Ben Shenglin, Geng Xin and Wan Feng: New Era, New Trend, New Landscape - The Internationalization of Chinese Enterprises

2022-02-22 IMIBen Shenglin, Co-director of IMI, Dean of Zhejiang University International Business School; Geng Xin, Post-doctoral Fellow, Zhejiang University International Business School; Wan Feng, Associate Professor, Zhejiang University International Business School

Introduction

There is an open debate regarding to globalization and deglobalization. Several deglobalization events happened in recent years, such as Brexit, China-United States trade war as well as the COVID-19 pandemic, leading to the decline of economic trades and investments between countries. While China has been focusing on contributing to globalization. Up to now, China has signed 206 cooperation documents with 141 countries and 32 international organizations on jointly building the Belt and Road. Meanwhile, China signed the Regional Comprehensive Economic Partnership Agreement (RCEP) with other 14 countries on 15th November 2020, which also shows China’s efforts in shaping new globalization. Being part of globalization, Chinese enterprises have started to do business abroad as well as to explore the international expansion. In addition, more and more Chinese enterprises appear on the Fortune Global 500 list, such as 135 Chinese enterprises being ranked as Global 500 companies in 2021. This is the second time that the number of Global 500 companies in China exceeded that in US.

In order to comprehensively investigate the international development of Chinese enterprises, the Zhejiang University International Business School (ZIBS) and the Cambridge Centre for Chinese Management (CCCM) in the Cambridge Judge Business School collaborated to develop the Degree of Internationalization (DOI) index for Chinese firms and jointly released the report on the internationalization of Chinese enterprises 2021. The DOI index and the report aim to convey the evolution, the status quo and future trends of the internationalization of Chinese enterprises. Meanwhile, they contribute to the literature on the internationalization of Chinese enterprises as well as explore the best practice of internationalization among Chinese enterprises. The report also attempts to provide some guidance of the further actions of Chinese enterprises. The DOI index is designed to measure the degree of internationalization of Chinese enterprises from three dimensions: international strategy, international performance and international branding.

New landscape: the features of Top 20 most international Chinese enterprises

The report focuses on analyzing the key features of top 20 most international Chinese enterprises. The common features among Top 20 enterprises are their outstanding performance in manufacturing upgrade and technological innovation. On the one hand, Chinese manufacturers have been accelerating the process of transformation and upgrade, ready to expand globally. Among all the Top 20 enterprises, 12 are from manufacturing industry, of which six are from computer, communication and other electronic equipment manufacturers. On the other hand, the technological innovation being taken as the core driving force for internationalization, has become the consensus of leading international enterprises. There are eight technology companies in the Top 20 list, all of which have made appreciable efforts to implement digitization and technological advancement as their core strategies.

The DOI Top 20 enterprises are well-deserved leaders in internationalization. They own 52% of the total number of overseas branches. Besides, their average number of overseas branches is 4.3 times that of the remaining 80 enterprises. Speaking of overseas assets, 58% of the total overseas assets of all enterprises belong to these 20 enterprises, which amounts 5.7 times the average of the remaining 80 enterprises. Their internationalization strategies are well-backed by their foreign asset resources.

International strategy:industrial characteristics matter

The globalization strategies should be designed in accordance with the industry-specific features of enterprises. Regarding the number of countries and regions that the Chinese enterprises branched into, the top five industries covered within the sample are air transport, manufacture of special purpose machinery, civil engineering, postal services, as well as internet and related service industries. In addition, internet companies have also been accelerating their international expansion and seeking for greater overseas opportunities. Meanwhile, by leveraging their technological advantages, these companies have been continuously exporting internet as well as digital infrastructure services. For instance, Alibaba Cloud has built 49 zones ready for use in 18 regions around the world, including Europe, North America, Southeast Asia, and the Middle East. It makes Alibaba Cloud the largest cloud computing platform in Asia. Huawei has established 26 research and development (R&D) competency centers across the globe and equipped itself with more than 700 mathematicians, above 800 physicists and over 120 chemists. It is worth mentioning that industries such as air transport and postal services are “born international” with their routes and operations located all over the world. These industries, therefore, have internationalization innately embedded in their company strategy.

