Dong Jinyue and Xia Le: What is Our Expectation of Bilateral Investment Treaty with the EU?

2018-08-11 IMI

The progress of China-EU BIT negotiation

Actually, starting from 1982, China has already signed bilateral investment agreements with 27 member countries of the EU (only Ireland was excluded). However, as the time goes, the new political and economic environment calls for a new bilateral investment agreement under the EU framework, instead of with the individual member country, which is the China-EU Bilateral Investment Treaty (BIT). The reasons for a unified bilateral investment agreement with the EU are straightforward:

First, starting from December 2009, Lisbon Treaty granted the EU the rights to make the FDI policies for all the member countries, making the previous individual agreements losing the legal effect. Second, when China signed the bilateral investment agreement with individual country of the EU previously, China was still the net receiver of the FDI with limited investment in the EU, thus, those individual agreements cannot effectively protect China’s interests as an investor to the EU now. Third, the contents of the agreement with the individual country are quite varying among the member countries, calling for a unified bilateral investment treaty under the EU framework.

Actually, the China-EU negotiations on the Bilateral Investment Treaty (BIT) started early in November of 2013. Till now, both sides have already gone through 17 rounds of negation on the contents of BIT. Recently, in July 2018, amid the trade war with the US, the China-EU summit was held in Beijing, seeking for the acceleration of the negotiations of BIT and put the BIT as the first priority in the bilateral cooperation.

The market believes that the prototype of the BIT between China and the EU should be based on the already signed bilateral investment agreements between the EU and Canada, Japan and the US.

According to the documents released by the EU, the main appeals of the EU on the BIT negotiations with China include the following contents, which are widely regarded as the concentrations and the difficulties in the bilateral negotiations:

(i) Pre-establishment national treatment, which means to provide national treatment for foreign capital during the entry stage, indicating that the capital importing country should provide foreign capital treatment that is no less than domestic capital in the pre-establishment stage.

(ii) Negative list management, which means the authorities from the two sides list the sectors which do not open to the foreign investors;

(iii) Competitive neutrality of the state-owned enterprises which is the recognition that significant government business activities which are in competition with the private sector should not have a competitive advantage or disadvantage simply by virtue of government ownership and control;

(iv) Expansion of the market permit, especially the openness of high-end service sector, the financial sector and the telecommunication sector, etc;

(v) Increasing the transparent and predictability of regulations;

(vi) Intellectual property rights protection;

(vii) High level of environmental and labor protection;

(viii) Effective dispute settlement mechanism.

Importantly, in the China-EU summit in July this year, the two sides have already exchanged the market entry permit list, marking an important progress of the BIT negotiation. Till now, the EU and China have reached agreements on the fields of non-discriminatory principles and regulatory environment improvement. However, there is still large discrepancy for the two sides in the fields of national treatment and negative list, etc. Both sides expect that they will exchange the negative list very soon this year, which will be another important step in the negotiation progress.

Some caveats might be noteworthy on BIT

Although the China-EU BIT negotiations have made important progress so far, there are still many difficulties ahead, including:

(i) Some member countries of the EU have conflicting attitude towards openness to Chinese investment. On the one hand, they want the globalization which brings about more opportunities to them while on the other hand, protectionism and populism also exist. Some member countries even restricted the investment of high-end manufacturing and high-tech industries to China. This makes the negotiation of BIT sometimes stagnant in the previous years. Moreover, the EU also has not admitted the market economy status of China yet.

(ii) Two sides have different core appeals: from Chinese side, China mainly wants the EU to be against protectionism while the EU intrinsically wants China to open more market. Actually, at the current stage of development of Chinese economy, the authorities still want to protect some comparatively weak but important industries to national economy; however, the EU wants to pursuit a larger scale of openness in Chinese market, especially financial sector and telecommunication.

