Hong Hao: A Lifeline for the Market

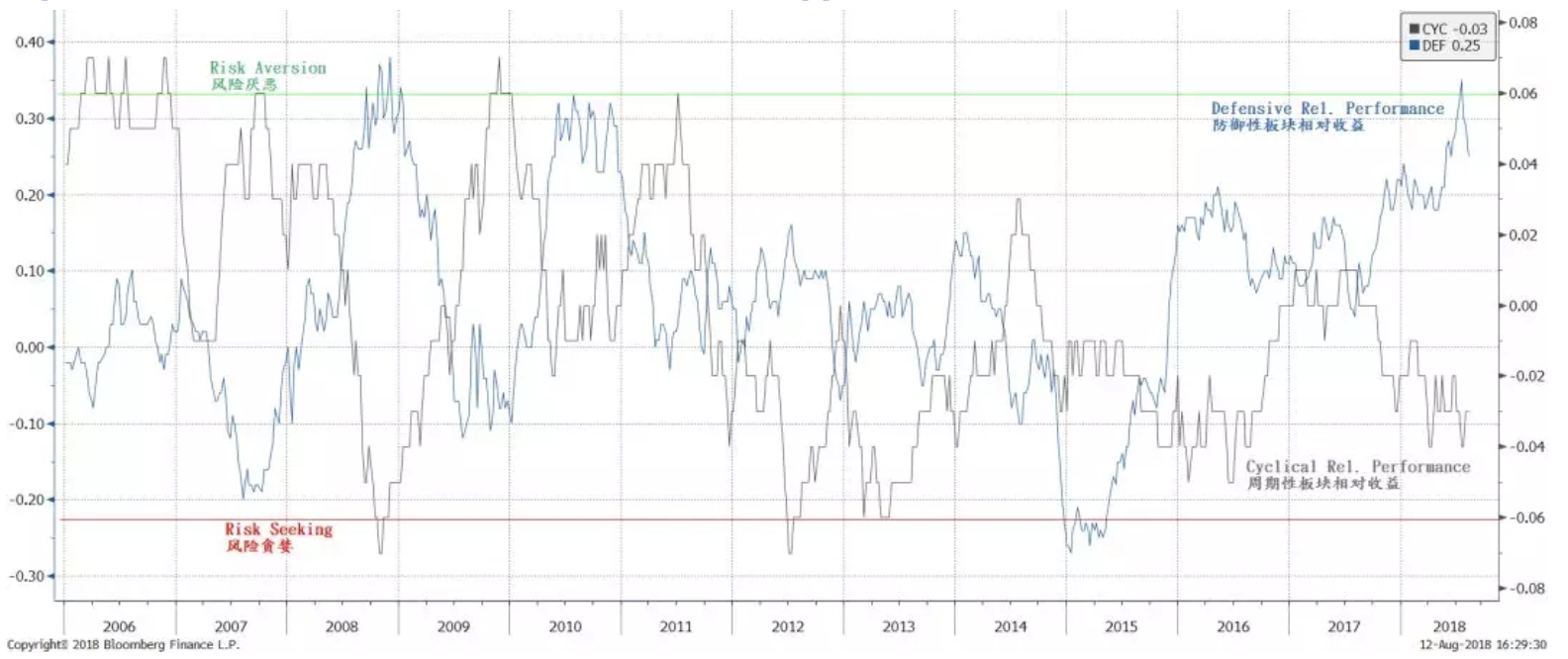

2018-08-16 IMI Figure 2: Defensive relative performance also suggests risk aversion

