Dong Jinyue and Xia Le: What’s in China’s Policy Arsenal to Counter Global Recession?

2020-04-28 IMI

The global economy is sliding into a deep recession

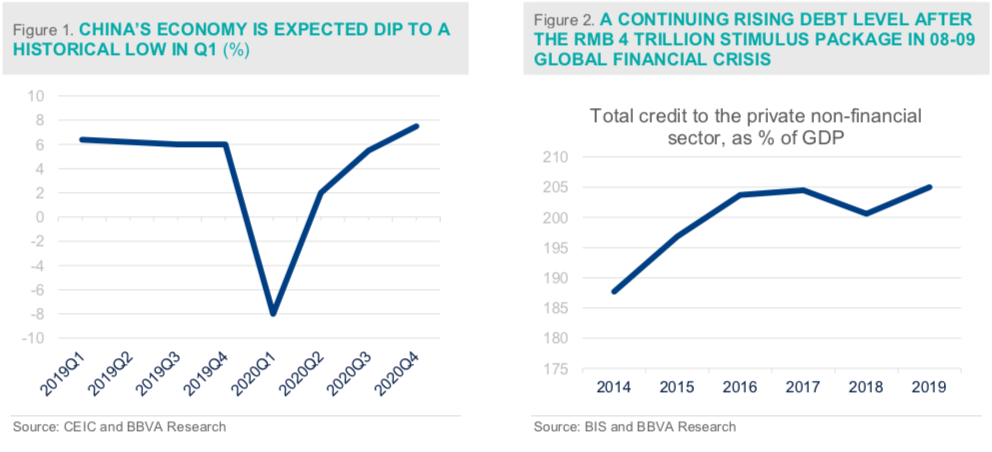

The outbreak of COVID-19 tips the global economy into a deep recession and its impact could endure in the long term. The measures adopted by countries to contain the COVID-19 contagion, together with the panic caused by the coronavirus, dramatically impair the normal economic activities. The market widely believes that the extent of the global recession caused by COVID-19 will be at least comparable to that of 2008-2009 Global Financial Crisis (GFC). (Figure 1)

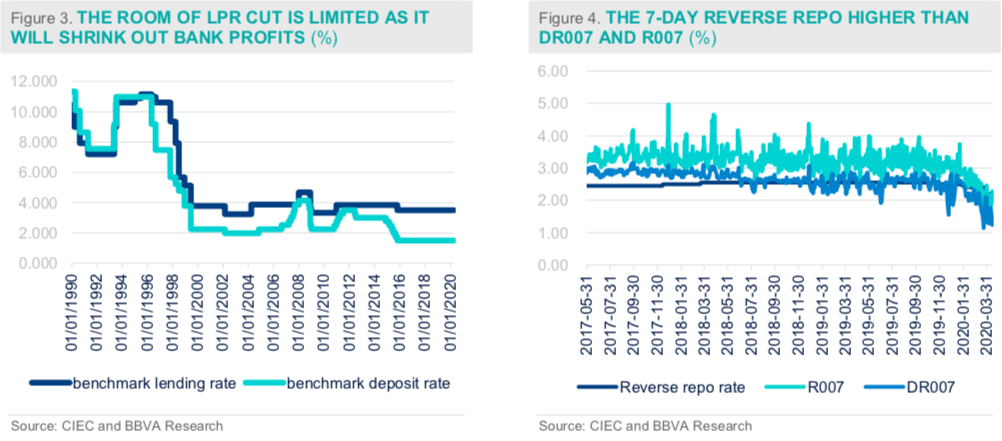

In face of the global economic recession, China’s authorities will deploy various fiscal and monetary policy tools to sustain the economy and avert financial meltdown. Fortunately, there are adequate policy tools in China’s policy arsenal. Meanwhile, Chinese authorities need to heed some lessons from their contentious RMB 4-trillion stimulus package unveiled during the 2008-2009 GFC, which is widely considered to be the prime culprit of China’s fast- rising debt level in the ensuing years. (Figure 2) In particular, the authorities should let the fiscal policy play a leading role this time, while making the loosening monetary measures complementary to fiscal ones. Moreover, the PBoC should be cautious about the use of interest rate cuts whilst proactively enacts quantitative tools to ensure the liquidity of financial sector.

