Herbert Poenisch: China's Asian Infrastructure Investment Bank (AIIB) Criteria for a Genuine Multilateral Organization: Compare EIB and ADB

2015-11-03 IMI Source: Annual Reports of EIB and ADB

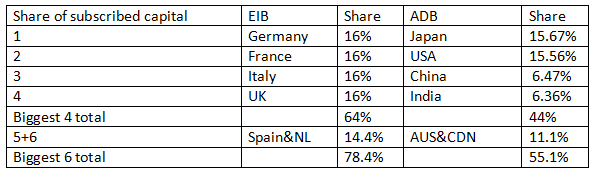

In the case of the EIB, the major countries were given equal shares independent of the differences in their GDP. In the case of the ADB, the share of the USA was revised downwards to match the share of the biggest country in the region , Japan. In addition, there are 2 non-regional members among the 6 biggest shareholders (see Table 1). Being among the biggest 4 could be a criteria for being eligible to nominate an institution’s president or vice-president.

If only 21 countries were to join the AIIB, in a hypothetical case, China would control 66%, thus having the same share as the biggest 4 in the EIB or more than the biggest 6 in the ADB. In order to preserve the multilateral character of the AIIB, while being exclusively Asian, other Asian countries should join this institution, first and foremost Japan, Australia, South Korea and Indonesia. Adding these, the hypothetical share of the biggest 4 would be 78.3% and of the biggest 6 would be 88%. This is still a high concentration but would warrant the character of a multilateral financial institution.

2.Funding of development banks

Such an institution can and should minimize the use of members’ contributions by using external resources, while maximizing the disbursements to member countries. The Ordinary Capital Resources (OCR) funds come from three distinct sources: the capital markets and private placements, paid-in-capital provided by shareholders and accumulated retained income (reserves). The main difference between our peers, the EIB and the ADBis that in the case of the EIB nearly all activities are included in the main OCR account whereas the ADB runs an OCR account as well as a number of separate accounts for special funds which are financed in separate ways. These are the Asian Development Fund, the Japan Special Fund, ADB Institute, the Pakistan Earthquake Fund, Regional Cooperation and Development Fund, Climate Change Fund, Asia Pacific Disaster Response Fund, Financial Sector Development Partnership Special Partnership Fund, Trust Funds for Co-Financing. The following comparison gives a partial picture of the ADB as it covers only the main account but not the special funds.

Our peers tap mainly capital markets, with private placements[The PBoC is the biggest investor in EIB bonds.] in second place. The proposed World Bank Global Infrastructure Facility (GIF) targets the massive resources of global institutional investors, such as asset managers, private equity funds, pension and insurance funds with assets exceeding USD 100trn under management[Institutional Investors http://www.oecd.org/finance/financial-markets/42143444.pdf]. These investors are looking for long-term, sustainable and stable investments[See IBRD (2014): ibid].

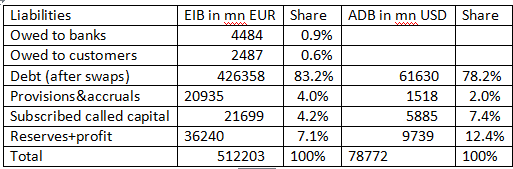

Table 2: Liabilities of EIB and ADB, end of 2013

Source: Annual Reports of EIB and ADB

In the case of the EIB, the major countries were given equal shares independent of the differences in their GDP. In the case of the ADB, the share of the USA was revised downwards to match the share of the biggest country in the region , Japan. In addition, there are 2 non-regional members among the 6 biggest shareholders (see Table 1). Being among the biggest 4 could be a criteria for being eligible to nominate an institution’s president or vice-president.

If only 21 countries were to join the AIIB, in a hypothetical case, China would control 66%, thus having the same share as the biggest 4 in the EIB or more than the biggest 6 in the ADB. In order to preserve the multilateral character of the AIIB, while being exclusively Asian, other Asian countries should join this institution, first and foremost Japan, Australia, South Korea and Indonesia. Adding these, the hypothetical share of the biggest 4 would be 78.3% and of the biggest 6 would be 88%. This is still a high concentration but would warrant the character of a multilateral financial institution.

