Steve H. Hanke:Keep Your Eye on Broad Money; That's What Counts

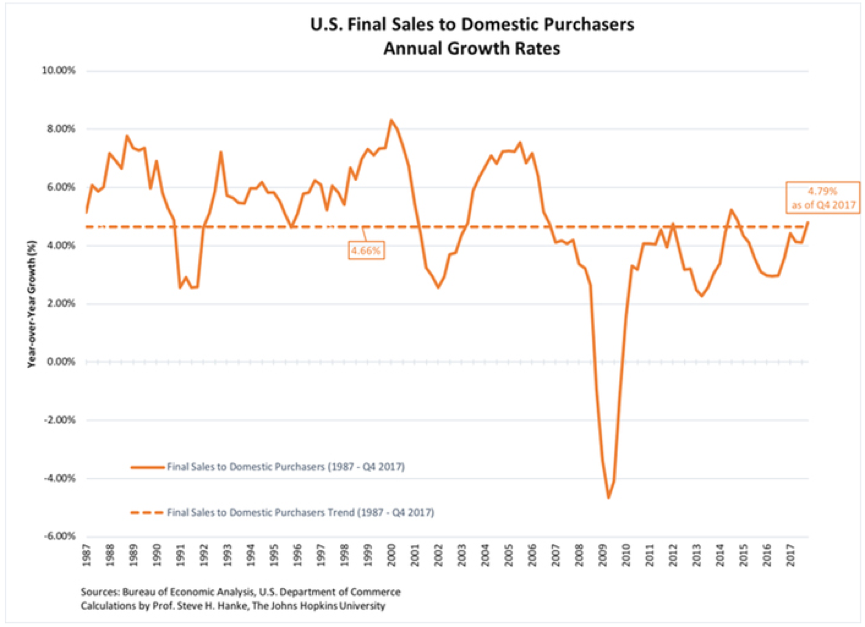

2018-05-07 IMI If we move to the rate of growth for the economy’s nominal aggregate demand (measured by Final Sales to Domestic Purchasers, which equals GDP + Imports - Exports - Change in Inventory), it is just a tad over the trend rate of growth of 4.7% (see the chart below). Again, not bad.

If we move to the rate of growth for the economy’s nominal aggregate demand (measured by Final Sales to Domestic Purchasers, which equals GDP + Imports - Exports - Change in Inventory), it is just a tad over the trend rate of growth of 4.7% (see the chart below). Again, not bad.

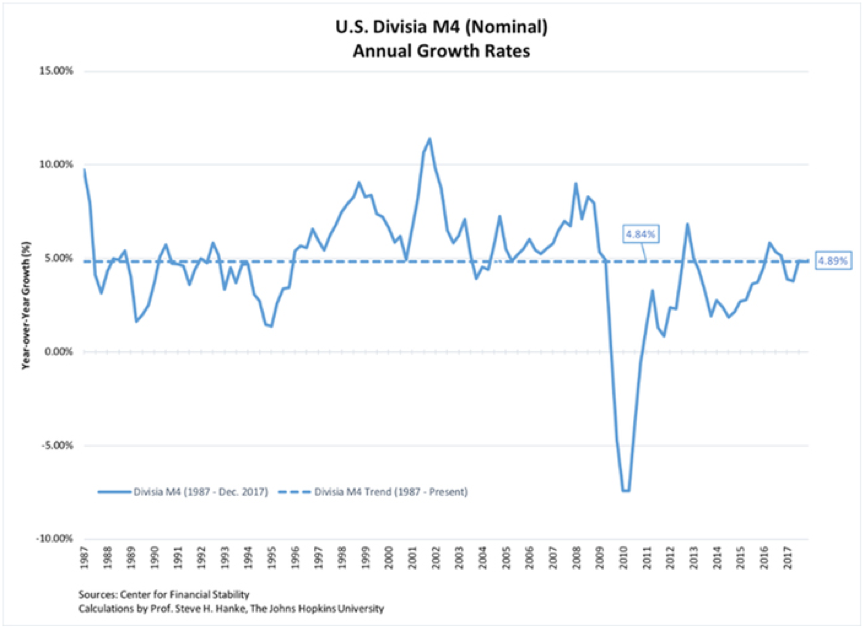

So, everything is running pretty smoothly — right on the trend rates. What could go wrong? The biggest risk is that the Fed could slam on the breaks too hard, and broad money growth would decelerate. That would cause aggregate demand to slow, and everything that is so nicely balanced would, well, not be so nicely balanced. If you want to follow this saga, stop obsessing over the Fed funds rate moves, and keep your eyes on the best measure for the growth of broad money, Divisia M4.

So, everything is running pretty smoothly — right on the trend rates. What could go wrong? The biggest risk is that the Fed could slam on the breaks too hard, and broad money growth would decelerate. That would cause aggregate demand to slow, and everything that is so nicely balanced would, well, not be so nicely balanced. If you want to follow this saga, stop obsessing over the Fed funds rate moves, and keep your eyes on the best measure for the growth of broad money, Divisia M4.