Dong Jinyue and Xia Le: How Resilient Is the Economy to Housing Price Fall?

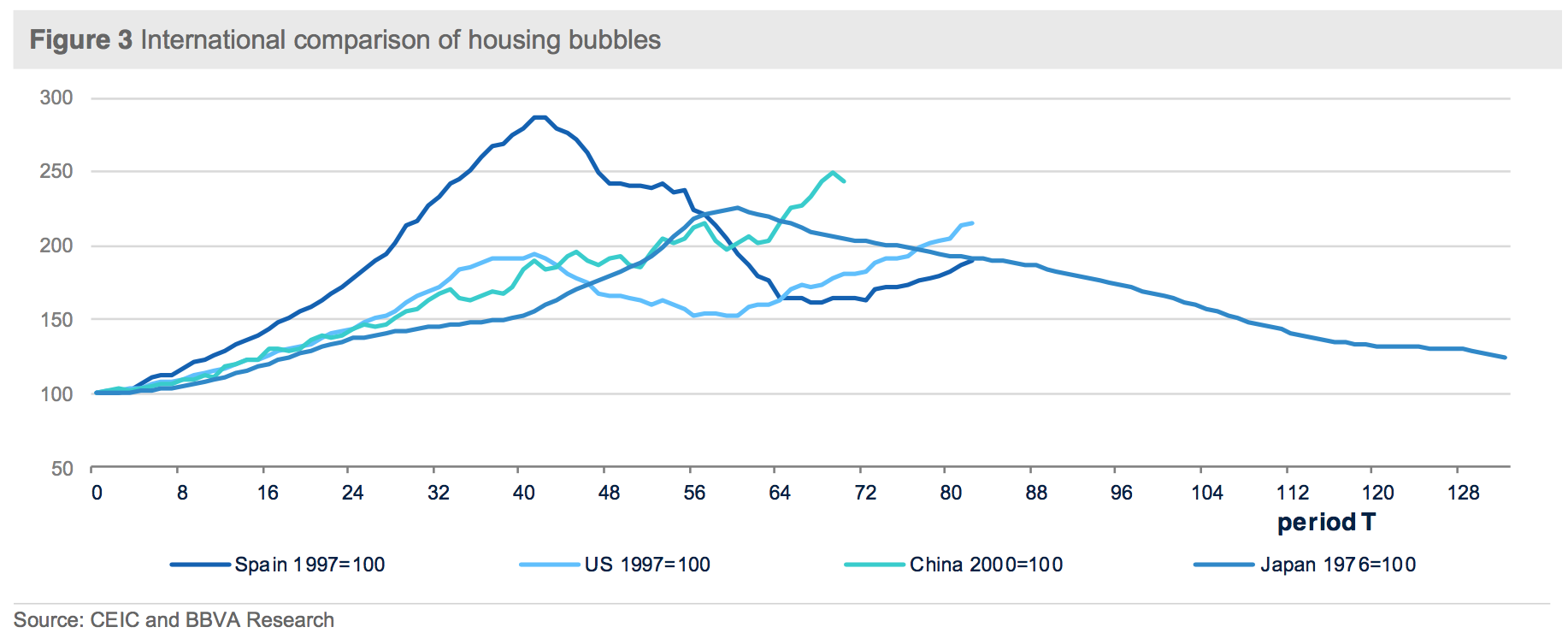

2018-04-25 IMI Despite the recent slow-down since mid-2016, the housing bubble of China still appears sizable compared with some precedents in advanced countries. (Figure 3) Indeed, the current China housing price index has already surpassed the peak prices in Japan and the US, although it still falls behind Spain.

Despite the recent slow-down since mid-2016, the housing bubble of China still appears sizable compared with some precedents in advanced countries. (Figure 3) Indeed, the current China housing price index has already surpassed the peak prices in Japan and the US, although it still falls behind Spain.

How growth reacts to the housing price slowdown?

