Xia Le, Dong Jinyue: Decline in Foreign Reserves won't Grind to a Halt in 2017: Scenario-based Projections

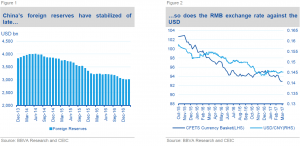

2017-04-14 IMI However, the downtrends of both foreign reserves and the RMB exchange rate have seemingly stabilized at the beginning of the year. In February, the amount of foreign reserves even rebounded to above USD 3 trillion thanks to the authorities’ tightening measures under the capital account and the temporary retreat of the USD strength. It begs the question whether the amount of foreign reserves is able to stabilize at the current level or even resume the uptrend over the medium-long term. We therefore extend our previous scenario analysis to end-2017 to come up with our projections of China’s foreign reserves. Like last time, our analysis starts with identifying the drivers behind the decline in foreign reserves.

Decomposing the change of China’s foreign reserves

Consistent with our previous report in 2016, we provide a method of decomposing foreign reserve decline is shown as follows:

Foreign reserves change= foreign reserve’s currency valuation effect +current account balance +net FDI+ foreign debt repayment+ domestic FX holding change + portfolio flows

Below are some details of the factors used in decomposition formula:

- We take into account the currency valuation eff The authorities revealed that the non-USD assets account for around 30% of China’s foreign reserves. If the US Dollar Index (DXY) appreciates, the value of non-USD assets will shrink accordingly, leading to the decline of USD-denominated aggregate foreign reserves.

- We use figures of current account balance retrieved from Balance of Payment (BOP) report.

- We use figures of net FDI from Balance of Payment (BOP) report as well.

- The proxy of foreign debt repayment is based on the monthly series of “Balance of Bank Client Cross- border FX Payment and Receipt” provided by SAFE. Compared to other proxies, it is a cash-based indicator just like foreign reserv We found that Chinese firms started to accelerate the pace of their foreign debt payment after the unexpected devaluation of the RMB in August 2015.

The item of domestic FX holding change includes not only FX deposit change of households and the corporate sector, but also banks’ FX position change. In the aftermath of the RMB devaluation in August 2017, household and enterprises scrambled to exchange their RMB deposits for the USD. In the meantime, banks increased their holding of FX so as to honor their forward currency contracts sold to clients. Therefore, we use the nominal value of banks’ forward FX sales to estimate the amount of banks’ FX position change last year. It is noted that this item could underestimate the effect of Chinese household and corporate sector rebalancing their portfolios toward foreign currencies because they could move their holding of FX abroad instead of keeping it in the domestic banking sector.

- The portfolio flows is defined as the residual item in our decomposition formula.

However, the downtrends of both foreign reserves and the RMB exchange rate have seemingly stabilized at the beginning of the year. In February, the amount of foreign reserves even rebounded to above USD 3 trillion thanks to the authorities’ tightening measures under the capital account and the temporary retreat of the USD strength. It begs the question whether the amount of foreign reserves is able to stabilize at the current level or even resume the uptrend over the medium-long term. We therefore extend our previous scenario analysis to end-2017 to come up with our projections of China’s foreign reserves. Like last time, our analysis starts with identifying the drivers behind the decline in foreign reserves.

Decomposing the change of China’s foreign reserves

Consistent with our previous report in 2016, we provide a method of decomposing foreign reserve decline is shown as follows:

Foreign reserves change= foreign reserve’s currency valuation effect +current account balance +net FDI+ foreign debt repayment+ domestic FX holding change + portfolio flows

Below are some details of the factors used in decomposition formula:

- We take into account the currency valuation eff The authorities revealed that the non-USD assets account for around 30% of China’s foreign reserves. If the US Dollar Index (DXY) appreciates, the value of non-USD assets will shrink accordingly, leading to the decline of USD-denominated aggregate foreign reserves.

- We use figures of current account balance retrieved from Balance of Payment (BOP) report.

- We use figures of net FDI from Balance of Payment (BOP) report as well.