This note focuses on examing China’s policy room and assessing the efficiency of a number of main fiscal and monetary policy tools. In particular, monetary policy tools to be discussed include: (i) interest rate cut (including LPR, benchmark deposit rate, open market operation rates, MLF etc.); (ii) RRR cut; (iii) other liquidity management tools, such as to extent the debt payment time for households and enterprises. The fiscal policy tools we will discuss mainly include tax cuts and fee reduction, special government bond, local government bond and new infrastructure investment support etc.

Monetary policy: more conservative interest rate cuts and more proactive liquidity management

On the front of monetary policy, we believe that China has enough policy reserve of conventional measures and doesn’t need to follow some advanced economies to enact non-conventional measures such as zero interest rate or even negative interest rate. A positive interest rate is in line with China’s potential growth and prevents the run- up of asset bubbles. Moreover, a positive interest rate encourages household savings and helps to maintain financial stability.

Given the nature of COVID-19 shock, a good strategy is to be more cautious about interest rate cuts while being more proactive using liquidity management tools. At the same time, the PBoC needs to smooth the transmission mechanism of monetary policy and to enhance the new corridor framework.

The appropriate monetary easing tools could be summarized as follows:

-Interest rate cut: China’s authorities have full control of four types of policy rates:

First, Loan Prime Rate (LPR), which is the new monetary policy rate to replace the previously benchmark lending rate after 2019 August. Under the new LPR pricing scheme, LPR is priced as the one-year Medium- term Lending Facilities (MLF) plus some adding points quoted by a group of selected commercial banks.

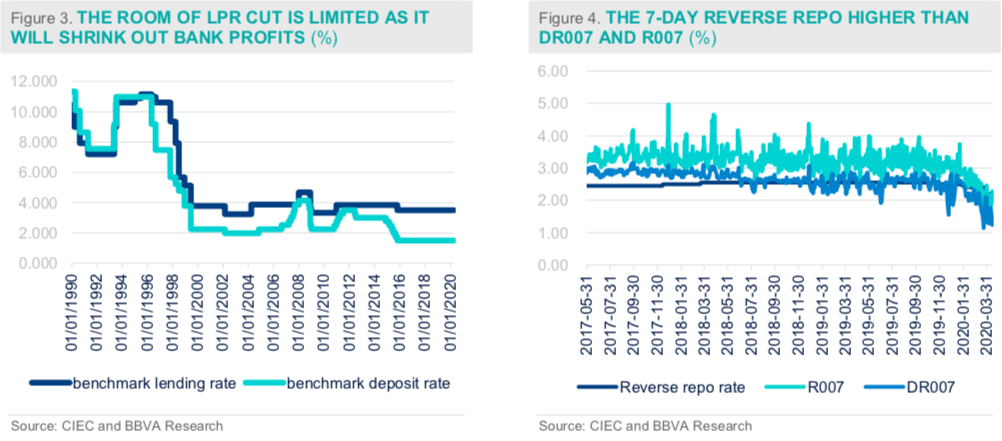

Second, the benchmark deposit rate, which directly dictates banks’ financing costs. The PBoC indicates that they prefer to keep the benchmark deposit rate even though the benchmark lending rate was replaced by the LPR. The current one-year benchmark deposit rate at 1.5% is already of the historical low. (Figure 3)

Third, the reverse repo rate in open market operation (OMO), which has a great influence on short-term financing costs of financial institutions. The current 7-day reverse repo rate is 2.4%, higher than 7-day R007 (interbank market rate for non-banking financial institutions) and 7-day DR007 (interbank market rate for banks). (Figure 4)

Last, medium-term lending facilities (MLF) rate, which is the rate that the central bank lends fund to commercial banks which provide high quality securities as pledges to the central bank. Under the new LPR scheme, the MLF becomes the pricing base for LPR although the two rates do not necessarily co-move each time.

