Herbert Poenisch: Pegging to RMB

2015-07-09 IMI

1.Functions of an international currency

The main four functions of an international currency are[ Ma Guonan and Villar, Agustin (2014): Internationalisation of emerging market currencies. In: BIS Papers 78. www.bis.org/publications ]: 1) trade invoicing and payment, 2) foreign exchange trading, 3) issue of domestic portfolio liabilities and 4) investment by non-residents in domestic portfolio liabilities. China’s RMB is progressing well on the first function[ IMI Report 2015 on Internationalisation of the RMB], slowly on the second function[ BIS (2013): Triennial Foreign Exchange Survey. Foreign exchange turnover in April 2013, www.bis.org/statistics ] but hardly at all on the third and fourth functions. China is a giant in trade but a dwarf in finance.

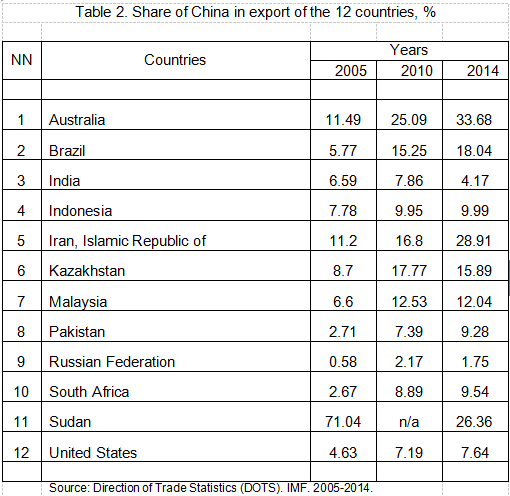

As more countries record a rising share of trade with China, China will need to look at fulfilling these functions before long. The advantages for trading partners of China by using RMB are that the number of exchange rates involved in settling trade will be reduced and the clearing of trade will be simplified by direct settlement between the local currency (such as Rand) and RMB. In addition, pegging to the RMB will reduce the impact of volatility of the USD/RMB exchange rate.

2.Countries’ foreign exchange reserves and composition at present

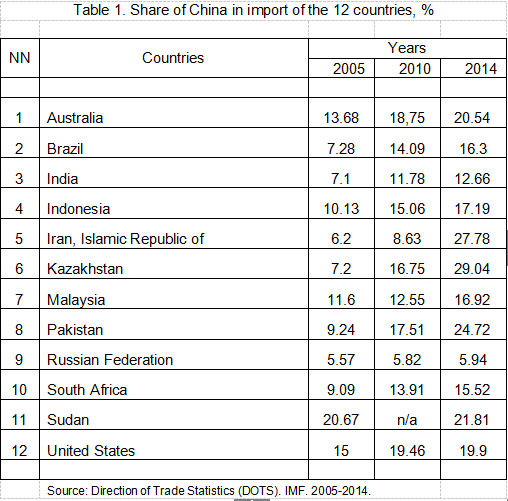

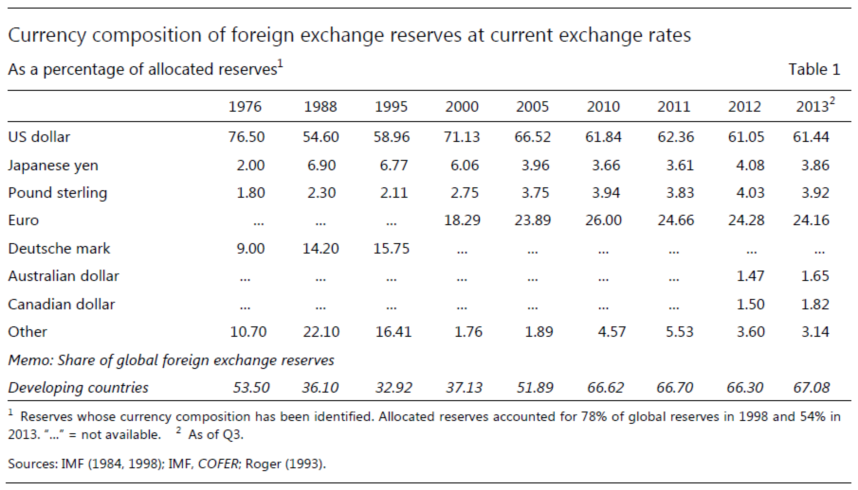

Total world foreign exchange reserves amounted close to USD 12trn at the end of 2014. If we subtract the Chinese foreign exchange reserves of close to USD 4trn, there remain some USD 8trn to be allocated among the major currencies (USD, EUR, JPY, GBP, AUD CND, CHF) and possibly RMB. An increasing share, some two thirds are owned by central banks in emerging markets (see table 1).

