Dong Jingyue and Xia Le:RMB Depreciation——This Time is Different

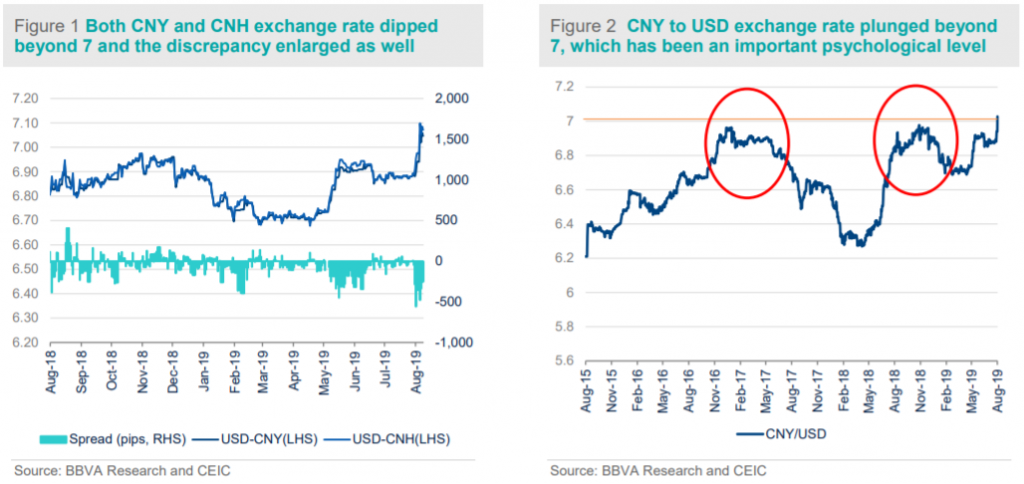

2019-08-20 IMI The policy motivations behind the sharp depreciation are multifold. First, it is in response to President Donald Trump’s tariff threat. The currency appreciation implied that Chinese policymakers will take a tougher stance on the ever-escalating trade dispute with the US. In the past, China's authorities painstakingly kept the currency stable so as to alleviate President Trump's critique of currency manipulation. Second, through currency depreciation, China’s authorities have released more policy room in case of further deterioration in external environment. Despite the significant slowdown in growth momentum, China has been refrained from using monetary policy easing to stimulate the economy. The concern of maintaining exchange rate stability is one of important reasons why the authorities are reluctant to loosen its monetary policy further. The break of the 7 level in the exchange rate has in essence rendered more policy room to the authorities. In future, they will have more freedom to use monetary policy tool to cushion the shock from trade tension escalation.

Will the depreciation lead to financial turmoil as in 2015?

This time is different The sharp depreciation is reminiscent of the infamous episode of RMB devaluation four years ago. On August 11th 2015, the People’s Bank of China (PBoC) attempted to introduce a market-based pricing mechanism of the RMB in a bid to offset the then intensifying growth headwinds through currency depreciation. The reforming efforts proved to be unsuccessful just in a couple of weeks after the devaluation itself caused unexpected financial turmoil. Massive capital outflows, primarily driven by market panic, led to a vicious circle of capital flight and currency depreciation. The PBoC finally had to roll back the short-lived pricing mechanism.

The policy motivations behind the sharp depreciation are multifold. First, it is in response to President Donald Trump’s tariff threat. The currency appreciation implied that Chinese policymakers will take a tougher stance on the ever-escalating trade dispute with the US. In the past, China's authorities painstakingly kept the currency stable so as to alleviate President Trump's critique of currency manipulation. Second, through currency depreciation, China’s authorities have released more policy room in case of further deterioration in external environment. Despite the significant slowdown in growth momentum, China has been refrained from using monetary policy easing to stimulate the economy. The concern of maintaining exchange rate stability is one of important reasons why the authorities are reluctant to loosen its monetary policy further. The break of the 7 level in the exchange rate has in essence rendered more policy room to the authorities. In future, they will have more freedom to use monetary policy tool to cushion the shock from trade tension escalation.

Will the depreciation lead to financial turmoil as in 2015?