2.Funding of development banks

Such an institution can and should minimize the use of members’ contributions by using external resources, while maximizing the disbursements to member countries. The Ordinary Capital Resources (OCR) funds come from three distinct sources: the capital markets and private placements, paid-in-capital provided by shareholders and accumulated retained income (reserves). The main difference between our peers, the EIB and the ADBis that in the case of the EIB nearly all activities are included in the main OCR account whereas the ADB runs an OCR account as well as a number of separate accounts for special funds which are financed in separate ways. These are the Asian Development Fund, the Japan Special Fund, ADB Institute, the Pakistan Earthquake Fund, Regional Cooperation and Development Fund, Climate Change Fund, Asia Pacific Disaster Response Fund, Financial Sector Development Partnership Special Partnership Fund, Trust Funds for Co-Financing. The following comparison gives a partial picture of the ADB as it covers only the main account but not the special funds.

Our peers tap mainly capital markets, with private placements[The PBoC is the biggest investor in EIB bonds.] in second place. The proposed World Bank Global Infrastructure Facility (GIF) targets the massive resources of global institutional investors, such as asset managers, private equity funds, pension and insurance funds with assets exceeding USD 100trn under management[Institutional Investors http://www.oecd.org/finance/financial-markets/42143444.pdf]. These investors are looking for long-term, sustainable and stable investments[See IBRD (2014): ibid].

Table 2: Liabilities of EIB and ADB, end of 2013

Sources: Statutory Financial Statements of EIB and ADB, own calculations

Funding in table 2 shows that both peers, EIB and ADB work mainly with three OCR, made up of external resources(83.2% vs 78.2%) with a low shares of reserves plus current profit (7% vs 12.4%) and paid-in-capital (4.2% vs 7.4%).

Looking at the peer examples of ADB and EIB we see two completely different financing models. Whereas the ADB’s outstanding borrowings of USD 61bn compared with the subscribed capital of USD 164bn result in a gearing ratio of 37%, the EIB is far more leveraged with borrowings of EUR 426bn over a subscribed capital of EUR 243bn, a gearing ratio of 175%. The difference is explained by the higher share of paid-in or called capital which is 9% (EUR 21.7bn over EUR 243bn in EIB and only 5% (USD 8bn over USD 164bn) in ADB.

Although the gearing ratio can be decided later, the major share of funding of the AIIB should be OCR, raised by issuing various types of debt securities in Asian financial marketsor private placements to tap Asian savings. Partnership with Asian institutional investors, such as pension funds (eg CPF), insurance funds and sovereign wealth funds (egTemasek, Khazanah), benefitting the borrower as well as the investor should be added.

Regarding currencies, the ADB borrowed in 10 currencies, the major ones such as USD, JPY, GBP, AUD, NZD, SGD as well as in EME currencies, such as BRR, MXP, TLY and ZAR. Note that it does not issue in borrowers’ currencies.

The EIB issued in 15 currencies, the bulk of which are in the core currencies: EUR 49%, USD 30% and GBP 13%. The rest are made up of global currencies, such as the JPY, CHF, CAD, AUD but also of borrowers’ currencies, such as TLY, RUB, PLN and CZK.

The maturity profile would depend on market conditions, preferably long-term to match the long-term infrastructure investments.

For the AIIB, issuing currencies should be convertible currencies as well as regional currencies, first and foremost the RMB. The RMB issues could be domestic issues, which would require a permit from the Chinese MoF as well as from SAFE to export the RMB. International RMB issues, such as dim-sum bonds would also require the permit of the Chinese MoF but would be freely disposable.

The mix of borrowing between different currencies would depend primarily on the borrowing costs but would also contain a political element to boost the internationalization of regional currencies, first and foremost the RMB. The securities issued should become part of Asian Bond Fund 1 (in convertible currencies) and Asian Bond Fund 2 (in RMB). International investors would thus be able to purchase AIIB securities in the Asian capital markets as well as through private placements.

3.Investment activities of development banks

Due to the different structures of our peer developments banks, the activities differ as well. Whereas the EIB concentrates all its activities in the main account, loans to customers and credit institutions make up the bulk of assets. In the case of ADB, loans and investments form only part of the overall activities. The special funds are earmarked for special purposes (evident in the names of these special funds) and financed in different ways, including grants from member countries. The EIB on the other hand includes such special funds under off-balance sheet items as “assets held on behalf of third parties”.