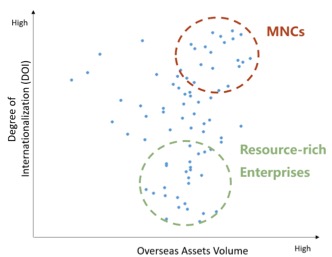

International performance:MNC vs resource-rich enterprises

Ownership of overseas assets alone does not guarantee greater success in globalization. While the paths of internationalization for Chinese enterprises diverge, two types of companies emerged as majorities. Type I are multinational corporations such as Huawei Investment & Holdings and Lenovo Group Limited, which can be featured as “large and open”. This type of companies tends to own appreciable amount of overseas assets and are early starters on overseas development, which has granted themselves edges in promoting both the scope and depth of their internationalization performance. Type II are resource-rich companies, holding a large amount of overseas resources but are less international. Typical examples include mining companies such as Luoyang Luanchuan Molybdenum Industry Group Co., Ltd and Yankuang Group Co., Ltd. Although companies within this sector tend to be well equipped in overseas assets and do operate globally, their brand recognition tend to be limited within their niche market.

Figure 1 Correlation between the overseas assets volume and the degree of internationalization (DOI)

Source: Zhejiang University International Business School (ZIBS), The Cambridge Centre of Chinese Management (CCCM)

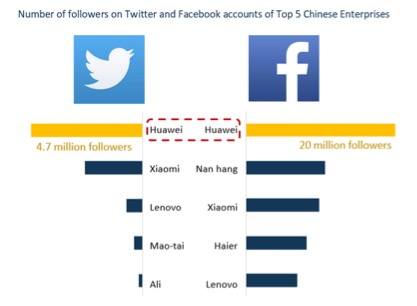

International branding:consumer-goods producers are dominating

Consumer goods companies tend to have easier access to international brand recognition. Seven out of the 10 most international companies in DOI are from this category, which also encompasses the top five companies in terms of social media (Twitter and Facebook) followers. Yet only 58 and 68 of the DOI Top100 companies have set up official Twitter and Facebook accounts, respectively. More efforts are called upon for Chinese enterprises to further promote and publicize themselves through mainstream international social media platforms.

Figure 2 Number of followers on Twitter and Facebook accounts of the Top 5 Chinese enterprises

Source: Zhejiang University International Business School (ZIBS), The Cambridge Centre of Chinese Management (CCCM)

The next move of Chinese enterprises’ internationalization

Firstly, Chinese enterprises should seize post-pandemic opportunities by opening up. The new development paradigm of China is featured by the “Dual Circulation”, where “domestic circulation plays a leading role and international circulation supports.” Chinese enterprises must embrace this new paradigm as it brings about great opportunities through multilateral cooperation initiatives such as the “Belt and Road Initiative” and the “Regional Comprehensive Economic Partnership (RCEP)” agreement. With such policy dividends, the timing is favorable for Chinese enterprises to collaborate with their overseas counterparts as long as a thorough due diligence and a risk control plan are executed beforehand.

Secondly, Chinese enterprises should align their international strategy with the strategy of the country. Chinese enterprises are suggested to explore market opportunities among the “Belt and Road” countries. It is wise to focus on the “Belt and Road” countries which had promoted communications among multiple countries ever since its launch in 2015. The reason is that, on one hand, the population of “Belt and Road ” countries accounted for 62.4% of the word’s total (2019), which opens access to an enormous market for Chinese enterprises; On the other hand, investments from China to these countries have been already burgeoning since 2015: the total amount of investment to the “Belt and Road ” countries accounted for 12.6% of the overall out-bound investment of China in 2015, and raised to 16.2% in 2020; newly signed construction contracts value accounted for 44.1% of the overall oversea contracts in 2015 and raised to 55.4% in 2020. With such experiences Chinese enterprises will be dealing with relatively lower level of risks.

Thirdly, it is crucial for Chinese enterprises to promote the transformation from “made in China” to “created in China”. International branding will benefit from innovation as well as advanced craftsmanship.“Go Global” strategy is committed to supporting Chinese enterprises investing worldwide and those persistently focusing on developing their competitive edge are able to go forward further by building greater brand reputation in the global market. Huawei puts more than 10% of annual income into research and development, and its R&D staff accounts for 49% of the company’s human resource; Geely registers more than 1000 patents all over the world every year; Lenovo established its research institution back in 1999 and is working on the pioneering technologies of the information and communication industry ever since. To constantly nurture their business success and brand growth in the global market, the Chinese enterprises must be highly professional, extremely cautious, and fully dedicated to the product quality, which are the key elements of the so-called “craftsmanship”.

