Xia Le: A Tale of Two Markets for the Redback

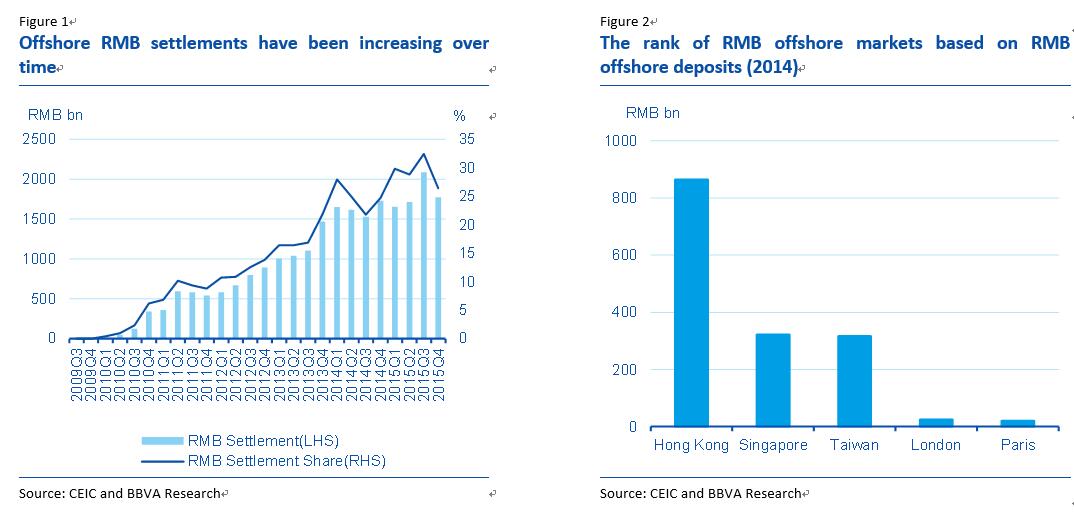

2016-03-10 IMI The CNH market has become increasingly active since its inception. To date, the CNH market offers many types of RMB business and financial products including spot FX, deliverable forwards, swaps, deposits and CDs, Dim Sum bonds (RMB denominated bond issued in offshore market), RMB-denominated loans, etc. In its 2013 Triennial Central Bank Survey, the Bank of International Settlement (BIS) stated “…Renminbi turnover soared from $34 billion to $120 billion. The renminbi has thus become the ninth most actively traded currency in 2013, with a share of 2.2% in global FX volumes, mostly driven by a significant expansion of offshore renminbi trading”.

One currency, two markets

In theory, the onshore (CNY) and offshore (CNH) RMB markets are segmented because China hasn’t fully opened its capital account yet. There are various forms of restrictions limiting investors from transferring RMB funds between the CNY and CNH markets. The CNY market remains highly regulated by the People’s Bank of China (PBoC). For example, access to the wholesale FX market is granted only to domestic banks, finance companies, and domestic subsidiaries of foreign banks. On the other hand, there isn’t an official regulator in the CNH market. Local regulators can only apply their rules to financial institutions under their own jurisdictions. Indeed, these regulators have less appetite for imposing additional restrictions on offshore RMB business. Instead, they have been attempting to lobby China’s authorities to relax their restrictions for cross-border RMB business because it could gain more business opportunities for their financial markets and institutions.

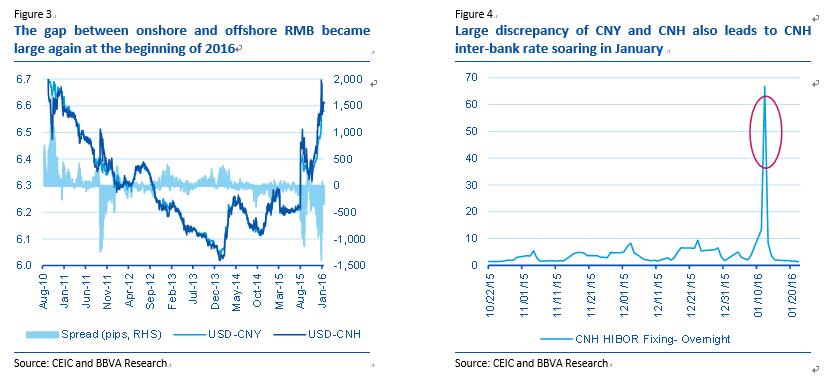

The segmentation between the CNY and CNH markets unavoidably led to a price differential (Figure 3). The gap between the CNY and CNH rates was wider at the early stage of the CNH market development (2010 August-2011 January). During that period, the CNH rate appreciated more than the CNY one because the currency was less available in overseas market. Due to the fact that China’s still closed capital account limited the arbitrage behaviours between these two markets, the price differential cannot be fully eliminated.