(iii) It is also difficult to reach the agreement on the “competitive neutrality of state-owned enterprises” so far. The EU, together with the US, has been criticizing China on protecting the state-owned enterprises in competition policy making, bank borrowing, subsidies etc. Thus, the EU wants to cite the principle of “competitive neutrality” in order to support the competitiveness of their firms in China. This unavoidably brings about a lot of challenges on the current mechanism of state-owned enterprises and China’s socialism system.

BIT’s implications for the US-China trade war and Chinese economy

China’s recent pushing forward the progress of signing the BIT with the EU is initially aimed to offset the shock from the trade war with the US. And from our perspective, BIT negotiations with the EU also provide China a way to end this trade war with the US gracefully.

By waging trade-war against China, the US wants to urge China to make material changes in the following areas: (i) reducing a huge trade surplus against the US; (ii) honoring their market-opening promise under the WTO system; (iii) stopping the practice of stealing advanced technologies from US firms (including forced technique transfer, lack of Intellectual property IP protection, internet hacking etc.) and (iv) leveling the playing field for US firms and scrapping certain industry policies and subsidies.

Although the EU disagrees with the US on their unilateral approach, the EU has very similar requests for China. Therefore, among these requests from the US, all of them are expected to be covered through the negotiations of the BIT between the EU and China. If both sides manage to finalize the BIT as pledged, it will set an example for the US to negotiate with China to end the trade war. More importantly, it will add enormous pressure to the Trump administration because the European firms, with a BIT with China in place, are likely to enjoy advantages in accessing to China’s domestic market over their US peers. The US will have the urgency to solve the trade disputes with China soon to get equal treatments.

