Xia Le,Betty Huang,and Tomasa Rodrigo: Financial Deleveraging--Two Steps Forward; One Step Back

2017-05-26 IMIThis article appeared in BBVA Research China Ecnomic Watch on May 22, 2017.

Xia Le, Senior Research Fellow of IMI, Chief Economist for Asia, BBVA.

Betty Huang, Economist, BBVA.

Tomasa Rodrigo, Economist, BBVA.

Summary

After months of persistent regulatory tightening in domestic financial markets, China’s authorities unexpectedly fine-tuned their stance of monetary prudence and leverage control by injecting a vast amount of liquidity into the banking sector in the past couple of weeks.

It is too sanguine to conclude that the regulatory storms come to an end after the recent liquidity injection by the PBoC and the regulators’ suave words. The authorities have just loosened the rein a little bit to avoid unnecessary market panic and selloffs in financial markets. We interpret the authorities’ strategy as “two steps forward one step back”. After the market stabilizes and absorbs their messages, they are set to leap forward again.

It is a formidable task to achieve a deleveraging in the financial sector while not causing a systemic debacle. In China’s case, a confluence factors could help the authorities to ensure a soft-landing, including the authorities’ lessons drawn from previous attempts, the high level of RRR in China’s banking sector and the de facto state ownership of important financial institutions.

On balance, the process of China’s financial deleveraging could last for a few years, acccomained with greater volatilities in domestic financial markets. The liquidity squeeze and small-scaled selloffs could appear repeatedly before the authorities achieve their goal of deleveraging. The currency value could become one of important binding constraints for the authorities to press ahead with their deleveraging strategies. Moreover, the regulatory storms could take a toll on the real economy, leading to a protracted period of growth below its potential level.

A brief introduction

After months of persistent regulatory tightening in domestic financial markets, China’s authorities unexpectedly fine- tuned their stance of monetary prudence and leverage control by injecting a vast amount of liquidity into the banking sector through reverse repo and Medium Lending Facility (MLF) in the past couple of weeks. In the meantime, a number of regulators communicated to the market to alleviate the fast-rising market tension stemming from the policy- driven liquidity squeeze.

The authorities’ latest policy moves beg a number of crucial questions with respect to the ongoing regulatory storms—— why did the authorities choose such a time to fine-tune their policy? Does it mean the authorities will abandon their previous target of reining in shadow banking activities? Is it possible for China to deploy its deleveraging strategy without causing a systemic debacle in the country’s gigantic financial sector? This economic watch attempts to address the above issues and shed light on China’s policy outlook for its financial sector.

The origin of the regulatory storms

Starting from December 2016, a number of China’s regulators, including the CBRC (banking regulator), CSRC (security market regulator) and CIRC (insurance regulator), stepped up their efforts to curb shadow banking activities. Meanwhile, the PBoC also shifted their policy stance to “prudent” and implement a new regulatory framework of Macro Prudential Assessment (MPA), the thrust of which is to force banks to include many previously off-balance-sheet activities into their books. That being said, the main targets of currently regulatory tightening are the wealth management products (WMPs) and bank- issued CDs in the interbank market, through which many small-and- medium-sized banks (SMBs) and non-banking financial institutions (NFBIs) raise funds to support their risky lending behaviours on and off their balance sheets. (Refer to our Banking Monitor)

These shadow banking activities have not only aggravated the indebtedness of the corporate sector but also increased the leverage of the entire financial sector and made it more vulnerable to any potential external shocks. Given that the bulk of these activities are not reflected on financial institutions’ balance sheets, the existing supervisory requirements of liquidity or capital adequacy cannot effectively limit their expansion. The rampant growth of these activities could also lead to risk-transfer within the financial sector, in which financial institutions have less incentive to monitor and manage risks associated with these activities since they tend to believe the risks have been shifted to other counterparties through complex and opaque structures of deals. As a consequence, the interconnectedness of the financial sector has been strengthened to elevate the systemic risk on the one hand, while the risk management of these activities become even laxer on the other.