The development banks provide resources to member countries (the EIB also extends small amounts to non-member countries). The main instruments are loans, technical assistance (TA), grants, guarantees and equity investments.

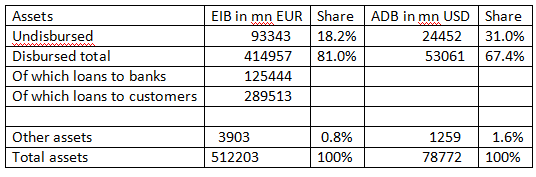

Table 3: Assets of EIB and ADB, end of 2013

Sources: Statutory Financial Statements of EIB and ADB, own calculations

Funding in table 2 shows that both peers, EIB and ADB work mainly with three OCR, made up of external resources(83.2% vs 78.2%) with a low shares of reserves plus current profit (7% vs 12.4%) and paid-in-capital (4.2% vs 7.4%).

Looking at the peer examples of ADB and EIB we see two completely different financing models. Whereas the ADB’s outstanding borrowings of USD 61bn compared with the subscribed capital of USD 164bn result in a gearing ratio of 37%, the EIB is far more leveraged with borrowings of EUR 426bn over a subscribed capital of EUR 243bn, a gearing ratio of 175%. The difference is explained by the higher share of paid-in or called capital which is 9% (EUR 21.7bn over EUR 243bn in EIB and only 5% (USD 8bn over USD 164bn) in ADB.

Although the gearing ratio can be decided later, the major share of funding of the AIIB should be OCR, raised by issuing various types of debt securities in Asian financial marketsor private placements to tap Asian savings. Partnership with Asian institutional investors, such as pension funds (eg CPF), insurance funds and sovereign wealth funds (egTemasek, Khazanah), benefitting the borrower as well as the investor should be added.

Regarding currencies, the ADB borrowed in 10 currencies, the major ones such as USD, JPY, GBP, AUD, NZD, SGD as well as in EME currencies, such as BRR, MXP, TLY and ZAR. Note that it does not issue in borrowers’ currencies.

The EIB issued in 15 currencies, the bulk of which are in the core currencies: EUR 49%, USD 30% and GBP 13%. The rest are made up of global currencies, such as the JPY, CHF, CAD, AUD but also of borrowers’ currencies, such as TLY, RUB, PLN and CZK.

The maturity profile would depend on market conditions, preferably long-term to match the long-term infrastructure investments.

For the AIIB, issuing currencies should be convertible currencies as well as regional currencies, first and foremost the RMB. The RMB issues could be domestic issues, which would require a permit from the Chinese MoF as well as from SAFE to export the RMB. International RMB issues, such as dim-sum bonds would also require the permit of the Chinese MoF but would be freely disposable.

The mix of borrowing between different currencies would depend primarily on the borrowing costs but would also contain a political element to boost the internationalization of regional currencies, first and foremost the RMB. The securities issued should become part of Asian Bond Fund 1 (in convertible currencies) and Asian Bond Fund 2 (in RMB). International investors would thus be able to purchase AIIB securities in the Asian capital markets as well as through private placements.

3.Investment activities of development banks

Due to the different structures of our peer developments banks, the activities differ as well. Whereas the EIB concentrates all its activities in the main account, loans to customers and credit institutions make up the bulk of assets. In the case of ADB, loans and investments form only part of the overall activities. The special funds are earmarked for special purposes (evident in the names of these special funds) and financed in different ways, including grants from member countries. The EIB on the other hand includes such special funds under off-balance sheet items as “assets held on behalf of third parties”.

The development banks provide resources to member countries (the EIB also extends small amounts to non-member countries). The main instruments are loans, technical assistance (TA), grants, guarantees and equity investments.

Table 3: Assets of EIB and ADB, end of 2013

Source: Statutory Financial Statements of EIB and ADB, own calculations

The mix between disbursed loans and undisbursed funds varies between the two peer organisations. The share of loans to customers (including loans to credit institutions[EIB lending to SME is channeled through credit institutions so not to compete with them directly.]) is higher in the EIB whereas the share of undisbursed funds is higher in the ADB. A higher share of undisbursed funds could be due to stringent lending criteria. The receivables from swaps and payables on swaps were balanced.