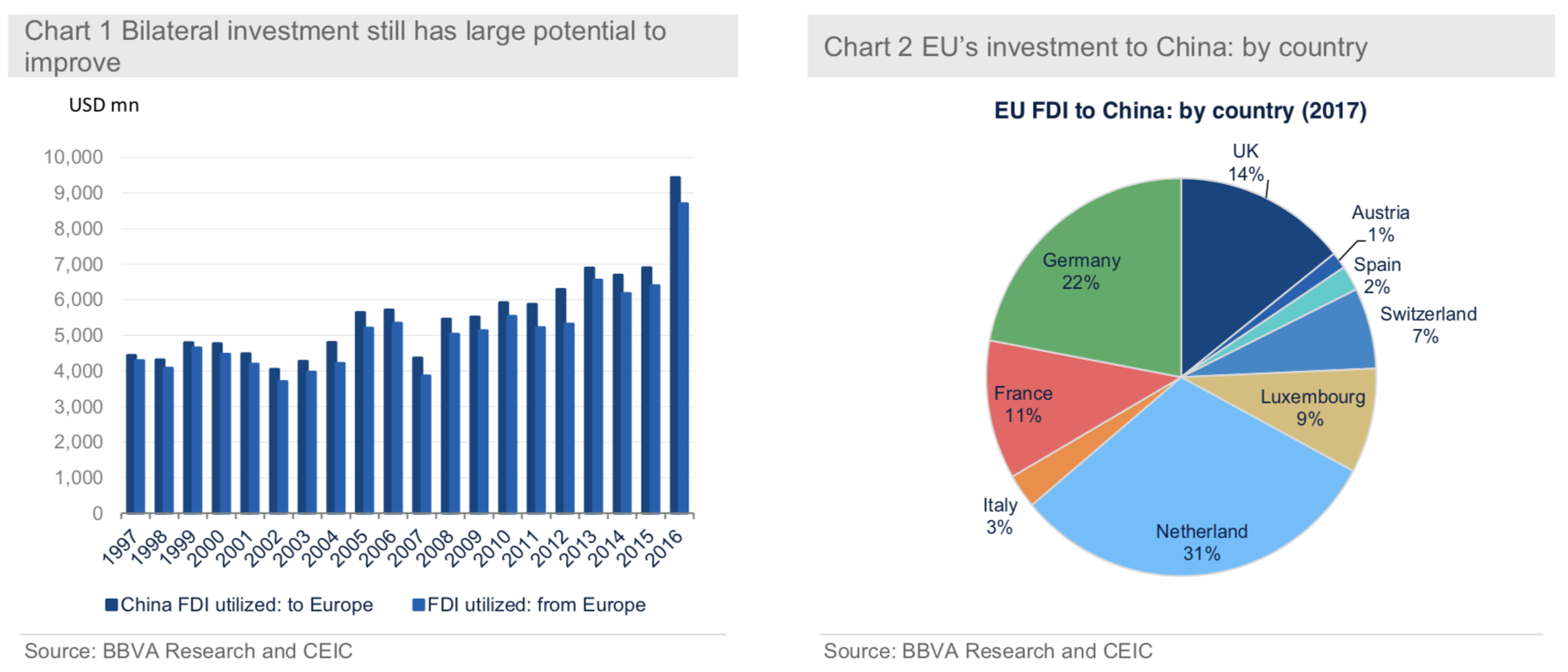

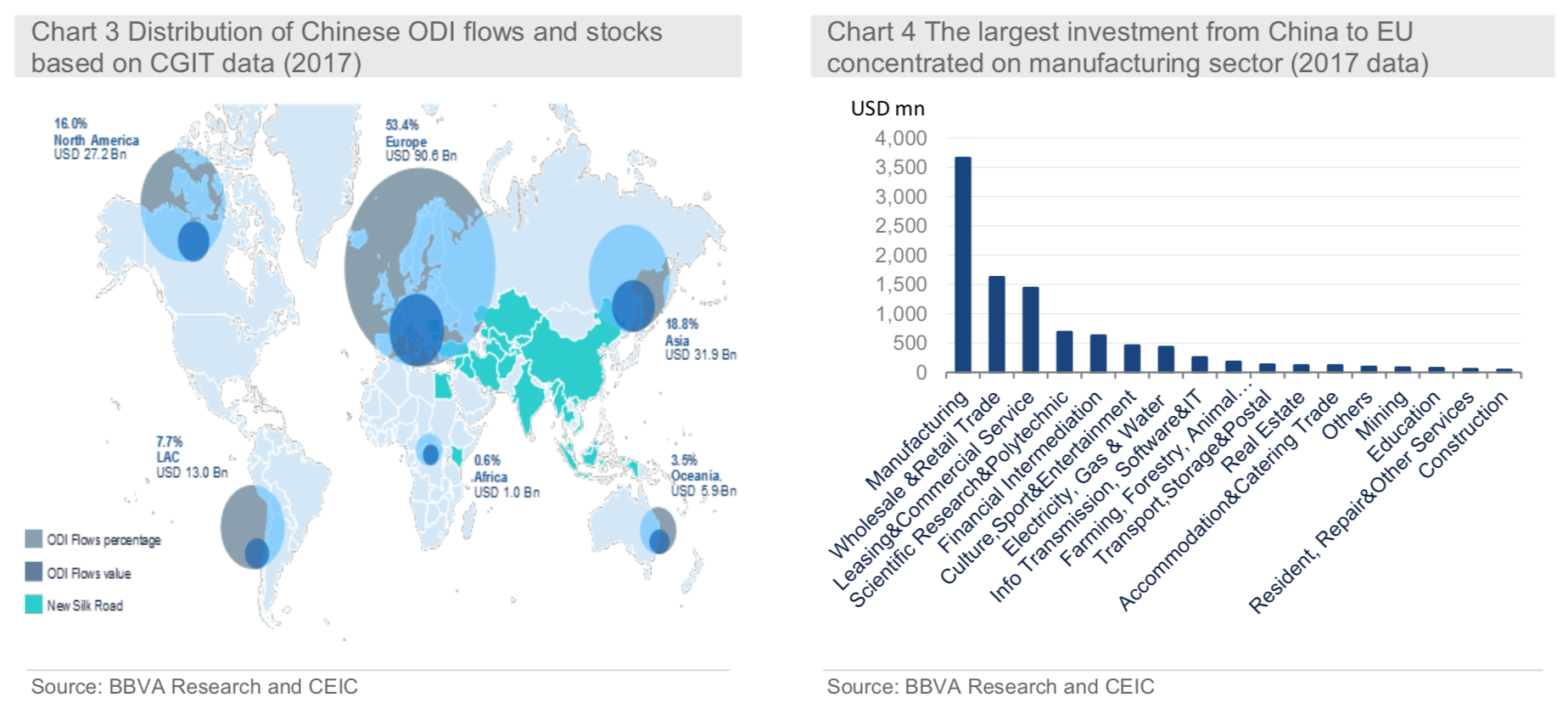

The BIT with the EU also has important implications on Chinese economy. Amid the recent trade war and the domestic deleveraging in real economy and the financial sector, economic growth has moderated as seen by the Q2 outturns. The progress of signing BIT with the EU not only offsets the external shock from the US but also significantly promotes bilateral foreign direct investment in and out of China, which stimulates China’s growth in the medium to long term. In addition, the BIT progress also improves market sentiment of China’s investors, which might be a positive signal to Chinese financial market and RMB exchange rate.

Finally, providing more market entry to the EU investment also could press ahead the SOE reform in China. By introducing free competition, especially the competition neutrality of the state-owned enterprises, the BIT might lead the SOEs to participate in the international competitions and to avoid over-protections by the government, bringing about more vigor to SOEs. Moreover, it will also have positive impact on China’s private enterprises, as they might have more global investors and receive more fair competitions. In the long run, China’s policy of deepening open-up will enhance the competitiveness of China’s enterprises in the world arena.

The progress of China-EU BIT negotiation

Actually, starting from 1982, China has already signed bilateral investment agreements with 27 member countries of the EU (only Ireland was excluded). However, as the time goes, the new political and economic environment calls for a new bilateral investment agreement under the EU framework, instead of with the individual member country, which is the China-EU Bilateral Investment Treaty (BIT). The reasons for a unified bilateral investment agreement with the EU are straightforward:

First, starting from December 2009, Lisbon Treaty granted the EU the rights to make the FDI policies for all the member countries, making the previous individual agreements losing the legal effect. Second, when China signed the bilateral investment agreement with individual country of the EU previously, China was still the net receiver of the FDI with limited investment in the EU, thus, those individual agreements cannot effectively protect China’s interests as an investor to the EU now. Third, the contents of the agreement with the individual country are quite varying among the member countries, calling for a unified bilateral investment treaty under the EU framework.