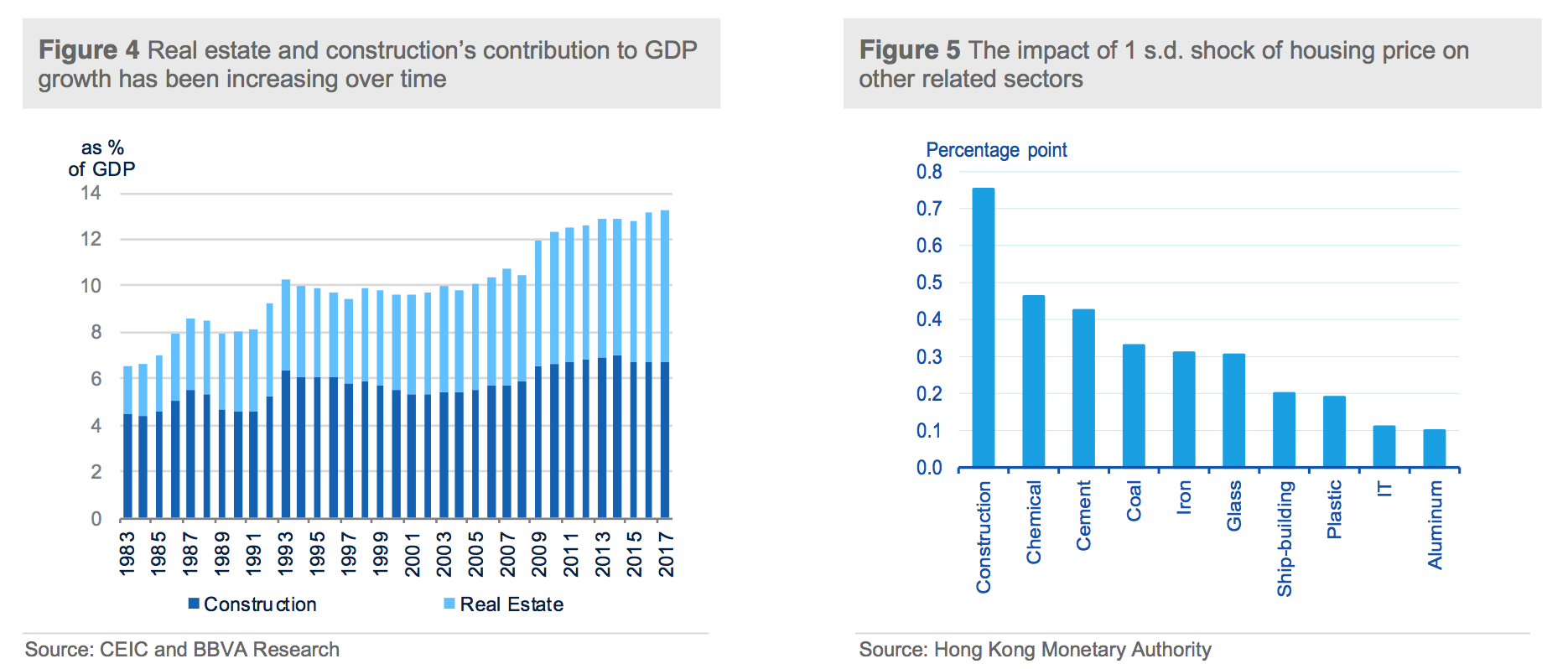

China’s real estate sector remains the focus of intense interest given its large contribution to economic growth, its relevance of the banking sector stability, government revenue, enterprises and its social implications for households. Regarding the aggregate growth, real estate and construction sector contributes around 13% of the total GDP in 2016. (Figure 4) This ratio seems a bit lower but quite comparable with the ratio in the US (17.2%), Japan (17.5%) and Germany (15.7%). Taking into account of its strong linkages to its upstream and downstream sectors (Figure 5), real estate related industries are estimated to contribute around 25% of GDP.

Housing price could fall into a declining zone and will remain sluggish for a few years, which will unavoidably take a toll on economic growth. A natural question to ask is how large the price decreasing will lead to a recession of the economy. However, it is a challenging question that to what extent the fall in housing prices will lead to a recession of the economy given different model set-ups and understanding of the economic linkages. Some research work, which depends much less on structure models, concluded that roughly a 10% drop in property prices leads to a 1% drop in GDP growth in “normal times” (using past data to predict the future) in the short term (1-2 quarters).