The choice of projects to be financed are mainly those for which private finance would be difficult to find. In recent years infrastructure financing has been surpassed by other priorities, such as SMEs, environmental projects, education.

While one focus of total EIB lending of EUR 74bn in 2013 was still infrastructure projects, the major share EUR 21.9bn (or30%) went to support SMEs. EUR 17.2bn (or 23%) went to support innovation and skills, EUR 15.9bn (or 22%) was devoted to infrastructure projects in transport, energy and urban renewal, and EUR 19bn (or 25%) was invested into climate support projects.

The activities of the ADB are concentrated in five core operational areas. These should absorb 80% of lending. These areas are: infrastructure, environment, regional cooperation and integration (RCI), finance sector development, and education. Support for other areas of operations, such as health, agriculture, and disaster and emergency assistance, is to be selectively provided.

The AIIB would be well advised to focus on infrastructure projects as its name and its mandated purpose indicates. The other choice to be made will be either domestic projects in member countries or cross-border infrastructure projects which will serve regional cooperation and the integration of Asian economies.

Recipients of AIIB loans can be either various levels of government and government linked entities or the private sector. There can also be joint projects where the government outsources certain activities to the private sector.

The loans can be provided in local currency, RMB or convertible currencies. It is up the Asset-Liabilities Committee of the development bank to manage the various currency mismatches and to buy hedging operations (such as swaps).

Loans for infrastructure projects are likely to be long-term and should be remunerated above the borrowing rate. The main advantage for the borrowing country is that it can raise funds at the credit spread of the AIIB or the major shareholder, China. Again, the Asset-Liabilities Committee needs to balance the maturity risk.

Loans could be extended as fixed interest loans or variable interest loans. In an uncertain interest environment, long-term loans are likely to be variable interest loans. The Bank needs to purchase hedging instruments to mitigate interest risk. The Bank could also consider extending loans according to Islamic principles for Islamic member states. In this case long-term profit sharing replaces the long-term interest rate calculations.

4.Procedures, transparency and corporate governance

A reputable multilateral development bank which relies on external borrowing will have to adhere to international best practices, put in place clear mandates, structures, procedures and accountability. It will have to publish the information in prospectuses for investors as well as publish regular reports on the website as well as to shareholders. Reports will have to be audited by internationally accepted auditors.

The following structures are in place in our peer development banks:

4.1.Define mandate

The ADB’s mandate is to help its developing member countries (DMC) to reduce poverty and improve living conditions and quality of life.Whether it be through investment in infrastructure, health care services, financial and public administration systems, or helping nations prepare for the impact of climate change or better manage their natural resources, ADB is committed to helping DMCs evolve into thriving, modern economies that are well integrated with each other and the world.

The EIBsupports projects that make a significant contribution to growth and employment in Europe. As part of its counter-cyclical approach, its activities focus on four priority areas:innovation and skills,access to finance for smaller businesses climate action and strategic infrastructure.

The AIIB mandate should focus on the importance of infrastructure projects of DMCs as well as on the importance of cross-border infrastructure development projects to promote Asian integration.

4.2.Headquarters

The ADB specified Manila, Philippines as its headquarter and the EIB resides in Luxemburg. Both peer banks are not resident in any major shareholder country.

The AIIB would be well advised to set up its headquarter in any Asian country apart from the major ones. A country with a well-developed infrastructure and good access to international financial markets should be chosen.

4.3.Financial management principles

The ADB stipulates that total borrowing may not exceed the sum of callable capital from non-borrowing members, paid-in-capital and reserves. Total lending may not exceed total subscribed capital plus reserves.Under ADB’s lending policy, the total amountof disbursed loans, approved equity investments, and the maximum amount that could be demanded from ADB under its guaranteeportfolio may not exceed the total amount of ADB’s unimpairedsubscribed capital, reserves, and surplus.

The EIB can raise additional capital from shareholders through the callable capital. This is done regularly to underpin the Bank’s financial standing and receives support from member countries. The business model is to finance large volumes at low margins.The EIB raises the bulk of its lending resources on the international capital markets through bond issues. Its excellent rating allows it to borrow at advantageous rates. It is thus able to offer good terms to our clients.

