Dong Jingyue and Xia Le:China Economic Outlook

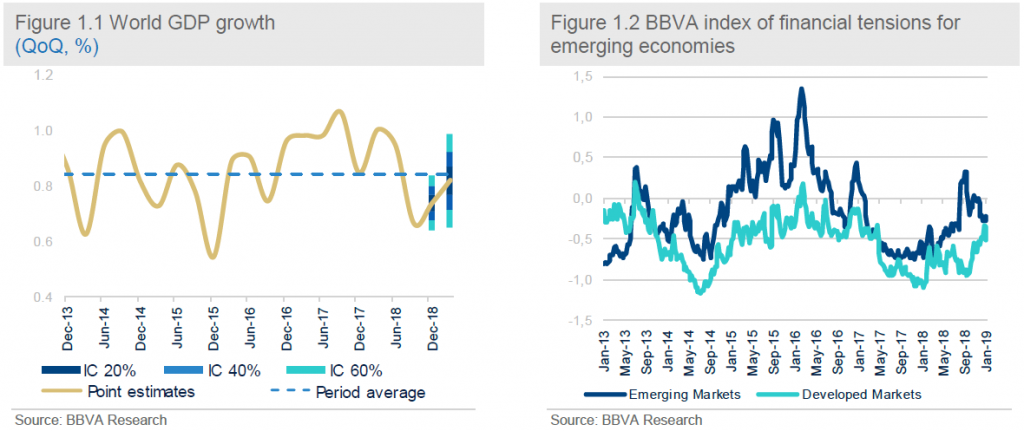

2019-01-29 IMI- Global economy: Global growth is moderating slightly and risks are intensifying

The Federal Reserve raised interest rates by 25 basis points in December, to 2.50%, bringing the total increase in 2018 to 100 basis points. The ECB for its part brought an end to its asset purchase programme, although it reaffirmed that interest rates would be kept low at least until the summer. And on top of this is political uncertainty. In the United States the partial government shut-down and in Europe the continuing logjam over the United Kingdom’s exit from the European Union, together with the doubts about Italy’s budget (now apparently dispelled) combined to increase investors’ caution.

In this environment, stock exchanges and credit markets saw sharp corrections, particularly in the market for leveraged loans and in other relatively high-risk credit segments, which had grown significantly in recent years thanks to the low interest rates. All this had a feedback effect on caution in the market and drove volatility up. Federal Funds Futures went from showing additional interest rate hikes to reflecting some probability of cuts in 2019. In this situation, investors sought refuge in sovereign bonds, which led to sharp falls in long-term interest rates in the United States and Germany. The dollar held steady, since the lowering of expectations of Federal Reserve rate hikes was offset by inflows seeking refuge in a context of heightened risk aversion. The euro failed to capitalise on the end of the ECB’s asset purchase programme, remaining under pressure from the slowdown in growth and the political uncertainty in the United Kingdom and Italy.

In contrast with this, and also with what we saw in much of 2018, downward corrections in emerging market assets were more contained this time around. Even the most vulnerable countries, which had been severely penalised in the previous quarters, seem to be stabilising and are even showing some improvement following the adoption of measures. Nonetheless, the correction in commodity prices, particularly oil, due to both demand and supply factors, penalised Latin American currencies relative to Asian ones.

The Federal Reserve’s hitting the pause button has contained tensions, which are still likely to remain high for a few quarters, until the uncertainty on a number of political fronts is dispelled

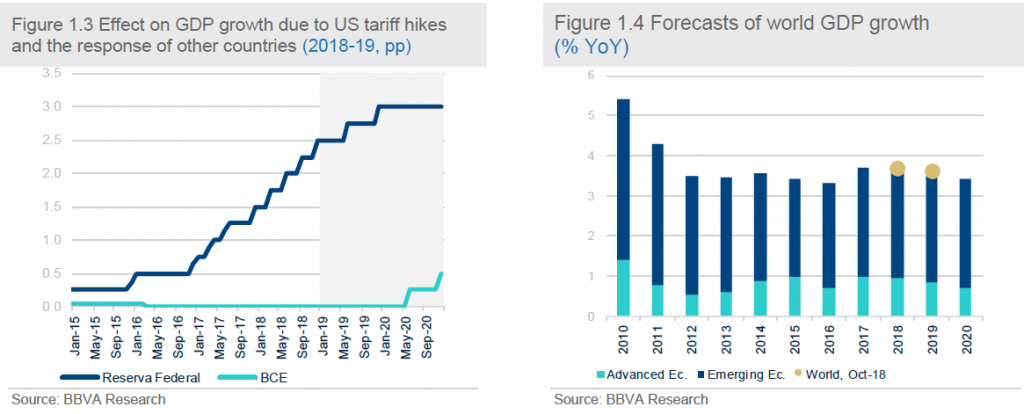

The caution shown by central banks in the face of deteriorating economic data and the sharp increase in financial tensions has been reflected in market expectations as to the Federal Reserve, which assign some probability to interest rates cuts in 2019. Recent comments by Federal Reserve members, as well as the minutes of the last meeting, point to the Fed’s being patient and rate hikes depending on how the economy evolves. In this context, we expect a pause in the first half of this year before a resumption of the cycle of federal funds interest rate hikes in June (25 basis points), reaching 3% in December 2019 and bringing the current cycle of increases to an end (see Figure 1.3).

In Europe, following the end of the asset purchase programme at the end of 2018, the ECB will remain present in the debt market through the total reinvestment of maturing assets for a period estimated at more than two years (beyond the start of the interest rate hikes). As regards interest rates, although the central bank has not altered its discourse (interest rates will remain at current levels at least until the summer), it might do so in the next few months. We consider that in view of the slowdown of the eurozone economy and the increased risks, the ECB will exercise extra caution and will delay the increase in rates, both of the deposit rate, with an initial hike of 10 basis points in December 2019 (three months later than planned) and of the official rate, with an increase of 25 basis points in June 2020 (six months later than previously envisaged) (see Figure 1.3). As regards liquidity, the next few months are likely to see the announcement of a new liquidity auction to ensure a smooth transition for the maturing targeted longer-term refinancing operations (TLTROs).

The pause in the Federal Reserve’s cycle of rate hikes has been key to containing the sharp increase in financial tensions in the past few months, but volatility will remain high in the first quarter, depending on how the trade negotiations between the United States and China evolve. The signs seem positive, with China committing to buy more US products and making an effort to meet demands that it respects intellectual property and technology transfer rights. The conflict on these more structural matters will take some time to resolve, but the clearer evidence of the negative impact of protectionism on activity and the turbulence in the financial markets make it more likely that some kind of agreement will be reached at the end of March, thus avoiding additional increases in US tariffs on Chinese goods.

In Europe, the resolution of the United Kingdom’s leaving the European Union will be key. At the moment, the process remains blocked by the strong opposition to the draft agreement negotiated between the UK government and the European Union, and although there is no clear alternative, a majority in parliament is equally opposed to a no-deal Brexit. In this context, it seems necessary to extend Article 50 (i.e. postpone Brexit) beyond March, and the scenarios remain open, ranging from an agreement to stay in the customs union to a no-deal or “cliff-edge” exit, as well as an early general election or a second referendum. Nonetheless, the probability of a disorderly exit by the United Kingdom from the European Union remains low.

The other source of concern at global level is the economic slowdown in China. In this regard, the Chinese authorities continue to take measures aimed at supporting growth, from tax cuts and increased investment in infrastructure to monetary policy support to encourage lending to SMEs. All this should allow a smooth adjustment to growth in China without neglecting the aim of reducing the excessive indebtedness.

The satisfactory resolution of these eminently political events in the first half of the year, together with the patience and caution of the major central banks, is key to ensuring the smooth adjustment of the world economy.

The Federal Reserve raised interest rates by 25 basis points in December, to 2.50%, bringing the total increase in 2018 to 100 basis points. The ECB for its part brought an end to its asset purchase programme, although it reaffirmed that interest rates would be kept low at least until the summer. And on top of this is political uncertainty. In the United States the partial government shut-down and in Europe the continuing logjam over the United Kingdom’s exit from the European Union, together with the doubts about Italy’s budget (now apparently dispelled) combined to increase investors’ caution.

In this environment, stock exchanges and credit markets saw sharp corrections, particularly in the market for leveraged loans and in other relatively high-risk credit segments, which had grown significantly in recent years thanks to the low interest rates. All this had a feedback effect on caution in the market and drove volatility up. Federal Funds Futures went from showing additional interest rate hikes to reflecting some probability of cuts in 2019. In this situation, investors sought refuge in sovereign bonds, which led to sharp falls in long-term interest rates in the United States and Germany. The dollar held steady, since the lowering of expectations of Federal Reserve rate hikes was offset by inflows seeking refuge in a context of heightened risk aversion. The euro failed to capitalise on the end of the ECB’s asset purchase programme, remaining under pressure from the slowdown in growth and the political uncertainty in the United Kingdom and Italy.

