Steve H. Hanke: The Fed’s Misleading Money Supply Measures

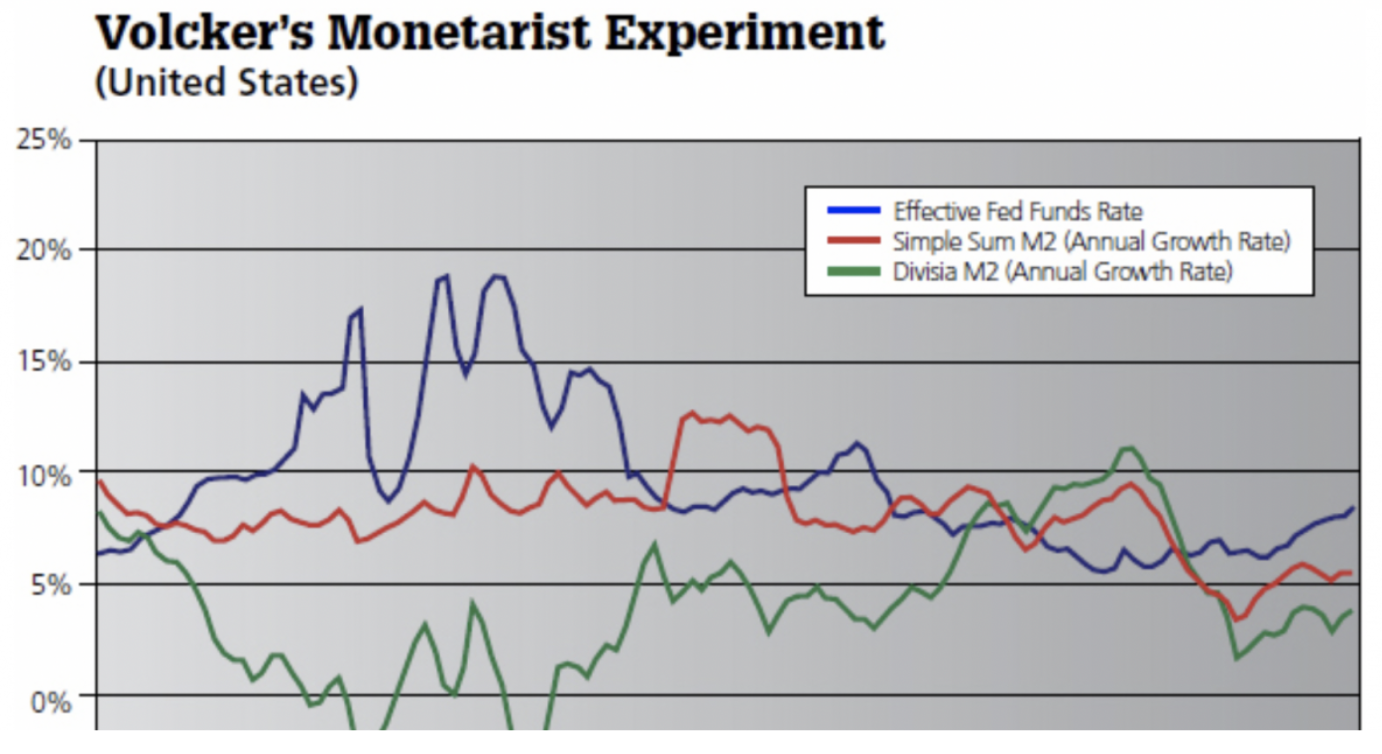

2018-11-06 IMI Why the huge divergences between the standard simple-sum measures of M2 that Volcker was observing and the true Divisia M2 measure? As the Fed pushed the fed funds rate up, the opportunity cost of holding cash increased. In consequence, retail money market funds and time deposits, for example, became relatively more attractive and received a lower weight when measured by a Divisia metric. Faced with a higher interest rate, people had a much stronger incentive to avoid “large” cash and checking account balances, opting to keep their funds in relatively high-yielding assets. As the fed funds rate went up, the divergence between the simple-sum and Divisia M2 measures increased.

Alas, the data problems associated with Volcker’s monetary experiment have been ignored by the Fed. Indeed, as Bill Barnett concluded in his book Getting It Wrong: How Faulty Monetary Statistics Undermine the Fed, the Financial System, and the Economy: “When more and better data were needed by the private sector, as the complexity of financial products grew, the quantity and quality of Fed data declined.” Fortunately, we have a reliable alternative for the provision of high-quality money supply data: The Center for Financial Stability.

