Herbert Poenisch: From Capital Outflows to Capital Inflows in China—Role of Banks and Issuers of Debt Securities

2018-06-16 IMI- The cross border banking business

Just a reminder that increases in assets constitute a capital outflow, a decrease a capital inflow, triggered by residents. The inverse is true for liabilities where an increase constitutes a capital inflow whereas a decrease is a capital outflow, both triggered by non-residents.

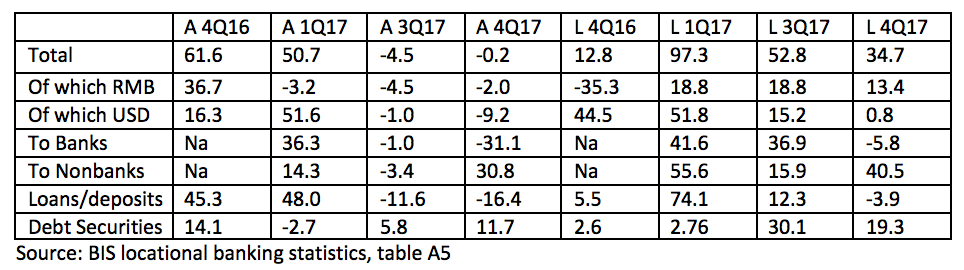

The following picture emerges. Massive increases in total assets turned into modest decreases by the end of 2017, ie capital inflows. Massive increases in liabilities were recorded towards the end of 2017, also recorded as capital inflows in the balance of payments. It should be noted that increases in net liabilities raise the international debt of China.

The currency shares of the outstanding claims and liabilities remained largely unchanged in the course of 2017. Foreign currencies made up 88% of all claims, the USD alone 70% and RMB 12%; as shares of liabilities foreign currencies made up 70%, USD only 37% and RMB 30%. Regarding the adjusted changes, the currency composition changed. Lending in both, RMB but mostly in USD contracted towards the end of the year. Liabilities increased mostly in RMB but also in USD. Both components together make up the capital inflows for the whole year.

Regarding counterparts, lending to banks decreased towards the end of the year, whereas deposits by banks increased, but declined in the last quarter. Lending to non banks had a mixed picture but deposits by non banks continued strongly. The same picture of capital inflows emerges.

Finally, the breakdown into instruments, China resident banks reduced their loans in the latter part of the year whereas deposits increased apart from the last quarter. The modest purchase of debt securities continued whereas new issuance surged in the latter part of the year. This again confirms the picture of massive inflows towards the end of 2017.

The breakdown shows that within the overall picture of declining claims versus massive increase in liabilities, both deposits and securities issued, there are marked changes which raise questions for analysis. Why is cross border lending declining in times when Chinese banks are supposed to support Chinese projects abroad? Why has the USD continued to play such a dominant role when the rhetoric has suggested otherwise? Has the weakness of the USD played any role? Why has lending to other banks declined, and lending to non banks only picked up recently? Why has lending in RMB declined when liabilities in RMB surged? Which non banks, Chinese or foreign have massively increased their deposits or bought banks’ debt securities? Answers will be attempted in the third section.

Just a reminder that increases in assets constitute a capital outflow, a decrease a capital inflow, triggered by residents. The inverse is true for liabilities where an increase constitutes a capital inflow whereas a decrease is a capital outflow, both triggered by non-residents.

The following picture emerges. Massive increases in total assets turned into modest decreases by the end of 2017, ie capital inflows. Massive increases in liabilities were recorded towards the end of 2017, also recorded as capital inflows in the balance of payments. It should be noted that increases in net liabilities raise the international debt of China.

The currency shares of the outstanding claims and liabilities remained largely unchanged in the course of 2017. Foreign currencies made up 88% of all claims, the USD alone 70% and RMB 12%; as shares of liabilities foreign currencies made up 70%, USD only 37% and RMB 30%. Regarding the adjusted changes, the currency composition changed. Lending in both, RMB but mostly in USD contracted towards the end of the year. Liabilities increased mostly in RMB but also in USD. Both components together make up the capital inflows for the whole year.

Regarding counterparts, lending to banks decreased towards the end of the year, whereas deposits by banks increased, but declined in the last quarter. Lending to non banks had a mixed picture but deposits by non banks continued strongly. The same picture of capital inflows emerges.

Finally, the breakdown into instruments, China resident banks reduced their loans in the latter part of the year whereas deposits increased apart from the last quarter. The modest purchase of debt securities continued whereas new issuance surged in the latter part of the year. This again confirms the picture of massive inflows towards the end of 2017.