Actually, the China-EU negotiations on the Bilateral Investment Treaty (BIT) started early in November of 2013. Till now, both sides have already gone through 17 rounds of negation on the contents of BIT. Recently, in July 2018, amid the trade war with the US, the China-EU summit was held in Beijing, seeking for the acceleration of the negotiations of BIT and put the BIT as the first priority in the bilateral cooperation.

The market believes that the prototype of the BIT between China and the EU should be based on the already signed bilateral investment agreements between the EU and Canada, Japan and the US.

According to the documents released by the EU, the main appeals of the EU on the BIT negotiations with China include the following contents, which are widely regarded as the concentrations and the difficulties in the bilateral negotiations:

(i) Pre-establishment national treatment, which means to provide national treatment for foreign capital during the entry stage, indicating that the capital importing country should provide foreign capital treatment that is no less than domestic capital in the pre-establishment stage.

(ii) Negative list management, which means the authorities from the two sides list the sectors which do not open to the foreign investors;

(iii) Competitive neutrality of the state-owned enterprises which is the recognition that significant government business activities which are in competition with the private sector should not have a competitive advantage or disadvantage simply by virtue of government ownership and control;

(iv) Expansion of the market permit, especially the openness of high-end service sector, the financial sector and the telecommunication sector, etc;

(v) Increasing the transparent and predictability of regulations;

(vi) Intellectual property rights protection;

(vii) High level of environmental and labor protection;

(viii) Effective dispute settlement mechanism.