There were also a few episodes when the CNH interbank rates spiked due to the liquidity shortage in the offshore market, for example in October 2011. This type of liquidity shortage can quickly be fixed when the Hong Kong Monetary Authority (HKMA), with the PBoC’s support, injected RMB liquidity into the offshore market.

Over time the CNY and CNH rates tended to converge as the PBoC steadily stepped up their efforts to liberalize the capital account and push forward RMB internationalization. Moreover, to boost the international usage of the RMB, the authorities also increased their tolerance of arbitrage behaviours which exploited interest and exchange rate differentials between the CNY and CNH markets. These efforts have proved to be effective in the sense that they have substantially increased the usage of the RMB in overseas markets and thereby enabled the “redback” to meet the International Monetary Fund’s “freely usable” requirement for its inclusion in the currency basket of the Special Drawing Rights (SDRs) last November.

Pricing power shifted to the CNH market after the 2015 August devaluation

The gap between the CNH and CNY exchange rates started to widen again after the PBoC unexpectedly announced the reform of the RMB fixing price mechanism and devalued the currency by 1.9% on August 11 2015. (See our China Flash) In retrospect, the authorities seemingly intended to increase the flexibility of the RMB exchange rate. However, the timing of this move seems questionable as global financial markets were then surrounded by enormous uncertainties over the US Fed’s monetary policy. As such, the unexpected RMB devaluation rattled investors and made the exchange rate anchorless. Panicked investors thought that China wanted to join the “currency war” and would depreciate the RMB much deeper to regain its competitiveness in exports. More pessimistic investors even interpreted that the devaluation itself was a signal of the economy implosion and scrambled to transfer their money out of the country. Policymakers’ poor communication also hindered investors from learning the true policy intention at the first time.

To avoid too sharp depreciation and associated risk of accelerating capital flight, the authorities intervened into the CNY market again to stabilize investors’ expectations. However, an unintended result is that the PBoC gave the pricing power of RMB to the offshore market because the CNH market was less affected by the government’s interventions. Our Granger Causality empirical results (Refer to the BOX at the end) demonstrate that in the aftermath of the August devaluation, the CNH price tends to have a guide impact on the CNY price, while the CNY price has no significant guide impact on the CNH price.

Since then, the CNH market has persistently priced a relatively lower value of the RMB than its onshore counterpart. The authorities thus faced a policy dilemma: the more interventions they did in the CNY market, the larger extent of depreciation was priced in the CNH market. In turn, the large depreciation pressure of the offshore market transmitted to the onshore market via cross-border arbitrage behaviors and consequently nullified the authorities’ interventions.

The CNH market has become increasingly active since its inception. To date, the CNH market offers many types of RMB business and financial products including spot FX, deliverable forwards, swaps, deposits and CDs, Dim Sum bonds (RMB denominated bond issued in offshore market), RMB-denominated loans, etc. In its 2013 Triennial Central Bank Survey, the Bank of International Settlement (BIS) stated “…Renminbi turnover soared from $34 billion to $120 billion. The renminbi has thus become the ninth most actively traded currency in 2013, with a share of 2.2% in global FX volumes, mostly driven by a significant expansion of offshore renminbi trading”.

One currency, two markets

In theory, the onshore (CNY) and offshore (CNH) RMB markets are segmented because China hasn’t fully opened its capital account yet. There are various forms of restrictions limiting investors from transferring RMB funds between the CNY and CNH markets. The CNY market remains highly regulated by the People’s Bank of China (PBoC). For example, access to the wholesale FX market is granted only to domestic banks, finance companies, and domestic subsidiaries of foreign banks. On the other hand, there isn’t an official regulator in the CNH market. Local regulators can only apply their rules to financial institutions under their own jurisdictions. Indeed, these regulators have less appetite for imposing additional restrictions on offshore RMB business. Instead, they have been attempting to lobby China’s authorities to relax their restrictions for cross-border RMB business because it could gain more business opportunities for their financial markets and institutions.

The segmentation between the CNY and CNH markets unavoidably led to a price differential (Figure 3). The gap between the CNY and CNH rates was wider at the early stage of the CNH market development (2010 August-2011 January). During that period, the CNH rate appreciated more than the CNY one because the currency was less available in overseas market. Due to the fact that China’s still closed capital account limited the arbitrage behaviours between these two markets, the price differential cannot be fully eliminated.