In contrast with this, and also with what we saw in much of 2018, downward corrections in emerging market assets were more contained this time around. Even the most vulnerable countries, which had been severely penalised in the previous quarters, seem to be stabilising and are even showing some improvement following the adoption of measures. Nonetheless, the correction in commodity prices, particularly oil, due to both demand and supply factors, penalised Latin American currencies relative to Asian ones.

The Federal Reserve’s hitting the pause button has contained tensions, which are still likely to remain high for a few quarters, until the uncertainty on a number of political fronts is dispelled

The caution shown by central banks in the face of deteriorating economic data and the sharp increase in financial tensions has been reflected in market expectations as to the Federal Reserve, which assign some probability to interest rates cuts in 2019. Recent comments by Federal Reserve members, as well as the minutes of the last meeting, point to the Fed’s being patient and rate hikes depending on how the economy evolves. In this context, we expect a pause in the first half of this year before a resumption of the cycle of federal funds interest rate hikes in June (25 basis points), reaching 3% in December 2019 and bringing the current cycle of increases to an end (see Figure 1.3).

In Europe, following the end of the asset purchase programme at the end of 2018, the ECB will remain present in the debt market through the total reinvestment of maturing assets for a period estimated at more than two years (beyond the start of the interest rate hikes). As regards interest rates, although the central bank has not altered its discourse (interest rates will remain at current levels at least until the summer), it might do so in the next few months. We consider that in view of the slowdown of the eurozone economy and the increased risks, the ECB will exercise extra caution and will delay the increase in rates, both of the deposit rate, with an initial hike of 10 basis points in December 2019 (three months later than planned) and of the official rate, with an increase of 25 basis points in June 2020 (six months later than previously envisaged) (see Figure 1.3). As regards liquidity, the next few months are likely to see the announcement of a new liquidity auction to ensure a smooth transition for the maturing targeted longer-term refinancing operations (TLTROs).

The pause in the Federal Reserve’s cycle of rate hikes has been key to containing the sharp increase in financial tensions in the past few months, but volatility will remain high in the first quarter, depending on how the trade negotiations between the United States and China evolve. The signs seem positive, with China committing to buy more US products and making an effort to meet demands that it respects intellectual property and technology transfer rights. The conflict on these more structural matters will take some time to resolve, but the clearer evidence of the negative impact of protectionism on activity and the turbulence in the financial markets make it more likely that some kind of agreement will be reached at the end of March, thus avoiding additional increases in US tariffs on Chinese goods.

In Europe, the resolution of the United Kingdom’s leaving the European Union will be key. At the moment, the process remains blocked by the strong opposition to the draft agreement negotiated between the UK government and the European Union, and although there is no clear alternative, a majority in parliament is equally opposed to a no-deal Brexit. In this context, it seems necessary to extend Article 50 (i.e. postpone Brexit) beyond March, and the scenarios remain open, ranging from an agreement to stay in the customs union to a no-deal or “cliff-edge” exit, as well as an early general election or a second referendum. Nonetheless, the probability of a disorderly exit by the United Kingdom from the European Union remains low.

The other source of concern at global level is the economic slowdown in China. In this regard, the Chinese authorities continue to take measures aimed at supporting growth, from tax cuts and increased investment in infrastructure to monetary policy support to encourage lending to SMEs. All this should allow a smooth adjustment to growth in China without neglecting the aim of reducing the excessive indebtedness.

The satisfactory resolution of these eminently political events in the first half of the year, together with the patience and caution of the major central banks, is key to ensuring the smooth adjustment of the world economy.

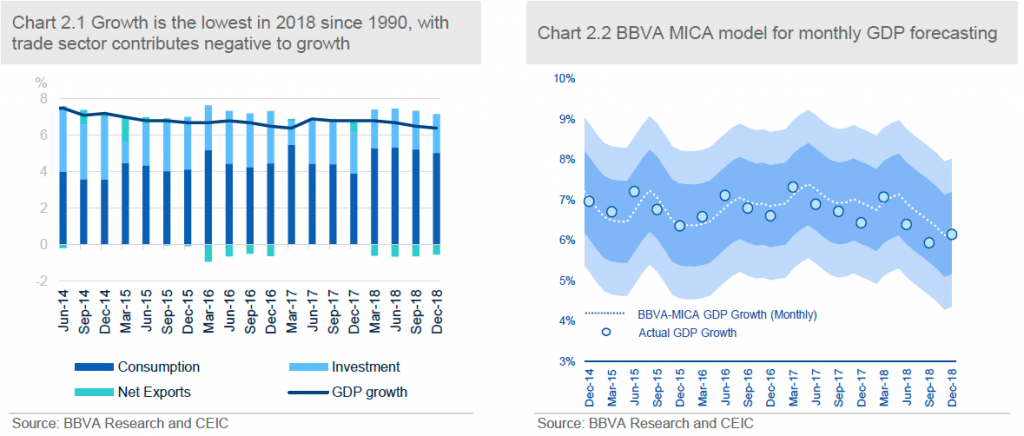

- Growth headwinds are strengthening

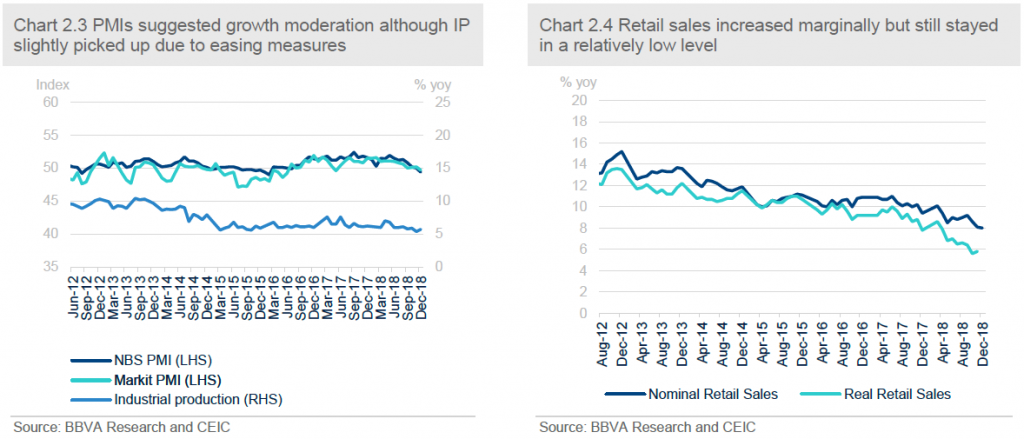

From the perspective of supply side, industrial production surprisingly increased from 5.4% y/y in November to 5.7% y/y in December (consensus: 5.3% y/y) due to the recent monetary and fiscal easing measures. However, the different indicators of producers’ sentiment of December hinted that growth moderation continues. China’s official manufacturing PMI decreased below the watershed level of 50 to 49.4 in December from 50 in the previous month (Consensus: 50), while the Caixin China Manufacturing PMI, which includes a survey sample tilting toward SMEs and exporters, moderated to 49.7 in December (versus consensus 50.2) from 50.2 in the previous month (Figure 2.3). The below-watershed of both the official PMI and Caixin PMI reflected headwinds to China’s export sector amid the faded front-loading behavior as well as the lackluster domestic demand.

Retail sales hovered around in a territory below double-digit growth through the second half of 2018. In real term, the performance was even worse. In December, retail sales growth slightly rebounded to 8.2% y/y from the previous month’s reading of 8.1% y/y (consensus: 8.1%). (Figure 2.4) The slowdown was led by auto sales growth, which had a negative expansion at -8.5% y/y in December due to the expiration of fiscal subsidy for passenger car purchase. The silver lining is the rapid growth of online sales, surging 25.4% y/y in January-December. Overall, we believe that the abovementioned growth headwinds dampened consumers’ confidence thus slowed consumption growth.

From the perspective of supply side, industrial production surprisingly increased from 5.4% y/y in November to 5.7% y/y in December (consensus: 5.3% y/y) due to the recent monetary and fiscal easing measures. However, the different indicators of producers’ sentiment of December hinted that growth moderation continues. China’s official manufacturing PMI decreased below the watershed level of 50 to 49.4 in December from 50 in the previous month (Consensus: 50), while the Caixin China Manufacturing PMI, which includes a survey sample tilting toward SMEs and exporters, moderated to 49.7 in December (versus consensus 50.2) from 50.2 in the previous month (Figure 2.3). The below-watershed of both the official PMI and Caixin PMI reflected headwinds to China’s export sector amid the faded front-loading behavior as well as the lackluster domestic demand.