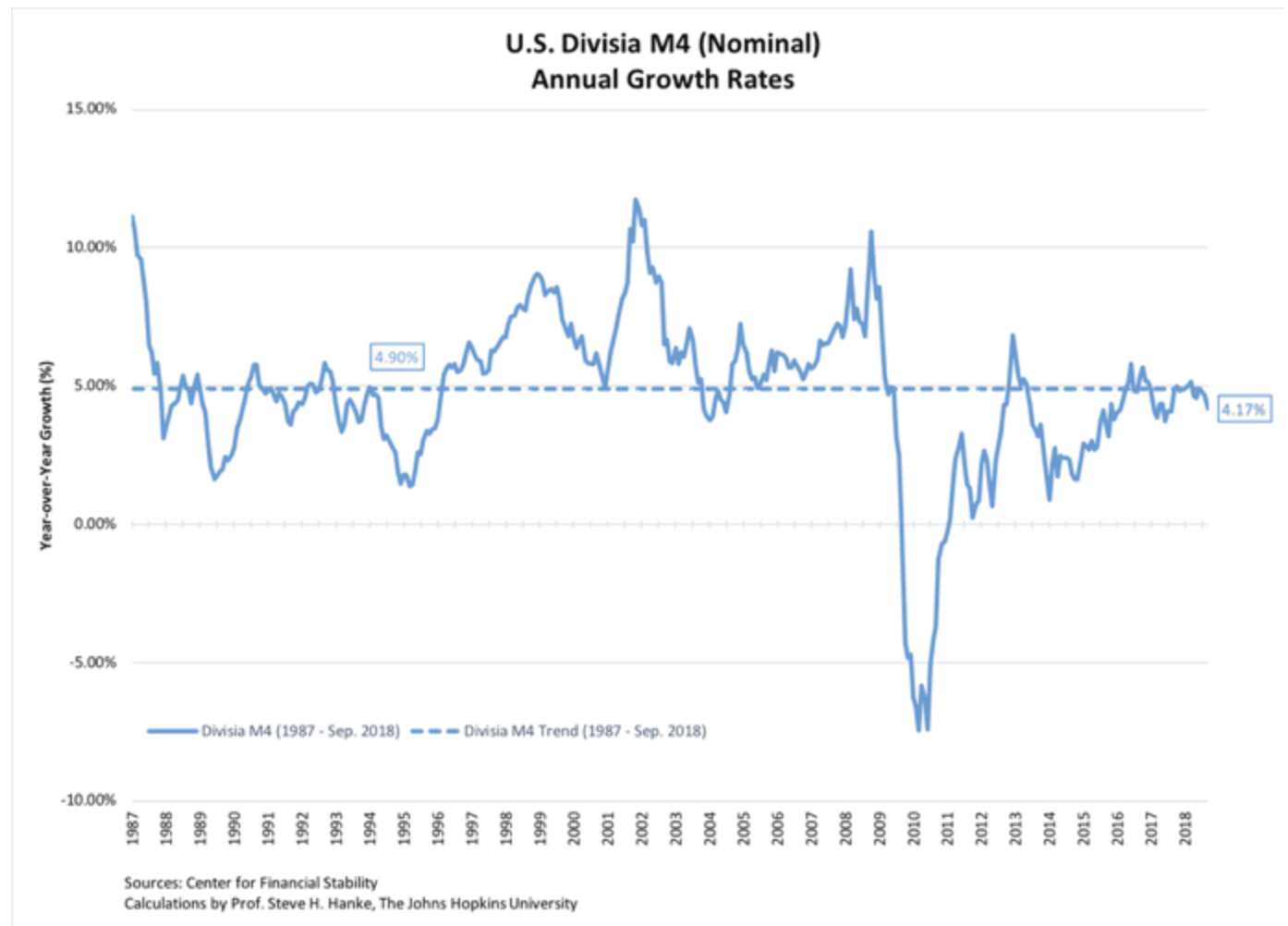

Where are we today? As shown in the chart below, the Divisia M4 growth rate is 4.2% yr/yr. That rate is a bit weak. Indeed, it is lower than it has been during the past year, and it is also below its trend rate for the past 30 years of 4.9%. This suggests that the Fed’s balance sheet unwind has resulted in a somewhat “tight” monetary stance.

Why the huge divergences between the standard simple-sum measures of M2 that Volcker was observing and the true Divisia M2 measure? As the Fed pushed the fed funds rate up, the opportunity cost of holding cash increased. In consequence, retail money market funds and time deposits, for example, became relatively more attractive and received a lower weight when measured by a Divisia metric. Faced with a higher interest rate, people had a much stronger incentive to avoid “large” cash and checking account balances, opting to keep their funds in relatively high-yielding assets. As the fed funds rate went up, the divergence between the simple-sum and Divisia M2 measures increased.

Alas, the data problems associated with Volcker’s monetary experiment have been ignored by the Fed. Indeed, as Bill Barnett concluded in his book Getting It Wrong: How Faulty Monetary Statistics Undermine the Fed, the Financial System, and the Economy: “When more and better data were needed by the private sector, as the complexity of financial products grew, the quantity and quality of Fed data declined.” Fortunately, we have a reliable alternative for the provision of high-quality money supply data: The Center for Financial Stability.

Where are we today? As shown in the chart below, the Divisia M4 growth rate is 4.2% yr/yr. That rate is a bit weak. Indeed, it is lower than it has been during the past year, and it is also below its trend rate for the past 30 years of 4.9%. This suggests that the Fed’s balance sheet unwind has resulted in a somewhat “tight” monetary stance.

