaterally imposing tariff.

At the same time, China actively pushes for the signing of free trade agreement (FTA) and bilateral investment treaty (BIT) with EU and Japan. It is also pushing for the signing of Regional Comprehensive Economic Partnership (ASEAN 10+ China, Japan, South Korea, India, Australian, New Zealand). These initiatives are aimed to offset the shock from the trade war, which also provides China a way to end this trade war with the US gracefully.

That being said, if China can manage to sign FTAs and BITs with the EU and Japan, the market-access issues between China and the US will become much easier to solve, which can also lay a good ground for solving other differences between them. Certainly there will be more volatility along the way ahead even China decides to implement this policy. But that’s the right way to end this trade war with the least cost.

Altogether, the two battles at the same time bring about more challenges to Chinese authorities in policy-making. How to balance the financial and industrial deleveraging and growth, as well as the policy fine-tuning to offset the external shock remains the key point in the following months. We believe that at the current stage, the authorities need to put the external risk at the first priority and maintain market sentiments through fine-tuning the previous tightening monetary policy stance.

China-US trade war: a prolonged process but still manageable

The trade war with the US finally exploded on July 6th when the US actually imposed 25% tariff on China’s imports with the total target of USD 34 billion while China retaliated back with the same tariff rate on the same amount of the US imports.

To retrospect, on May 20th, only ten days after the bilateral trade statement for “no trade war”, the US decided to impose tariffs on about USD 50 billion in Chinese imports. After the US announcement, China retaliated by announcing to impose same rate of tariff on the same amount of imports from the US. Right after that, Trump threatened to impose another 10% on China’s USD 200 billion goods, which marks the escalation of the trade war between China and the US. Apparently, it has made it impossible for China to implement a similar retaliatory measure since China’s total exports to the US only amounted to USD 150 billion last year. To a certain extent, the Trump’s move is drawing a new deadline for China and the US to reach an agreement.

We predict that the China-US trade war will last for the following months, especially it will be last at least until the mid-term election of the US because the political conflicts among the US top politicians play an important role in the length and the depth of this war. On the other hand, although the trade war between the two largest economies will not end soon, a full-blown China-US trade war is not our baseline scenario, in other words, we believe the trade war will be still at a manageable level.

Altogether, in our baseline scenario, we generally forecast a 0.2-0.3% GDP declining will be for China this year while a much less growth impact on the US which is almost ignorable. Moreover, based on our recent China Economic Watch: Reignited China-US trade war and its implication on global value chain, by calculating the value-added part of China’s exports to the US using the OECD-WTO ViTA database, we estimate that among the USD 50 billion amount of China’s exports to the US which are subject to Trump’s tariff imposing in the first round, around USD 30 billion are value-added production in China (other USD 20 billion are from the upstream countries which have supply chain with China). This will lead to around 0.06% GDP (or 0.32% of total exports) decreasing, given the elasticity by categories of the exported goods provided by the World Bank database. Moreover, the additional USD 200 billion of Trump’s second round announcement will lead to around 0.24% GDP decreasing based on this value-added methodology.

From China’s perspective, after reviewing a number of methods which China could use in the escalating trade dispute with the US (please see our China Economic Watch: What will be China’s weapon in the trade war arsenal?), we find that China’s policy options to counter the US tariff measures are limited. We expect that the authorities will implement the methods such as restricting on US business in China, targeting service trade such as education and tourism as well as adopting the retaliatory tariff measure, but are unlikely to dump the US Treasury bond or guide currency depreciation. More importantly, with time going these retaliatory measures tend to have increasingly negative impact on China itself. For the positive side, the reality could make China actively seek for a solution through bilateral negotiation rather than escalating confrontation with the US. We expect that the two sides will restart the negotiation soon after the initial stage of the trade-war.

Finally, as the seesaw battle between the US and China seems to have continued for several months starting from the beginning of the year, the market looks like to have priced in the effect of trade war already, leading to a less volatile financial markets after the trade war started. For instance, we did not see a sharp dip of the S&P stock index in July, so is the Done Jones Industrial Average index. However, the market reflection in China’s stock market seems more significant as a larger stock market drop was found in China’s Shanghai Stock Exchange Composite index, which is a 22.6% decreasing from this year’s peak at the beginning of the year.

Monetary and fiscal policy are shifting to the easing side

The trade war with the US, together with the domestic deleveraging, makes Chinese authorities facing two battles at the same time. Amid the external and internal growth headwinds, economic activities slowed down in Q2, forcing the authorities to fine tune their previous tightening policy stance to support the economic growth. The fine-tuned policies include the following perspectives:

First, the authorities fine-tuned their tightening monetary policy stance to offset the external shock and domestic deleveraging. In particular, the PBoC cut Reserve Requirement Rate (RRR) to maintain the market liquidity recently. In addition, the PBoC also expanded the range of pledged assets for commercial banks to apply for Mid-term lending facilities (MLF) from the PBoC. More importantly, the PBoC did not follow the US FED to hike the interest rate, namely, to increase the DR-007, sending a signal of policy easing.