Among the research on this topic, some research paper[1] develops a theory of Bubble Economics (non-linear and often “systemic” forces which cause significant misallocations of resources) to estimate this effect. Their theory draws on the standard elements of most stories of Bubble Economics, looking at the way banking, construction, savings/investment, local government and equities sectors interact. Their conclusion shows that a 15%-20% property price drop could cause recession (generally defined as two consecutive quarters of negative economic growth, as measured by the seasonal adjusted quarter-on-quarter figures for real GDP), if China’s economy resembles other large economies having already experienced property-related asset crises.

How growth reacts to the housing price slowdown?

China’s real estate sector remains the focus of intense interest given its large contribution to economic growth, its relevance of the banking sector stability, government revenue, enterprises and its social implications for households. Regarding the aggregate growth, real estate and construction sector contributes around 13% of the total GDP in 2016. (Figure 4) This ratio seems a bit lower but quite comparable with the ratio in the US (17.2%), Japan (17.5%) and Germany (15.7%). Taking into account of its strong linkages to its upstream and downstream sectors (Figure 5), real estate related industries are estimated to contribute around 25% of GDP.

Housing price could fall into a declining zone and will remain sluggish for a few years, which will unavoidably take a toll on economic growth. A natural question to ask is how large the price decreasing will lead to a recession of the economy. However, it is a challenging question that to what extent the fall in housing prices will lead to a recession of the economy given different model set-ups and understanding of the economic linkages. Some research work, which depends much less on structure models, concluded that roughly a 10% drop in property prices leads to a 1% drop in GDP growth in “normal times” (using past data to predict the future) in the short term (1-2 quarters).

Among the research on this topic, some research paper[1] develops a theory of Bubble Economics (non-linear and often “systemic” forces which cause significant misallocations of resources) to estimate this effect. Their theory draws on the standard elements of most stories of Bubble Economics, looking at the way banking, construction, savings/investment, local government and equities sectors interact. Their conclusion shows that a 15%-20% property price drop could cause recession (generally defined as two consecutive quarters of negative economic growth, as measured by the seasonal adjusted quarter-on-quarter figures for real GDP), if China’s economy resembles other large economies having already experienced property-related asset crises.

Gauging different sectors’ resilience to housing prices correction

It is important to measure how vulnerable are different sectors including government, banking, enterprises and households to the prospective price slowdown in the housing market.

Gauging different sectors’ resilience to housing prices correction

It is important to measure how vulnerable are different sectors including government, banking, enterprises and households to the prospective price slowdown in the housing market.

- Land sales is an important source of government’s revenues, decreasing with housing price