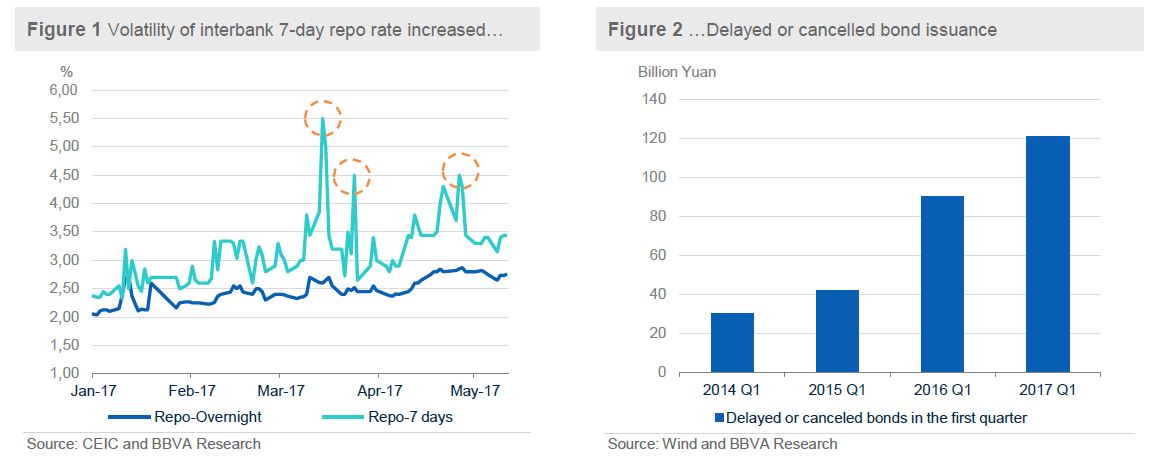

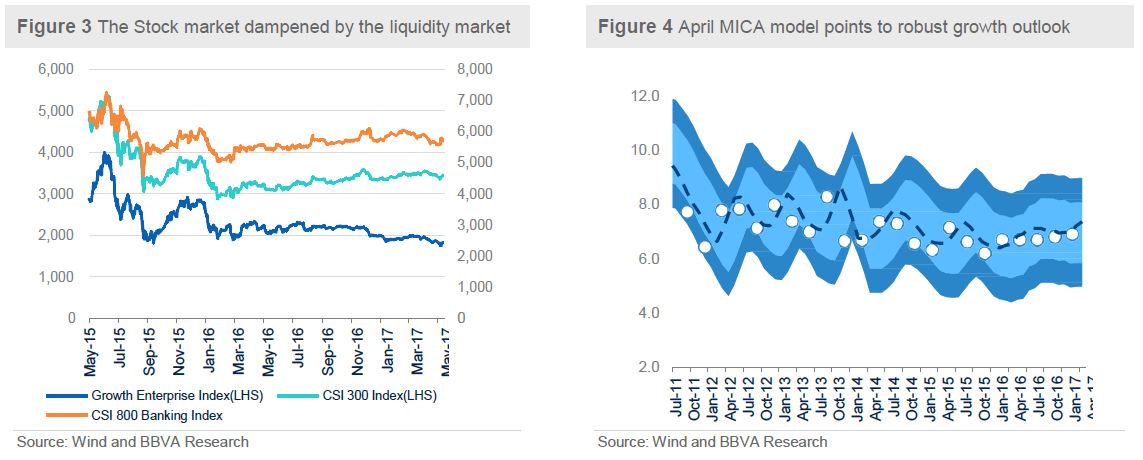

The combination of monetary prudence and regulatory storms is aimed to tackle the rising financial vulnerability associated with shadow banking activities, which unavoidably led to the tight liquidity and elevated tensions in domestic financial markets. Since the beginning of the year, the volatility of interbank 7-day repo rate, which is a widely received market indicator, has significantly increased with several spikes. (Figure 1) The liquidity squeeze in the money market quickly spilled over to the bond market and raised the financing costs of bond issuance. Through April, a large number of bond issuances (valuing around RMB 260 billion) were delayed or cancelled due to elevated interest rate. (Figure 2) The liquidity squeeze has also dampened the stock market, in particular on the listed SMBs and NFBIs with greater exposure to WMPs and heavy financing reliance on interbank banks. (Figure 3)

The curtain has just been lifted…

It is too sanguine to conclude that the regulatory storms come to an end after the recent liquidity injection by the PBoC and the regulators’ suave words. First of all, the previously implemented tightening efforts have not achieved much given the gigantic size of shadow banking activities. According to our estimate, Chinese banks’ aggregate exposure to shadow banking activities amounted to RMB 58.5 trillion as of end-2016, or 11.3% of banks’ total assets. It’s a huge figure compared to banks’ 4-5% leverage ratio, (which is defined as the ratio of a bank’s tier-I capital after deduction to its total assets). A back-on-the-envelope calculation tells that banks’ tier-I capital could be entirely wiped out if 40% of these high-risk shadow banking activities turned losses. It means that the deleveraging process in the financial sector will likely be a multi-year campaign rather than a one-off effort. The authorities know this point very well. Since the last quarter of 2016, the authorities have repeatedly emphasized that the priority of the government in the economic area will be given to financial stability. That being said, they will continue defuse the risks associated with shadow banking activities while calibrating their pace of regulatory implementation so as to avoid that policy missteps lead to market panic.

Second, China’s growth momentum continues to be robust despite some recently emerging signs of moderation. According to the estimation of our MICA model, the monthly GDP growth in April still remained above 7.0% y/y. (Figure 4) The strong growth impulse in China and the benign external environment are expected to help China achieve a decent growth rate (likely 6.0-6.5%) for this year. Since the authorities have already downplayed the importance of growth relative to financial stability, it is unlikely for them to halt their efforts of reining in shadow banking activities at the current stage.