4.4.Due diligence and project selection

In 2011, ADB introduced policy-based lending, which enhanced the program lending policy by mainstreaming programmatic budget support and enhancing crisis response capacity. ADB hasfour policy-based lending products, each catering to a different situation in a DMC: stand-alonepolicy-based lending, programmatic approach, special policy-based lending, and countercyclicalsupport facility lending.

EIB projects are appraised by a team thatcomprises, in addition to bankers, economists, engineersand other sector specialists, risk managers and lawyers. Theviability of projects is assessed from four angles (economic,technical, environmental and financial) and strict risk policiesand guidelines are applied at selection and throughoutthe lifecycle of the loan.

Post-signature monitoring is performed with a view to interveningearly in a transaction where initial conditions mayhave deteriorated or contractual clauses may have beenbreached. Strict adherence to screening and ex ante evaluationrules, coupled with systematic ex post reviews, will benefit loan portfolio quality.

4.5.Risk Management

The ADB constantly scrutinizes the following risks: credit risk, sovereign and non-sovereign, for its OCR as well as the treasury portfolio; market risk, interest and foreign exchange risk on both sides of the balance sheet, liquidity risk, as well as operational risk.ADB maintains an independent risk management group and has various management committees with responsibility to oversee ADB-wide risk issues and endorse related decisionsfor approval by the Board of Directors and President.

The EIB aligns its risk management systems with bestmarket practices, and adherence to those practices ismonitored by the independent Audit Committee.The Bank’s lending policies set out minimum credit qualitylevels for both borrowers and guarantors in lendingoperations and identify the types of security that aredeemed acceptable.

4.6.Asset and Liability management (ALM)

The ADB has an asset-liability framework that guides all financial policies related to the bank’s assets and liabilities.

The EIB Treasury manages the interest rate and foreign exchangerate risk position of the Banks assets and liabilitieswithin prescribed limits. This involves rebalancing the interestrate risk profile and replenishing the Banks liquidityin 14 currencies through the use of standard derivative instrumentsto achieve a target financial duration. ALM policyaims to ensure self-sustainability of the Bank’s businessand growth of own funds.

4.7.Audit and Control Process

ADB Management has been assessing the effectiveness of its internal controls over financialreporting since 2008. ADB staff across several departments andoffices are responsible for (i) identifying and testing key controls and (ii) assessing andevaluating the design and operating effectiveness of the business processes. Concurrently, the external auditor performed an independent test of selected key controls.

The EIB Audit Committee is an independentstatutory body, appointed by and reporting directly tothe Board of Governors, in compliance with the formalitiesand procedures defined in the Bank’s Statute and Rules ofProcedure. The role of the Audit Committee is to verify thatthe Bank’s operations have been conducted and its bookskept in a proper manner and that the activities of the Bankconform to best banking practice. The Audit Committeehas overall responsibility for the auditing of the Bank’s accounts.

Within the Auditing and Control Process there are also the External Auditors, the Financial Control, the Inspectorate General, the Chief Compliance Officer, and Management Control.

Conclusion

While the proposal for the Asian Infrastructure Investment Bank fits in well into the overall Chinese strategy “Asia for Asians” the proliferation of new proposals should be narrowed into viable projects. At present the following China-led projects are on the table: the AIIB, the New BRICS Development Bank, the Maritime Silk Road Bank, and in addition, Premier Li has offered USD 20bn to finance infrastructure and development projects in ASEAN countries.

All these announcements need to be followed up by concrete actions within a reasonable time, not to risk being viewed as too ambitious. In the case of AIIB, countries have expressed their interest in becoming members and even signed MoUs. A committee of these interested parties needs to be formed to work out a detailed proposal which would address the issues laid out in this article and study the experience of multilateral peers, such as the EIB and ADB.

This is a golden opportunity for China to gain experience in organizing other countries under its leadership to design a multilateral undertaking, where smaller countries feel respected and integrated into a common sense of purpose and a common strategy. This has been the secret of success of US led multilateral institutions over the past 70 years.