This time is different The sharp depreciation is reminiscent of the infamous episode of RMB devaluation four years ago. On August 11th 2015, the People’s Bank of China (PBoC) attempted to introduce a market-based pricing mechanism of the RMB in a bid to offset the then intensifying growth headwinds through currency depreciation. The reforming efforts proved to be unsuccessful just in a couple of weeks after the devaluation itself caused unexpected financial turmoil. Massive capital outflows, primarily driven by market panic, led to a vicious circle of capital flight and currency depreciation. The PBoC finally had to roll back the short-lived pricing mechanism.

In the aftermath of this unsuccessful reform, the RMB entered into a phase of persistent depreciation until January 2017. The onshore exchange rate depreciated from 6.20 in August 2015 to 6.95 early 2017. Over the same period, the PBoC lost almost 30% of its foreign reserves as a result of frequent market interventions. (Figure 3)

We would like to argue that the recent depreciation of the RMB, albeit past the psychological level of 7, is unlikely to lead to financial turmoil like in 2015:

First and foremost, this time the authorities kept the currency’s pricing mechanism intact, in stark contrast to the case of 2015 when the authorities attempted to leave the pricing function to the anchorless market forces entirely. Now the authorities still have a great say in determining the mid-price (or opening price) of the RMB exchange rate. Moreover, the permissible trading range of the RMB exchange rate is defined as +-2% around the mid-price per day. That being said, the authorities can effectively confine the movement of the exchange rate in a desirable range every day, averting a self-fulfilling trend of currency depreciation witnessed in 2015. (Figure 4)

Second, the authorities have accumulated valuable experience over the past few years through their practice of maintaining FX market expectations. Since Monday of this week, the PBoC has significantly raised their voices to communicate to the market so as to manage investors’ expectations and avoid market panic. Meanwhile, the authorities are now equipped with more tools to maneuver the exchange rate in both onshore and offshore market. In particular, the Ministry of Finance and the PBoC currently go to Hong Kong’s offshore market regularly to issue RMB-denominated treasury bonds and central bank bills. Through the issuance of these RMB products, the authorities could flexibly adjust the RMB liquidity in the offshore market and thereby stabilize the currency’s offshore exchange rate.

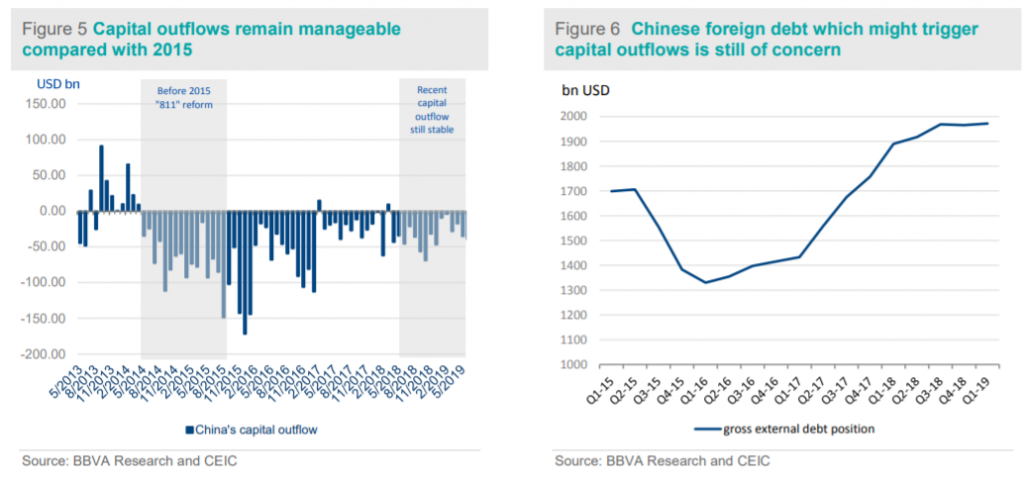

Last but not least, China’s authorities still maintain a tight grip of the country’s capital account, making it almost impossible to see a large-scaled capital flight. The current situation is in stark contrast to the case in 2015 when the authorities substantially relaxed restrictions to allow capital to flow freely across the border. Since the currency devaluation of 2015, China’s authorities have painstakingly been enhancing their monitor and management of the capital account. For the positive side, those capital account restrictions introduced in the aftermath of 2015 devaluation will effectively prevent the vicious circle of currency depreciation and capital flight. (Figure 5)