There were also a few episodes when the CNH interbank rates spiked due to the liquidity shortage in the offshore market, for example in October 2011. This type of liquidity shortage can quickly be fixed when the Hong Kong Monetary Authority (HKMA), with the PBoC’s support, injected RMB liquidity into the offshore market.

Over time the CNY and CNH rates tended to converge as the PBoC steadily stepped up their efforts to liberalize the capital account and push forward RMB internationalization. Moreover, to boost the international usage of the RMB, the authorities also increased their tolerance of arbitrage behaviours which exploited interest and exchange rate differentials between the CNY and CNH markets. These efforts have proved to be effective in the sense that they have substantially increased the usage of the RMB in overseas markets and thereby enabled the “redback” to meet the International Monetary Fund’s “freely usable” requirement for its inclusion in the currency basket of the Special Drawing Rights (SDRs) last November.

Pricing power shifted to the CNH market after the 2015 August devaluation

The gap between the CNH and CNY exchange rates started to widen again after the PBoC unexpectedly announced the reform of the RMB fixing price mechanism and devalued the currency by 1.9% on August 11 2015. (See our China Flash) In retrospect, the authorities seemingly intended to increase the flexibility of the RMB exchange rate. However, the timing of this move seems questionable as global financial markets were then surrounded by enormous uncertainties over the US Fed’s monetary policy. As such, the unexpected RMB devaluation rattled investors and made the exchange rate anchorless. Panicked investors thought that China wanted to join the “currency war” and would depreciate the RMB much deeper to regain its competitiveness in exports. More pessimistic investors even interpreted that the devaluation itself was a signal of the economy implosion and scrambled to transfer their money out of the country. Policymakers’ poor communication also hindered investors from learning the true policy intention at the first time.

To avoid too sharp depreciation and associated risk of accelerating capital flight, the authorities intervened into the CNY market again to stabilize investors’ expectations. However, an unintended result is that the PBoC gave the pricing power of RMB to the offshore market because the CNH market was less affected by the government’s interventions. Our Granger Causality empirical results (Refer to the BOX at the end) demonstrate that in the aftermath of the August devaluation, the CNH price tends to have a guide impact on the CNY price, while the CNY price has no significant guide impact on the CNH price.

Since then, the CNH market has persistently priced a relatively lower value of the RMB than its onshore counterpart. The authorities thus faced a policy dilemma: the more interventions they did in the CNY market, the larger extent of depreciation was priced in the CNH market. In turn, the large depreciation pressure of the offshore market transmitted to the onshore market via cross-border arbitrage behaviors and consequently nullified the authorities’ interventions.

The offshore market gave its way to the financial stability for the time being

Now the authorities have prioritized the goal of stabilizing people’s expectation for the RMB exchange rate and stemming capital outflows. On top of introducing a basket currency index (CFETS) as the new anchor for the RMB exchange rate (see our recent China Flash), the authorities have also increased their interventions in the onshore market so as to establish their credibility of this new FX policy regime soon.

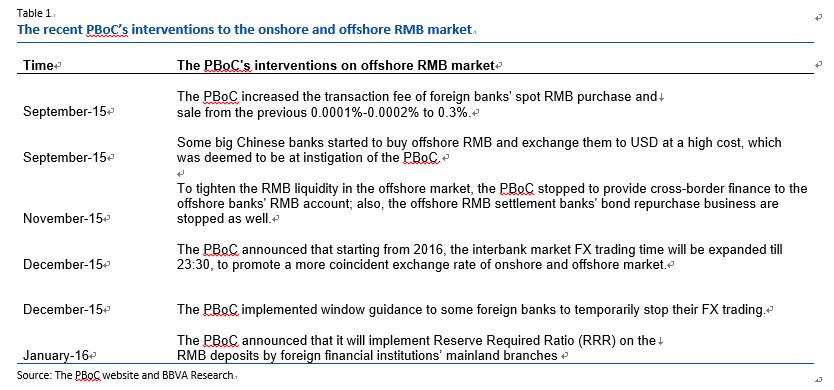

To solve the policy dilemma mentioned in the previous section, the authorities have adopted new approaches to deal with the offshore market as well. In particular, they cut off the linkages between the two markets to impede the transmission of depreciation pressure across the borders. In the meantime, the authorities deliberately reduced the RMB liquidity in the offshore market to raise the CNH interest rates. High interest rate levels will not only increase the attractiveness of holding RMB but also add financing costs for the RMB short-sellers in the offshore market. It is also believed that China’s authorities are attempting to intervene in the CNH market via some Chinese banks’ overseas subsidiaries. (Table 1)

The offshore market gave its way to the financial stability for the time being

Now the authorities have prioritized the goal of stabilizing people’s expectation for the RMB exchange rate and stemming capital outflows. On top of introducing a basket currency index (CFETS) as the new anchor for the RMB exchange rate (see our recent China Flash), the authorities have also increased their interventions in the onshore market so as to establish their credibility of this new FX policy regime soon.

