Gaston Gelos : Macroprudential policy taking stock and looking forward

2023-12-24 IMI

This is a speech by Gaston Gelos at CEPR Paris Symposium, Paris on 8 December 2023.

Gaston Gelos, Deputy Head, Monetary and Economic Department of the BIS.

It is a pleasure and an honour to be here today, celebrating the CEPR’s 40th anniversary.

I am going to speak about macroprudential policies: what we have learned so far about their effectiveness, ways of assessing their impact, challenges and the pending agenda. I will conclude with some brief thoughts on the current conjuncture.

Let me highlight upfront the three messages I would like to convey. First, macroprudential policy works and is under-utilised. Second, we have new ways of measuring its overall impact. And third, international cooperation to tackle pending non-bank regulation is key.

It may be useful to start with some definitions.

Macroprudential policy is the use of primarily prudential tools to limit systemic risk. Systemic risk, in turn, according to the BIS-Financial Stability Board (FSB)-IMF definition, is “a risk of disruption to financial services that is caused by an impairment of all or parts of the financial system and has the potential to have serious negative consequences for the real economy”. Note that this does not necessarily involve the failure of a financial institution.

The term “macroprudential” is about as old as the CEPR – it was first used by Peter Cooke in 1979. Andrew Crockett laid out key elements of macroprudential policy in a speech in 2000

(Crockett 2000), and a conceptual framework was put forward by Claudio Borio in 2003

(Borio 2003)). In a recent stock-taking paper (Biljanovska et al (2023)) we assess the evidence so far, and point to open questions.

Emerging market economies (EMEs) were early adopters of macroprudential policies – often implementing currency mismatch-related measures. After the Great Financial Crisis, advanced economies (AEs) implemented a range of macroprudential tools in the context of the Basel III reforms. These include the countercyclical capital buffer (CCyB), a capital surcharge for global systemically important banks (G-SIBs), and the total loss-absorbing capacity (TLAC) requirement. Many countries also adopted borrower-based tools, such as loan-to-value ratios (LTVs) and debt service-to-income ratios (DSTIs).

After years of tightening, the Covid-19 shock was a test of countries’ readiness to relax tools in stress periods. Currently, rising interest rates pose a new resilience test for the financial system (Graph 1).

Macroprudential tools vary a lot in their specific design, and are tailored to countries’ specific institutional, legal and other structural characteristics. As of mid-2022, the IMF counted 2,432

tools in place across 183 jurisdictions. Broad-based tools and measures for systemically important institutions were somewhat more popular in AEs. Liquidity measures were more important in EMEs, and they are often aimed at limiting FX risk (Graph 2).

Estimating the effects of macroprudential policies is difficult. A key reason is an endogeneity problem. Since macroprudential policy tends to respond to increases in credit and asset prices, it is often difficult to disentangle cause and effect. Recent studies use micro data or policy surprises to address this problem, and generally find large and highly significant effects, especially for borrower-based tools. Overall, we can say that macroprudential policy succeeds in reducing the build-up of vulnerabilities.

Let me give you a few more specific takeaways from the evidence:

• For household credit, the strongest effects come from LTVs, DSTIs, loan loss provisions (LLPs) and loan restrictions.

• The effects of macroprudential measures on house prices are weaker, but strongest from LTVs and LLPs.

• Capital requirements have weaker direct effects on house prices and credit.

A meta-analysis of many empirical studies shows average effects of tightening macroprudential measures on credit obtained through weighted least squares regressions; weights are proportional to the precision of each result (Graph 3). The quantitative results are not

straightforward to interpret, but it is interesting to see that the estimates based on micro data are generally larger, particularly for housing, liquidity and other measures. This reflects two effects: on the one hand, the fact that the micro studies are better able to overcome endogeneity problems (which typically lead to underestimating the impact), and, on the other hand, that aggregate data capture leakage and aggregate effects not measured with the micro data.

In our stocktaking exercise, we also conclude that the evidence strongly suggests that macroprudential policy can reduce adverse macro-financial feedback from shocks.

Let me give you a few specific examples:

• The release of countercyclical capital buffers can support credit through stress periods (Couaillier et al (2022)).

• Borrower-based tools can increase borrower resilience. Having DSTIs in place reduces households’ propensity to default around shocks (Nier et al (2019)).

• Macroprudential policy can reduce tail risks to output (Brandao-Marques et al (2020), Galan (2020)).

• In emerging market and developing economies (EMDEs), tighter regulation reduces the sensitivity of GDP to global financial conditions (Bergant et al (2020)).

Here is an illustration of this last point (Graph 4). A tighter level of regulation reduces the sensitivity of GDP growth to VIX movements and capital flow shocks. A broad set of macroprudential tools contribute to this result. This study by colleagues at the BIS and the IMF also finds that tighter macroprudential regulation allows monetary policy to respond more countercyclically to global financial shocks.

