Steve H. Hanke: Iran’s Rial Is in a Death Spiral, Again

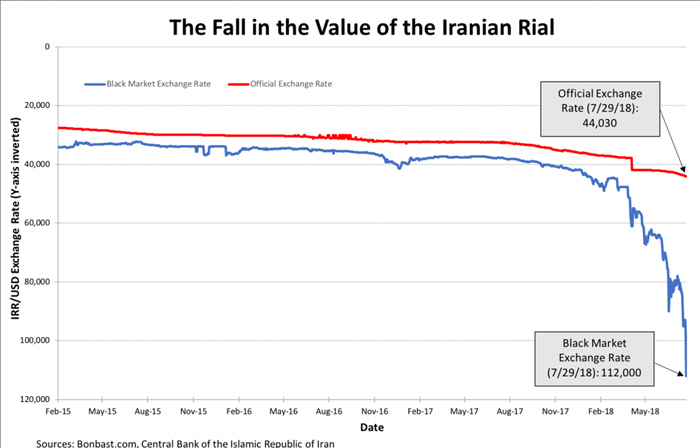

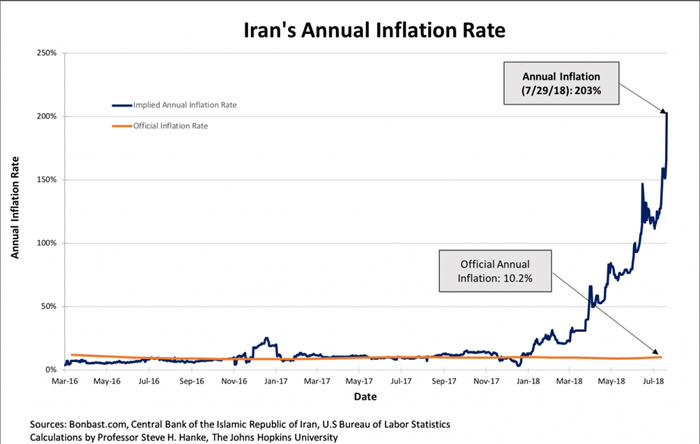

2018-08-11 IMI With the collapse of the rial, inflation has taken off. The chart below shows that ugly picture. By using the IRR/USD exchange rate, which represents the most important price in Iran, I measure Iran’s inflation rate. Indeed, the black-market exchange rate can be reliably transformed into accurate measurements of countrywide inflation rates (for those who want to read about the methodology in Farsi). The chart below shows how, with the collapse of the rial’s value against the U.S. dollar, Iran’s implied annual inflation rate has surged to 203%. That is almost twenty times higher than the official inflation rate of 10.2%.

With the collapse of the rial, inflation has taken off. The chart below shows that ugly picture. By using the IRR/USD exchange rate, which represents the most important price in Iran, I measure Iran’s inflation rate. Indeed, the black-market exchange rate can be reliably transformed into accurate measurements of countrywide inflation rates (for those who want to read about the methodology in Farsi). The chart below shows how, with the collapse of the rial’s value against the U.S. dollar, Iran’s implied annual inflation rate has surged to 203%. That is almost twenty times higher than the official inflation rate of 10.2%.

While the situation is life-threatening, there is a way to cure the patient and to cure the patient rapidly. I know this first-hand because I have brought back several countries from near-death, hyperinflation episodes. For example, just take Bulgaria, where I was President Petar Stoyanov’s adviser (1997-2002).

In February 1997, Bulgaria was witnessing hyperinflation. The inflation rate was 242% per month. Yes, that was a monthly inflation rate, not an annual rate. And, to put things into perspective, Bulgaria’s monthly inflation rate of 242% in February 1997 was higher than Iran’s current annual inflation rate of 203%. It is worth noting that Iran’s current annual inflation rate, while very elevated, is a rate well below the hyperinflation threshold.

