Sun Chao and Zhang Rui: Weak Transmission, New Trend: The Influence of Internationalization of RMB Exchange Rate on China's Bond Market

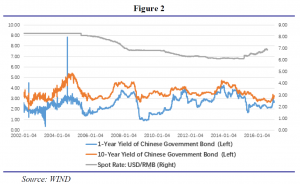

2017-01-16 IMI Secondly, when considering the impact of exchange rate on the yield of government bonds, we find that the RMB’s exchange rate is not a major factor that influence the bond market. In the logic chain of “exchange rate-inflation”, The bulk stock’s price is an important intermediary variables. When a country’s currency depreciates, the cost of imports increases so that it will push the cost of living higher. Under the background of domestic supply-side structural reform which has already led to price increases in some raw materials, the growth of emerging market recovers so that the fall in international commodity price are smaller than the currency’s devaluation in magnitude. This re-bounce of global commodity prices has already pushed up the domestic inflation rate (2.5%) and may continue. In the future, this transmission may strengthen (Figure 2).

Secondly, when considering the impact of exchange rate on the yield of government bonds, we find that the RMB’s exchange rate is not a major factor that influence the bond market. In the logic chain of “exchange rate-inflation”, The bulk stock’s price is an important intermediary variables. When a country’s currency depreciates, the cost of imports increases so that it will push the cost of living higher. Under the background of domestic supply-side structural reform which has already led to price increases in some raw materials, the growth of emerging market recovers so that the fall in international commodity price are smaller than the currency’s devaluation in magnitude. This re-bounce of global commodity prices has already pushed up the domestic inflation rate (2.5%) and may continue. In the future, this transmission may strengthen (Figure 2).

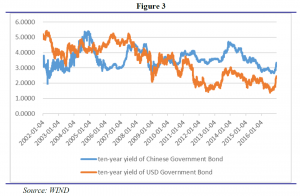

Despite of a large scale QE, there is still no domestic de-leveraging occurred in the US, which means that the cost of borrowing dollars is extremely low. Meanwhile, China generates demand for capital due to the “4 trillion” fiscal stimulus program of 2009. Besides, return on assets on Chinese market is higher due to higher interest rate caused by higher economic growth rate. As a result, borrowing dollars and investing in China becomes profitable and so that“dollars liquidity” is generated .Because of the existence of the cross-border arbitrage of capital, we can see a strong relationship between China and US government bond yields from 2008. Looking forward, with US interest rate gradually increases, the difference in interest rate is expected to narrow, which will lead to a reduction in capital inflows and thus put pressure on China’s bond market (Figure 3).

Despite of a large scale QE, there is still no domestic de-leveraging occurred in the US, which means that the cost of borrowing dollars is extremely low. Meanwhile, China generates demand for capital due to the “4 trillion” fiscal stimulus program of 2009. Besides, return on assets on Chinese market is higher due to higher interest rate caused by higher economic growth rate. As a result, borrowing dollars and investing in China becomes profitable and so that“dollars liquidity” is generated .Because of the existence of the cross-border arbitrage of capital, we can see a strong relationship between China and US government bond yields from 2008. Looking forward, with US interest rate gradually increases, the difference in interest rate is expected to narrow, which will lead to a reduction in capital inflows and thus put pressure on China’s bond market (Figure 3).

Thirdly, the impact of RMB depreciation on the credit spread on domestic corporate bond has been limited thus far. This is because currently the overall level of debt denominated in dollar of the Chinese firms is relatively low. However, we find that household appliances, transportation and light manufacturing are industries that have comparatively high level of debt ratio denominated in dollar. Since they are pro-cyclical industries, they are also prone to exchange rate fluctuations caused by the fundamentals of the Chinese economy apart from the recent unilateral appreciation of the dollar, leading to variations in the credit spread.It is also a trend that firms in the real estate industry increasingly raise capital through issuing foreign debt due to various restrictions on bank loans and debt-issuance domestically, increasing the exposure of those firms to exchange rate fluctuations. The capital outflows and the fall in the prices of risky assets may also cause potential shock to the real estate sector and leading to higher credit risk of real estate firms. Overall, credit spread on corporate bonds of some industries may widen due to the increase in the level of debt denominated in foreign currencies.

