Dong Jinyue and Xia Le: What Will be China’s Weapons in the Trade War Arsenal?

2018-07-14 IMI (iii) “Anyone but the US”

Recently, China’s National Development and Reform Commission (NDRC) announced the 2018 “negative list” for foreign investment. Compared to its 2017 version, the new negative list features a significant reduction in the restrictions of foreign investment. In particular, China’s authorities dropped many restrictions of foreign investment in a number of sectors including finance, automotive and aviation etc.

This opening-up measure can also create certain policy room for China to retaliate the US tariff measures. For example, China’s authorities can intentionally prolong the approval process of US enterprises’ applications to enter these newly opened industries while give certain fast track to firms from other trade partners. This method will give certain disadvantage to the US firms but won’t hurt them immediately.

(iv)Targeting service trade such as education and tourism

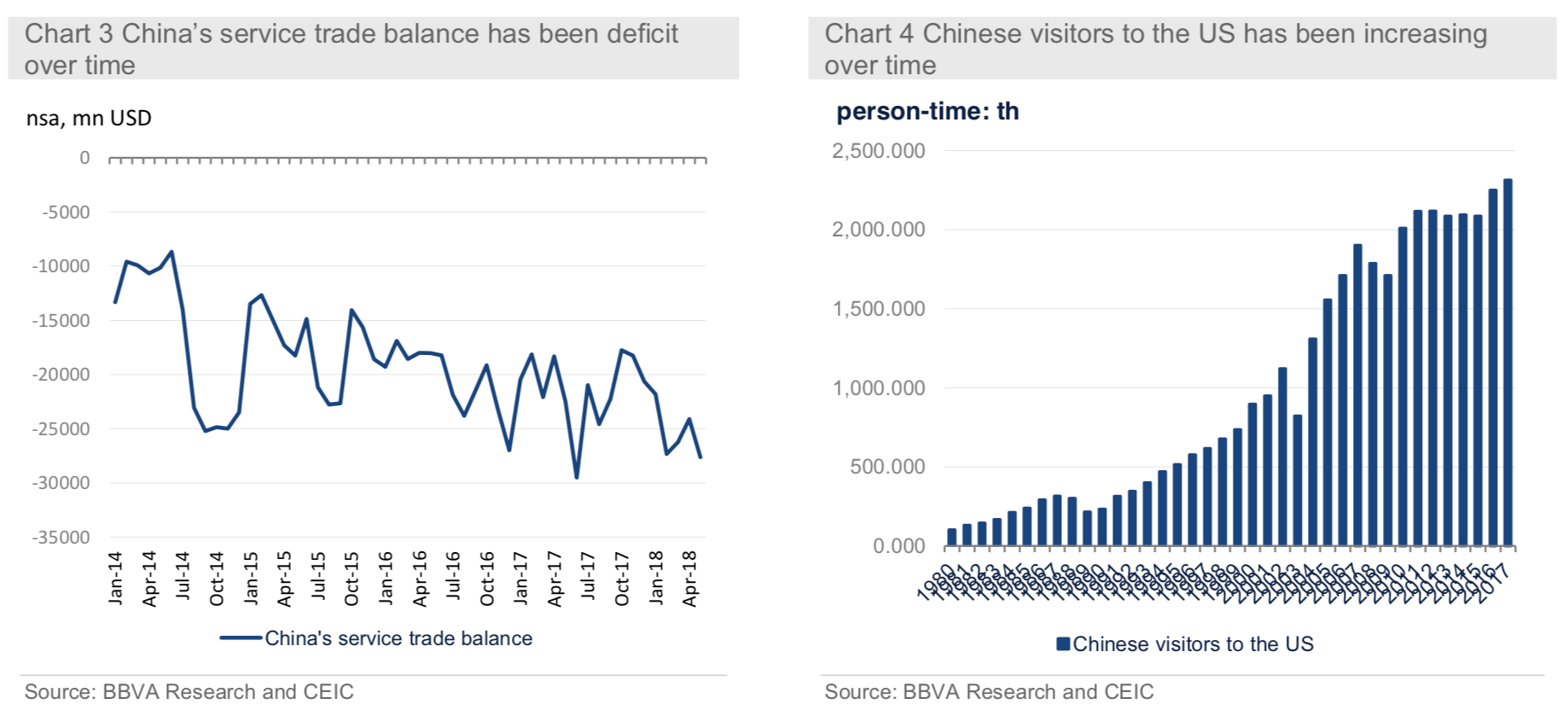

It is noted that the US has a surplus of USD 39 billion against China under the service trade, more than half of which comes from spending by Chinese tourists and Chinese students attending American schools and

colleges. (Chart 3 and 4)

China could target this service trade deficit and put more restrictions to control the number of Chinese tourists to the US. Indeed China has a recent track record of using it as an economic weapon. For instance, China’s authorities forbid domestic travel agencies to organize tourist groups to the South Korea in 2017 when the two countries’ relation turned sour.