Second, the authorities also maintain expansionary fiscal policy stance. In particular, several tax cut schemes were announced recently, including: (i) Raising workers’ monthly personal allowance to 5,000 yuan from 3,500 yuan; (ii) Making interest payments on mortgage loans, and education, training and medical expenses tax deductible. (iii) Starting from May 1, the tax rate will be lowered from 17% to 16% for manufacturing and some other industries, and from 11% to 10% for transportation, construction, basic telecommunication services, and farm produce.

Third, more opening-up policies are announced amid the trade war. Recently, China’s National Development and Reform Commission (NDRC) announced the 2018 “negative list” for foreign investment. Compared to its 2017 version, the new negative list features a significant reduction in the restrictions of foreign investment. In particular, China’s authorities dropped many restrictions of foreign investment in a number of sectors including finance, automotive, aviation etc. Moreover, China is actively cooperating with the EU for the bilateral investment, namely to seek to sign the Bilateral Investment Treaty (BIT) as well as to reform the rules of WTO. We expect that China will accelerate the progress of opening the market to other countries amid the trade war with the US.

Fourth, the authorities also temporarily implemented regulatory forbearance. In particular, China may delay the release of new regulations for banks’ wealth management products (WMPs) as part of a broader push to curb financial sector risk because of recent market turmoil. The new rules were expected to be announced between late June and early July, however, regulators have opted to hold off on releasing the new guidelines and wait for a

“while” because of the recent market volatility caused by increasing concerns over a protracted trade war.

Altogether, escalating trade war risk has forced the authorities to shift their monetary and fiscal policy to the easing side.

The recent RRR cut signaled that policy stance will shift back to neutral from the previous one with tightening bias. On the front of policy interest rate, we are afraid that the PBoC won’t do any adjustment at the current stage under the newly established corridor system. In particular, an interest rate hike following the US will slow down the economy to a further extent while an interest rate cut might further depreciate RMB exchange rate and to stimulate shadow banking growth again. Thus, RRR cuts might be a better tool to maintain a sufficient liquidity in the market. In the meantime, we expect that the regulatory tightening will maintain to curb the shadow banking activities and contain financial risks.

From the perspective of fiscal policy, we expect more easing measures will be announced to offset the external shock and the domestic deleveraging. The authorities might finally add more deficits through the extra budget. Moreover, more tax cuts might be implemented later this year.

4. Growth risks intensified

Domestic deleveraging and the trade war with the US are the two battles Chinese authorities are facing at the current stage. Reflected by the Q2 growth moderation, it seems like the growth headwinds are intensifying now.

Domestically, the on-going deleveraging in the real economy and financial sector, with its original intention of mitigating the over-capacity and financial instability respectively, might drag on growth in the medium term. These policy measures mainly include supply-side deleveraging as well as cooling down the housing market and shadow banking.

Altogether, the authorities need to find a balance and choose an appropriate pace between pushing forward the deleveraging progress and maintaining a sustainable growth momentum. In this respect, market participants should guard against the risk of over-tightening stemming from the overconfidence of policymakers or the uncoordinated policy conduct among monetary, fiscal and supply-side policy initiatives.

Some other risks at the current stage also include the persisting financial risks. In particular, bond default risk is on the rise amid financial tightening. Until now, at least 15 corporate bond defaults this year, worth more than USD 2 billion. Additional bond defaults are likely among property developers and local-government financing vehicles which have relied on shadow banking vehicles for their funding.

Regarding the exploded trade war with the US, although the further rounds of negotiations have not been settled at the current stage, China has indeed taken some efforts to avoid the further escalation of the battle. For instance, China has shown their willingness to narrow its surplus against the US in the previous rounds of negotiation. China also announced that they are going to increase protection of intellectual properties and set out to establish intellectual property courts around the country. Now it seems that China’s authorities are ready to scrap their ambitious plan of “Made in China 2025” and even downplay the “One Belt One Road” initiatives.

Now China is trying to ally with the EU and Japan to fight against the US. Unfortunately, the EU has rejected China’s demand to publish an anti-US joint statement in the forthcoming Sino-European Summit. According to the media report, the EU is sharing almost every US concern with China although they don’t agree to US practice of unilaterally imposing tariff.

At the same time, China actively pushes for the signing of free trade agreement (FTA) and bilateral investment treaty (BIT) with EU and Japan. It is also pushing for the signing of Regional Comprehensive Economic Partnership (ASEAN 10+ China, Japan, South Korea, India, Australian, New Zealand). These initiatives are aimed to offset the shock from the trade war, which also provides China a way to end this trade war with the US gracefully.

That being said, if China can manage to sign FTAs and BITs with the EU and Japan, the market-access issues between China and the US will become much easier to solve, which can also lay a good ground for solving other differences between them. Certainly there will be more volatility along the way ahead even China decides to implement this policy. But that’s the right way to end this trade war with the least cost.

Altogether, the two battles at the same time bring about more challenges to Chinese authorities in policy-making. How to balance the financial and industrial deleveraging and growth, as well as the policy fine-tuning to offset the external shock remains the key point in the following months. We believe that at the current stage, the authorities need to put the external risk at the first priority and maintain market sentiments through fine-tuning the previous tightening monetary policy stance.