Retail sales hovered around in a territory below double-digit growth through the second half of 2018. In real term, the performance was even worse. In December, retail sales growth slightly rebounded to 8.2% y/y from the previous month’s reading of 8.1% y/y (consensus: 8.1%). (Figure 2.4) The slowdown was led by auto sales growth, which had a negative expansion at -8.5% y/y in December due to the expiration of fiscal subsidy for passenger car purchase. The silver lining is the rapid growth of online sales, surging 25.4% y/y in January-December. Overall, we believe that the abovementioned growth headwinds dampened consumers’ confidence thus slowed consumption growth.

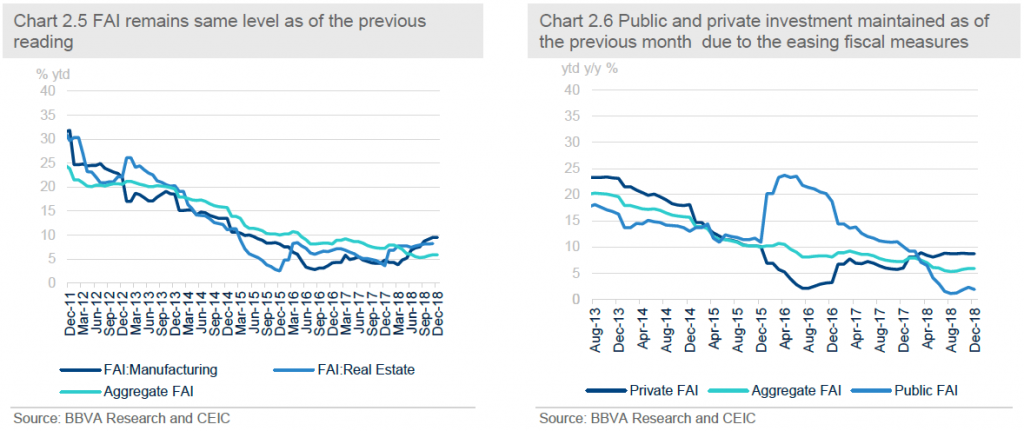

In December, investment was generally maintained as of the previous month’s growth rate, mainly supported by the authorities’ recent fiscal and monetary easing measures. (Chart 2.5) FAI remains at 5.9% ytd y/y as of the previous month (consensus: 6% ytd y/y), but still in a comparatively low territory. The weak FAI is led by public investment, which bears the brunt of previously implemented tightening measures to rein in debt growth. In particular, public investment decelerated to 1.9% ytd y/y from 2.3% ytd y/y in the previous month. But it is still higher than the growth rate back to Q3 2018, indicating the fiscal easing measures are on the way. In the following months, we predict a further trending up of public FAI growth as the fiscal easing takes effects. Meanwhile, private FAI maintains at 8.7% ytd y/y, suggesting private investment is also sluggish as the investment sentiments is weak during economic slowdown. (Chart 2.6)

Inflation significantly moderated

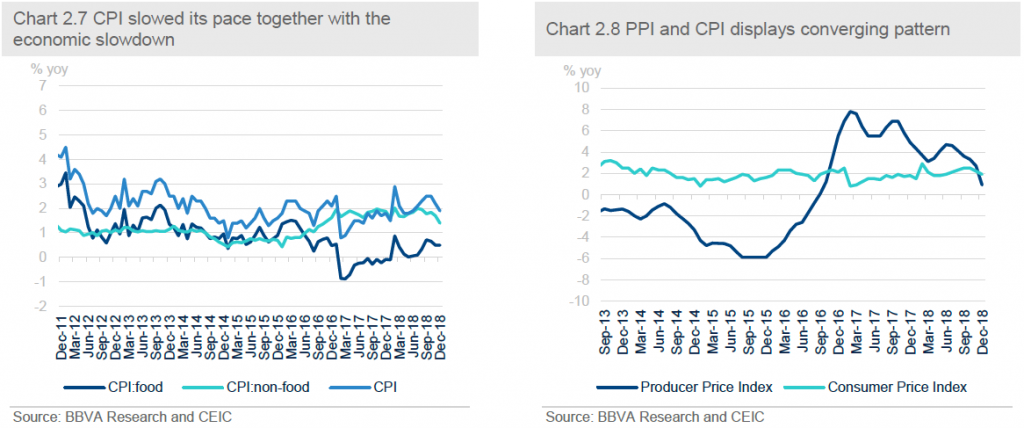

Headline CPI inflation slowed down to 1.9% y/y in December from 2.2% in the previous month, lower than the market consensus at 2.1%. The CPI moderation is mainly due to the sluggish economic growth. By category, food price remains at 2.5 y/y as of the previous month, while non-food price decreased from 1.7% to 2.1% y/y. (Figure 2.7)

Converging pattern of CPI and PPI is set to continue. On the other hand, PPI decreased significantly to 0.9% y/y in December from 2.7% in the previous month (Consensus: 1.6%). Given the unsettled trade war and economic slowdown, the authorities transit their previous focus of deleveraging the over-capacity sector to “maintaining the leveraging level” of these sectors. As the supply-side reform dissipates, together with the base effect, the PPI declined significantly in December. (Figure 2.8) Thus, in the coming months, supply-side shocks caused by overcapacity elimination are likely to have diminishing marginal impact on price levels as investors have already factored it into their expectations.

In December, investment was generally maintained as of the previous month’s growth rate, mainly supported by the authorities’ recent fiscal and monetary easing measures. (Chart 2.5) FAI remains at 5.9% ytd y/y as of the previous month (consensus: 6% ytd y/y), but still in a comparatively low territory. The weak FAI is led by public investment, which bears the brunt of previously implemented tightening measures to rein in debt growth. In particular, public investment decelerated to 1.9% ytd y/y from 2.3% ytd y/y in the previous month. But it is still higher than the growth rate back to Q3 2018, indicating the fiscal easing measures are on the way. In the following months, we predict a further trending up of public FAI growth as the fiscal easing takes effects. Meanwhile, private FAI maintains at 8.7% ytd y/y, suggesting private investment is also sluggish as the investment sentiments is weak during economic slowdown. (Chart 2.6)

Inflation significantly moderated

Headline CPI inflation slowed down to 1.9% y/y in December from 2.2% in the previous month, lower than the market consensus at 2.1%. The CPI moderation is mainly due to the sluggish economic growth. By category, food price remains at 2.5 y/y as of the previous month, while non-food price decreased from 1.7% to 2.1% y/y. (Figure 2.7)

Converging pattern of CPI and PPI is set to continue. On the other hand, PPI decreased significantly to 0.9% y/y in December from 2.7% in the previous month (Consensus: 1.6%). Given the unsettled trade war and economic slowdown, the authorities transit their previous focus of deleveraging the over-capacity sector to “maintaining the leveraging level” of these sectors. As the supply-side reform dissipates, together with the base effect, the PPI declined significantly in December. (Figure 2.8) Thus, in the coming months, supply-side shocks caused by overcapacity elimination are likely to have diminishing marginal impact on price levels as investors have already factored it into their expectations.

The current monetary policy is more “targeting” on supporting SMEs

In front of the growth moderation, the authorities beefed up their monetary easing measures.

Total social financing and M2 increased due to monetary easing, but the transmission mechanism still weak. The biggest challenge at the current stage is that the PBOC needs to do a delicate balancing act between trying to stem flagging economic growth without fueling financial stability concerns amid elevated debt levels. Actually, in many circumstances, the authorities politically have been committed to avoiding a 'flood' of stimulus like what they did in 2008 Global Financial Crisis; on contrast, they want more targeted stimulus measures, especially to support Small and Medium Enterprises (SMEs) and private enterprises. Actually, the authorities reiterated to “maintain a proactive fiscal policy and a prudent monetary policy” instead of paraphrasing it as an “easing or proactive monetary policy”. In practice, being conscious of debt overhang and financial stability risks, the PBOC has resorted to “targeted” policy easing measures instead of a universal easing.

In this regard, on December 20th 2018, the PBoC introduced the targeted medium term lending facility (TMLF). The maximum term of TMLF is 3 years as the SMEs could renew TMLF every year till three years. In addition, the lending rate is 3.15% at the current stage, lower than the previous MLF which is 3.3%.