However, we expect the impact of this measure could be limited since the US tourism industry is not that susceptible to Chinese tourists as the South Korea. Moreover, now the Trump administration deliberately tightens the visa issuance to Chinese students and researchers for so-called national security reason. It is hard to tell to what extent these measures could hurt the US.

(iii) “Anyone but the US”

Recently, China’s National Development and Reform Commission (NDRC) announced the 2018 “negative list” for foreign investment. Compared to its 2017 version, the new negative list features a significant reduction in the restrictions of foreign investment. In particular, China’s authorities dropped many restrictions of foreign investment in a number of sectors including finance, automotive and aviation etc.

This opening-up measure can also create certain policy room for China to retaliate the US tariff measures. For example, China’s authorities can intentionally prolong the approval process of US enterprises’ applications to enter these newly opened industries while give certain fast track to firms from other trade partners. This method will give certain disadvantage to the US firms but won’t hurt them immediately.

(iv)Targeting service trade such as education and tourism

It is noted that the US has a surplus of USD 39 billion against China under the service trade, more than half of which comes from spending by Chinese tourists and Chinese students attending American schools and

colleges. (Chart 3 and 4)

China could target this service trade deficit and put more restrictions to control the number of Chinese tourists to the US. Indeed China has a recent track record of using it as an economic weapon. For instance, China’s authorities forbid domestic travel agencies to organize tourist groups to the South Korea in 2017 when the two countries’ relation turned sour.

However, we expect the impact of this measure could be limited since the US tourism industry is not that susceptible to Chinese tourists as the South Korea. Moreover, now the Trump administration deliberately tightens the visa issuance to Chinese students and researchers for so-called national security reason. It is hard to tell to what extent these measures could hurt the US.

(v) Cooperating with other countries in trade and international investment

Now China is trying to ally with the EU and Japan to fight against the US. Unfortunately, the EU seems to be not interested in it. As some EU officials revealed, they have rejected China’s demand to publish an anti-US joint statement in the forthcoming Sino-European Summit. According to the media report, the EU is sharing almost every US concern with China although they don’t agree to US practice of unilaterally imposing tariff.

At the same time, China actively pushes for the signing of free trade agreement (FTA) and bilateral investment treaty (BIT) with EU and Japan. It is also pushing for the signing of Regional Comprehensive Economic Partnership (ASEAN 10+ China, Japan, South Korea, India, Australian, New Zealand). These initiatives are aimed to offset the shock from the trade war. From our perspective, they also provide China a way to end this trade war with the US gracefully.

Indeed, US major complaints against China in essence are the market-access issues. For example, the US claimed “forced technique transfer” usually happened in the joint venture between China’s local companies and multinational companies. The root reason is that China’s government didn’t fully open some sectors to foreign investors but only permit joint-ventures with local companies. As such, many local companies ask for technique transfer as one of premises to cooperate with foreign investors. Such a problem can easily be solved when China directly open these sectors to foreign investors and permit them to establish branches or control the major stake in the joint venture.

That being said, if China can manage to sign FTAs and BITs with the EU and Japan, the market-access issues between China and the US will become much easier to solve, which can also lay a good ground for solving other differences between them. Thus, this should be the right way to end this trade war with the least cost.

