Hong Hao: War and Peace

2019-05-21 IMI Source: BOCOM Int'l

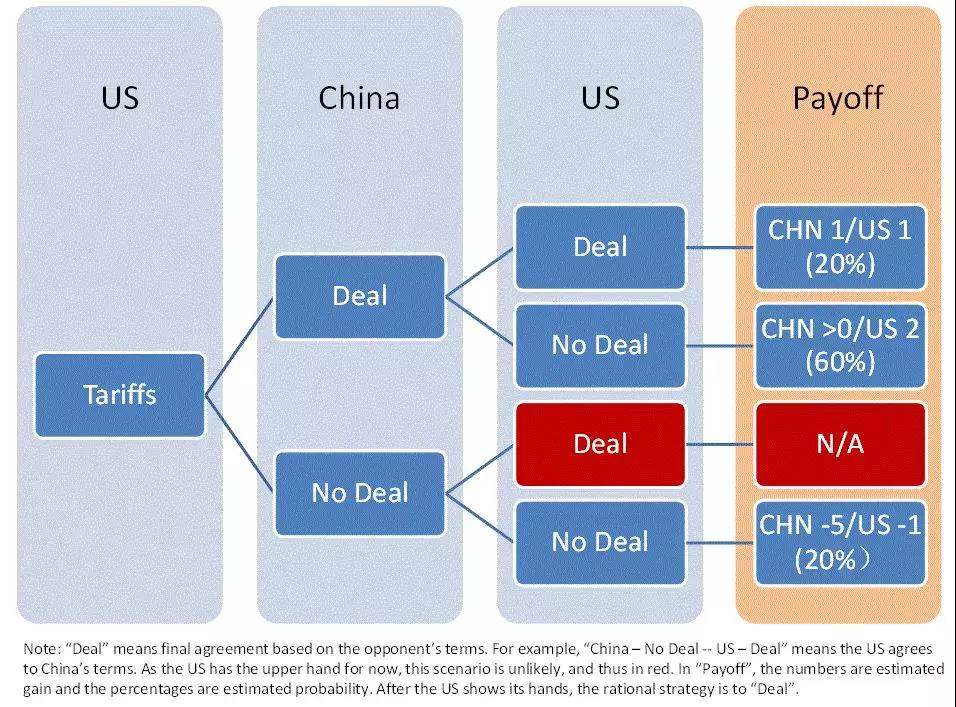

That sounds plausible on paper. But such analysis has a number of restrictive assumptions: each player is rational being one of them. But it is easy to lose one’s head in a stressful situation. The analysis is also short-term focus and entirely utilitarian, ignoring longer-term impacts such as relocation of industrial supply chain, loss of foreign confidence and potential capital flight. Further, in such a game, the winning strategy for both sides is really to play “tit-for-tat” – you scratch my back and I scratch yours. Before the hiccup, both sides did show goodwill in delaying tariffs and compromising during talks to reach an agreement. But now tension starts to escalate.