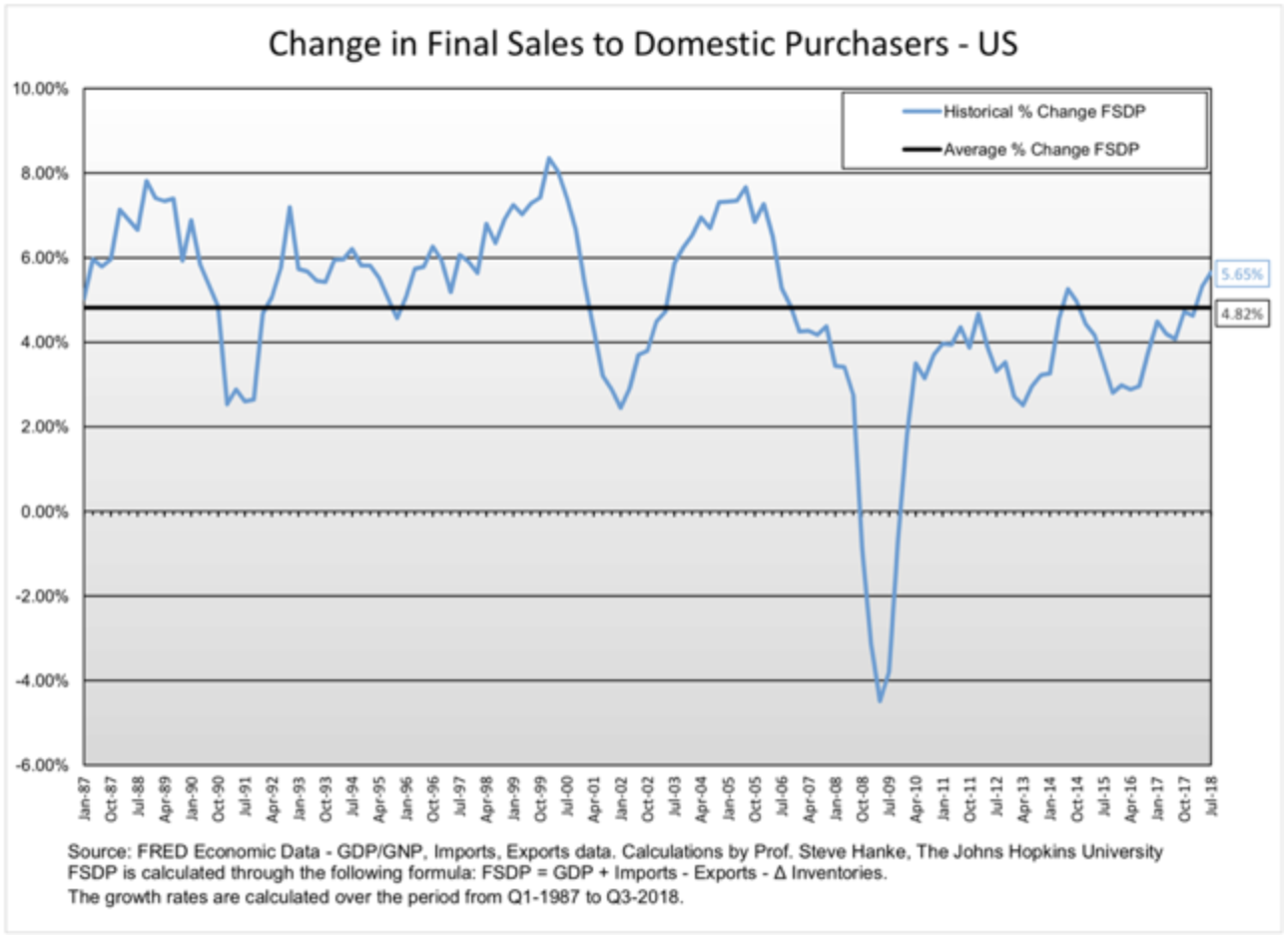

If we turn to aggregate demand measured in nominal terms, it is holding up rather well (see the chart below). At a 5.65% yr/yr rate, nominal aggregate demand, as measured by final sales to domestic purchases, is above its 30-year trend rate of 4.82%. So for now, things look pretty good. But, a monetary storm cloud would develop if the Fed were to misstep and slip into a quantitative tightening mode. Without Divisa M4 on the Fed’s dashboard, the Fed might not realize the storm forming on the horizon.

If we turn to aggregate demand measured in nominal terms, it is holding up rather well (see the chart below). At a 5.65% yr/yr rate, nominal aggregate demand, as measured by final sales to domestic purchases, is above its 30-year trend rate of 4.82%. So for now, things look pretty good. But, a monetary storm cloud would develop if the Fed were to misstep and slip into a quantitative tightening mode. Without Divisa M4 on the Fed’s dashboard, the Fed might not realize the storm forming on the horizon.