On top of the TMLF, the authorities also have implemented a series of administrative policies to support SMEs, including highlighting the big banks’ efforts to boost lending to cash-starved small firms, offering collateral waivers and setting loan targets to SMEs. To guide lending to small firms, authorities have issued directives to banks, arranged meetings between executives of banks and private firms, and doled out tax breaks for banks’ “micro-loans”, etc.

Except for the targeted monetary measures supporting SMEs, the authorities cut Reserve Requirement Rate

(RRR) by 1% to maintain the market liquidity in January. The PBoC said the RRR cut will release about 1.5 trillion yuan (US$218 billion) of liquidity into the country’s banking system. Generally speaking, RRR cut is deemed to be a safer way compared with universal interest rate cut to avoid currency depreciation and capital outflows. In addition, the PBoC indicated not to follow the US FED to hike the interest rate, and deliberately maintain the DR-007 which is the monetary policy rate as well as some other interbank lending rates such as SHIBOR at a comparatively low level, sending a strong signal of policy easing.

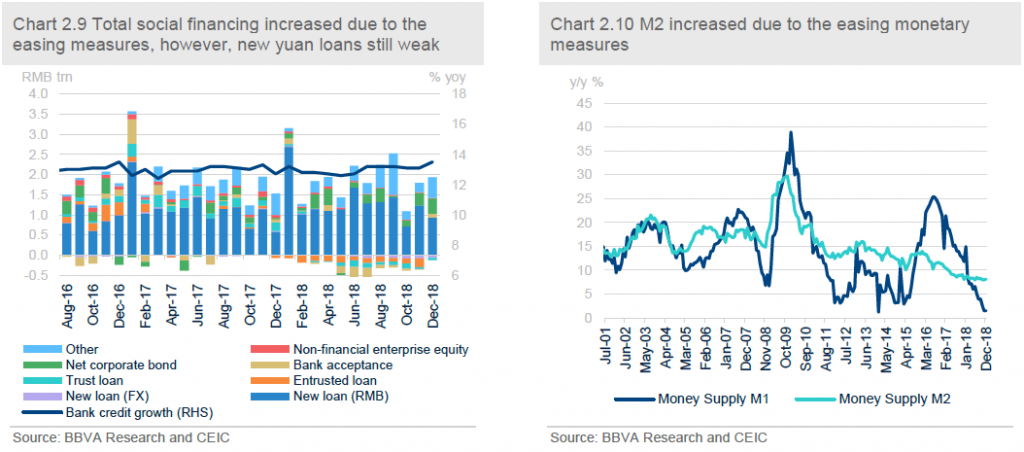

Due to the recent monetary easing measures, the growth of total social financing expanded in December to RMB 1,589.8 billion (prior: RMB 1,523.9 billion; consensus: RMB 1,300 billion) and M2 growth also marginally increased to 8.1% y/y from 8% y/y in the previously month (consensus: 8.1% y/y). However, new yuan loans declined to RMB 1,080 billion (prior: RMB 1,250 billion; consensus: RMB 825 billion), indicating that the current monetary transmission mechanism is still not smoothly going as banks are still reluctant to lend amid growth slowdown, although the PBoC has already done a series of easing measures. (Figure 2.9 and Figure 2.10)

The current monetary policy is more “targeting” on supporting SMEs

In front of the growth moderation, the authorities beefed up their monetary easing measures.

Total social financing and M2 increased due to monetary easing, but the transmission mechanism still weak. The biggest challenge at the current stage is that the PBOC needs to do a delicate balancing act between trying to stem flagging economic growth without fueling financial stability concerns amid elevated debt levels. Actually, in many circumstances, the authorities politically have been committed to avoiding a 'flood' of stimulus like what they did in 2008 Global Financial Crisis; on contrast, they want more targeted stimulus measures, especially to support Small and Medium Enterprises (SMEs) and private enterprises. Actually, the authorities reiterated to “maintain a proactive fiscal policy and a prudent monetary policy” instead of paraphrasing it as an “easing or proactive monetary policy”. In practice, being conscious of debt overhang and financial stability risks, the PBOC has resorted to “targeted” policy easing measures instead of a universal easing.

In this regard, on December 20th 2018, the PBoC introduced the targeted medium term lending facility (TMLF). The maximum term of TMLF is 3 years as the SMEs could renew TMLF every year till three years. In addition, the lending rate is 3.15% at the current stage, lower than the previous MLF which is 3.3%.

On top of the TMLF, the authorities also have implemented a series of administrative policies to support SMEs, including highlighting the big banks’ efforts to boost lending to cash-starved small firms, offering collateral waivers and setting loan targets to SMEs. To guide lending to small firms, authorities have issued directives to banks, arranged meetings between executives of banks and private firms, and doled out tax breaks for banks’ “micro-loans”, etc.

Except for the targeted monetary measures supporting SMEs, the authorities cut Reserve Requirement Rate

(RRR) by 1% to maintain the market liquidity in January. The PBoC said the RRR cut will release about 1.5 trillion yuan (US$218 billion) of liquidity into the country’s banking system. Generally speaking, RRR cut is deemed to be a safer way compared with universal interest rate cut to avoid currency depreciation and capital outflows. In addition, the PBoC indicated not to follow the US FED to hike the interest rate, and deliberately maintain the DR-007 which is the monetary policy rate as well as some other interbank lending rates such as SHIBOR at a comparatively low level, sending a strong signal of policy easing.

Due to the recent monetary easing measures, the growth of total social financing expanded in December to RMB 1,589.8 billion (prior: RMB 1,523.9 billion; consensus: RMB 1,300 billion) and M2 growth also marginally increased to 8.1% y/y from 8% y/y in the previously month (consensus: 8.1% y/y). However, new yuan loans declined to RMB 1,080 billion (prior: RMB 1,250 billion; consensus: RMB 825 billion), indicating that the current monetary transmission mechanism is still not smoothly going as banks are still reluctant to lend amid growth slowdown, although the PBoC has already done a series of easing measures. (Figure 2.9 and Figure 2.10) Fiscal easing measures currently focusing on the tax cut and local government debt expansion

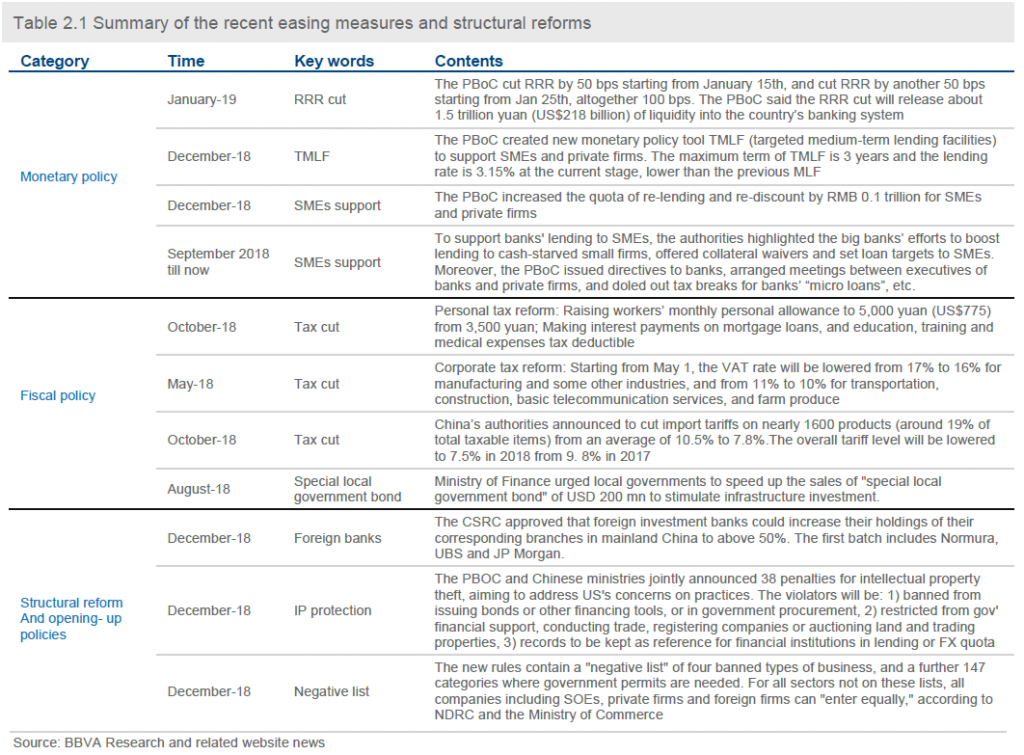

China has pledged a more proactive fiscal policy to shore up the economy, where growth eased to its slowest pace since 1990 as a campaign to tackle debt risks and the trade war with the US dragged market sentiments. Actually, in 2018, the authorities have already implemented a series of tax cuts in various perspectives to reduce the costs and stimulate growth, which we summarize in Table 2.1.