Nearly all foreign exchange reserves are held in the major currencies. The USD share has been fairly stable at some 60%, much larger than the US share in world trade[ McCauley, Robert and Chan, Tracy (2014): Currency movements drive reserve composition. In: BIS Quarterly Review, December www.bis.org/publications ]. The EUR share is also larger than the EU share in world trade (see table1). This can be explained by a currency zone, ie countries using a certain currency for trade with third countries, eg Saudi Arabia selling oil to countries other than the US, denominated in USD.

Table 3. Currency composition of foreign exchange reserves at current exchange rates (as a percentage of allocated reserves)

1.Functions of an international currency

The main four functions of an international currency are[ Ma Guonan and Villar, Agustin (2014): Internationalisation of emerging market currencies. In: BIS Papers 78. www.bis.org/publications ]: 1) trade invoicing and payment, 2) foreign exchange trading, 3) issue of domestic portfolio liabilities and 4) investment by non-residents in domestic portfolio liabilities. China’s RMB is progressing well on the first function[ IMI Report 2015 on Internationalisation of the RMB], slowly on the second function[ BIS (2013): Triennial Foreign Exchange Survey. Foreign exchange turnover in April 2013, www.bis.org/statistics ] but hardly at all on the third and fourth functions. China is a giant in trade but a dwarf in finance.

As more countries record a rising share of trade with China, China will need to look at fulfilling these functions before long. The advantages for trading partners of China by using RMB are that the number of exchange rates involved in settling trade will be reduced and the clearing of trade will be simplified by direct settlement between the local currency (such as Rand) and RMB. In addition, pegging to the RMB will reduce the impact of volatility of the USD/RMB exchange rate.

2.Countries’ foreign exchange reserves and composition at present

Total world foreign exchange reserves amounted close to USD 12trn at the end of 2014. If we subtract the Chinese foreign exchange reserves of close to USD 4trn, there remain some USD 8trn to be allocated among the major currencies (USD, EUR, JPY, GBP, AUD CND, CHF) and possibly RMB. An increasing share, some two thirds are owned by central banks in emerging markets (see table 1).

Nearly all foreign exchange reserves are held in the major currencies. The USD share has been fairly stable at some 60%, much larger than the US share in world trade[ McCauley, Robert and Chan, Tracy (2014): Currency movements drive reserve composition. In: BIS Quarterly Review, December www.bis.org/publications ]. The EUR share is also larger than the EU share in world trade (see table1). This can be explained by a currency zone, ie countries using a certain currency for trade with third countries, eg Saudi Arabia selling oil to countries other than the US, denominated in USD.

Table 3. Currency composition of foreign exchange reserves at current exchange rates (as a percentage of allocated reserves)

Source: BIS Paper 78

The share of RMB estimated less than 2% of world’s foreign exchange reserves is much lower than China’s share in world trade, amounting to some 12% at the end of 2014.

3.Possible exchange rate regimes for countries with big China trade

Starting from the theoretical possibilities, countries can either float or peg their currency to another (major trading partner) currency. Under the present international financial architecture based on the Bretton Woods system, most trades were denominated and settled in USD. When the EUR was introduced in 1999, it replaced the shares of various Eurozone currencies but did not encroach on the USD share.

Now, however, countries with strong trade links with China would benefit from seeking an exchange arrangement with RMB. This could range from pegging to RMB, either with an adjustable peg or a fixed peg, to a currency board where all foreign assets would be RMB denominated assets.