2. Forecast of RMB exchange rate in 2017: slow depreciation

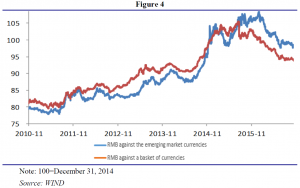

The accumulated depreciation pressure of the RMB began in 2014, when the economic and the monetary conditions of China and the United States have shown a double - cycle deviation. As a result, the RMB, which at that time was to a large extent pegged to the USD, appreciated passively.In 2014, the US economy showed sign of recovery and therefore expectation of exiting the Quantitative Easing program arose. As a result, the currency got into a strengthening cycle. Meanwhile, the Chinese economy faced significant slow-down,and monetary policy was loose. There is a clear fundamental deviation in the economy and monetary cycle of China and the US, but due to the lack of flexibility in the exchange rate system, RMB has appreciated by nearly 16% against a basket of emerging market currencies.At present, the depreciation pressure has been effectively released. One crucial aspect is that most of the distortions which the RMB against the emerging market currencies index have been released. Due to the exchange rate reform over the past year,the RMB against a basket of emerging market currencies index has fallen to 10.9%. Taking into account the relative performance of the Chinese economy against that of the other emerging market economies over this period, it is reasonable to conclude that exchange rate distortions have largely been corrected.When looking at the index of the RMB against a basket of currencies, it has returned to the level back in September 2014, when expectation of US monetary tightening strengthened, a level that is likely to be proved sustainable in the long run (Figure 4).

Thirdly, the impact of RMB depreciation on the credit spread on domestic corporate bond has been limited thus far. This is because currently the overall level of debt denominated in dollar of the Chinese firms is relatively low. However, we find that household appliances, transportation and light manufacturing are industries that have comparatively high level of debt ratio denominated in dollar. Since they are pro-cyclical industries, they are also prone to exchange rate fluctuations caused by the fundamentals of the Chinese economy apart from the recent unilateral appreciation of the dollar, leading to variations in the credit spread.It is also a trend that firms in the real estate industry increasingly raise capital through issuing foreign debt due to various restrictions on bank loans and debt-issuance domestically, increasing the exposure of those firms to exchange rate fluctuations. The capital outflows and the fall in the prices of risky assets may also cause potential shock to the real estate sector and leading to higher credit risk of real estate firms. Overall, credit spread on corporate bonds of some industries may widen due to the increase in the level of debt denominated in foreign currencies.

2. Forecast of RMB exchange rate in 2017: slow depreciation

The accumulated depreciation pressure of the RMB began in 2014, when the economic and the monetary conditions of China and the United States have shown a double - cycle deviation. As a result, the RMB, which at that time was to a large extent pegged to the USD, appreciated passively.In 2014, the US economy showed sign of recovery and therefore expectation of exiting the Quantitative Easing program arose. As a result, the currency got into a strengthening cycle. Meanwhile, the Chinese economy faced significant slow-down,and monetary policy was loose. There is a clear fundamental deviation in the economy and monetary cycle of China and the US, but due to the lack of flexibility in the exchange rate system, RMB has appreciated by nearly 16% against a basket of emerging market currencies.At present, the depreciation pressure has been effectively released. One crucial aspect is that most of the distortions which the RMB against the emerging market currencies index have been released. Due to the exchange rate reform over the past year,the RMB against a basket of emerging market currencies index has fallen to 10.9%. Taking into account the relative performance of the Chinese economy against that of the other emerging market economies over this period, it is reasonable to conclude that exchange rate distortions have largely been corrected.When looking at the index of the RMB against a basket of currencies, it has returned to the level back in September 2014, when expectation of US monetary tightening strengthened, a level that is likely to be proved sustainable in the long run (Figure 4).

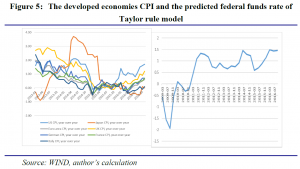

Economic data shows that US CPI growth has kept ahead among world's leading economies. Meanwhile, the US unemployment rate is close to the natural rate of unemployment. Based on our calculations by the Taylor rule, the implied Federal Fund rate is around 1.45%.Even if we consider the crowding-out effect of Trump's fiscal stimulus on investment, inflows of capital and the uncertain prospect of the global economy,the implied rate should be at around 1.2%. The current federal funds rate, however, remains at 0.45%.This implies that after the rate-rise in December 2016, the Federal Reserve is likely to raise rate about 2-3 times in 2017. The implications of this in 2017 include further capital inflows in to the US, thus bringing depreciation pressure on the RMB (Figure 5).

Economic data shows that US CPI growth has kept ahead among world's leading economies. Meanwhile, the US unemployment rate is close to the natural rate of unemployment. Based on our calculations by the Taylor rule, the implied Federal Fund rate is around 1.45%.Even if we consider the crowding-out effect of Trump's fiscal stimulus on investment, inflows of capital and the uncertain prospect of the global economy,the implied rate should be at around 1.2%. The current federal funds rate, however, remains at 0.45%.This implies that after the rate-rise in December 2016, the Federal Reserve is likely to raise rate about 2-3 times in 2017. The implications of this in 2017 include further capital inflows in to the US, thus bringing depreciation pressure on the RMB (Figure 5).