Except for the tax cuts and fee reductions, the authorities also urged special local government bond issuance, in a bid to stimulate investment, as FAI has already dropped to a decade low in the recent months. In particular, Ministry of Finance announced in August 2018 that local governments need to speed up the sales of "special local government bond" of USD 200 million to stimulate infrastructure investment. From this perspective, we expect a significant infrastructure fixed asset investment increasing in 2019.

Fiscal easing measures currently focusing on the tax cut and local government debt expansion

China has pledged a more proactive fiscal policy to shore up the economy, where growth eased to its slowest pace since 1990 as a campaign to tackle debt risks and the trade war with the US dragged market sentiments. Actually, in 2018, the authorities have already implemented a series of tax cuts in various perspectives to reduce the costs and stimulate growth, which we summarize in Table 2.1.

Except for the tax cuts and fee reductions, the authorities also urged special local government bond issuance, in a bid to stimulate investment, as FAI has already dropped to a decade low in the recent months. In particular, Ministry of Finance announced in August 2018 that local governments need to speed up the sales of "special local government bond" of USD 200 million to stimulate infrastructure investment. From this perspective, we expect a significant infrastructure fixed asset investment increasing in 2019.

Growth slowdown might urge the authorities to implement some easing measures in housing market

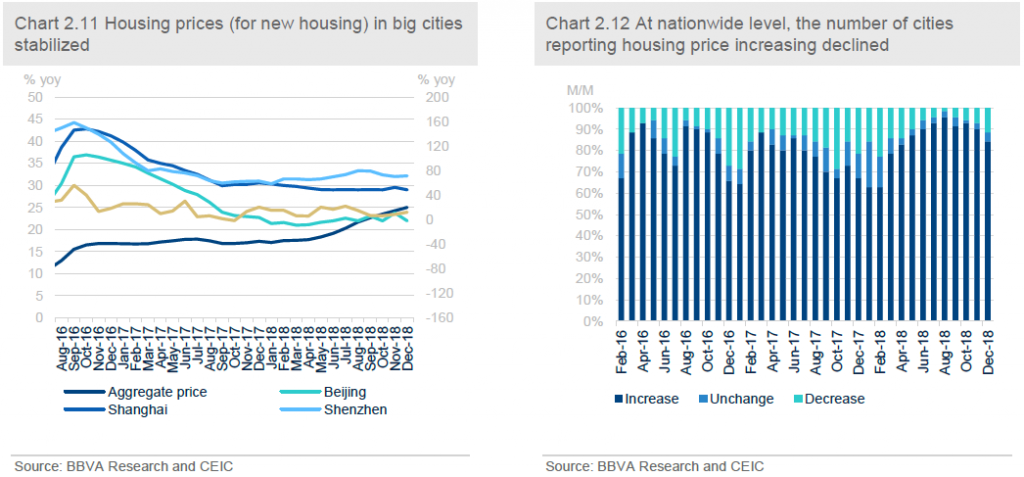

In December, housing price in tier-1 cities displayed some diverging pattern for the newly established and second-hand housing price. In particular, the price for new housing still accelerated for both m/m and y/y growth while the second-hand housing prices all declined. On the other hand, the trading volumes in general seem still increasing.(Figure 2.11) Meanwhile, at the national level, the number of cities that reported housing price increasing declined in December. (Figure 2.12) The housing market moderation suggests the authorities’ previous tightening measures to contain the run-up housing price have taken some effect.

Growth slowdown might urge the authorities to implement some easing measures in housing market

In December, housing price in tier-1 cities displayed some diverging pattern for the newly established and second-hand housing price. In particular, the price for new housing still accelerated for both m/m and y/y growth while the second-hand housing prices all declined. On the other hand, the trading volumes in general seem still increasing.(Figure 2.11) Meanwhile, at the national level, the number of cities that reported housing price increasing declined in December. (Figure 2.12) The housing market moderation suggests the authorities’ previous tightening measures to contain the run-up housing price have taken some effect.

However, although the previous housing market tightening measures helped to ease housing bubble and maintain financial stability, housing market cooling down also drags on growth. Given that the housing market has strong spillover effect to other upstream and downstream sectors of the economy, it is an important growth engine in China. Amid the unsettled trade war with the US and domestic growth slowdown this year, we expect the authorities will implement some easing measures in housing market as well, or at least not to push forward the previous tightening measures, in a bid to stimulate growth.

Exports growth finally dipped to a negative region due to the faded effect of front-loading

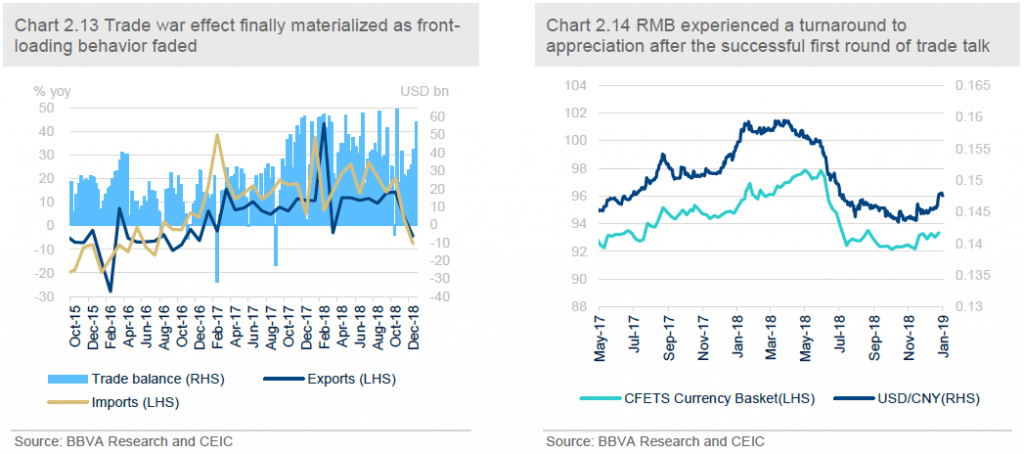

As the front-loading effect gradually faded, the trade war’s damage to China’s export sector finally materialized. In particular, in December, the growth of exports (in USD terms) significantly dipped to -4.4% y/y (versus consensus: 2% y/y) from the previous reading of 3.9% y/y. On the other hand, imports also dropped to a year-on-year growth of -7.6% from previously 2.9% y/y (versus consensus: 4.5% y/y) due to the domestic economic slowdown which reduces the external demand. As a result, the balance of trade expanded to USD 57.06 billion in December from USD 41.86 billion in the previous month (consensus: USD 51.6 billion). (Figure 2.13)

However, in our baseline scenario which we assign 80% possibility, both sides will reach some no-tariff agreement in the coming March, we predict that the exports will finally picked up in the second half of this year after the significant drop in the Q1 2019 as exporters have already front-loaded their orders with the US.

RMB exchange rate turned to appreciate with the progress of US-China talk moving on

The RMB exchange rate experienced a big turnaround right after the successful first round of US-China trade talk in Beijing, indicating that the current RMB exchange rate is led by market sentiments of trade war progress to a large extent. Accumulatively, the RMB has appreciated by 2.9% against the USD from its weakest level in November 2018 till now (from 6.96 to 6.76). It is also noted that the RMB appreciation during this period is not only against the USD but also against the CFETS currency basket, which was introduced in November 2015 as a benchmark of the RMB exchange rate. (Figure 2.14)

In addition to the bilateral trade talk progress, some other factors that contribute to RMB appreciation also include the slower pace of US interest rate hike and weaker USD Index. However, as domestic growth slowdown continues which plays a fundamental role on RMB depreciation in the medium to long term, we still believe the Yuan exchange rate will still maintain a comparatively weak trend in the coming months.

RMB exchange rate is quite depending on the China-US negotiation result in coming March. RMB exchange rate in the short term will be quite depending on the China-US negotiation result in the coming much. In our baseline scenario which we assign 80% possibility, the two sides will reach a deal, then RMB depreciation pressure will be largely released. However, is the risk scenario materializes, yuan will easily go beyond the psychological level of 7. Altogether, we forecast RMB to USD exchange rate will reach around 6.7 at end-2019.

However, although the previous housing market tightening measures helped to ease housing bubble and maintain financial stability, housing market cooling down also drags on growth. Given that the housing market has strong spillover effect to other upstream and downstream sectors of the economy, it is an important growth engine in China. Amid the unsettled trade war with the US and domestic growth slowdown this year, we expect the authorities will implement some easing measures in housing market as well, or at least not to push forward the previous tightening measures, in a bid to stimulate growth.

