Herbert Poenisch: RMB-A Maturing Currency

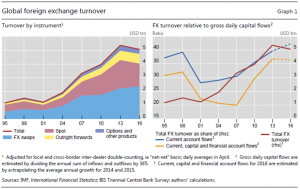

2017-01-16 IMI As graph 1 shows total daily market activity declined from USD5.4tr in 2013 to USD5.1tr in 2016 mainly due to the decline in spot transactions. Comparing with capital flows, financial account flows increased more rapidly since 2007 compared with current account flows. As will be seen below, the use of RMB for financial transactions has overtaken the use for current account transactions. Using a currency for financial transactions is a characteristic of a mature currency which can serve as global currency before long.

A number of factors explains this decline. The BIS mentions the expectations that the FED would begin tapering its asset purchases, the wake of the Swiss Franc shock at the beginning of 2015 and measures to curb high frequency trading (HFT). All these developments had a disproportionate impact on spot trading, because market participants seek returns by taking open currency positions or, in the case of HFT, focus on the most liquid instruments.

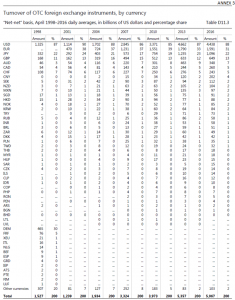

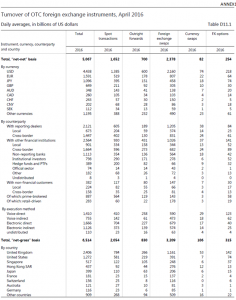

By contrast, trading in forex swaps rose because of the increase in currency hedging activity by long term institutional investors, as they rebalanced their international portfolios on the back of central bank quantitative easing programmes. As money market rates and lending spreads in major currencies diverged, this also contributed to the rise in forex swap turnover.Looking at instruments, the forex swaps exceed the spot transactions and other derivatives such as the forwards and options (see annex 1). The breakdown of participants in forex trade has not changed in the recent survey. Trade is still dominated in equal shares by dealers and financial institutions with the share of non-financials falling to below 10% (see annex 1), reflecting the low importance of foreign trade as determinant of forex demand and exchange rate determination.

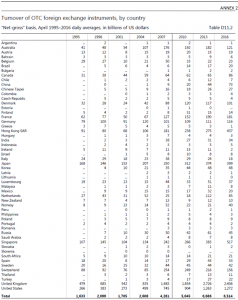

Regarding centres of foreign exchange trade there has been a marked shift from the UK and Europe to Asian centres, notably China, Japan, Hong Kong and Singapore. Whereas the UK dominated the forex market in previous surveys with 41% of trade, its share declined to 37%. The US share remained stable at 19%. The four major Asian centres increased their share from 16% to 22%, reflecting the shift of economic gravity to Asia. China’s share doubled albeit from a low basis (see annex 2).

Finally, regarding currencies, the USD remains the dominant one, present in 88% of all currency pairs. The EUR declined markedly from its peak in 2010 of 39% to 31% in 2016. The other major currencies (JPY, GBP, CHF, AUD, CAD) maintained their shares, and Asian currencies among EME currencies increased their share, notably the RMB to 4%, the HKD and SGD and KRW to 2% (see annex 3).

2. Performance of RMB

The share of forex trade conducted in RMB has doubled every three years. Total daily turnover has reached over USD202 billion or 4% of global forex turnover…Along with the rise in the overall trading of RMB, its use as a financial instrument and to back financial rather than trade transactions has also increased. In the past, most of the limited turnover was in spot transactions.

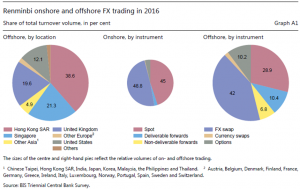

Cross-border RMB demand has increased through a number of channels. First, starting in July 2009, China allowed the use of RMB in the settlement of cross-border trade. Second, both outward and inward direct investment have grown rapidly, with a big share of RMB in the outward direction. Third, offshore RMB can also serve as a vehicle for portfolio investment in China through channels such as dim sum bond issuance (offshore RMB-denominated bond issuance) and the RMB Qualified Foreign Institutional Investor scheme (RQFII). The salient features are shown in Graph A1=2 below.

As graph 1 shows total daily market activity declined from USD5.4tr in 2013 to USD5.1tr in 2016 mainly due to the decline in spot transactions. Comparing with capital flows, financial account flows increased more rapidly since 2007 compared with current account flows. As will be seen below, the use of RMB for financial transactions has overtaken the use for current account transactions. Using a currency for financial transactions is a characteristic of a mature currency which can serve as global currency before long.