- The proxy of foreign debt repayment is based on the monthly series of “Balance of Bank Client Cross- border FX Payment and Receipt” provided by SAFE. Compared to other proxies, it is a cash-based indicator just like foreign reserv We found that Chinese firms started to accelerate the pace of their foreign debt payment after the unexpected devaluation of the RMB in August 2015.

The item of domestic FX holding change includes not only FX deposit change of households and the corporate sector, but also banks’ FX position change. In the aftermath of the RMB devaluation in August 2017, household and enterprises scrambled to exchange their RMB deposits for the USD. In the meantime, banks increased their holding of FX so as to honor their forward currency contracts sold to clients. Therefore, we use the nominal value of banks’ forward FX sales to estimate the amount of banks’ FX position change last year. It is noted that this item could underestimate the effect of Chinese household and corporate sector rebalancing their portfolios toward foreign currencies because they could move their holding of FX abroad instead of keeping it in the domestic banking sector.

- The portfolio flows is defined as the residual item in our decomposition formula.

By our method, we decompose the historical series of foreign reserve changes since 2010. It is noted that the item of portfolio outflow was significantly narrowed in 2016 compared to the outturns of 2015 and 2014. We believe it is mainly due to the implementation of tightening measures under the capital account after the RMB devaluation in August 2015. Nevertheless, portfolio outflows continued to be the largest driver behind the decline in foreign reserves last year.

Meanwhile, domestic FX holding change and net FDI account for larger share of foreign reserve decline in 2016 than in the previous year. In particular, net FDI turn negative (USD -58.5 billion) on the BOP of 2016, compared to a positive inflow of USD 77 billion in 2015. Both factors are driven by Chinese residents increasing demand for diversifying their asset portfolios after the RMB ended its one-way depreciation in 2015. As we discussed in our thematic report ( “On the way to the floating regime: RMB is set to depreciate”), these two factors will indeed lead to a rebalancing of Chinese residents’ asset portfolios. The statistics of China’s International Investment Position shows that Chinese residents’ total foreign assets even slightly increased through 2016. We reckon that these two factors will remain as the main driving forces of China’s capital outflows and foreign reserve depletion in the coming years.

Comparatively, the contribution of valuation effect and foreign debt repayment decreased in 2016. The former was due to the fact that the USD appreciated by a less extent with respect to other currencies in 2016. The latter reflected that investors’ sentiment have largely stabilized since the beginning of 2016. After the authorities reassured the public that they won’t pursue a large one-off devaluation again, the borrowers of USD denominated debt tended to normalize their pace of repayment.

Two scenarios of foreign reserve projection at end-2017

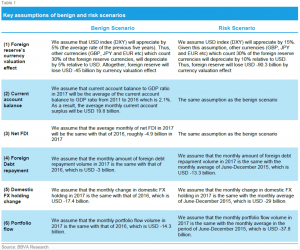

We construct two scenarios to forecast the dynamics of foreign reserves at end-2017 based on different assumptions regarding the drivers of foreign reserve changes. In our “benign” scenario, we assume that most of items in the decomposition equation will converge to the tranquil path in 2016. By contrast, the “risk” scenario assumes that the evolution of many factors follow the trend observed between August and December 2015. The starting point of our forecast is February 2017 when we have the latest available foreign reserve outturn.

By our method, we decompose the historical series of foreign reserve changes since 2010. It is noted that the item of portfolio outflow was significantly narrowed in 2016 compared to the outturns of 2015 and 2014. We believe it is mainly due to the implementation of tightening measures under the capital account after the RMB devaluation in August 2015. Nevertheless, portfolio outflows continued to be the largest driver behind the decline in foreign reserves last year.

Meanwhile, domestic FX holding change and net FDI account for larger share of foreign reserve decline in 2016 than in the previous year. In particular, net FDI turn negative (USD -58.5 billion) on the BOP of 2016, compared to a positive inflow of USD 77 billion in 2015. Both factors are driven by Chinese residents increasing demand for diversifying their asset portfolios after the RMB ended its one-way depreciation in 2015. As we discussed in our thematic report ( “On the way to the floating regime: RMB is set to depreciate”), these two factors will indeed lead to a rebalancing of Chinese residents’ asset portfolios. The statistics of China’s International Investment Position shows that Chinese residents’ total foreign assets even slightly increased through 2016. We reckon that these two factors will remain as the main driving forces of China’s capital outflows and foreign reserve depletion in the coming years.