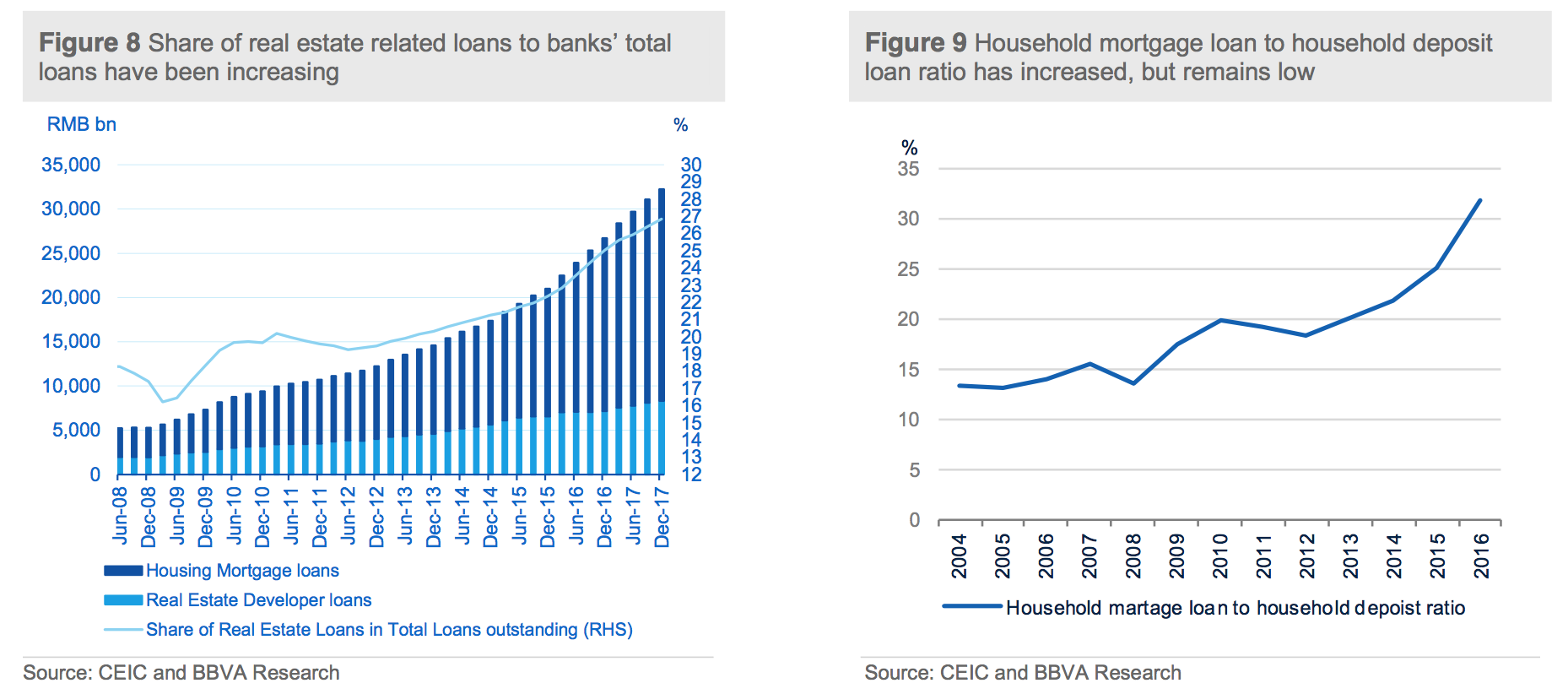

- Banks’ exposure on housing has been increasing with manageable risks

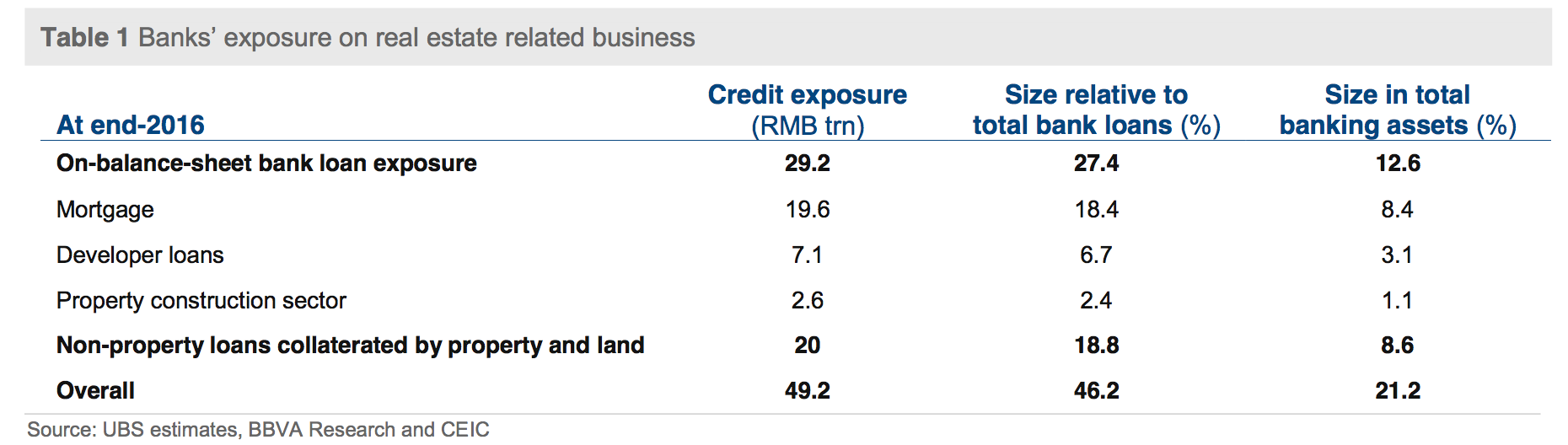

The risk of housing market slowdown on the banking sector seems limited at the current stage. Banks have a strict requirement for minimum down payment of housing mortgage, most of time at 30% of the housing value. Meanwhile, household’s mortgage loan to household deposit ratio, although increasing in the recent years to around 33%, is also low, indicating that housing mortgage can be covered by a small fraction of household deposits. (Figure 9) Although banks’ lending to real estate sector has been rising over time, the related risks are still manageable. Comparatively, the vulnerable part could be the credit exposure through the shadow banking activities, which are notoriously risky for their lack of transparency and high leverage.