A number of factors explains this decline. The BIS mentions the expectations that the FED would begin tapering its asset purchases, the wake of the Swiss Franc shock at the beginning of 2015 and measures to curb high frequency trading (HFT). All these developments had a disproportionate impact on spot trading, because market participants seek returns by taking open currency positions or, in the case of HFT, focus on the most liquid instruments.

By contrast, trading in forex swaps rose because of the increase in currency hedging activity by long term institutional investors, as they rebalanced their international portfolios on the back of central bank quantitative easing programmes. As money market rates and lending spreads in major currencies diverged, this also contributed to the rise in forex swap turnover.Looking at instruments, the forex swaps exceed the spot transactions and other derivatives such as the forwards and options (see annex 1). The breakdown of participants in forex trade has not changed in the recent survey. Trade is still dominated in equal shares by dealers and financial institutions with the share of non-financials falling to below 10% (see annex 1), reflecting the low importance of foreign trade as determinant of forex demand and exchange rate determination.

Regarding centres of foreign exchange trade there has been a marked shift from the UK and Europe to Asian centres, notably China, Japan, Hong Kong and Singapore. Whereas the UK dominated the forex market in previous surveys with 41% of trade, its share declined to 37%. The US share remained stable at 19%. The four major Asian centres increased their share from 16% to 22%, reflecting the shift of economic gravity to Asia. China’s share doubled albeit from a low basis (see annex 2).

Finally, regarding currencies, the USD remains the dominant one, present in 88% of all currency pairs. The EUR declined markedly from its peak in 2010 of 39% to 31% in 2016. The other major currencies (JPY, GBP, CHF, AUD, CAD) maintained their shares, and Asian currencies among EME currencies increased their share, notably the RMB to 4%, the HKD and SGD and KRW to 2% (see annex 3).

2. Performance of RMB

The share of forex trade conducted in RMB has doubled every three years. Total daily turnover has reached over USD202 billion or 4% of global forex turnover…Along with the rise in the overall trading of RMB, its use as a financial instrument and to back financial rather than trade transactions has also increased. In the past, most of the limited turnover was in spot transactions.

Cross-border RMB demand has increased through a number of channels. First, starting in July 2009, China allowed the use of RMB in the settlement of cross-border trade. Second, both outward and inward direct investment have grown rapidly, with a big share of RMB in the outward direction. Third, offshore RMB can also serve as a vehicle for portfolio investment in China through channels such as dim sum bond issuance (offshore RMB-denominated bond issuance) and the RMB Qualified Foreign Institutional Investor scheme (RQFII). The salient features are shown in Graph A1=2 below.

RMB offshore trading is concentrated in four centres, Hong Kong, Singapore, London and US (left hand diagramme). In line with global trends, RMB swaps have become the dominant instrument, in the onshore as well as in the offshore RMB markets. This underlines the growing importance of financial transactions in the RMB segment.

3. Financialisation of RMB

Using any currency for financial transactions without involvement of residents is a necessary condition for a global reserve currency. Both, the GBP and the USD have fulfilled this function during their heydays as world reserve currencies. In case of the USD financial engineering advanced to such a degree that use for trade transactions was dwarfed by use for financial transactions (see above).

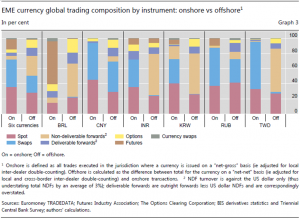

RMB has only just started on this path of financialisation as evidenced by the 2016 forex survey. As annex 1 shows, for the first time daily RMB spot transactions of USD68 billion, which are closely linked with real transactions such as trade and FDI have been overtaken by derivatives transactions. First and foremost swap transactions of USD86bn, then outright forwards of USD28 bn and forex options of USD 18bn have documented the financial use of RMB. The financialisation has taken place not only on the offshore RMB market but also on the onshore RMB market (see graph 3 below). However, the two are still separated as residents by and large do not have access to the offshore RMB markets and non-residents do not have access to the onshore RMB market.

RMB offshore trading is concentrated in four centres, Hong Kong, Singapore, London and US (left hand diagramme). In line with global trends, RMB swaps have become the dominant instrument, in the onshore as well as in the offshore RMB markets. This underlines the growing importance of financial transactions in the RMB segment.