Once RMB will be accepted as component of the SDR basket[ The IMF is expected to decide on this issue by the end of 2015.], a major hurdle to pegging to RMB will have been removed. Foreign exchange reserves held in RMB will from then onwards be eligible as official foreign exchange reserves under the IMF definition[ Under the IMF definition a currency is eligible for inclusion in the SDR basket if it is issued by a major exporting country and if its currency is freely usable.]. Even before that decision, countries are now holding RMB reserves.

China can either take a laissez faire attitude to these unilateral decisions, such as the US has done so far or take a pro-active approach, even including a reform of the international monetary systems towards a multi-polar currency standard by design rather than by default. Short of this major task, China will have to provide adequate investment opportunities in RMB for countries’ foreign exchange reserves.

4.Investment possibilities in RMB denominated securities

According to BIS securities statistics, total outstanding debt consists of 2 components, domestic securities and international securities. International debt securities are issued outside the country either in local currency or foreign currencies. At the end of 2014 international debt securities amounted to USD 22 tr, domestic debt securities USD 59 tr, totaling USD 81tr[ BIS Securities statistics: www.bis.org/statistics ]. For the world as a whole there are ample international and domestic debt securities to invest the current total foreign exchange reserves of USD 12 tr.

At present central banks from some 50 countries hold and invest small amounts of their foreign exchange reserves in RMB[ Strictly speaking these do not count as foreign exchange reserves under the IMF definition.]. Assuming that countries round the world (except China) would be investing an initial average of 3% of their foreign exchange reserves (total USD 8tr) amounting to USD 240bn in RMB the following picture would emerge.

Adequate investment vehicles can be supplied either as international debt securities, such as off-shore RMB dim sum bonds or domestic debt securities, either issued by the Chinese government of by quasi government agencies, such as the policy banks. The present foreign holdings of RMB are invested in these securities and can be liquidated and exchanged into other currencies any time.

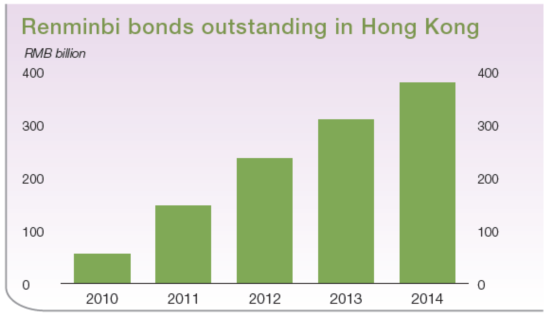

The current largest available pool of off-shore RMB bonds are issued and traded in Hong Kong. At the end of 2014 they amounted close to RMB400, or USD 61bn, thus not enough to accommodate even 3% of world’s foreign exchange reserves.

Graph 1: Offshore RMB bonds outstanding in Hong Kong (end 2014)

Source: BIS Paper 78

The share of RMB estimated less than 2% of world’s foreign exchange reserves is much lower than China’s share in world trade, amounting to some 12% at the end of 2014.

3.Possible exchange rate regimes for countries with big China trade

Starting from the theoretical possibilities, countries can either float or peg their currency to another (major trading partner) currency. Under the present international financial architecture based on the Bretton Woods system, most trades were denominated and settled in USD. When the EUR was introduced in 1999, it replaced the shares of various Eurozone currencies but did not encroach on the USD share.

Now, however, countries with strong trade links with China would benefit from seeking an exchange arrangement with RMB. This could range from pegging to RMB, either with an adjustable peg or a fixed peg, to a currency board where all foreign assets would be RMB denominated assets.

Once RMB will be accepted as component of the SDR basket[ The IMF is expected to decide on this issue by the end of 2015.], a major hurdle to pegging to RMB will have been removed. Foreign exchange reserves held in RMB will from then onwards be eligible as official foreign exchange reserves under the IMF definition[ Under the IMF definition a currency is eligible for inclusion in the SDR basket if it is issued by a major exporting country and if its currency is freely usable.]. Even before that decision, countries are now holding RMB reserves.

China can either take a laissez faire attitude to these unilateral decisions, such as the US has done so far or take a pro-active approach, even including a reform of the international monetary systems towards a multi-polar currency standard by design rather than by default. Short of this major task, China will have to provide adequate investment opportunities in RMB for countries’ foreign exchange reserves.