However, some challenges are still here. For instance, compared with 2015, Chinese foreign debt outstanding has been on the rise, which might trigger capital outflows when RMB exchange rate going down similar as in 2015. Together with the continuing economic slowdown, this gives policy makers more challenges to strengthen the capital control measures at the current stage. (Figure 6)

In the aftermath of this unsuccessful reform, the RMB entered into a phase of persistent depreciation until January 2017. The onshore exchange rate depreciated from 6.20 in August 2015 to 6.95 early 2017. Over the same period, the PBoC lost almost 30% of its foreign reserves as a result of frequent market interventions. (Figure 3)

We would like to argue that the recent depreciation of the RMB, albeit past the psychological level of 7, is unlikely to lead to financial turmoil like in 2015:

First and foremost, this time the authorities kept the currency’s pricing mechanism intact, in stark contrast to the case of 2015 when the authorities attempted to leave the pricing function to the anchorless market forces entirely. Now the authorities still have a great say in determining the mid-price (or opening price) of the RMB exchange rate. Moreover, the permissible trading range of the RMB exchange rate is defined as +-2% around the mid-price per day. That being said, the authorities can effectively confine the movement of the exchange rate in a desirable range every day, averting a self-fulfilling trend of currency depreciation witnessed in 2015. (Figure 4)

Second, the authorities have accumulated valuable experience over the past few years through their practice of maintaining FX market expectations. Since Monday of this week, the PBoC has significantly raised their voices to communicate to the market so as to manage investors’ expectations and avoid market panic. Meanwhile, the authorities are now equipped with more tools to maneuver the exchange rate in both onshore and offshore market. In particular, the Ministry of Finance and the PBoC currently go to Hong Kong’s offshore market regularly to issue RMB-denominated treasury bonds and central bank bills. Through the issuance of these RMB products, the authorities could flexibly adjust the RMB liquidity in the offshore market and thereby stabilize the currency’s offshore exchange rate.

Last but not least, China’s authorities still maintain a tight grip of the country’s capital account, making it almost impossible to see a large-scaled capital flight. The current situation is in stark contrast to the case in 2015 when the authorities substantially relaxed restrictions to allow capital to flow freely across the border. Since the currency devaluation of 2015, China’s authorities have painstakingly been enhancing their monitor and management of the capital account. For the positive side, those capital account restrictions introduced in the aftermath of 2015 devaluation will effectively prevent the vicious circle of currency depreciation and capital flight. (Figure 5)

However, some challenges are still here. For instance, compared with 2015, Chinese foreign debt outstanding has been on the rise, which might trigger capital outflows when RMB exchange rate going down similar as in 2015. Together with the continuing economic slowdown, this gives policy makers more challenges to strengthen the capital control measures at the current stage. (Figure 6)

RMB exchange rate outlook All in all, we believe that the current depreciation of the RMB won’t repeat the history of the currency devaluation in 2015 to plunge the country’s financial system into turmoil. For the moment, China’s authorities have no intention to initiate a bout of deep depreciation. That being said, the prospect of China-US trade talks will dictate the evolution of the RMB exchange rate in the short term.

We define two scenarios for the RMB exchange rate at end-2019: in the first scenario, if China-US trade war maintains the current situation, particularly, 10% tariff on the USD 300 billion goods without further escalation, the RMB exchange rate is expected to fluctuate around the level of 7.15 at end of this year; in the second scenario, the RMB exchange rate could further plunged to 7.4-7.5 if both sides further escalate the trade war in the second half of the year, such as to raise the tariff to 25% for all the Chinese exports to the US.

RMB exchange rate outlook All in all, we believe that the current depreciation of the RMB won’t repeat the history of the currency devaluation in 2015 to plunge the country’s financial system into turmoil. For the moment, China’s authorities have no intention to initiate a bout of deep depreciation. That being said, the prospect of China-US trade talks will dictate the evolution of the RMB exchange rate in the short term.

We define two scenarios for the RMB exchange rate at end-2019: in the first scenario, if China-US trade war maintains the current situation, particularly, 10% tariff on the USD 300 billion goods without further escalation, the RMB exchange rate is expected to fluctuate around the level of 7.15 at end of this year; in the second scenario, the RMB exchange rate could further plunged to 7.4-7.5 if both sides further escalate the trade war in the second half of the year, such as to raise the tariff to 25% for all the Chinese exports to the US.