Source: Statutory Financial Statements of EIB and ADB, own calculations

The mix between disbursed loans and undisbursed funds varies between the two peer organisations. The share of loans to customers (including loans to credit institutions[EIB lending to SME is channeled through credit institutions so not to compete with them directly.]) is higher in the EIB whereas the share of undisbursed funds is higher in the ADB. A higher share of undisbursed funds could be due to stringent lending criteria. The receivables from swaps and payables on swaps were balanced.

The choice of projects to be financed are mainly those for which private finance would be difficult to find. In recent years infrastructure financing has been surpassed by other priorities, such as SMEs, environmental projects, education.

While one focus of total EIB lending of EUR 74bn in 2013 was still infrastructure projects, the major share EUR 21.9bn (or30%) went to support SMEs. EUR 17.2bn (or 23%) went to support innovation and skills, EUR 15.9bn (or 22%) was devoted to infrastructure projects in transport, energy and urban renewal, and EUR 19bn (or 25%) was invested into climate support projects.

The activities of the ADB are concentrated in five core operational areas. These should absorb 80% of lending. These areas are: infrastructure, environment, regional cooperation and integration (RCI), finance sector development, and education. Support for other areas of operations, such as health, agriculture, and disaster and emergency assistance, is to be selectively provided.

The AIIB would be well advised to focus on infrastructure projects as its name and its mandated purpose indicates. The other choice to be made will be either domestic projects in member countries or cross-border infrastructure projects which will serve regional cooperation and the integration of Asian economies.

Recipients of AIIB loans can be either various levels of government and government linked entities or the private sector. There can also be joint projects where the government outsources certain activities to the private sector.

The loans can be provided in local currency, RMB or convertible currencies. It is up the Asset-Liabilities Committee of the development bank to manage the various currency mismatches and to buy hedging operations (such as swaps).

Loans for infrastructure projects are likely to be long-term and should be remunerated above the borrowing rate. The main advantage for the borrowing country is that it can raise funds at the credit spread of the AIIB or the major shareholder, China. Again, the Asset-Liabilities Committee needs to balance the maturity risk.

Loans could be extended as fixed interest loans or variable interest loans. In an uncertain interest environment, long-term loans are likely to be variable interest loans. The Bank needs to purchase hedging instruments to mitigate interest risk. The Bank could also consider extending loans according to Islamic principles for Islamic member states. In this case long-term profit sharing replaces the long-term interest rate calculations.

4.Procedures, transparency and corporate governance

A reputable multilateral development bank which relies on external borrowing will have to adhere to international best practices, put in place clear mandates, structures, procedures and accountability. It will have to publish the information in prospectuses for investors as well as publish regular reports on the website as well as to shareholders. Reports will have to be audited by internationally accepted auditors.

The following structures are in place in our peer development banks:

4.1.Define mandate

The ADB’s mandate is to help its developing member countries (DMC) to reduce poverty and improve living conditions and quality of life.Whether it be through investment in infrastructure, health care services, financial and public administration systems, or helping nations prepare for the impact of climate change or better manage their natural resources, ADB is committed to helping DMCs evolve into thriving, modern economies that are well integrated with each other and the world.

The EIBsupports projects that make a significant contribution to growth and employment in Europe. As part of its counter-cyclical approach, its activities focus on four priority areas:innovation and skills,access to finance for smaller businesses climate action and strategic infrastructure.

The AIIB mandate should focus on the importance of infrastructure projects of DMCs as well as on the importance of cross-border infrastructure development projects to promote Asian integration.

4.2.Headquarters

The ADB specified Manila, Philippines as its headquarter and the EIB resides in Luxemburg. Both peer banks are not resident in any major shareholder country.

The AIIB would be well advised to set up its headquarter in any Asian country apart from the major ones. A country with a well-developed infrastructure and good access to international financial markets should be chosen.

4.3.Financial management principles

The ADB stipulates that total borrowing may not exceed the sum of callable capital from non-borrowing members, paid-in-capital and reserves. Total lending may not exceed total subscribed capital plus reserves.Under ADB’s lending policy, the total amountof disbursed loans, approved equity investments, and the maximum amount that could be demanded from ADB under its guaranteeportfolio may not exceed the total amount of ADB’s unimpairedsubscribed capital, reserves, and surplus.