Comparatively, the contribution of valuation effect and foreign debt repayment decreased in 2016. The former was due to the fact that the USD appreciated by a less extent with respect to other currencies in 2016. The latter reflected that investors’ sentiment have largely stabilized since the beginning of 2016. After the authorities reassured the public that they won’t pursue a large one-off devaluation again, the borrowers of USD denominated debt tended to normalize their pace of repayment.

Two scenarios of foreign reserve projection at end-2017

We construct two scenarios to forecast the dynamics of foreign reserves at end-2017 based on different assumptions regarding the drivers of foreign reserve changes. In our “benign” scenario, we assume that most of items in the decomposition equation will converge to the tranquil path in 2016. By contrast, the “risk” scenario assumes that the evolution of many factors follow the trend observed between August and December 2015. The starting point of our forecast is February 2017 when we have the latest available foreign reserve outturn.

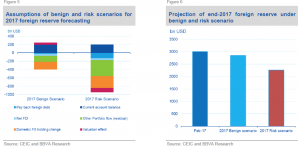

Based on the above assumptions, we project that China’s foreign reserves will drop by USD 158 billion this year, to USD 2,852 billion by December of 2017 in our benign scenario. That being said, the pressure of portfolio outflows can largely be offset by the stable trade surplus. By contrast, foreign reserves will significantly decline to USD 2,262 billion by the end of this year in our risk scenario (falling by USD 748 billion in 2017). Accelerating portfolio outflows, speeding-up foreign debt payment and the residents’ increasing willingness of holding FX deposits will all contribute to the sharp decline of foreign reserves. (Figure 5 & 6)

Based on the above assumptions, we project that China’s foreign reserves will drop by USD 158 billion this year, to USD 2,852 billion by December of 2017 in our benign scenario. That being said, the pressure of portfolio outflows can largely be offset by the stable trade surplus. By contrast, foreign reserves will significantly decline to USD 2,262 billion by the end of this year in our risk scenario (falling by USD 748 billion in 2017). Accelerating portfolio outflows, speeding-up foreign debt payment and the residents’ increasing willingness of holding FX deposits will all contribute to the sharp decline of foreign reserves. (Figure 5 & 6)

We expect that the real case is likely to tilt toward the benign scenario. That said, China’s foreign reserves are set to continue its downtrend this year. On the positive side, the depletion of foreign reserves will help Chinese household and corporate sectors to rebalance their portfolios through increasing outbound FDI and FX deposit holding. However, the authorities need to guard against the risks in the way ahead. If financial turmoil emerges again, the accelerating portfolio outflows and foreign debt payment could pose serious threats to the country’s giant but highly-leveraged financial system.

To avert a swift depletion of foreign reserves and its associated risks to financial stability, the authorities need to prevent large swings in the exchange rate as several driving forces of foreign reserve depletion are sensitive to abrupt movements of the currency. In this respect, it seems a wise idea to continue establishing the policy credibility of linking the RMB exchange rate to the CFETS currency basket. Moreover, they will continue to use macro prudential policy tools so as to encourage inflow and limit outflows under the capital account.

We expect that the real case is likely to tilt toward the benign scenario. That said, China’s foreign reserves are set to continue its downtrend this year. On the positive side, the depletion of foreign reserves will help Chinese household and corporate sectors to rebalance their portfolios through increasing outbound FDI and FX deposit holding. However, the authorities need to guard against the risks in the way ahead. If financial turmoil emerges again, the accelerating portfolio outflows and foreign debt payment could pose serious threats to the country’s giant but highly-leveraged financial system.

To avert a swift depletion of foreign reserves and its associated risks to financial stability, the authorities need to prevent large swings in the exchange rate as several driving forces of foreign reserve depletion are sensitive to abrupt movements of the currency. In this respect, it seems a wise idea to continue establishing the policy credibility of linking the RMB exchange rate to the CFETS currency basket. Moreover, they will continue to use macro prudential policy tools so as to encourage inflow and limit outflows under the capital account.