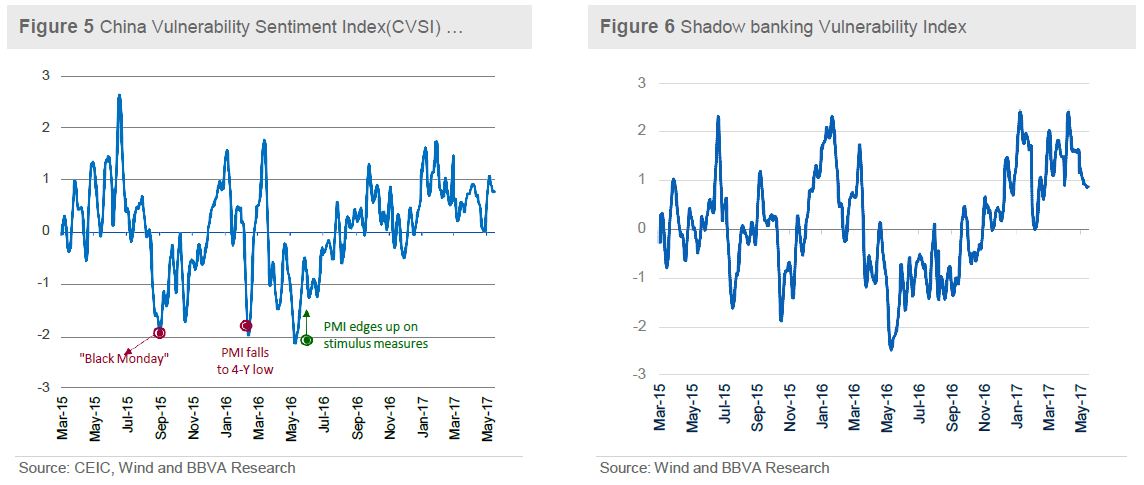

Last but not least, our China Vulnerability Sentiment Index (CVSI) 1 , which is our in-house developed and multidimensional to gauge the global media’s sentiment about a number of Chinese vulnerabilities, still remains positive despite the recently rising tension in domestic financial markets. (Figure 5) Interestingly, a sub-index of CVSI tracking the sentiment about shadow banking activities tended to perform better during the period of regulatory tightening and softened after liquidity injection. (Figure 6) The CVSI indicates that the current market situation hasn’t deteriorated to the extent comparable to the previous episodes of financial turmoil. As such, the authorities still have adequate room to push forward their deleveraging campaign. Moreover, the sub-index of CVSI regarding shadow banking activities implies that the public, even including some market participants, tends to welcome the measures targeting to curb shadow banking activities. It will reinforce the authorities’ resolve to rein in shadow banking activities and lower the general leverage of the financial sector.

All in all, the ease of regulatory tightening is likely to be transitory. The authorities will definitely continue their long- term campaign of facilitating the decelerating financial sector and curtailing shadow banking activities. Now the authorities have just loosened the rein a little bit to avoid unnecessary market panic and selloffs in financial markets. We interpret the authorities’ strategy as “two steps forward one step back”. After the market absorbs their messages, they will leap forward again along the way of deleveraging. There is no doubt that they will unveil more regulations in a targeted and calibrated way.

Is it possible to achieve a deleveraging without debacle?

It is a formidable task to achieve a deleveraging in the financial sector while not causing a systemic debacle. In China’s case, a confluence factors could help the authorities to attain it in a smoother way. The authorities seem to have taken lessons from their past unsuccessful attempts to do similar things. In particular, they are paying more attention to market communications to avoid causing unnecessary market panic. Different regulators also learn to implement regulations and initiatives in a coordinated way. Their approach of “two steps forward one step back” is especially helpful in defusing the risks of shadow banking activities while avoiding policy missteps of bluntly pricking the asset bubbles.

Another important cushion which the authorities could count on is the high level of reserve requirement ratio (RRR) of China’s banking sector. For large banks, their RRR stands at 17% of its total deposit. Even SMBs have a RRR of 15% now. That being said, the authorities can unleash a vast amount of liquidity to the banking sector when they deem necessary. With such a high RRR level at disposal, the authorities have ample room to manoeuvre along the way of deleveraging.

It is also noted that all the important Chinese financial institutions are state-owned. Such an ownership structure might not be good for the efficiency but it could help to stabilize the public confidence during the time of market turmoil. For the banking sector as a whole, the ability to receive deposits from households and firms during stress time is imperative for its survival. Fortunately, the state-owned nature of financial institutions could help to steady people’s confidence and avert a bank-run scenario.

On balance, the process of China’s financial deleveraging could last for a few years, accompanied with greater volatilities in domestic financial markets. The liquidity squeeze and small-scaled selloffs could appear repeatedly before the authorities achieve their goal of deleveraging. Although China has put their capital account under tight grip now, the turbulence in domestic financial markets can spill over to the currency market and add further downward pressure to the seemingly stabilized RMB exchange rate. We tend to believe that the currency value could become one of important binding constraints for the authorities to press ahead with their deleveraging strategies. Moreover, the regulatory storms could take a toll on the real economy by raising general funding costs. In this respect, we might see several years of growth below its potential level.

1.For those readers who are interested in the details of CSVI, you can have access to our working paper via the link