Herbert Poenisch: Recent Capital Flows Through Chinese Banks

2017-08-07 IMI Brief analysis of recent developments:

Brief analysis of recent developments:

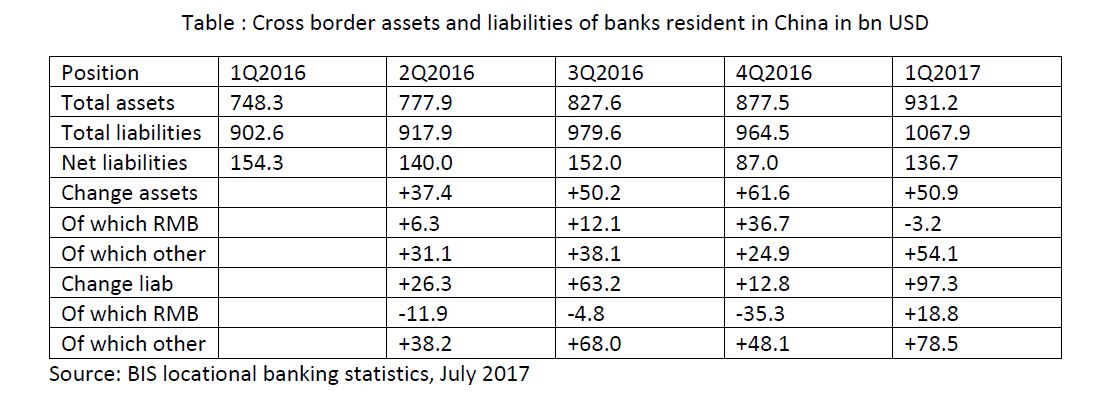

- Cross-border lending continued unabated, notably in other currencies than RMB. This trend of strong lending in foreign currencies has been observed for several quarters, with lending in RMB even in decline in 1Q 2017.

- The net liabilities of the banking sector continued to be recorded, with the exception of the 4Q2016 which recorded substantial outflows, due to continued growth of cross-border claims while the liabilities declined markedly.

- Looking at the breakdown into currencies, the decline in RMB liabilities was substantial. The declines were recorded during all quarters of 2016, however mostly in the last quarter. The biggest source of cross-border deposits is Hong Kong.