4.Investment possibilities in RMB denominated securities

According to BIS securities statistics, total outstanding debt consists of 2 components, domestic securities and international securities. International debt securities are issued outside the country either in local currency or foreign currencies. At the end of 2014 international debt securities amounted to USD 22 tr, domestic debt securities USD 59 tr, totaling USD 81tr[ BIS Securities statistics: www.bis.org/statistics ]. For the world as a whole there are ample international and domestic debt securities to invest the current total foreign exchange reserves of USD 12 tr.

At present central banks from some 50 countries hold and invest small amounts of their foreign exchange reserves in RMB[ Strictly speaking these do not count as foreign exchange reserves under the IMF definition.]. Assuming that countries round the world (except China) would be investing an initial average of 3% of their foreign exchange reserves (total USD 8tr) amounting to USD 240bn in RMB the following picture would emerge.

Adequate investment vehicles can be supplied either as international debt securities, such as off-shore RMB dim sum bonds or domestic debt securities, either issued by the Chinese government of by quasi government agencies, such as the policy banks. The present foreign holdings of RMB are invested in these securities and can be liquidated and exchanged into other currencies any time.

The current largest available pool of off-shore RMB bonds are issued and traded in Hong Kong. At the end of 2014 they amounted close to RMB400, or USD 61bn, thus not enough to accommodate even 3% of world’s foreign exchange reserves.

Graph 1: Offshore RMB bonds outstanding in Hong Kong (end 2014)

Source: HKMA[ HKMA (2015): The Premier Offshore RMB Business Centre, April www.hkma.gov.hk ]

Although the size of China’s domestic bond market denominated in RMB is still small in terms of GDP, however, in absolute terms it is already the 5th largest one after the USD, EUR, JPY and GBP denominated domestic bonds[ BIS Securities statistics: www.bis.org/statistics ].

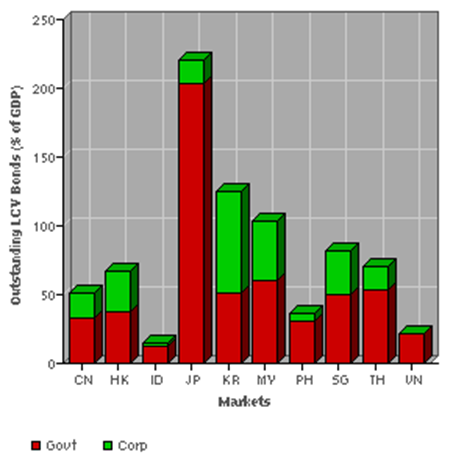

Graph 2: Size (in % of GDP) and composition of LCY bonds in Asia (end 2014)

Source: HKMA[ HKMA (2015): The Premier Offshore RMB Business Centre, April www.hkma.gov.hk ]

Although the size of China’s domestic bond market denominated in RMB is still small in terms of GDP, however, in absolute terms it is already the 5th largest one after the USD, EUR, JPY and GBP denominated domestic bonds[ BIS Securities statistics: www.bis.org/statistics ].

Graph 2: Size (in % of GDP) and composition of LCY bonds in Asia (end 2014)