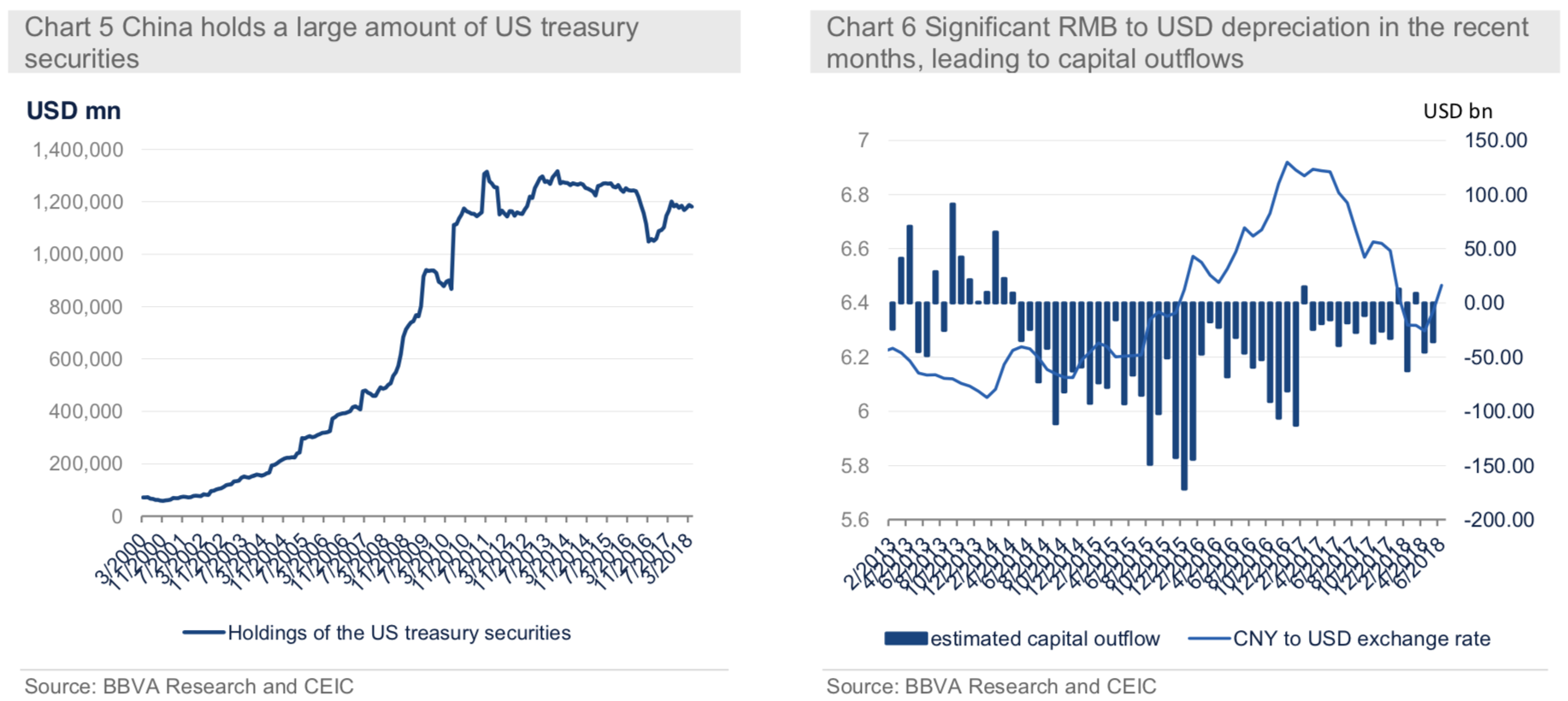

(vi) Dumping US treasury bonds

China is the biggest creditor of the United States: It owns more US government bonds than any other country, with the total amount around US 1.17 trillion as disclosed by US department of the treasury. We believe that the real figure could be higher than it as China’s government also holds US treasury bonds through certain special purpose vehicles (SPVs). (Chart 5)

(v) Cooperating with other countries in trade and international investment

Now China is trying to ally with the EU and Japan to fight against the US. Unfortunately, the EU seems to be not interested in it. As some EU officials revealed, they have rejected China’s demand to publish an anti-US joint statement in the forthcoming Sino-European Summit. According to the media report, the EU is sharing almost every US concern with China although they don’t agree to US practice of unilaterally imposing tariff.

At the same time, China actively pushes for the signing of free trade agreement (FTA) and bilateral investment treaty (BIT) with EU and Japan. It is also pushing for the signing of Regional Comprehensive Economic Partnership (ASEAN 10+ China, Japan, South Korea, India, Australian, New Zealand). These initiatives are aimed to offset the shock from the trade war. From our perspective, they also provide China a way to end this trade war with the US gracefully.

Indeed, US major complaints against China in essence are the market-access issues. For example, the US claimed “forced technique transfer” usually happened in the joint venture between China’s local companies and multinational companies. The root reason is that China’s government didn’t fully open some sectors to foreign investors but only permit joint-ventures with local companies. As such, many local companies ask for technique transfer as one of premises to cooperate with foreign investors. Such a problem can easily be solved when China directly open these sectors to foreign investors and permit them to establish branches or control the major stake in the joint venture.