The EIB can raise additional capital from shareholders through the callable capital. This is done regularly to underpin the Bank’s financial standing and receives support from member countries. The business model is to finance large volumes at low margins.The EIB raises the bulk of its lending resources on the international capital markets through bond issues. Its excellent rating allows it to borrow at advantageous rates. It is thus able to offer good terms to our clients.

4.4.Due diligence and project selection

In 2011, ADB introduced policy-based lending, which enhanced the program lending policy by mainstreaming programmatic budget support and enhancing crisis response capacity. ADB hasfour policy-based lending products, each catering to a different situation in a DMC: stand-alonepolicy-based lending, programmatic approach, special policy-based lending, and countercyclicalsupport facility lending.

EIB projects are appraised by a team thatcomprises, in addition to bankers, economists, engineersand other sector specialists, risk managers and lawyers. Theviability of projects is assessed from four angles (economic,technical, environmental and financial) and strict risk policiesand guidelines are applied at selection and throughoutthe lifecycle of the loan.

Post-signature monitoring is performed with a view to interveningearly in a transaction where initial conditions mayhave deteriorated or contractual clauses may have beenbreached. Strict adherence to screening and ex ante evaluationrules, coupled with systematic ex post reviews, will benefit loan portfolio quality.

4.5.Risk Management

The ADB constantly scrutinizes the following risks: credit risk, sovereign and non-sovereign, for its OCR as well as the treasury portfolio; market risk, interest and foreign exchange risk on both sides of the balance sheet, liquidity risk, as well as operational risk.ADB maintains an independent risk management group and has various management committees with responsibility to oversee ADB-wide risk issues and endorse related decisionsfor approval by the Board of Directors and President.

The EIB aligns its risk management systems with bestmarket practices, and adherence to those practices ismonitored by the independent Audit Committee.The Bank’s lending policies set out minimum credit qualitylevels for both borrowers and guarantors in lendingoperations and identify the types of security that aredeemed acceptable.

4.6.Asset and Liability management (ALM)

The ADB has an asset-liability framework that guides all financial policies related to the bank’s assets and liabilities.

The EIB Treasury manages the interest rate and foreign exchangerate risk position of the Banks assets and liabilitieswithin prescribed limits. This involves rebalancing the interestrate risk profile and replenishing the Banks liquidityin 14 currencies through the use of standard derivative instrumentsto achieve a target financial duration. ALM policyaims to ensure self-sustainability of the Bank’s businessand growth of own funds.

4.7.Audit and Control Process

ADB Management has been assessing the effectiveness of its internal controls over financialreporting since 2008. ADB staff across several departments andoffices are responsible for (i) identifying and testing key controls and (ii) assessing andevaluating the design and operating effectiveness of the business processes. Concurrently, the external auditor performed an independent test of selected key controls.

The EIB Audit Committee is an independentstatutory body, appointed by and reporting directly tothe Board of Governors, in compliance with the formalitiesand procedures defined in the Bank’s Statute and Rules ofProcedure. The role of the Audit Committee is to verify thatthe Bank’s operations have been conducted and its bookskept in a proper manner and that the activities of the Bankconform to best banking practice. The Audit Committeehas overall responsibility for the auditing of the Bank’s accounts.

Within the Auditing and Control Process there are also the External Auditors, the Financial Control, the Inspectorate General, the Chief Compliance Officer, and Management Control.

Conclusion

While the proposal for the Asian Infrastructure Investment Bank fits in well into the overall Chinese strategy “Asia for Asians” the proliferation of new proposals should be narrowed into viable projects. At present the following China-led projects are on the table: the AIIB, the New BRICS Development Bank, the Maritime Silk Road Bank, and in addition, Premier Li has offered USD 20bn to finance infrastructure and development projects in ASEAN countries.

All these announcements need to be followed up by concrete actions within a reasonable time, not to risk being viewed as too ambitious. In the case of AIIB, countries have expressed their interest in becoming members and even signed MoUs. A committee of these interested parties needs to be formed to work out a detailed proposal which would address the issues laid out in this article and study the experience of multilateral peers, such as the EIB and ADB.

This is a golden opportunity for China to gain experience in organizing other countries under its leadership to design a multilateral undertaking, where smaller countries feel respected and integrated into a common sense of purpose and a common strategy. This has been the secret of success of US led multilateral institutions over the past 70 years.