Figure 2: Defensive relative performance also suggests risk aversion

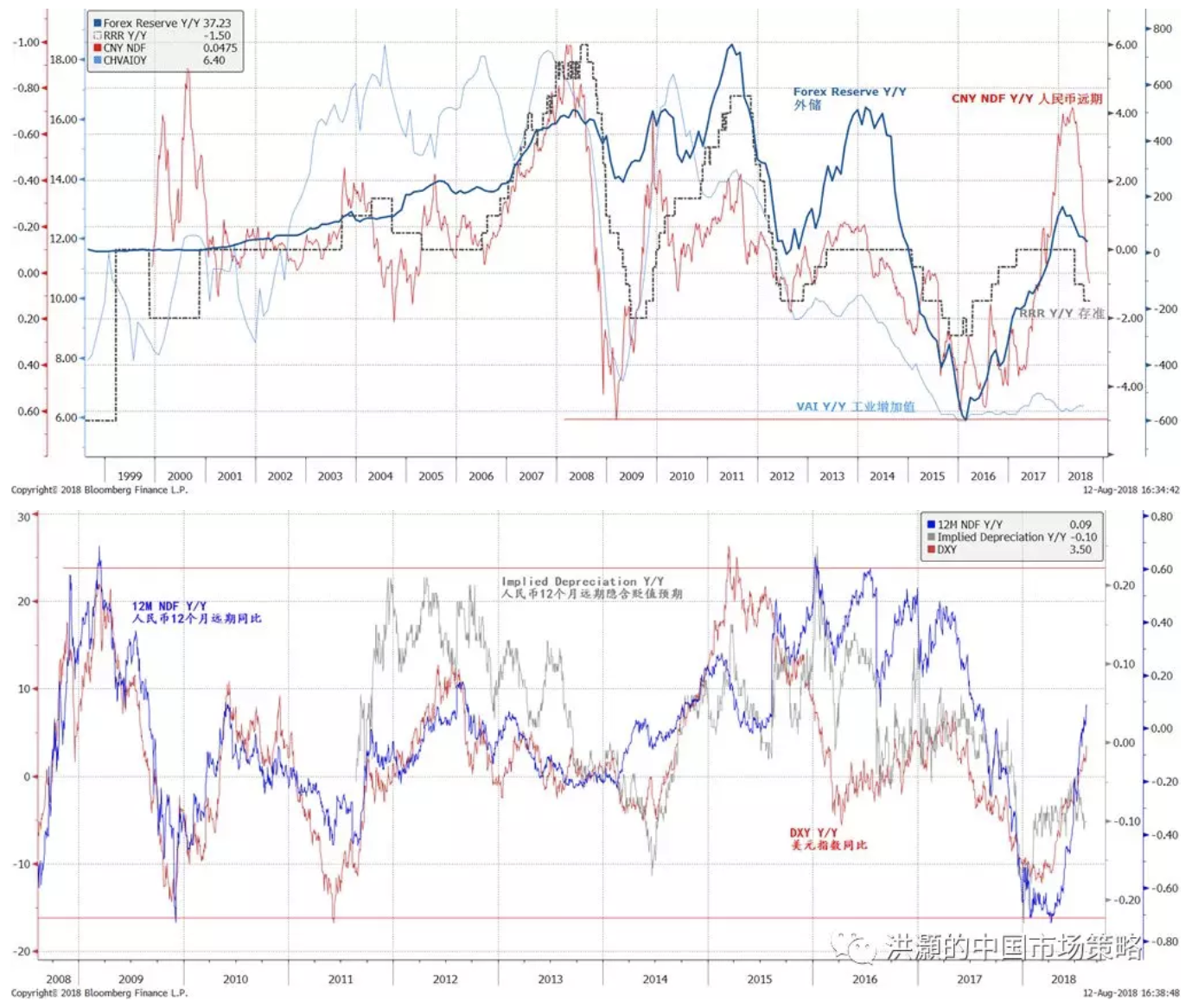

In our 2H18 outlook report “Rough Sailing”, we wrote about a likely recovery in infrastructure spending in the second half, as well as easing of monetary conditions to support bank lending (20180521). At the time of writing our second-half outlook, we believed that the plunge of infrastructure spending in the first half was not sustainable, and infrastructure spending should be once again deployed to support economic growth. Further, as loan demand recovered in the second half, some smaller banks with low reserves would find it challenging to expand lending. As such, more RRR cuts, as well as further yuan weakness, were likely (Figure 3). Already, we have seen one 50bp RRR cut in late June – one month after our report. And the yuan has weakened substantially.

Figure 3: Further RRR cut likely; the yuan has a well-defined trading range, and is set to depreciate further

In our 2H18 outlook report “Rough Sailing”, we wrote about a likely recovery in infrastructure spending in the second half, as well as easing of monetary conditions to support bank lending (20180521). At the time of writing our second-half outlook, we believed that the plunge of infrastructure spending in the first half was not sustainable, and infrastructure spending should be once again deployed to support economic growth. Further, as loan demand recovered in the second half, some smaller banks with low reserves would find it challenging to expand lending. As such, more RRR cuts, as well as further yuan weakness, were likely (Figure 3). Already, we have seen one 50bp RRR cut in late June – one month after our report. And the yuan has weakened substantially.