That being said, if China can manage to sign FTAs and BITs with the EU and Japan, the market-access issues between China and the US will become much easier to solve, which can also lay a good ground for solving other differences between them. Thus, this should be the right way to end this trade war with the least cost.

(vi) Dumping US treasury bonds

China is the biggest creditor of the United States: It owns more US government bonds than any other country, with the total amount around US 1.17 trillion as disclosed by US department of the treasury. We believe that the real figure could be higher than it as China’s government also holds US treasury bonds through certain special purpose vehicles (SPVs). (Chart 5)

Investors worry that if China could dump its holding of US treasury bonds to retaliate for US tariff measures against China. Although this action looks very powerful at the first glance, it might be not effective in practice.

As a response the Federal Reserve can signal a slowdown of rate hikes and change its pace of balance sheet reduction, which can help to cushion the shocks from China’s short selling. Moreover, the US government could even cite national security laws to freeze China’s holding of US treasury bonds if they believe that China’s dumping behaviors aim to disrupt US financial market.

All in all, we believe that Chinese authorities will take a cool-headed approach and are unlikely to take extreme steps such as dumping US Treasury bonds.

(vii) Guiding RMB depreciation

The recent sharp depreciation of the RMB makes the market suspect whether China will use the RMB depreciation to retaliate the US. (Chart 6) We cannot agree to this point because the side effect of this currency weapon is too unpredictable.

As we witnessed in 2015-2016, a sharp currency depreciation could lead to large-scale capital outflows and pose material threats to the financial stability. There is no point for the authorities to risk financial stability in hitting back US tariff measures.

Indeed, the PBoC’s intervention into the FX market early this week has confirmed our prediction. Although the authorities are willing to allow the market to play an important role in pricing the currency, they will be very cautious to avert any risk of creating an adverse spiral between currency depreciation and capital flight. That being said, although the RMB exchange rate is expected to maintain a weak trend in the coming months due to the trade war, the authorities will ensure that the pace of depreciate is not too steep.

Conclusion

After reviewing a number of methods which China could use in the escalating trade dispute with the US, we find that China’s policy options to counter the US tariff measures are actually limited. We expect that the authorities will implement the methods from (i) to (v) but are unlikely to resort to method (vi) and (vii), namely dumping US treasury bonds and guiding currency depreciation.

More importantly, with time going, these retaliatory measures tend to have increasingly negative impact on China itself. For the positive side, the reality could make China actively seek for a solution through bilateral negotiation rather than escalating confrontation with the US. We expect that the two sides will restart the negotiation soon after the initial stage of the trade-war.

Investors worry that if China could dump its holding of US treasury bonds to retaliate for US tariff measures against China. Although this action looks very powerful at the first glance, it might be not effective in practice.

As a response the Federal Reserve can signal a slowdown of rate hikes and change its pace of balance sheet reduction, which can help to cushion the shocks from China’s short selling. Moreover, the US government could even cite national security laws to freeze China’s holding of US treasury bonds if they believe that China’s dumping behaviors aim to disrupt US financial market.

All in all, we believe that Chinese authorities will take a cool-headed approach and are unlikely to take extreme steps such as dumping US Treasury bonds.

(vii) Guiding RMB depreciation

The recent sharp depreciation of the RMB makes the market suspect whether China will use the RMB depreciation to retaliate the US. (Chart 6) We cannot agree to this point because the side effect of this currency weapon is too unpredictable.

As we witnessed in 2015-2016, a sharp currency depreciation could lead to large-scale capital outflows and pose material threats to the financial stability. There is no point for the authorities to risk financial stability in hitting back US tariff measures.

Indeed, the PBoC’s intervention into the FX market early this week has confirmed our prediction. Although the authorities are willing to allow the market to play an important role in pricing the currency, they will be very cautious to avert any risk of creating an adverse spiral between currency depreciation and capital flight. That being said, although the RMB exchange rate is expected to maintain a weak trend in the coming months due to the trade war, the authorities will ensure that the pace of depreciate is not too steep.

Conclusion

After reviewing a number of methods which China could use in the escalating trade dispute with the US, we find that China’s policy options to counter the US tariff measures are actually limited. We expect that the authorities will implement the methods from (i) to (v) but are unlikely to resort to method (vi) and (vii), namely dumping US treasury bonds and guiding currency depreciation.

More importantly, with time going, these retaliatory measures tend to have increasingly negative impact on China itself. For the positive side, the reality could make China actively seek for a solution through bilateral negotiation rather than escalating confrontation with the US. We expect that the two sides will restart the negotiation soon after the initial stage of the trade-war.