As the current RMB exchange rate determination mechanism still places a high weight on the performance of dollar, we conclude that the RMB will still depreciate in the year to come given the above factors. The extent of depreciation, however, is likely to be limited.From a global prospective, 2016 is a year of global political and economic events that were hardly expected by mainstream policymakers, businesspersons and academics alike. Both Brexit and Trump winning the General Election in the US marked a decadency of globalization since the cold war era.The driving force behind these events is the unequal nature of globalization process. In this round of "creative destruction", lower-middle class has benefited the least from globalization, who particularly welcome the political promises of the extremist on the political right wing. The sheer size of those group has changed the political landscape significantly and will continue to have important implications on international political economy. This long-term uncertainty in the coming year, along with the recovery of US economy and potential fiscal stimulus promoted by Trump, will further increase the returns on dollar assets.

We observe that Chinese economy remained stable. Firms are actively increasing the level of inventory; due to a recovery of external demand, trade surplus also widens. Both of these show that the demand side of the economy has been recovering, and the CPI and the PPI both go up. It is also expected that the fiscal deficit will enlarge next year mainly due to the planned increased expenditure on infrastructure, which will further support the economy in 2017. The stable fundamentals imply that RMB does not have the basis for large depreciation against the dollar. With the advancement of deleveraging in the financial market and the real estate sector, and the financial asset prices are making significant adjustments, reducing asset bubbles that have already existed and thus easing the depreciating pressure of RMB.

As the economy with the largest foreign exchange reserves in the world, China has the capability of maintaining RMB stability. Recently, the PBOC’s change of monetary policy stance has already reflecteditsintention to stabilize the pace of RMB depreciationas well as to promote deleveraging in the domestic financial market. Besides, the PBOC has sufficient capacity to smooth out the excessive volatility which coming from the outflows. To sum up, we believes that the RMB exchange rate will depreciate slowly in 2017. In the short term, there may be fluctuations, but the market expectations will eventually stabilizeafter this overreactions mostly due to the sentiments on the fiscal and monetary policy in the US. When coming to the impact of the RMB exchange rate on domestic bond yields, the depreciation of RMB is more likely to affect the market sentiment rather than bringing significant economic transmissions.

As the current RMB exchange rate determination mechanism still places a high weight on the performance of dollar, we conclude that the RMB will still depreciate in the year to come given the above factors. The extent of depreciation, however, is likely to be limited.From a global prospective, 2016 is a year of global political and economic events that were hardly expected by mainstream policymakers, businesspersons and academics alike. Both Brexit and Trump winning the General Election in the US marked a decadency of globalization since the cold war era.The driving force behind these events is the unequal nature of globalization process. In this round of "creative destruction", lower-middle class has benefited the least from globalization, who particularly welcome the political promises of the extremist on the political right wing. The sheer size of those group has changed the political landscape significantly and will continue to have important implications on international political economy. This long-term uncertainty in the coming year, along with the recovery of US economy and potential fiscal stimulus promoted by Trump, will further increase the returns on dollar assets.

We observe that Chinese economy remained stable. Firms are actively increasing the level of inventory; due to a recovery of external demand, trade surplus also widens. Both of these show that the demand side of the economy has been recovering, and the CPI and the PPI both go up. It is also expected that the fiscal deficit will enlarge next year mainly due to the planned increased expenditure on infrastructure, which will further support the economy in 2017. The stable fundamentals imply that RMB does not have the basis for large depreciation against the dollar. With the advancement of deleveraging in the financial market and the real estate sector, and the financial asset prices are making significant adjustments, reducing asset bubbles that have already existed and thus easing the depreciating pressure of RMB.

As the economy with the largest foreign exchange reserves in the world, China has the capability of maintaining RMB stability. Recently, the PBOC’s change of monetary policy stance has already reflecteditsintention to stabilize the pace of RMB depreciationas well as to promote deleveraging in the domestic financial market. Besides, the PBOC has sufficient capacity to smooth out the excessive volatility which coming from the outflows. To sum up, we believes that the RMB exchange rate will depreciate slowly in 2017. In the short term, there may be fluctuations, but the market expectations will eventually stabilizeafter this overreactions mostly due to the sentiments on the fiscal and monetary policy in the US. When coming to the impact of the RMB exchange rate on domestic bond yields, the depreciation of RMB is more likely to affect the market sentiment rather than bringing significant economic transmissions.