Source: www.asianbondsonline.org

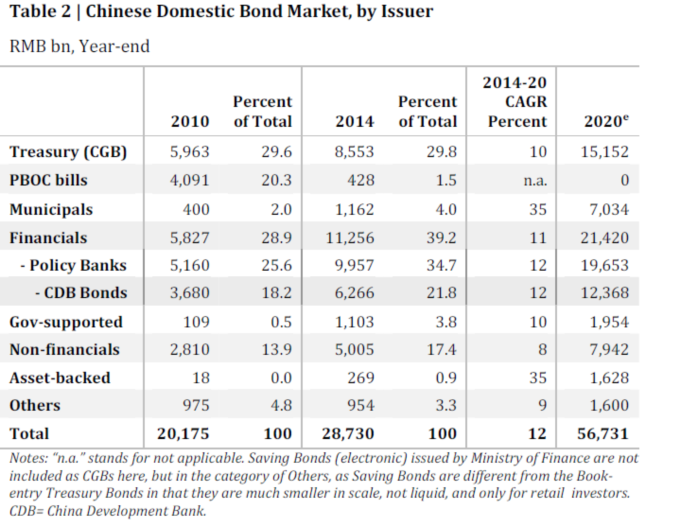

The total outstanding domestic RMB debt securities at the end of 2014 was RMB 28 tr or USD 4.5tr (see table 2 below). Chinese Government Bonds make up 30% of this total. Municipal bonds are expected to increase as a result of the loan to debt swap proposed by the Chinese government. On the contrary, PBOC bills have declined as less intervention in the foreign exchange market has lowered the need for sterilization bonds[ The sterilization bonds im emerging markets have been a major element of issuance of local currency bonds. Miyijima, Ken, Mohanty M S and Chan Tracy (2012): Emerging market local currency bonds: diversification and stability. In: BIS Working Papers Nr 391, November www.bis.org /publications ]. Overall, the domestic RMB bond market will be sufficiently large in absolute terms to accommodate more investment by foreign central banks.

Table 4. Chinese domestic bond market, by issuer (RMB bn, year-end)

Source: www.asianbondsonline.org

The total outstanding domestic RMB debt securities at the end of 2014 was RMB 28 tr or USD 4.5tr (see table 2 below). Chinese Government Bonds make up 30% of this total. Municipal bonds are expected to increase as a result of the loan to debt swap proposed by the Chinese government. On the contrary, PBOC bills have declined as less intervention in the foreign exchange market has lowered the need for sterilization bonds[ The sterilization bonds im emerging markets have been a major element of issuance of local currency bonds. Miyijima, Ken, Mohanty M S and Chan Tracy (2012): Emerging market local currency bonds: diversification and stability. In: BIS Working Papers Nr 391, November www.bis.org /publications ]. Overall, the domestic RMB bond market will be sufficiently large in absolute terms to accommodate more investment by foreign central banks.

Table 4. Chinese domestic bond market, by issuer (RMB bn, year-end)

Source: Guonan Ma and Wang Yao, FGI Working Paper 2015[ Ma Guonan and Wang Yao (2015): Can the Chinese bond market facilitate a globalizing RMB? In: Fung Global Institute Working Paper 2015. www.fgi.org ]

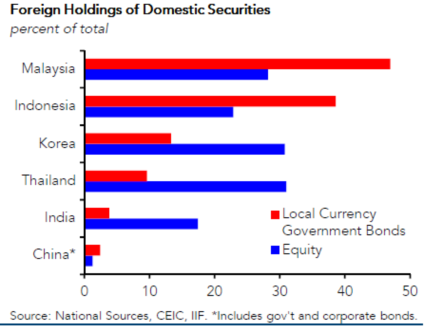

The share of foreign holdings of CBG is very small at present, some 1.5% of total. This compares with 40% of US Treasuries held by foreigners. Other foreign holding as share of total government bonds are contained in graph 3.

Graph 3: Foreign holdings of domestic securities

Source: Guonan Ma and Wang Yao, FGI Working Paper 2015[ Ma Guonan and Wang Yao (2015): Can the Chinese bond market facilitate a globalizing RMB? In: Fung Global Institute Working Paper 2015. www.fgi.org ]

The share of foreign holdings of CBG is very small at present, some 1.5% of total. This compares with 40% of US Treasuries held by foreigners. Other foreign holding as share of total government bonds are contained in graph 3.

Graph 3: Foreign holdings of domestic securities

Source: IIF Capital Flows May 2015[ Institute for International Finance (2015): Capital flows to emerging markets, 28 May, www.iif.org ]