To solve the policy dilemma mentioned in the previous section, the authorities have adopted new approaches to deal with the offshore market as well. In particular, they cut off the linkages between the two markets to impede the transmission of depreciation pressure across the borders. In the meantime, the authorities deliberately reduced the RMB liquidity in the offshore market to raise the CNH interest rates. High interest rate levels will not only increase the attractiveness of holding RMB but also add financing costs for the RMB short-sellers in the offshore market. It is also believed that China’s authorities are attempting to intervene in the CNH market via some Chinese banks’ overseas subsidiaries. (Table 1)

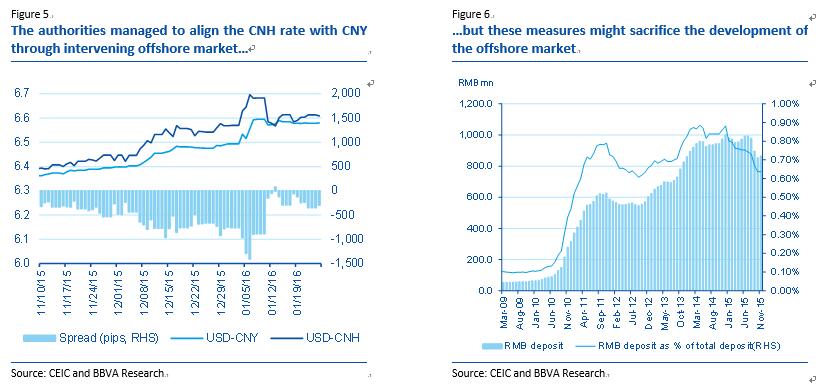

These new measures seem to be effective in the recent weeks as the authorities managed to align the CNH rate with the CNY. (Figure 5) However, these measures bear a high cost. They indeed have dampened foreign investors’ interest in the RMB and have largely weakened the price discovery function of the CNH market. The depth of the offshore market is also adversely affected, which means that the CNH interest and exchange rates will inevitably become more fickle. All in all, these measures will sacrifice the development of the offshore market, which is a serious setback for RMB internationalization. (Figure 6)

These new measures seem to be effective in the recent weeks as the authorities managed to align the CNH rate with the CNY. (Figure 5) However, these measures bear a high cost. They indeed have dampened foreign investors’ interest in the RMB and have largely weakened the price discovery function of the CNH market. The depth of the offshore market is also adversely affected, which means that the CNH interest and exchange rates will inevitably become more fickle. All in all, these measures will sacrifice the development of the offshore market, which is a serious setback for RMB internationalization. (Figure 6)

When will the CNH market thrive again?

The dramatic change of the CNH market largely mirrors the conflict between the exchange rate reform and the RMB internationalization under strong depreciation expectation and escalating global uncertainty. Under such a circumstance, the right sequencing issue becomes more pronounced than before. Although China’s authorities have been pushing forward a number of financial liberalization reforms on multiple fronts simultaneously, now it seems to be the right time to fine-tune the agenda and rearrange the order. In our opinion, the right sequencing should be the exchange rate reform first, then capital account opening and the RMB internationalization.

We believe that the authorities’ priority is to link the RMB value to a basket of currencies in order to stabilize market expectations and avert large-scaled capital exodus. The CNH market could suffer a period of stagnation until China’s authorities established its credibility of the new FX policy regime. That being said, the CNH market is likely to regain its prosperity in the next couple of years as capital account liberalization and RMB internationalization are back on the top of the authorities’ reform agenda again.

