Steve H. Hanke: Follow the Founders and Privatize Public Lands

2017-12-25 IMI It’s time to embrace the Founders’ principles and vision for land ownership in the United States. The federal government’s commercial grazing lands and timberlands should be privatized. We are not talking about national parks, wildlife refuges, national conservation areas, national monuments, wilderness areas, national historic sites, national memorials, national battlefields, national recreational areas, wild and scenic rivers, national seashores and lake shores, and national trails. These lands would be excluded from privatization. But, the lands managed by the Department of Defense (DOD), which amount to some 11.4 million acres, are in a separate category. Some of the DOD managed property is clearly “surplus” and should be included in any privatization initiative.

Not only would such a privatization program be desirable in principle, but it would generate significant benefits.

It’s time to embrace the Founders’ principles and vision for land ownership in the United States. The federal government’s commercial grazing lands and timberlands should be privatized. We are not talking about national parks, wildlife refuges, national conservation areas, national monuments, wilderness areas, national historic sites, national memorials, national battlefields, national recreational areas, wild and scenic rivers, national seashores and lake shores, and national trails. These lands would be excluded from privatization. But, the lands managed by the Department of Defense (DOD), which amount to some 11.4 million acres, are in a separate category. Some of the DOD managed property is clearly “surplus” and should be included in any privatization initiative.

Not only would such a privatization program be desirable in principle, but it would generate significant benefits.

- The productivity of privatized lands would increase. With private ownership, it would be possible to obtain more commercial, recreational, and environmental outputs than with federal ownership. For example, in a study of timberlands in Western Oregon, I found that the value of those public lands would increase 13-fold if they were privately owned.

- With increased productivity, not only would the value of lands be increased, but employment and economic activity would also be enhanced with private ownership.

- Consumers would be served more effectively, and lands would be allocated to their most highly valued uses. After all, the only way that private-land owners can profit from their property is to employ it for the satisfaction of other people’s wants. Serving consumers, of course, is the social function of private property. Private consumers and producers, not politicians and bureaucrats, would call the tune. The politicization of land use would be swept aside, and the political controversies that accompany public land ownership would be swept aside, too.

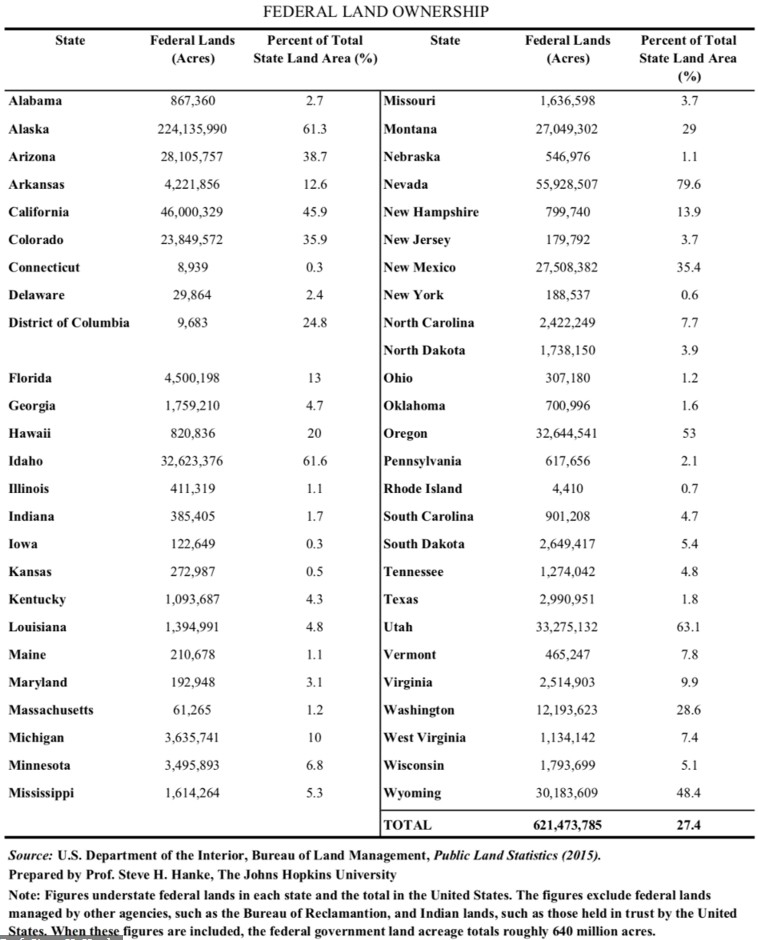

- Land sales would generate revenues for the federal government. These could be earmarked to pay down the federal debt of $20.2 trillion. To give some idea of the magnitude of a potential debt write down, consider that federal lands, excluding mineral rights and oil and gas, have been estimated by theS. Office of Management and Budget to be as high as $1.04 trillion.

- The annual federal costs (which incorrectly omit capital carrying charges) exceed the annual revenues generated from federal lands by a wide margin. Indeed, excluding mineral and oil and gas income, the revenues from public lands are $1.1 billion. These revenues are swamped by costs of $14.6 billion. Talk about a negative cash flow. Privatization would eliminate this negative cash flow for the federal government. This would benefit all United States taxpayers, who must now pay taxes to support the federal government’s retention of federal lands.

- A state and local tax base would be created, and in-lieu transfer payments from Washington would be reduced.

- Land-use decisions would become less politicized. Both commercial and non-commercial land users would spend less of their time and money attempting to obtain land-use rights through political and bureaucratic processes.