The risk of housing market slowdown on the banking sector seems limited at the current stage. Banks have a strict requirement for minimum down payment of housing mortgage, most of time at 30% of the housing value. Meanwhile, household’s mortgage loan to household deposit ratio, although increasing in the recent years to around 33%, is also low, indicating that housing mortgage can be covered by a small fraction of household deposits. (Figure 9) Although banks’ lending to real estate sector has been rising over time, the related risks are still manageable. Comparatively, the vulnerable part could be the credit exposure through the shadow banking activities, which are notoriously risky for their lack of transparency and high leverage.

Housing market’s influences on firms

China’s spectacular real estate boom might have some deep implications for resource allocation of the corporate sector. In particular, firms could increase their investment in properties during booming years to gain profits even these activities are unrelated to their main business. In addition, banks may be also influenced in deciding to allocate credit to firms (with or without real estate, and the amount of the properties they have) given that properties are collaterals favored by banks during the housing boom.

According to the listed firms’ financial statement, Chinese firms’ aggregate land value to total assets was averagely around 2.6% during 2013-2015, and it marginally decreased to 2.4% in 2016. Land value to gross sales ratio was around 7.3% during 2013-2015 and significantly accelerated to 10.4% in 2016. Although these figures are not as high as those of some advanced countries (for instance, in Japan, they are 19.3% and 27.3% respectively even in 1980s, according to the paper of Serdar Dinc and Patrick Mcguire, 2004[2]), it has been increasing over time during the past decades, indicating firms’ willingness to involve in the real estate sector. (Table 2)

Housing market’s influences on firms

China’s spectacular real estate boom might have some deep implications for resource allocation of the corporate sector. In particular, firms could increase their investment in properties during booming years to gain profits even these activities are unrelated to their main business. In addition, banks may be also influenced in deciding to allocate credit to firms (with or without real estate, and the amount of the properties they have) given that properties are collaterals favored by banks during the housing boom.

According to the listed firms’ financial statement, Chinese firms’ aggregate land value to total assets was averagely around 2.6% during 2013-2015, and it marginally decreased to 2.4% in 2016. Land value to gross sales ratio was around 7.3% during 2013-2015 and significantly accelerated to 10.4% in 2016. Although these figures are not as high as those of some advanced countries (for instance, in Japan, they are 19.3% and 27.3% respectively even in 1980s, according to the paper of Serdar Dinc and Patrick Mcguire, 2004[2]), it has been increasing over time during the past decades, indicating firms’ willingness to involve in the real estate sector. (Table 2)

Two more channels for a real estate boom might affect enterprises as well[3]: First is the collateral channel, which relaxes financial constraints faced by land-holding firms. Given that these firms could always use their properties as collateral to borrow from banks, their leverage ability is strengthened as the housing price increasing. The second is the crowding-out channel, as housing market boom may crowd out bank financing to non-land-holding firms. Given that those firms might be efficient in terms of business operations etc., this crowding-out effect makes distortions on resource allocation in China.

Altogether, given the firms’ behavior to be more involved in the housing market during the housing price boom, the current housing price slowdown due to the authorities’ tightening measures will definitely influence these firms’ balance sheets from an opposite side.

Two more channels for a real estate boom might affect enterprises as well[3]: First is the collateral channel, which relaxes financial constraints faced by land-holding firms. Given that these firms could always use their properties as collateral to borrow from banks, their leverage ability is strengthened as the housing price increasing. The second is the crowding-out channel, as housing market boom may crowd out bank financing to non-land-holding firms. Given that those firms might be efficient in terms of business operations etc., this crowding-out effect makes distortions on resource allocation in China.