Appendix 1. CNH’s price-guide mechanism becomes stronger after the 2015 August 11 RMB reform based on Granger Causality test

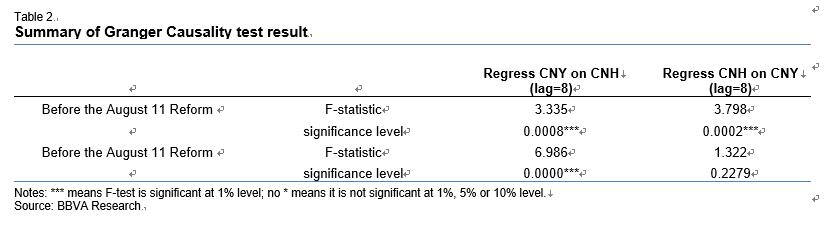

We deploy Granger Causality test to illustrate that CNH’s price-guide impact is increasing after the 2015 August 11 RMB exchange rate fixing price reform. Among many of the causality test methods in time series studies, Granger Causality test is the most widely used and intuitively straightforward.

The basic idea of Granger test is that X is said to Granger-cause Y if Y can be forecast better using past Y and past X than just past Y. To implement the idea, we normally do the regression from Y on the past X and past Y in the time t-1, t-2, etc. (lags are determined by some statistically optimal choice), and to test whether the F-test of all the past X’s coefficients are jointly significant.

We basically test the mutual Granger causality relationship between CNY and CNH exchange rate in two regions: before and after the 2015 August 11 RMB reform. The first time window is from August 23, 2010 to August 10, 2015 and the second time window is from August 11 2015 to January 15, 2016.

Table 2 is the summary of significance level of the F-statistic of our Granger Test. (Table 2) Our results show that: (1) CNH to USD exchange rate could Granger-cause CNY to USD exchange rate both before and after the August 11 RMB exchange rate reform; (2) CNY to USD exchange rate can Granger-cause CNH to USD before the reform, however, it cannot Granger-cause CNH to USD after the reform.

The empirical results indicate that CNH’s price-guide impact on CNY becomes stronger after the August 11 RMB exchange rate reform while CNY’s price-guide effect on the CNH offshore market turns weaker after the reform. That said, the price-guide mechanism of CNH/USD was much amplified after the RMB exchange rate fixing price reform.

When will the CNH market thrive again?

The dramatic change of the CNH market largely mirrors the conflict between the exchange rate reform and the RMB internationalization under strong depreciation expectation and escalating global uncertainty. Under such a circumstance, the right sequencing issue becomes more pronounced than before. Although China’s authorities have been pushing forward a number of financial liberalization reforms on multiple fronts simultaneously, now it seems to be the right time to fine-tune the agenda and rearrange the order. In our opinion, the right sequencing should be the exchange rate reform first, then capital account opening and the RMB internationalization.

We believe that the authorities’ priority is to link the RMB value to a basket of currencies in order to stabilize market expectations and avert large-scaled capital exodus. The CNH market could suffer a period of stagnation until China’s authorities established its credibility of the new FX policy regime. That being said, the CNH market is likely to regain its prosperity in the next couple of years as capital account liberalization and RMB internationalization are back on the top of the authorities’ reform agenda again.

Appendix 1. CNH’s price-guide mechanism becomes stronger after the 2015 August 11 RMB reform based on Granger Causality test

We deploy Granger Causality test to illustrate that CNH’s price-guide impact is increasing after the 2015 August 11 RMB exchange rate fixing price reform. Among many of the causality test methods in time series studies, Granger Causality test is the most widely used and intuitively straightforward.

The basic idea of Granger test is that X is said to Granger-cause Y if Y can be forecast better using past Y and past X than just past Y. To implement the idea, we normally do the regression from Y on the past X and past Y in the time t-1, t-2, etc. (lags are determined by some statistically optimal choice), and to test whether the F-test of all the past X’s coefficients are jointly significant.

We basically test the mutual Granger causality relationship between CNY and CNH exchange rate in two regions: before and after the 2015 August 11 RMB reform. The first time window is from August 23, 2010 to August 10, 2015 and the second time window is from August 11 2015 to January 15, 2016.

Table 2 is the summary of significance level of the F-statistic of our Granger Test. (Table 2) Our results show that: (1) CNH to USD exchange rate could Granger-cause CNY to USD exchange rate both before and after the August 11 RMB exchange rate reform; (2) CNY to USD exchange rate can Granger-cause CNH to USD before the reform, however, it cannot Granger-cause CNH to USD after the reform.

The empirical results indicate that CNH’s price-guide impact on CNY becomes stronger after the August 11 RMB exchange rate reform while CNY’s price-guide effect on the CNH offshore market turns weaker after the reform. That said, the price-guide mechanism of CNH/USD was much amplified after the RMB exchange rate fixing price reform.