Importantly, in the China-EU summit in July this year, the two sides have already exchanged the market entry permit list, marking an important progress of the BIT negotiation. Till now, the EU and China have reached agreements on the fields of non-discriminatory principles and regulatory environment improvement. However, there is still large discrepancy for the two sides in the fields of national treatment and negative list, etc. Both sides expect that they will exchange the negative list very soon this year, which will be another important step in the negotiation progress.

Some caveats might be noteworthy on BIT

Although the China-EU BIT negotiations have made important progress so far, there are still many difficulties ahead, including:

(i) Some member countries of the EU have conflicting attitude towards openness to Chinese investment. On the one hand, they want the globalization which brings about more opportunities to them while on the other hand, protectionism and populism also exist. Some member countries even restricted the investment of high-end manufacturing and high-tech industries to China. This makes the negotiation of BIT sometimes stagnant in the previous years. Moreover, the EU also has not admitted the market economy status of China yet.

(ii) Two sides have different core appeals: from Chinese side, China mainly wants the EU to be against protectionism while the EU intrinsically wants China to open more market. Actually, at the current stage of development of Chinese economy, the authorities still want to protect some comparatively weak but important industries to national economy; however, the EU wants to pursuit a larger scale of openness in Chinese market, especially financial sector and telecommunication.

(iii) It is also difficult to reach the agreement on the “competitive neutrality of state-owned enterprises” so far. The EU, together with the US, has been criticizing China on protecting the state-owned enterprises in competition policy making, bank borrowing, subsidies etc. Thus, the EU wants to cite the principle of “competitive neutrality” in order to support the competitiveness of their firms in China. This unavoidably brings about a lot of challenges on the current mechanism of state-owned enterprises and China’s socialism system.

BIT’s implications for the US-China trade war and Chinese economy

China’s recent pushing forward the progress of signing the BIT with the EU is initially aimed to offset the shock from the trade war with the US. And from our perspective, BIT negotiations with the EU also provide China a way to end this trade war with the US gracefully.

By waging trade-war against China, the US wants to urge China to make material changes in the following areas: (i) reducing a huge trade surplus against the US; (ii) honoring their market-opening promise under the WTO system; (iii) stopping the practice of stealing advanced technologies from US firms (including forced technique transfer, lack of Intellectual property IP protection, internet hacking etc.) and (iv) leveling the playing field for US firms and scrapping certain industry policies and subsidies.

Although the EU disagrees with the US on their unilateral approach, the EU has very similar requests for China. Therefore, among these requests from the US, all of them are expected to be covered through the negotiations of the BIT between the EU and China. If both sides manage to finalize the BIT as pledged, it will set an example for the US to negotiate with China to end the trade war. More importantly, it will add enormous pressure to the Trump administration because the European firms, with a BIT with China in place, are likely to enjoy advantages in accessing to China’s domestic market over their US peers. The US will have the urgency to solve the trade disputes with China soon to get equal treatments.

The BIT with the EU also has important implications on Chinese economy. Amid the recent trade war and the domestic deleveraging in real economy and the financial sector, economic growth has moderated as seen by the Q2 outturns. The progress of signing BIT with the EU not only offsets the external shock from the US but also significantly promotes bilateral foreign direct investment in and out of China, which stimulates China’s growth in the medium to long term. In addition, the BIT progress also improves market sentiment of China’s investors, which might be a positive signal to Chinese financial market and RMB exchange rate.

Finally, providing more market entry to the EU investment also could press ahead the SOE reform in China. By introducing free competition, especially the competition neutrality of the state-owned enterprises, the BIT might lead the SOEs to participate in the international competitions and to avoid over-protections by the government, bringing about more vigor to SOEs. Moreover, it will also have positive impact on China’s private enterprises, as they might have more global investors and receive more fair competitions. In the long run, China’s policy of deepening open-up will enhance the competitiveness of China’s enterprises in the world arena.