Altogether, given the firms’ behavior to be more involved in the housing market during the housing price boom, the current housing price slowdown due to the authorities’ tightening measures will definitely influence these firms’ balance sheets from an opposite side.

- Housing is the most important asset for Chinese households

Moreover, in the past years of housing boom, the demand of housing has been largely from the “speculative” households, especially in the tier-1 and tier-2 cities. This speculation behavior on the housing market led to an expansion of household mortgage loans, which increased by 22.4% from end-2016 to end-2017. The default risk of housing mortgage will be rising if housing price decelerated.

Housing price boom also leads to household wealth inequality across the whole society. An ADBI working paper[4] examines the issue of the widening wealth inequality in China from the perspective of housing. Using CHFS data from 2011, they find the wealth inequality including housing is much larger than income inequality. Housing value appreciation, in particular, contributes to wealth inequality by allowing households to enjoy equity market premium through investing more in equity markets and taking a higher position in risky assets.

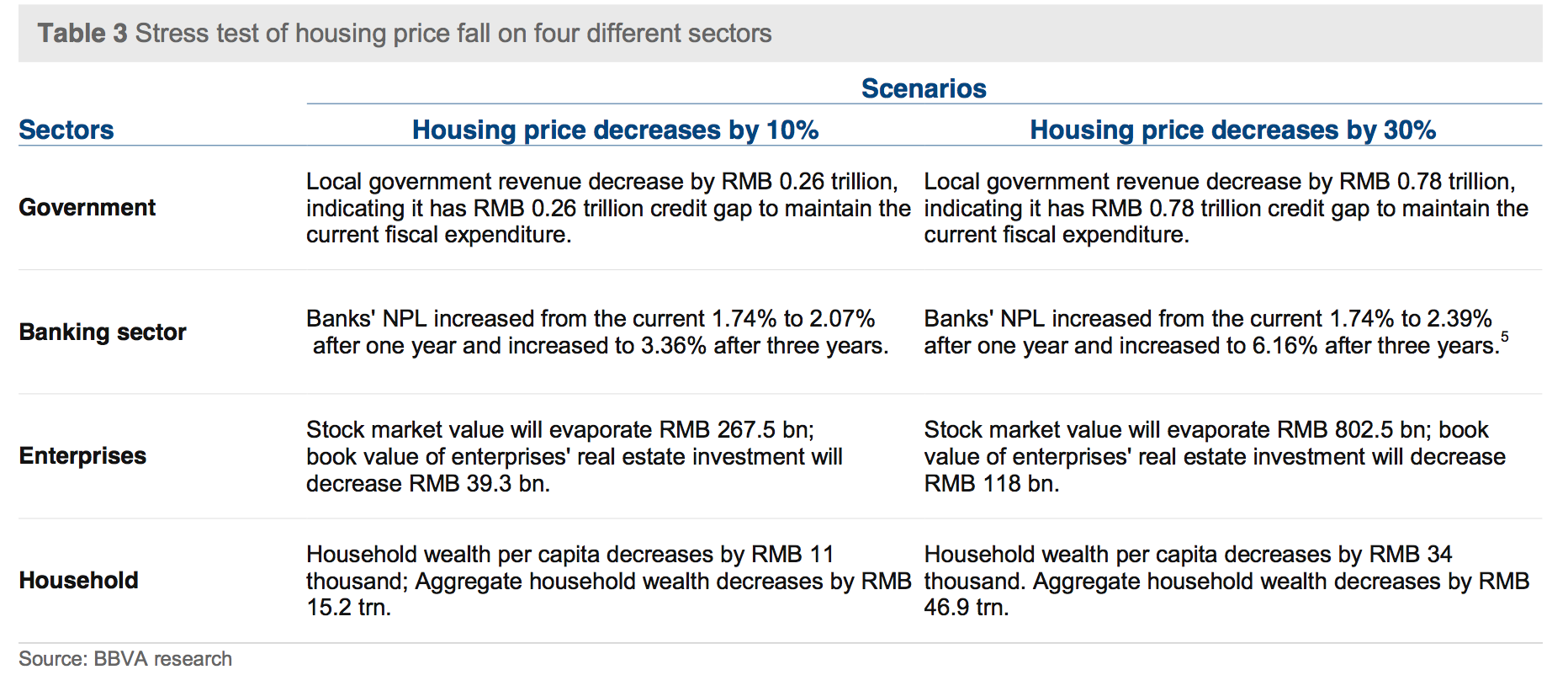

A stress test: the impact of housing price slowdown on four economic sectors

After analyzing the four economic sectors’ exposure to housing market above, we want to quantitatively assess the impact of housing price slowdown on these four sectors in order to evaluate how resilient of these sectors to housing price drop.