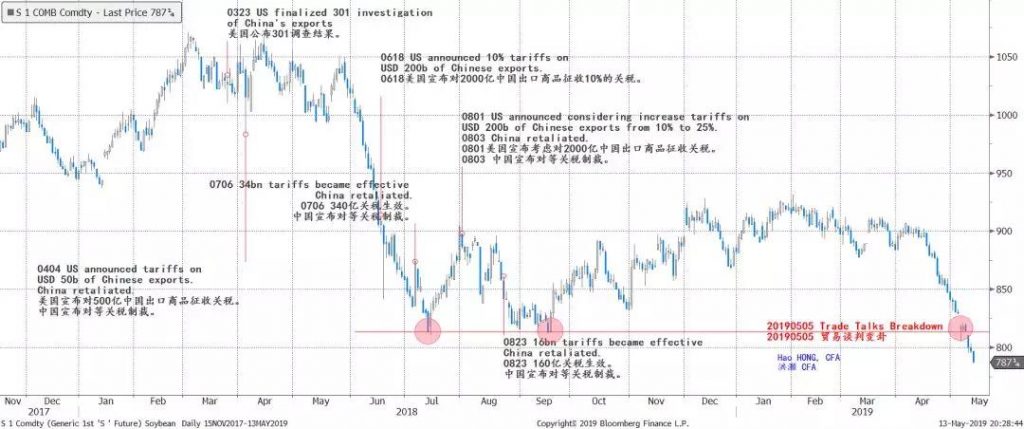

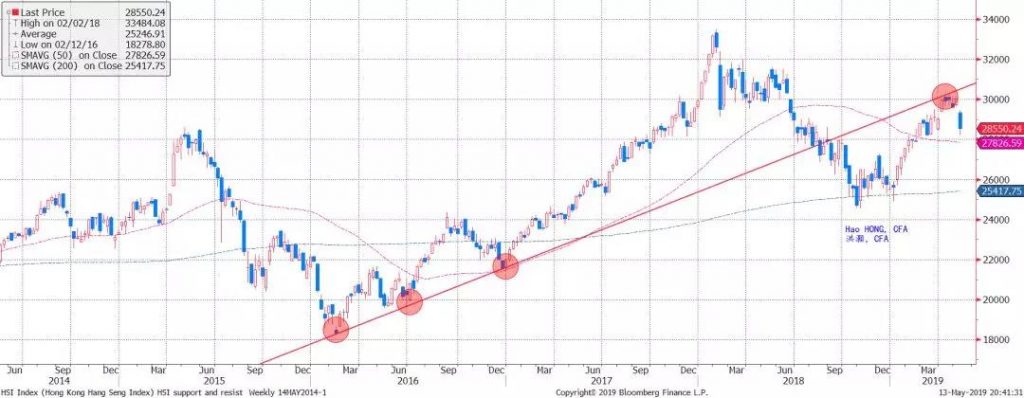

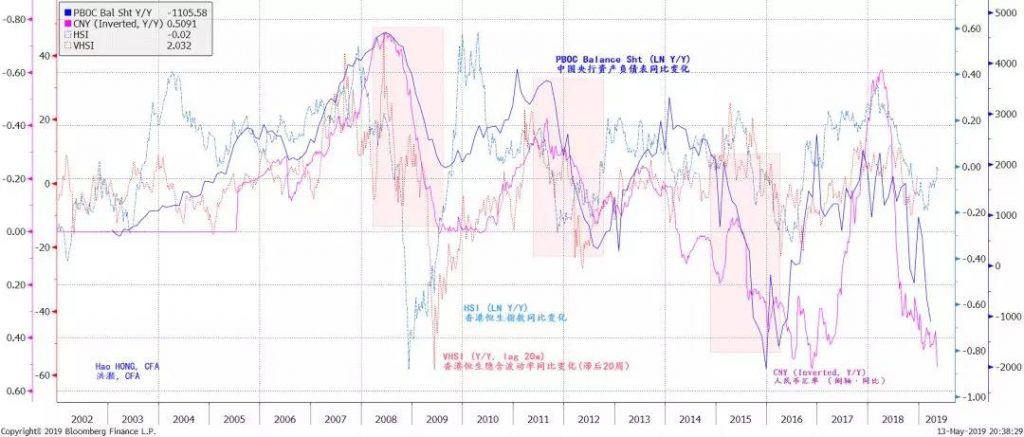

The constraints outside textbooks are showing in unpalatable technical patterns of risk asset prices. For instance, soybean futures has broken its support level last seen during the worsening trade talks in 2018; the Hang Seng’s long-term support has turned into significant near-term resistance; the RMB is plunging towards its lows (Figure 2-4) – just to name a few. This is a high-stake game that has the potential to change the trajectory of economic cycle, and reshape the world order. In our 2019 outlook report published last November, we set satisfactory trade talks as our base case, and a breakdown of talks as a risk scenario. While we continue to hope for the best, with theoretical support, the market is saying we should also prepare for the worst.

Figure 2: US soybean futures has broken its support level seen during the trade frictions in 2018

Source: BOCOM Int'l

That sounds plausible on paper. But such analysis has a number of restrictive assumptions: each player is rational being one of them. But it is easy to lose one’s head in a stressful situation. The analysis is also short-term focus and entirely utilitarian, ignoring longer-term impacts such as relocation of industrial supply chain, loss of foreign confidence and potential capital flight. Further, in such a game, the winning strategy for both sides is really to play “tit-for-tat” – you scratch my back and I scratch yours. Before the hiccup, both sides did show goodwill in delaying tariffs and compromising during talks to reach an agreement. But now tension starts to escalate.

The constraints outside textbooks are showing in unpalatable technical patterns of risk asset prices. For instance, soybean futures has broken its support level last seen during the worsening trade talks in 2018; the Hang Seng’s long-term support has turned into significant near-term resistance; the RMB is plunging towards its lows (Figure 2-4) – just to name a few. This is a high-stake game that has the potential to change the trajectory of economic cycle, and reshape the world order. In our 2019 outlook report published last November, we set satisfactory trade talks as our base case, and a breakdown of talks as a risk scenario. While we continue to hope for the best, with theoretical support, the market is saying we should also prepare for the worst.

Figure 2: US soybean futures has broken its support level seen during the trade frictions in 2018

Source: Bloomberg, BOCOM Int'l

Figure 3: the Hang Seng’s long-term support has turned into near-term resistance.

Source: Bloomberg, BOCOM Int'l

Figure 3: the Hang Seng’s long-term support has turned into near-term resistance.

Source: Bloomberg, BOCOM Int'l

Figure 4: The RMB is plunging towards its lowest of ~7 last seen in late 2016.

Source: Bloomberg, BOCOM Int'l

Figure 4: The RMB is plunging towards its lowest of ~7 last seen in late 2016.

Source: Bloomberg, BOCOM Int'l

Source: Bloomberg, BOCOM Int'l