What did we do in Bulgaria to crush hyperinflation within a few hours? We installed a currency board on July 1, 1997. And just what is a currency board? An orthodox currency board issues notes and coins convertible on demand into a foreign anchor currency at a fixed rate of exchange. (In Bulgaria, the notes and coins issued were in Bulgarian lev, and the anchor currency was the German mark.) As reserves, it holds low-risk, interest-bearing bonds denominated in the anchor currency and typically some gold. The reserve levels (both floors and ceilings) are set by law and are equal to 100%, or slightly more, of its monetary liabilities (notes, coins, and, if permitted, deposits). A currency board’s convertibility and foreign reserve cover requirements do not extend to deposits at commercial banks or to any other financial assets. A currency board generates profits (seigniorage) from the difference between the interest it earns on its reserve assets and the expense of maintaining its liabilities.

By design, a currency board has no discretionary monetary powers and cannot engage in the fiduciary issue of money. It has an exchange rate policy (the exchange rate is fixed), but no monetary policy. A currency board’s operations are passive and automatic. The sole function of a currency board is to exchange the domestic currency it issues for an anchor currency at a fixed rate. Consequently, the quantity of domestic currency in circulation is determined solely by market forces, namely the demand for domestic currency. Since the domestic currency issued via a currency board is a clone of its anchor currency, a currency board country is part of an anchor currency country’s unified currency area.

Bulgaria’s currency board has been very successful:

While the situation is life-threatening, there is a way to cure the patient and to cure the patient rapidly. I know this first-hand because I have brought back several countries from near-death, hyperinflation episodes. For example, just take Bulgaria, where I was President Petar Stoyanov’s adviser (1997-2002).

In February 1997, Bulgaria was witnessing hyperinflation. The inflation rate was 242% per month. Yes, that was a monthly inflation rate, not an annual rate. And, to put things into perspective, Bulgaria’s monthly inflation rate of 242% in February 1997 was higher than Iran’s current annual inflation rate of 203%. It is worth noting that Iran’s current annual inflation rate, while very elevated, is a rate well below the hyperinflation threshold.

What did we do in Bulgaria to crush hyperinflation within a few hours? We installed a currency board on July 1, 1997. And just what is a currency board? An orthodox currency board issues notes and coins convertible on demand into a foreign anchor currency at a fixed rate of exchange. (In Bulgaria, the notes and coins issued were in Bulgarian lev, and the anchor currency was the German mark.) As reserves, it holds low-risk, interest-bearing bonds denominated in the anchor currency and typically some gold. The reserve levels (both floors and ceilings) are set by law and are equal to 100%, or slightly more, of its monetary liabilities (notes, coins, and, if permitted, deposits). A currency board’s convertibility and foreign reserve cover requirements do not extend to deposits at commercial banks or to any other financial assets. A currency board generates profits (seigniorage) from the difference between the interest it earns on its reserve assets and the expense of maintaining its liabilities.

By design, a currency board has no discretionary monetary powers and cannot engage in the fiduciary issue of money. It has an exchange rate policy (the exchange rate is fixed), but no monetary policy. A currency board’s operations are passive and automatic. The sole function of a currency board is to exchange the domestic currency it issues for an anchor currency at a fixed rate. Consequently, the quantity of domestic currency in circulation is determined solely by market forces, namely the demand for domestic currency. Since the domestic currency issued via a currency board is a clone of its anchor currency, a currency board country is part of an anchor currency country’s unified currency area.

Bulgaria’s currency board has been very successful:

- It stopped hyperinflation in 1997, which peaked at a monthly rate of 242% in February 1997.

- It has allowed Bulgaria to weather all external financial crises, including the collapse of the Russian ruble in 1998 and the Great Recession of 2009.

- It also allowed Bulgaria to weather the banking collapse of the Corporate Commercial Bank (KTB), which occurred in 2014 (and which was not caused by, or had any connection to, the currency board system, but rather the Banking and Supervision Departments of the Bulgarian National Bank (BNB) that failed to properly regulate and monitor the KTB).

- Most importantly, since the government cannot borrow from the currency board (BNB), fiscal discipline is imposed on Bulgaria’s politicians. Since the installation of the currency board in 1997, fiscal deficits have been tightly controlled and the level of Bulgaria’s debt has plunged. Indeed, Bulgaria’s fiscal discipline and debt reduction have made Bulgaria a star performer in the European Union.