3. Financialisation of RMB

Using any currency for financial transactions without involvement of residents is a necessary condition for a global reserve currency. Both, the GBP and the USD have fulfilled this function during their heydays as world reserve currencies. In case of the USD financial engineering advanced to such a degree that use for trade transactions was dwarfed by use for financial transactions (see above).

RMB has only just started on this path of financialisation as evidenced by the 2016 forex survey. As annex 1 shows, for the first time daily RMB spot transactions of USD68 billion, which are closely linked with real transactions such as trade and FDI have been overtaken by derivatives transactions. First and foremost swap transactions of USD86bn, then outright forwards of USD28 bn and forex options of USD 18bn have documented the financial use of RMB. The financialisation has taken place not only on the offshore RMB market but also on the onshore RMB market (see graph 3 below). However, the two are still separated as residents by and large do not have access to the offshore RMB markets and non-residents do not have access to the onshore RMB market.

The main difference between RMB and other emerging market currencies are the Non-deliverable forwards (NDF). Whereas other EME currencies still have a large NDF market (notably BRL, INR, KRW, TWD), RMB and RUB have moved into the deliverable forwards (DF), particularly in the onshore segment for Chinese residents. The BIS cites the growing need for onshore hedging due to the fact most RMB bonds are held by domestic investors.

The DF for offshore RMB is possible, because ‘Chinese authorities permitted within still effective (but leaky) capital controls, a pool of offshore RMB which can be freely traded and delivered. The RMB forward market is thus split into three (i) an offshore NDF market (started in the 1990s), (ii) an onshore DF market (since 2007) and (iii) an offshore DF market, known as CNH market (since mid-2010). This framework came under severe strain in January 2016 when the CNH market liquidity was drained causing a sizable gap between RMB onshore and offshore interest rates and exchange rates.

The displacement of NDF by DF has progressed most in offshore centres which have traded RMB the longest, such as Hong Kong, Singapore and London. NDFs have still a high share in other European centres and the US.

Conclusion

The active policy of internationalization of RMB has driven the financialisation of RMB, a key characteristics of a mature currency. Forexswaps, outright forwards and forex options in RMB onshore as well as offshore markets have allowed markets to hedge their interest rate and exchange rate exposures in RMB. These together with a market oriented exchange rate policy introduced in August 2015, have given the RMB internationalization a major push.

Risks still remain, such as shortening of offshore RMB, but a more realistic exchange rate policy which is the hallmark of an international reserve currency together with wide availability of hedging instruments has allowed residents as well as non-residents to use and hedge RMB. At the same time, the separation of residents and non-residents through capital controls continues to function by and large, but a convergence between onshore and offshore trading patterns is a clear trend.

The main difference between RMB and other emerging market currencies are the Non-deliverable forwards (NDF). Whereas other EME currencies still have a large NDF market (notably BRL, INR, KRW, TWD), RMB and RUB have moved into the deliverable forwards (DF), particularly in the onshore segment for Chinese residents. The BIS cites the growing need for onshore hedging due to the fact most RMB bonds are held by domestic investors.

The DF for offshore RMB is possible, because ‘Chinese authorities permitted within still effective (but leaky) capital controls, a pool of offshore RMB which can be freely traded and delivered. The RMB forward market is thus split into three (i) an offshore NDF market (started in the 1990s), (ii) an onshore DF market (since 2007) and (iii) an offshore DF market, known as CNH market (since mid-2010). This framework came under severe strain in January 2016 when the CNH market liquidity was drained causing a sizable gap between RMB onshore and offshore interest rates and exchange rates.

The displacement of NDF by DF has progressed most in offshore centres which have traded RMB the longest, such as Hong Kong, Singapore and London. NDFs have still a high share in other European centres and the US.

Conclusion

The active policy of internationalization of RMB has driven the financialisation of RMB, a key characteristics of a mature currency. Forexswaps, outright forwards and forex options in RMB onshore as well as offshore markets have allowed markets to hedge their interest rate and exchange rate exposures in RMB. These together with a market oriented exchange rate policy introduced in August 2015, have given the RMB internationalization a major push.

Risks still remain, such as shortening of offshore RMB, but a more realistic exchange rate policy which is the hallmark of an international reserve currency together with wide availability of hedging instruments has allowed residents as well as non-residents to use and hedge RMB. At the same time, the separation of residents and non-residents through capital controls continues to function by and large, but a convergence between onshore and offshore trading patterns is a clear trend.

Annex 1

Annex 2

Annex 3