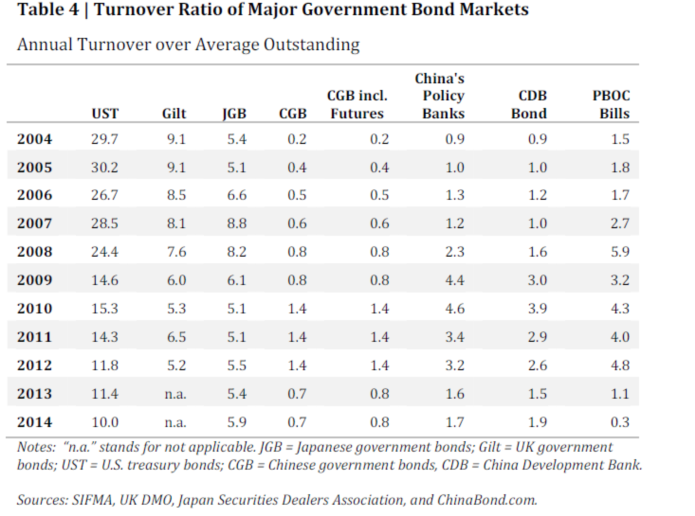

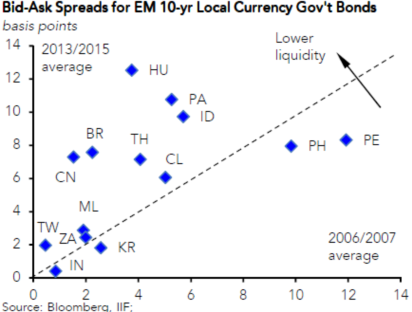

The main problems with the Chinese bond market at present are the fragmentation of regulations and trading platforms. For instance, the yield curve up to one year is under PBOC supervision, whereas the longer maturities are under MoF supervision. This fragmentation results in market segmentation which hampers market liquidity. As the indicators in table 4 and graph 4 show, liquidity measures such as the turnover ratio of major government bond markets is very low in China, compared with the most liquid government bonds, the US Treasuries, Japanese JGB and UK gilts.

Table 5. Turnover ratio of major government bond markets (annual turnover over average outstanding)

Source: IIF Capital Flows May 2015[ Institute for International Finance (2015): Capital flows to emerging markets, 28 May, www.iif.org ]

The main problems with the Chinese bond market at present are the fragmentation of regulations and trading platforms. For instance, the yield curve up to one year is under PBOC supervision, whereas the longer maturities are under MoF supervision. This fragmentation results in market segmentation which hampers market liquidity. As the indicators in table 4 and graph 4 show, liquidity measures such as the turnover ratio of major government bond markets is very low in China, compared with the most liquid government bonds, the US Treasuries, Japanese JGB and UK gilts.

Table 5. Turnover ratio of major government bond markets (annual turnover over average outstanding)

Source: Guonan Ma and Wang Yao, FGI Working Paper 2015

Measured by bid-ask spreads in the local currency government bond markets, the liquidity situation in the CGB market has deteriorated between 2007 and 2013. It seems that government securities are held to maturity with little secondary market trading.

Graph 4: Bid-ask spreads for various government bond markets: changes between 2006/2007 and 2013/2015

Source: Guonan Ma and Wang Yao, FGI Working Paper 2015

Measured by bid-ask spreads in the local currency government bond markets, the liquidity situation in the CGB market has deteriorated between 2007 and 2013. It seems that government securities are held to maturity with little secondary market trading.

Graph 4: Bid-ask spreads for various government bond markets: changes between 2006/2007 and 2013/2015

Source: IIF Capital flows, May 2015

Conclusion

Once the RMB will have been accepted as component of the SDR, many foreign central banks, notably those with significant trade links with China will search for investment vehicles in RMB. The CGB market needs to be further deepened and liquidity enhanced for reserve managers in foreign central banks to feel comfortable in investing in RMB vehicles. Once this will be achieved, pegging to the RMB will become a technicality. This can be done unilaterally, even without a major reform of the international financial system. This would be a major step forward in the process of internationalization of RMB.

Source: IIF Capital flows, May 2015

Conclusion

Once the RMB will have been accepted as component of the SDR, many foreign central banks, notably those with significant trade links with China will search for investment vehicles in RMB. The CGB market needs to be further deepened and liquidity enhanced for reserve managers in foreign central banks to feel comfortable in investing in RMB vehicles. Once this will be achieved, pegging to the RMB will become a technicality. This can be done unilaterally, even without a major reform of the international financial system. This would be a major step forward in the process of internationalization of RMB.