We assume two scenarios: in the first scenario, housing price drops by 10%; while in the second one, housing price drops by 30%. We analyze the influences of housing price drop on the wealth of government, enterprises, banking sector and household based on these sectors’ exposure on real estate market. (Table 3) Some background information and assumptions for each sector as below:

Government: Property and land related revenue contributes around 30% to local government’s total revenue in 2016, which was RMB 8.7 trillion.

Banking sector: Several transmission channels for housing price decreasing to banks’ NPL ratio: (i) housing price decreasing leads to banks’ assets decline; (ii) housing price decreasing indicates the deterioration of housing developers’ balance sheet, affecting their ability to pay back; (iii) housing price decline leads to the value of banks’ housing collateral value shrinking. Our estimation of housing price decreasing’s influence on banking sector’s NPL ratio is based on the VECM stress test model developed by Ping An Securities Research Department. (see footnote 5)

Firms: In 2016, total book value for real estate investment by enterprises (excluding banking and real estate firms) was RMB 393.4 billion; Given the average 2016 PB ratio at 6.8, housing price decreasing will lead to 6.8 times of real estate investment loss transiting for stock market value evaporation.

Household: In 2016, China's household assets per capita is RMB 0.17 million; among which, 66% is housing asset (RMB 0.11 million).

Moreover, in the past years of housing boom, the demand of housing has been largely from the “speculative” households, especially in the tier-1 and tier-2 cities. This speculation behavior on the housing market led to an expansion of household mortgage loans, which increased by 22.4% from end-2016 to end-2017. The default risk of housing mortgage will be rising if housing price decelerated.

Housing price boom also leads to household wealth inequality across the whole society. An ADBI working paper[4] examines the issue of the widening wealth inequality in China from the perspective of housing. Using CHFS data from 2011, they find the wealth inequality including housing is much larger than income inequality. Housing value appreciation, in particular, contributes to wealth inequality by allowing households to enjoy equity market premium through investing more in equity markets and taking a higher position in risky assets.

A stress test: the impact of housing price slowdown on four economic sectors

After analyzing the four economic sectors’ exposure to housing market above, we want to quantitatively assess the impact of housing price slowdown on these four sectors in order to evaluate how resilient of these sectors to housing price drop.

We assume two scenarios: in the first scenario, housing price drops by 10%; while in the second one, housing price drops by 30%. We analyze the influences of housing price drop on the wealth of government, enterprises, banking sector and household based on these sectors’ exposure on real estate market. (Table 3) Some background information and assumptions for each sector as below:

Government: Property and land related revenue contributes around 30% to local government’s total revenue in 2016, which was RMB 8.7 trillion.

Banking sector: Several transmission channels for housing price decreasing to banks’ NPL ratio: (i) housing price decreasing leads to banks’ assets decline; (ii) housing price decreasing indicates the deterioration of housing developers’ balance sheet, affecting their ability to pay back; (iii) housing price decline leads to the value of banks’ housing collateral value shrinking. Our estimation of housing price decreasing’s influence on banking sector’s NPL ratio is based on the VECM stress test model developed by Ping An Securities Research Department. (see footnote 5)

Firms: In 2016, total book value for real estate investment by enterprises (excluding banking and real estate firms) was RMB 393.4 billion; Given the average 2016 PB ratio at 6.8, housing price decreasing will lead to 6.8 times of real estate investment loss transiting for stock market value evaporation.

Household: In 2016, China's household assets per capita is RMB 0.17 million; among which, 66% is housing asset (RMB 0.11 million).