Exports growth finally dipped to a negative region due to the faded effect of front-loading

As the front-loading effect gradually faded, the trade war’s damage to China’s export sector finally materialized. In particular, in December, the growth of exports (in USD terms) significantly dipped to -4.4% y/y (versus consensus: 2% y/y) from the previous reading of 3.9% y/y. On the other hand, imports also dropped to a year-on-year growth of -7.6% from previously 2.9% y/y (versus consensus: 4.5% y/y) due to the domestic economic slowdown which reduces the external demand. As a result, the balance of trade expanded to USD 57.06 billion in December from USD 41.86 billion in the previous month (consensus: USD 51.6 billion). (Figure 2.13)

However, in our baseline scenario which we assign 80% possibility, both sides will reach some no-tariff agreement in the coming March, we predict that the exports will finally picked up in the second half of this year after the significant drop in the Q1 2019 as exporters have already front-loaded their orders with the US.

RMB exchange rate turned to appreciate with the progress of US-China talk moving on

The RMB exchange rate experienced a big turnaround right after the successful first round of US-China trade talk in Beijing, indicating that the current RMB exchange rate is led by market sentiments of trade war progress to a large extent. Accumulatively, the RMB has appreciated by 2.9% against the USD from its weakest level in November 2018 till now (from 6.96 to 6.76). It is also noted that the RMB appreciation during this period is not only against the USD but also against the CFETS currency basket, which was introduced in November 2015 as a benchmark of the RMB exchange rate. (Figure 2.14)

In addition to the bilateral trade talk progress, some other factors that contribute to RMB appreciation also include the slower pace of US interest rate hike and weaker USD Index. However, as domestic growth slowdown continues which plays a fundamental role on RMB depreciation in the medium to long term, we still believe the Yuan exchange rate will still maintain a comparatively weak trend in the coming months.

RMB exchange rate is quite depending on the China-US negotiation result in coming March. RMB exchange rate in the short term will be quite depending on the China-US negotiation result in the coming much. In our baseline scenario which we assign 80% possibility, the two sides will reach a deal, then RMB depreciation pressure will be largely released. However, is the risk scenario materializes, yuan will easily go beyond the psychological level of 7. Altogether, we forecast RMB to USD exchange rate will reach around 6.7 at end-2019.

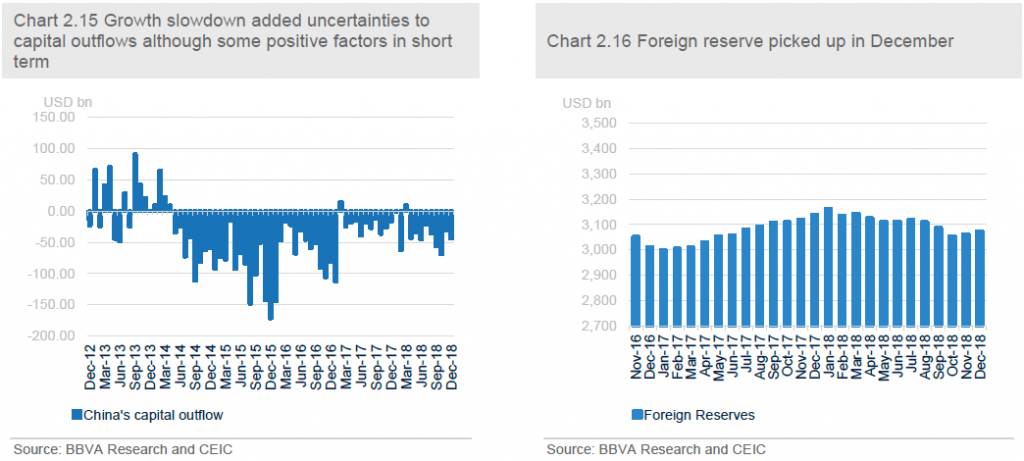

The unsettled trade war and growth slowdown added uncertainties to capital outflows

Foreign reserves increased to USD 3,072.7 billion in December from USD 3,061.7 billion in the previous month. Based on the outturns of trade balance, valuation effect and the foreign reserve change, we estimate that capital outflows amounted to USD 40 billion in December, compared with USD 35.36 billion in the previous month. (Figure 2.15 and 2.16)

PBoC now has more tools to stabilize RMB, instead of burning foreign reserve. In the short term, it seems like recently there are some positive factors to the capital account, including the appreciating RMB exchange rate after the successful first-round of trade talk, the slower pace of the FED interest rate hike and the good progress of the first round of bilateral trade war talks. Putting all of these together, we observe that the capital outflows during the past months actually have a much smaller scale than that of after August 2015 RMB exchange rate reform.

However, in the medium to long term, the domestic economic growth slowdown will add more uncertainties for capital outflows. In particular, a sharp dip of exports in 1H 2019 might shrink China’s current account surplus, adding pressure to foreign reserve. In addition, RMB exchange rate has not bottomed out yet which is quite depending on the China-US negotiation result in coming March, thus, the capital outflow pressures are still there. We expect the SAFE might in the future implement more capital account control measures to avoid a sharp capital outflow and to maintain RMB exchange rate stability.

The unsettled trade war and growth slowdown added uncertainties to capital outflows

Foreign reserves increased to USD 3,072.7 billion in December from USD 3,061.7 billion in the previous month. Based on the outturns of trade balance, valuation effect and the foreign reserve change, we estimate that capital outflows amounted to USD 40 billion in December, compared with USD 35.36 billion in the previous month. (Figure 2.15 and 2.16)

PBoC now has more tools to stabilize RMB, instead of burning foreign reserve. In the short term, it seems like recently there are some positive factors to the capital account, including the appreciating RMB exchange rate after the successful first-round of trade talk, the slower pace of the FED interest rate hike and the good progress of the first round of bilateral trade war talks. Putting all of these together, we observe that the capital outflows during the past months actually have a much smaller scale than that of after August 2015 RMB exchange rate reform.

However, in the medium to long term, the domestic economic growth slowdown will add more uncertainties for capital outflows. In particular, a sharp dip of exports in 1H 2019 might shrink China’s current account surplus, adding pressure to foreign reserve. In addition, RMB exchange rate has not bottomed out yet which is quite depending on the China-US negotiation result in coming March, thus, the capital outflow pressures are still there. We expect the SAFE might in the future implement more capital account control measures to avoid a sharp capital outflow and to maintain RMB exchange rate stability.