Overall, the effects of macroprudential policies are non-linear, but appear to hold up over time. Again, a few examples to illustrate the point:

• If the release of capital buffers generates additional “headroom” over and above minimum requirements, this can support lending.

• Tightening of borrower-based tools has diminishing marginal returns.

- DSTI ratio caps reduce default probability, but there is no additional benefit when tightening beyond certain thresholds (Nier et al (2019)).

- Resilience-building effects appear to hold up and strengthen over time. This is particularly true for borrower-based tools.

One important piece of good news is that the undesired side effects on consumption and output of a macroprudential tightening appear to be weak. This is true even for borrower- based tools (Alam et al (2019)). This means that macroprudential policy can often serve as a “surgical tool” to tackle specific vulnerabilities without broader adverse effects on the economy.

However, the news is not all good – there are sizeable “leakage” effects, with strong evidence of shifts to non-banks and foreign borrowing in response to macroprudential tightening of bank regulation (see eg Cizel et al (2019)). This underscores the benefits of expanding the perimeter of macroprudential action.

The Covid-19 shock was the first instance where macroprudential buffers were put to the test. What were the results? It became clear that banks were reluctant to breach regulatory capital ratios, even when this merely would have meant eating into usable buffers, with regulators encouraging them to do so. By contrast, the explicit release of CCyB and systemic buffers did support credit, especially for banks that would otherwise have been close to their regulatory thresholds. Of course, this means that you need a meaningful buffer space to release.

Overall, macroprudential policy clearly has a range of complex effects on borrowers, lenders and the economy as a whole. It has a “leaning against the wind” aspect, in the sense that it can stem excessive price and credit developments. But it can also build resilience, by building buffers that make the system more able to absorb adverse shocks.

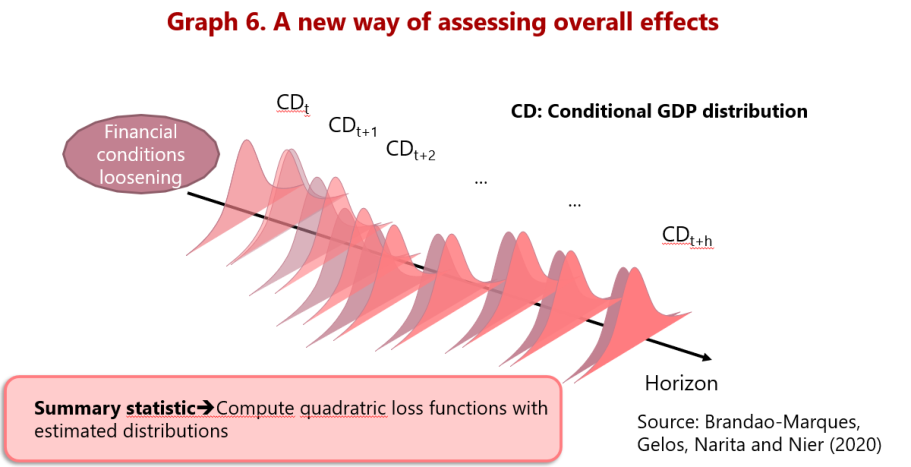

But what are the overall effects, not only in terms of reducing tail risks but, more generally, on the expected probability distribution of GDP over the medium term? This is obviously a difficult question. A paper I co-authored with Luis Brandao Marques, Erlend Nier and Machiko Narita develops a new approach to answer it, based on quantile regressions.

Let me explain the conceptual approach with some visuals, without going into details.

Here you see a stylised probability density of real GDP growth. Now, let's consider a sudden easing in financial conditions (Graph 5). This easing initially improves expected output growth in the near term, and shifts the distribution to the right.

However, this positive effect is temporary. In the medium term, the distribution typically shifts to the left, increasing the tail risks. Our question is how domestic policies can mitigate the impact on the entire distribution. Therefore, in a second step, we use loss functions to summarise the policy effects on the entire distribution.

Let me explain why we need a loss function using a dynamic chart.

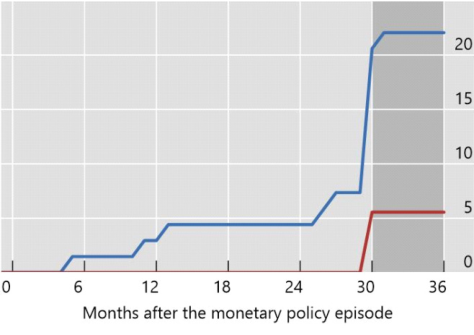

We estimate a path of estimated conditional distributions of real GDP growth in response to a loosening of financial conditions based on quantile regressions. We also have the estimated response with policy.