Figure 3: Further RRR cut likely; the yuan has a well-defined trading range, and is set to depreciate further

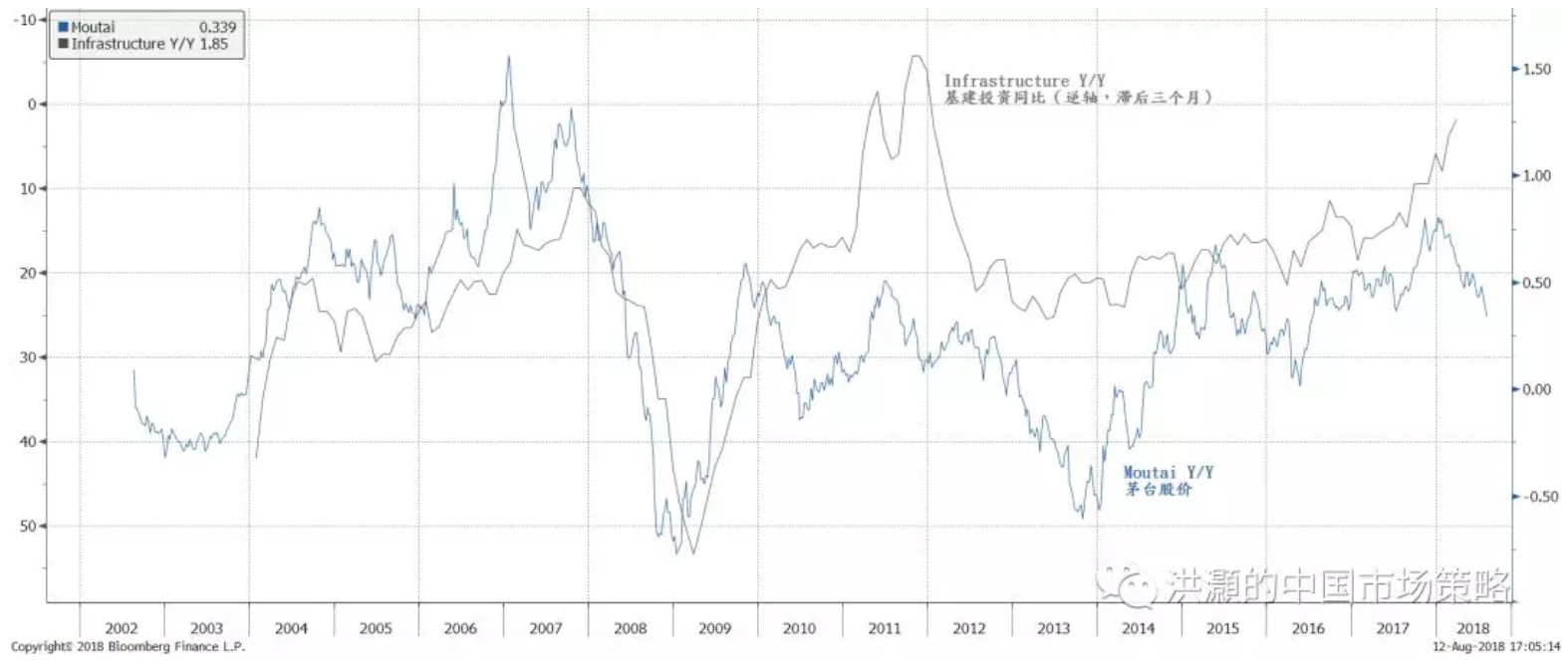

We have found a unique relationship between the stock performance of Moutai, the famous national liquor of China, and infrastructure spending. It appears that Moutai is a good forward indicator of the country’s infrastructure spending. The strong performance of the company tends to lead infrastructure spending by one or two quarters (Figure 4). While such relationship could be spurious, “Moutai greases the wheels”, as an old saying in the Chinese market goes.

Figure 4: The relationship between Moutai and infrastructure investment hints at infrastructure uptick

We have found a unique relationship between the stock performance of Moutai, the famous national liquor of China, and infrastructure spending. It appears that Moutai is a good forward indicator of the country’s infrastructure spending. The strong performance of the company tends to lead infrastructure spending by one or two quarters (Figure 4). While such relationship could be spurious, “Moutai greases the wheels”, as an old saying in the Chinese market goes.

Figure 4: The relationship between Moutai and infrastructure investment hints at infrastructure uptick

But such monetary priming will not resolve the secular challenges that China’s economy is confronting. Widening wealth gap is increasingly limiting the social mobility of the hoi polloi at the lower social strata. At a time when the practice of principal guarantee is being unwound, property has become one of the few assets of which the implicit guarantee remains intact. The property sector has simply become too big to fail. Such belief will drive an even bigger crowd longing for a better life to punt on property, delaying the fate that may have become difficult to escape.

But such monetary priming will not resolve the secular challenges that China’s economy is confronting. Widening wealth gap is increasingly limiting the social mobility of the hoi polloi at the lower social strata. At a time when the practice of principal guarantee is being unwound, property has become one of the few assets of which the implicit guarantee remains intact. The property sector has simply become too big to fail. Such belief will drive an even bigger crowd longing for a better life to punt on property, delaying the fate that may have become difficult to escape.