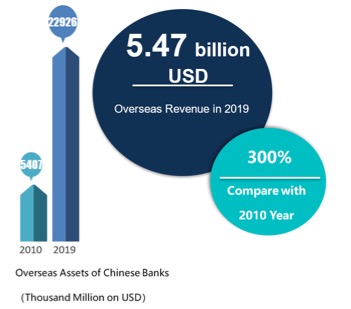

Fourthly, Chinese financial institutions will contribute to the internationalization of Chinese enterprises as well. Chinese financial institutions had formed a great driving force during mere decades of internationalization. In the “2020 Bank Internationalization Index” released jointly by Academy of Internet Finance (AIF) and Academy of Finance Research (AFR) of Zhejiang University and University of Macau, it shows that in 2019, the oversea assets value of Chinese banks had reached 2.29 trillion USD with 54.7 billion USD oversea revenue, tripled the number in 2010. Such strong influencer must not be ignored as it will give financial edges to Chinese enterprises during their overseas expansions.

Figure 3 Overseas Assets Volume of Chinese Enterprises

Source: Zhejiang University International Business School (ZIBS), Zhejiang University Academy of Internet Finance (AIF), Zhejiang University Institute of Finance Research (IFR), University of Macau: “Will De-globalization Disrupt Banks' International Expansion? Bank Internationalization Report——2020 Bank Internationalization Index”

Last but not least, Chinese enterprises should export “Chinese” by leveraging Fintech advantages. Lately, the internationalization of Chinese enterprises mainly focuses on outward product sales and foreign investment. While this path allowed Chinese enterprises to accumulate certain branding and technological advantages, these enterprises tend to fall short on setting and exporting well-recognized industry standards. Therefore, it is important for them to enlarge their international impacts and export "Chinese standards" into the global market. According to the “Global FinTech Development Report 2020” released jointly by Zhejiang University-Ant Group FinTech Centre, the Academy of Internet Finance (AIF) and International Business School (ZIBS) of Zhejiang University, China has become one of the three global FinTech giants (China, US, UK) with its demand-pull model of FinTech development. Specifically, there have been more than 800 million digital payment users up to 2020 in China and many representative FinTech hubs, such as Beijing, Shanghai, Shenzhen and Hangzhou. Therefore, it is of vital significance to encourage Chinese FinTech enterprises to go global, and to promote not only their products as well as brands, but also technologies and standards.

Conclusion

It is appreciated that more and more Chinese enterprises have achieved some succuss on internationalization, while Chinese enterprises still have some general problems needed to be solved. Currently, Chinese enterprises are leading by size but trailing in profitability. For instance, the total profit of Chinese enterprises ranked as Global 500 was lower than that of US companies. In addition, only two Chinese companies (Alibaba and Tencent) were ranked as BrandZ Top 10 most valuable global brands 2021, which means Chinese enterprises also need to put effort into gaining greater global recognition.

For Chinese enterprises, there is still a distance to really going global. In order to promote the internationalization of Chinese enterprises, they should keep communicating internationally and seize post-pandemic opportunities. Moreover, Chinese enterprises’ overseas expansions should in line with the strategy of the country. It is the best timing for Chinese enterprises to go global further, especially in the “Belt and Road” countries. Benefiting cooperation between China and partner countries and the policy and financial support of the Chinese government, Chinese enterprises face relative lower overseas risk when they are doing business in those countries. In addition, it is important for Chinese enterprises to promote their core comparativeness by concentrating on developing advanced craftmanship. By doing so, Chinese enterprises could achieve sustainable brand recognition in the international market. The internationalization of Chinese financial institutions also brings benefits to the internationalization of Chinese enterprises by properly using the overseas resource of Chinese financial institutions. Last, it is not the time that China just imported and followed the rules set up by the developed countries. Nowadays, China is also taking a leading place in some areas, such as FinTech. So, Chinese Fintech companies will be encouraged to go global along with exporting “China’s Standards”. Chinese President Xi Jinping pointed out, “multilateralism provides an effective way of upholding peace and promoting development”. Therefore, China will continue to practice multilateralism and Chinese enterprises will perform well in telling China’s stories on the global stage.

The report was first released by the Zhejiang University International Business School (ZIBS) and the Cambridge Centre for Chinese Management (CCCM) in the Cambridge Judge Business School in March 2021. More information about the DOI index, the report as well as the list of Top 100 most international Chinese enterprises, please refer to the report on the Internationalization of Chinese Enterprises 2021.