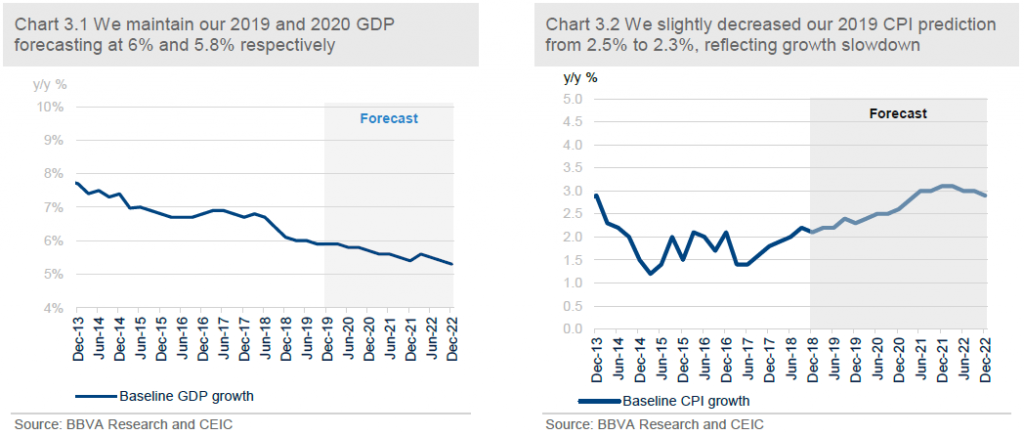

- More policy support are in pipeline to avert a hard-landing

Monetary policy: from “targeted” to “universal” easing

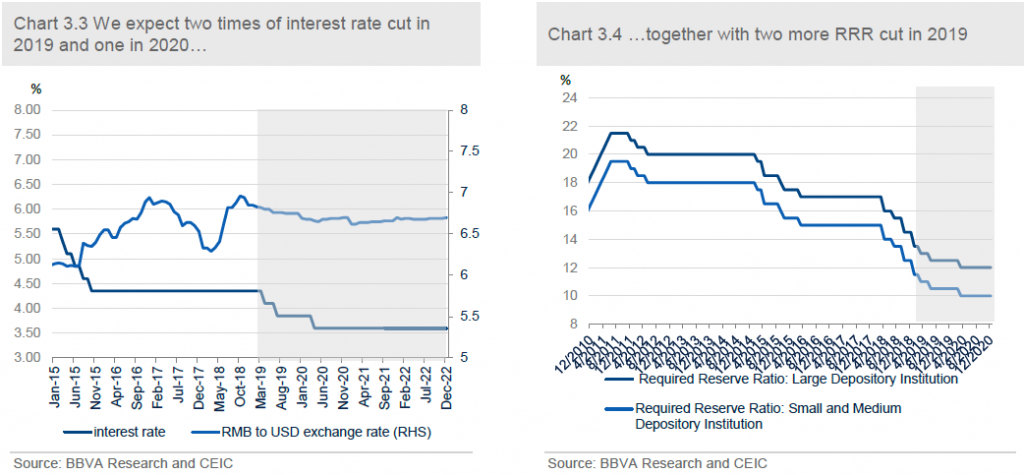

Amid rising hard-landing risk, the authorities have beefed up monetary easing to support economic growth. Now there is no doubt that the stance of monetary policy will stay accommodative throughout 2019. On top of a series of implemented targeted easing measures to support SMEs financing (summarized in Section 2), we expect the PBoC to deploy more universal cuts in both required reserve ratio (RRR) and benchmark interest rates this year. In particular, we anticipate that the RRR will be trimmed cumulatively by another 200 bps in the rest of 2019. Meanwhile, we project two benchmark interest rate cuts in the first and second quarter with each by 25bps. (Chart 3.3 and 3.4)

Our projection of benchmark interest rate cuts differs from the views of most market economists. They argue that the PBoC is unlikely to resort to benchmark interest rate cuts since they are pushing forward a critical transition from the old monetary policy framework, which features the benchmark interest rate as one of main policy tools, to a new framework centering around a corridor system of interbank interest rates. (See our previous China Economic Watch: Monetary policy: new framework, new stance).

Nevertheless, we believe that the rising hard-landing risk this year may override the authorities’ intention of monetary framework transition at this moment. Now the corridor system hasn’t been well established. The important missing part is the transmission channel from interbank market interest rates to banks’ lending and deposits offered to their clients. The main reason is that those interbank market interest rates are too volatile for banks to directly use them as the base of price-setting for their long-term financial products such as loans and deposits. As a consequence, the majority of banks’ long-term loans, such as mortgage and corporate loans, are still priced based on the benchmark lending rate (normally, the benchmark lending rate plus some floating rate).

Now both policymakers and market analysts are complaining that the transmission mechanism of monetary easing doesn’t function well since risk-averse banks are reluctant to transmit the lower financing costs (from the interbank market) to their clients. Therefore, a cut in the benchmark interest rates could be more effective than other easing measures targeted liquidity injection or RRR cut at such a juncture because it forcefully reduce banks’ charge on their clients. As banks’ total outstanding RMB loans stand at RMB 134.69 trillion (or 149.6 % of GDP), a cut in benchmark interest rate could lead to a considerable cost saving for those household and corporate borrowers.

Moreover, a cut in benchmark interest rate can send a strong signal of monetary easing to the market participants. Together with other pro-growth measures, benchmark interest rate cuts could reinforce firms’ confidence in growth outlook or at least the prospective credit condition. As such, they are able to help to repair the ill-functioned transmission channel from banks to real fund users.

Given the increasing growth headwinds and visible advantages of benchmark interest rate cuts, we believe that there is no reason for the authorities to shelve up this relatively effective monetary policy tool for a long-term goal of transition. We expect two benchmark interest rate cuts to come in the first and the second quarter, respectively. A prospected deal between China and the US could lessen the depreciation pressure of the RMB from March, which is to create a good time window for the PBoC to cut the benchmark interest rate.

Monetary policy: from “targeted” to “universal” easing

Amid rising hard-landing risk, the authorities have beefed up monetary easing to support economic growth. Now there is no doubt that the stance of monetary policy will stay accommodative throughout 2019. On top of a series of implemented targeted easing measures to support SMEs financing (summarized in Section 2), we expect the PBoC to deploy more universal cuts in both required reserve ratio (RRR) and benchmark interest rates this year. In particular, we anticipate that the RRR will be trimmed cumulatively by another 200 bps in the rest of 2019. Meanwhile, we project two benchmark interest rate cuts in the first and second quarter with each by 25bps. (Chart 3.3 and 3.4)

Our projection of benchmark interest rate cuts differs from the views of most market economists. They argue that the PBoC is unlikely to resort to benchmark interest rate cuts since they are pushing forward a critical transition from the old monetary policy framework, which features the benchmark interest rate as one of main policy tools, to a new framework centering around a corridor system of interbank interest rates. (See our previous China Economic Watch: Monetary policy: new framework, new stance).

Nevertheless, we believe that the rising hard-landing risk this year may override the authorities’ intention of monetary framework transition at this moment. Now the corridor system hasn’t been well established. The important missing part is the transmission channel from interbank market interest rates to banks’ lending and deposits offered to their clients. The main reason is that those interbank market interest rates are too volatile for banks to directly use them as the base of price-setting for their long-term financial products such as loans and deposits. As a consequence, the majority of banks’ long-term loans, such as mortgage and corporate loans, are still priced based on the benchmark lending rate (normally, the benchmark lending rate plus some floating rate).

Now both policymakers and market analysts are complaining that the transmission mechanism of monetary easing doesn’t function well since risk-averse banks are reluctant to transmit the lower financing costs (from the interbank market) to their clients. Therefore, a cut in the benchmark interest rates could be more effective than other easing measures targeted liquidity injection or RRR cut at such a juncture because it forcefully reduce banks’ charge on their clients. As banks’ total outstanding RMB loans stand at RMB 134.69 trillion (or 149.6 % of GDP), a cut in benchmark interest rate could lead to a considerable cost saving for those household and corporate borrowers.

Moreover, a cut in benchmark interest rate can send a strong signal of monetary easing to the market participants. Together with other pro-growth measures, benchmark interest rate cuts could reinforce firms’ confidence in growth outlook or at least the prospective credit condition. As such, they are able to help to repair the ill-functioned transmission channel from banks to real fund users.

Given the increasing growth headwinds and visible advantages of benchmark interest rate cuts, we believe that there is no reason for the authorities to shelve up this relatively effective monetary policy tool for a long-term goal of transition. We expect two benchmark interest rate cuts to come in the first and the second quarter, respectively. A prospected deal between China and the US could lessen the depreciation pressure of the RMB from March, which is to create a good time window for the PBoC to cut the benchmark interest rate.

How to fund the large-scale tax cuts under the current fiscal policy framework?

China has pledged a more proactive fiscal policy to shore up the economy, where growth eased to its slowest pace since the global financial crisis as a campaign to tackle debt risks and the trade war with the US dragged market sentiments. Actually, in 2018, the authorities have already implemented a series of tax cuts in various perspectives to reduce the costs and stimulate growth (summarized in Table 2.1 in Section 2).

Under the current circumstance, the authorities are expected to announce more rounds of tax cut measures in 2019. In particular, we anticipate another 2% of VAT cut in all the three levels, which means, the VAT rates will reduce to 14%, 8% and 4%, respectively. Altogether, based on our estimation, this will reduce tax of around RMB 990.5 billion, equivalent to 1.1% of GDP in 2019. This estimation comes on top of the at least 1.3 trillion yuan of tax reductions (including other items of tax cut except for VAT tax) estimated by Ministry of Finance for this year. In sum, China's tax and fee cuts will boost the real economy through reducing corporate burdens and creating a stable and fair business environment. In addition, it will stimulate consumption by increasing households’ wealth effect.

An important question is how the authorities fund the tax cuts under the current fiscal income-expenditure framework? The most straightforward way is to expand the fiscal deficit in 2019 and 2020 consecutively. In this regard, we predict the authorities will increase their fiscal budget to GDP ratio from -2.6% in 2018 to -3% in 2019 and 2020. The second way is to reduce the fiscal expenditure, such as to shrink the number of civil servants hiring, to reduce the other public service expenditure, and to decrease the subsidies to social security fund from general fiscal expenditure by injecting state capital management revenue into the social security fund. The third way is to increase the state capital management revenue, namely, to increase the ratio of SOEs profits to be submitted to the central government.

Altogether, we believe that to directly increase the fiscal budget to GDP ratio might be the most efficient way to cover the tax cut and fee reductions at the current stage, as the second and the third method need longer time to push forward the related reforms.