The breakdown shows that within the overall picture of declining claims versus massive increase in liabilities, both deposits and securities issued, there are marked changes which raise questions for analysis. Why is cross border lending declining in times when Chinese banks are supposed to support Chinese projects abroad? Why has the USD continued to play such a dominant role when the rhetoric has suggested otherwise? Has the weakness of the USD played any role? Why has lending to other banks declined, and lending to non banks only picked up recently? Why has lending in RMB declined when liabilities in RMB surged? Which non banks, Chinese or foreign have massively increased their deposits or bought banks’ debt securities? Answers will be attempted in the third section.

- Borrowing by international debt securities

The BIS publishes in table C3 a breakdown by issuer, by currencies, by maturities and by interest type. International organisations are a separate category, not residents of any specific country. The currency breakdown does not show as explicitly, only as local currency in issues by Chinese residents, in international issues by Chinese nationals only included in other currencies. Non Chinese residents and Non Chinese nationals issuing in RMB are included under other currencies issue of their respective country, eg UK government issuing treasuries in RMB.

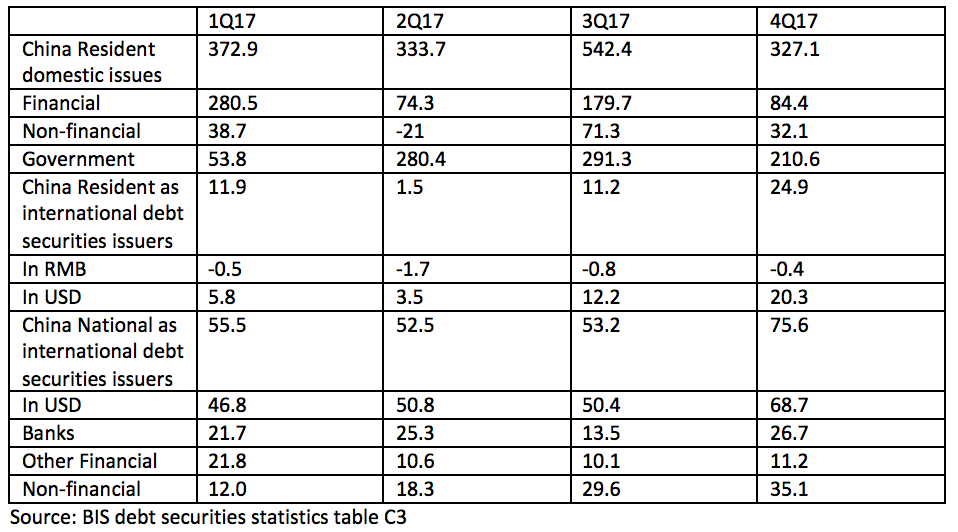

Regarding the issue activity in domestic debt markets, the dominant ones are the general government and financial institutions. Non-financial have issued rather modestly during 2017. In international debt markets, financial institutions are dominant, with non-financials picking up in the last quarters of 2017.

Regarding currencies, issuing in RMB by Chinese residents has declined, whereas issuing in USD has picked up markedly. In international issues by Chinese nationals the USD has been dominant as always.

The maturities of these issues are exclusively long term. Issues at fixed interest rates dominate the international issues of Chinese residents as well as Chinese nationals.

As in the cross border banking business, questions arise to explain the structural developments. What are the driving factors behind the issue activities of various issuers, market conditions, demand for funds and exchange rate expectations?

The BIS publishes in table C3 a breakdown by issuer, by currencies, by maturities and by interest type. International organisations are a separate category, not residents of any specific country. The currency breakdown does not show as explicitly, only as local currency in issues by Chinese residents, in international issues by Chinese nationals only included in other currencies. Non Chinese residents and Non Chinese nationals issuing in RMB are included under other currencies issue of their respective country, eg UK government issuing treasuries in RMB.

Regarding the issue activity in domestic debt markets, the dominant ones are the general government and financial institutions. Non-financial have issued rather modestly during 2017. In international debt markets, financial institutions are dominant, with non-financials picking up in the last quarters of 2017.

Regarding currencies, issuing in RMB by Chinese residents has declined, whereas issuing in USD has picked up markedly. In international issues by Chinese nationals the USD has been dominant as always.

The maturities of these issues are exclusively long term. Issues at fixed interest rates dominate the international issues of Chinese residents as well as Chinese nationals.

As in the cross border banking business, questions arise to explain the structural developments. What are the driving factors behind the issue activities of various issuers, market conditions, demand for funds and exchange rate expectations?

- Factors for banks’ cross border business and Chinese debt issuance in international markets