The next question is, how do we compare these paths of estimated distributions of future GDP growth with and without policies

In our study, we use a quadratic loss function, penalising the variance of output and inflation. On the x-axis, we have time (quarters). On the y-axis, we show the change in the losses compared with a situation where there was a loosening of financial conditions but no policy action. You can see that there is a considerable reduction in losses when macroprudential policies are tightened at the outset – and the effect builds up gradually and persists over time. The red line shows the effects of financial institution-based measures, the blue line that of broad-based measures.

Overall, what are the main takeaways on the evidence?

We have evidence of strong macroprudential policy benefits. Macroprudential policies can often be used as surgical tool without broader unintended side effects. Macroprudential policy also creates more room for monetary policy to focus on price stability. And it reduces the need to use FX intervention and capital controls in EMDEs.

In the light of the benefits, macroprudential policy may still be underused. Many jurisdictions have not yet built up countercyclical capital buffers. And the toolkit in many jurisdictions is still incomplete. For example, borrower-based tools are not in place everywhere.

So far, so good. But the use of macroprudential policies also entails many challenges. For one, further research is needed to help policymakers better calibrate tools. In addition, the assessment of risks is often difficult. Moreover, there is typically an inaction bias in the use of these policies – that is, a tendency to wait and see (CGFS (2023)).

The use of macroprudential policies also entails institutional and governance challenges. This is partly due to the often clear distributional consequences these policies may have on specific groups. Relatedly, the use of macroprudential policies often also entails political sensitivities – for example, when housing-related measures make it more difficult to purchase a home.

Moreover, cross-border activities and spillovers make international cooperation indispensable, which complicates matters. And lastly, targeting financial stability is more complicated in various ways than monetary policy – the target is not clearly visible, and the successes not obvious. It is not like targeting 2% inflation.

Let me now turn to the pending agenda.

The non-bank financial intermediary (NBFI) sector has grown considerably since the Great Financial Crisis – in particular, bond mutual funds. While a strong NBFI sector entails many benefits for the financial system, it also has its own vulnerabilities. I won’t go into all the different NBFI sectors and discuss risks and potential mitigants. In some cases, for example when it comes to open-ended mutual funds, these risks have been discussed widely for some years now. In other cases, they are newer and less obvious.

Let me just underscore that the March 2020 episode, when the NBFI sector amplified stress and required central bank support to calm markets, underlining the need for fundamental adjustments to the regulatory framework for NBFIs.

In this context, I’d like to now turn to the importance of international cooperation, highlighting the case of investment funds.

Mutual and other investment funds often entail significant cross-border activities (eg AE bond funds investing in EMEs, or AE commercial real estate funds investing across borders (ECB (2023), ESRB (2023)). But domestic regulators and supervisors do not generally internalise cross-border spillovers. The regulators of, say, a mutual fund industry in an AE or an offshore financial centre do not have the mandate to consider the impact funds’ activities may have, say, in an EME, where these funds may have a large footprint. Similarly, we have seen increased activity of cross-border commercial real estate funds influencing real estate dynamics in the countries in which they are investing, and potentially contributing to the build-up of vulnerabilities there. By contrast, domestically aimed macroprudential measures have international spillovers (Claessens et

al (2021a)). Another reason that internationally coordinated action is needed in this area is that fund domiciles can change quickly, evading the regulatory perimeter of any individual jurisdiction.

Therefore, international collaboration is key, and the Financial Stability Board (FSB) is taking the lead in many areas.

New frontiers in macroprudential policy include risks stemming from crypto/decentralised finance (DeFi), big tech/fintech and climate risks. I don’t have time to cover these areas today.

Turning to the current conjuncture, the full effects of higher yields yet remain to be seen in a context of widespread vulnerabilities, particularly related to high debt levels. Evidence shows that prudential tightening helps reduce the likelihood of financial stress and leaves monetary policy more space to fight inflation (Graph 8). Consequently, macroprudential policy needs to be kept tight for as long as possible, or even tightened further where appropriate. In addition, we need to implement Basel III in full, without delay, and strengthen supervision.

Graph 8. Crisis frequency and capital requirements

Source: Boissay, Borio, Leonte and Shim (2023)

Let me conclude. As the cumulative evidence has shown, macroprudential policy is effective – and overall, it is underutilised. It can alleviate the burden for monetary policy, allowing more headroom to respond to economic shocks.

While it is difficult to identify the effects of macroprudential policy with precision, a new way of assessing its overall effects over a longer time horizon and comparing policies gives us a clearer picture of the benefits as well as the undesired consequences. International spillovers pose a challenge for regulation, particularly for the NBFI sector. In the light of existing vulnerabilities, at this point, it is still important to keep macroprudential policies tight.

Thank you very much.