There is a good chance to end the US-China tariff war

A turnaround of US-China relationship seems to appear after President Trump and President Xi met during the Argentina G20 summit and agreed to halt the tariff war for 90 days so that both sides can solve their trade disputes via bilateral negotiations.

As part of follow-ups, a delegation composed of US technocrats visited Beijing in early January and had communications with their Chinese peers, which President Trump described “…going very well” in his twitter. On China’s side, the authorities kept promulgating new opening-up policies to foreign investors as part of efforts to address the US government’s concerns. It is reported that China’s vice Premier Liu He, who is de facto the chief trade negotiator of China’s side, is going to visit Washington on January 30th and 31st to nail the final version of the bilateral agreement so as to end the tariff war lasting for more than six months.

The agreement under negotiation is likely to include China’s spending spree on US goods and services which is expected to substantially reduce China’s trade surplus against the US. Moreover, China needs to address a series of concerns raised by the US ranging from forced technology transfer to cyber intrusions for commercial purposes.

We expect that both administrations can easily achieve some agreement on China’s long shopping list and put it into practice. On US demands of IP protection, further market opening-up and cyber theft, China is able to make some promises. The thorny part of bilateral negotiations will be how China can make the US believe they will seriously honor all their promises. That being said, more noises could appear relating to the ongoing bilateral negotiations before the preset deadline of March 1st. Nevertheless, we continue to assign 80% probability to the scenario that the ongoing negotiations will lead to a good outcome.

RMB exchange rate outlook

After the August 11th 2015 RMB exchange rate reform, RMB exchange rate is experiencing the second round of depreciation since April this year amid the trade war risk. However, RMB to USD exchange rate seems like to have a significant turnaround recently right after the US and China successfully finished the first round of trade negotiation in Beijing. On January 11th, RMB to USD exchange rate experienced a 1.3% daily appreciation, the largest one-day appreciation for the past several months. That means, the RMB exchange rate at the current stage is quite market sentiment driven, especially, based on the trade talk progress with the US.

In our baseline scenario which we assign 80% possibility, the US and China will reach the deal in March 2019, indicating the RMB will not go through a sharp depreciation trend after that. In addition, as FED signaled the slowing path of interest rate hike, emerging market currencies might have a release in 2019.

On the other hand, if the risk scenario materializes that the two sides fail the talk, the RMB exchange rate will easily depreciate beyond the psychological level of 7. Under this scenario, the PBoC might use the measures that were implemented during 2015 market turmoil, including tightening capital control, intervening HK offshore RMB market, burning foreign reserve to defend RMB exchange rate etc.

However, in the medium term, even though the trade war with the US is settled in March, there are still economic fundamentals for RMB depreciation: (i) continuing domestic economic slowdown; (ii) easing monetary measures leading the interest rate difference with the US shrink.

Looking ahead, RMB exchange rate in the short term will be quite depending on the China-US negotiation result in the coming much. But continuing depreciation pressure will be last for the following months, mainly due to domestic growth slowdown. However, the depreciation will not be that sharp given the ongoing satisfactory progress of US-China trade talk. Under the current circumstance, the equilibrium exchange rate should be in a range of 6.7-7. Altogether, we predict RMB exchange rate will reach 6.7 at end-2019. In addition, RMB exchange rate flexibility will be further enhanced, as exchange rate reform deepened.

How to fund the large-scale tax cuts under the current fiscal policy framework?

China has pledged a more proactive fiscal policy to shore up the economy, where growth eased to its slowest pace since the global financial crisis as a campaign to tackle debt risks and the trade war with the US dragged market sentiments. Actually, in 2018, the authorities have already implemented a series of tax cuts in various perspectives to reduce the costs and stimulate growth (summarized in Table 2.1 in Section 2).

Under the current circumstance, the authorities are expected to announce more rounds of tax cut measures in 2019. In particular, we anticipate another 2% of VAT cut in all the three levels, which means, the VAT rates will reduce to 14%, 8% and 4%, respectively. Altogether, based on our estimation, this will reduce tax of around RMB 990.5 billion, equivalent to 1.1% of GDP in 2019. This estimation comes on top of the at least 1.3 trillion yuan of tax reductions (including other items of tax cut except for VAT tax) estimated by Ministry of Finance for this year. In sum, China's tax and fee cuts will boost the real economy through reducing corporate burdens and creating a stable and fair business environment. In addition, it will stimulate consumption by increasing households’ wealth effect.

An important question is how the authorities fund the tax cuts under the current fiscal income-expenditure framework? The most straightforward way is to expand the fiscal deficit in 2019 and 2020 consecutively. In this regard, we predict the authorities will increase their fiscal budget to GDP ratio from -2.6% in 2018 to -3% in 2019 and 2020. The second way is to reduce the fiscal expenditure, such as to shrink the number of civil servants hiring, to reduce the other public service expenditure, and to decrease the subsidies to social security fund from general fiscal expenditure by injecting state capital management revenue into the social security fund. The third way is to increase the state capital management revenue, namely, to increase the ratio of SOEs profits to be submitted to the central government.

Altogether, we believe that to directly increase the fiscal budget to GDP ratio might be the most efficient way to cover the tax cut and fee reductions at the current stage, as the second and the third method need longer time to push forward the related reforms.

There is a good chance to end the US-China tariff war

A turnaround of US-China relationship seems to appear after President Trump and President Xi met during the Argentina G20 summit and agreed to halt the tariff war for 90 days so that both sides can solve their trade disputes via bilateral negotiations.

As part of follow-ups, a delegation composed of US technocrats visited Beijing in early January and had communications with their Chinese peers, which President Trump described “…going very well” in his twitter. On China’s side, the authorities kept promulgating new opening-up policies to foreign investors as part of efforts to address the US government’s concerns. It is reported that China’s vice Premier Liu He, who is de facto the chief trade negotiator of China’s side, is going to visit Washington on January 30th and 31st to nail the final version of the bilateral agreement so as to end the tariff war lasting for more than six months.

The agreement under negotiation is likely to include China’s spending spree on US goods and services which is expected to substantially reduce China’s trade surplus against the US. Moreover, China needs to address a series of concerns raised by the US ranging from forced technology transfer to cyber intrusions for commercial purposes.

We expect that both administrations can easily achieve some agreement on China’s long shopping list and put it into practice. On US demands of IP protection, further market opening-up and cyber theft, China is able to make some promises. The thorny part of bilateral negotiations will be how China can make the US believe they will seriously honor all their promises. That being said, more noises could appear relating to the ongoing bilateral negotiations before the preset deadline of March 1st. Nevertheless, we continue to assign 80% probability to the scenario that the ongoing negotiations will lead to a good outcome.

RMB exchange rate outlook

After the August 11th 2015 RMB exchange rate reform, RMB exchange rate is experiencing the second round of depreciation since April this year amid the trade war risk. However, RMB to USD exchange rate seems like to have a significant turnaround recently right after the US and China successfully finished the first round of trade negotiation in Beijing. On January 11th, RMB to USD exchange rate experienced a 1.3% daily appreciation, the largest one-day appreciation for the past several months. That means, the RMB exchange rate at the current stage is quite market sentiment driven, especially, based on the trade talk progress with the US.

In our baseline scenario which we assign 80% possibility, the US and China will reach the deal in March 2019, indicating the RMB will not go through a sharp depreciation trend after that. In addition, as FED signaled the slowing path of interest rate hike, emerging market currencies might have a release in 2019.

On the other hand, if the risk scenario materializes that the two sides fail the talk, the RMB exchange rate will easily depreciate beyond the psychological level of 7. Under this scenario, the PBoC might use the measures that were implemented during 2015 market turmoil, including tightening capital control, intervening HK offshore RMB market, burning foreign reserve to defend RMB exchange rate etc.

However, in the medium term, even though the trade war with the US is settled in March, there are still economic fundamentals for RMB depreciation: (i) continuing domestic economic slowdown; (ii) easing monetary measures leading the interest rate difference with the US shrink.

Looking ahead, RMB exchange rate in the short term will be quite depending on the China-US negotiation result in the coming much. But continuing depreciation pressure will be last for the following months, mainly due to domestic growth slowdown. However, the depreciation will not be that sharp given the ongoing satisfactory progress of US-China trade talk. Under the current circumstance, the equilibrium exchange rate should be in a range of 6.7-7. Altogether, we predict RMB exchange rate will reach 6.7 at end-2019. In addition, RMB exchange rate flexibility will be further enhanced, as exchange rate reform deepened.

- Growth slowdown is the prime risk in 2019