Conclusion

After analyzing the linkages between property market and banking sector, government, enterprises and household, together with the macro economy as a whole, we do not believe bubble burst or “housing market collapsing” story will hold at the current stage. Given the powerful market intervention ability of Chinese authorities on land market, housing market and credit market, the nationwide housing market collapse is almost impossible.

However, although a nationwide housing market collapse or financial crisis might be circumvented, some important caveats are noteworthy: First, in terms of economic growth, the on-going tightening measures will certainly drag on growth, although not a “collapse”, given property sector’s complicated linkages to other sectors. This gives the authorities a long-lasting challenge to balance a decent growth figure and financial stability. Second, a more significant problem of the current housing market is that it leads to an imbalanced wealth distribution. For instance, the incredible high housing prices in tier-1 cities have led to many straight conflicts between households with property and the ones without it, between people in urban and rural areas, between inter-generations etc. These imbalances, in the long term, will lead to many serious social conflicts and eventually shrink the policy room of maneuvering the property market. Third, the current high housing prices also increases the labor cost, suppressing urbanization process. In addition, the property market’s crowding-out effect to other sectors also might drag on the economic growth as a whole.

[1] B. Michael and S. Zhao (2016), “Bubble Economics: How Big a Shock to China’s Real Estate Sector Will Throw the Country into Recession, and Why Does It Matter?” Lincoln Institute of Land Policy, working paper, WP16BM1.

[2] Serdar Dinc and Patrick McGuire (2004), “Did investors regard real estate as “safe” during the “Japanese Bubble” in the 1980s?”, Bank for International Settlements, working paper No. 164.

[3] T. Chen, L. Liu, W.Xiong and L. Zhou (2017), “Real estate boom and misallocation of capital in China”, working paper, Peking University.

[4] S. Li, J. Li and A. Ouyang (2017), “Housing and household wealth inequality: evidence from People’s Republic of China”, Asian Development Bank Institute, working paper series No. 671.

[5] More detailed analysis of this test about housing price slowdown on banking sector could be found in Zhang Ming, W Wei and X. Chen (2017), “Will housing price slowdown lead to banking crisis”, Ping An Securities Research Department report, Chinese version

Conclusion

After analyzing the linkages between property market and banking sector, government, enterprises and household, together with the macro economy as a whole, we do not believe bubble burst or “housing market collapsing” story will hold at the current stage. Given the powerful market intervention ability of Chinese authorities on land market, housing market and credit market, the nationwide housing market collapse is almost impossible.

However, although a nationwide housing market collapse or financial crisis might be circumvented, some important caveats are noteworthy: First, in terms of economic growth, the on-going tightening measures will certainly drag on growth, although not a “collapse”, given property sector’s complicated linkages to other sectors. This gives the authorities a long-lasting challenge to balance a decent growth figure and financial stability. Second, a more significant problem of the current housing market is that it leads to an imbalanced wealth distribution. For instance, the incredible high housing prices in tier-1 cities have led to many straight conflicts between households with property and the ones without it, between people in urban and rural areas, between inter-generations etc. These imbalances, in the long term, will lead to many serious social conflicts and eventually shrink the policy room of maneuvering the property market. Third, the current high housing prices also increases the labor cost, suppressing urbanization process. In addition, the property market’s crowding-out effect to other sectors also might drag on the economic growth as a whole.

[1] B. Michael and S. Zhao (2016), “Bubble Economics: How Big a Shock to China’s Real Estate Sector Will Throw the Country into Recession, and Why Does It Matter?” Lincoln Institute of Land Policy, working paper, WP16BM1.

[2] Serdar Dinc and Patrick McGuire (2004), “Did investors regard real estate as “safe” during the “Japanese Bubble” in the 1980s?”, Bank for International Settlements, working paper No. 164.

[3] T. Chen, L. Liu, W.Xiong and L. Zhou (2017), “Real estate boom and misallocation of capital in China”, working paper, Peking University.

[4] S. Li, J. Li and A. Ouyang (2017), “Housing and household wealth inequality: evidence from People’s Republic of China”, Asian Development Bank Institute, working paper series No. 671.

[5] More detailed analysis of this test about housing price slowdown on banking sector could be found in Zhang Ming, W Wei and X. Chen (2017), “Will housing price slowdown lead to banking crisis”, Ping An Securities Research Department report, Chinese version