Steve H. Hanke: It’s Time to Dump Most Central Banks

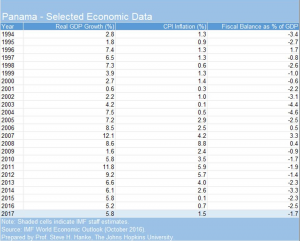

2017-03-30 IMI -Panama’s GDP growth rates have been relatively high. Since 1994, when the Mexican tequila crisis commenced, real GDP growth has averaged 5.8% per year.

-Inflation rates have been somewhat lower than those in the U.S. Since 1994, CPI inflation has averaged 2.3% per year.

-Since Panama’s fiscal authorities can’t borrow from a central bank, the fiscal accounts face a “hard” budget constraint dictated by the bond markets. In consequence, fiscal discipline is imposed, and since 1994, Panama’s fiscal deficit as percent of GDP has averaged 1.7% per year.

-Interest rates have mirrored world market rates, adjusted for transaction costs and risk.

-Panama’s real exchange rate has been very stable and on a slightly depreciating trend vis-à-vis that of the U.S.

-Panama’s banking system, which operates without a central bank lender of last resort, has proven to be extremely resilient. Indeed, it weathered a major political crisis between Panama and the United States in 1988 and made a strong comeback by early 2000.

To avoid the pain described in the New York Times reportage, emerging-market countries should dump their central banks and local currencies. They should follow Panama’s lead and adopt a stable foreign currency. Or, they could install a competitive currency regime, which would allow for more than one foreign currency to be used.

-Panama’s GDP growth rates have been relatively high. Since 1994, when the Mexican tequila crisis commenced, real GDP growth has averaged 5.8% per year.

-Inflation rates have been somewhat lower than those in the U.S. Since 1994, CPI inflation has averaged 2.3% per year.

-Since Panama’s fiscal authorities can’t borrow from a central bank, the fiscal accounts face a “hard” budget constraint dictated by the bond markets. In consequence, fiscal discipline is imposed, and since 1994, Panama’s fiscal deficit as percent of GDP has averaged 1.7% per year.

-Interest rates have mirrored world market rates, adjusted for transaction costs and risk.

-Panama’s real exchange rate has been very stable and on a slightly depreciating trend vis-à-vis that of the U.S.

-Panama’s banking system, which operates without a central bank lender of last resort, has proven to be extremely resilient. Indeed, it weathered a major political crisis between Panama and the United States in 1988 and made a strong comeback by early 2000.

To avoid the pain described in the New York Times reportage, emerging-market countries should dump their central banks and local currencies. They should follow Panama’s lead and adopt a stable foreign currency. Or, they could install a competitive currency regime, which would allow for more than one foreign currency to be used.