At the current stage, the room for further rate cutting is limited. In China, bank deposits still account for a lion’s share of household financial wealth (around 46% of total financial wealth in 2016 according to an authoritative survey). The downward adjustment of benchmark deposit rate will reduce the interest income of household and could have significantly negative impact on private consumption.

In the meantime, China’s banking sector is not in a good shape. In the summer of 2019, several median-size banks were bailed out by the authorities in different ways. Although the authorities have done a very good job of containing the spillover effects of these bank failures, the asset quality of smaller lenders in China continue to be a grave concern. Therefore, too aggressive cuts of banks’ lending rate, without the downward adjustment of deposit rate, will avoidably squeeze banks’ net interest margin and even endanger the financial stability. That being said, the authorities will guide the lending rate to a lower level but in a more measured way. We envisage that the LPR will be lowered to 3.5% by the end-2020, implying additional downward adjustment of 55 bps from its current level.

-RRR (reserve requirement rate) cut: it is also a traditional quantitative tool of monetary policy in providing liquidity into the market. By cutting RRR, it could increase the money multiplier thus to increase the money supply to the real economy. Moreover, the cut of RRR might lead to a decline in short-term interest rates thus reduce the cost of bank in the liability side, in a sense it could release the pressure of interest rate cuts which reduce the lending rate thus protect banks’ profits. Moreover, compared with the interest rate cut above, RRR cut has much less pressure on the RMB exchange rate.

-Other liquidity management tools, such as to extend the debt payment time for households and enterprises:

The PBoC announced the temporary extension of debt payment for SMEs in March. We reckon that this kind of debt payment extension could be applied to more firms and households. These measures will mitigate the liquidity pressure of households and enterprises, thus to stimulate consumption and maintain investment.

Fiscal policy will play a leading role in this round of stimulus

Fiscal policy is expected to play a leading role in the stimulus package, as some fiscal tools can be more targeted compared with monetary easing. The available fiscal policy tools include: tax cut and fee reduction, issuance of special government bond and special local government bond, and support for new infrastructure investment etc. However, the authorities need to design the fiscal stimulus so as to avert a fast rise in leverage as it did during 2008-2009 GFC.

-Tax cut and fee reduction: this measure could be implemented more targeted in the sectors influenced by COVID-19, such as restaurants, entertainment, communication, retail sector and civil aviation. Except for the tax cuts, the government could also allow these enterprises to extent the payment time of social insurance, housing provided fund etc. to release their pressure of hiring people. Moreover, a direct fiscal transfer to these attacked sectors could also lower their funding costs and release their liquidity pressure.

-Issuance of special government bond. Actually, the recent Politburo working conference has already announced to increase this year’s fiscal deficit and to increase the issuance of special government bond (the last two times of issuance was in 1998 and 2007). We assume that if the government could increase the fiscal deficit to GDP ratio from previously 3% to 4% (equal to RMB 1 trillion around), taking into consideration of the increasing special government bond scale which is expected to be RMB 2 trillion, it will be RMB 3 trillion of stimulus in this regard.

-Expand the issuance of local government bond. Previously before the outbreak of COVID-19, we predicted the local government bond issuance will reach RMB 2.5-3 trillion this year. Now we anticipate that this figure will increase to RMB 4-5 trillion this year. Combining the local government bond issuance with the above-stated special government bond and deficit to GDP ratio expansion, there will be around RMB 5 trillion scale of fiscal stimulus, which is equivalent with that of 2008-2009 Global Financial Crisis.

-Support the new infrastructure investment. This is also a hot topic among the market participants recently as infrastructure investment has always been a counter-cyclical tool for Chinese authorities. However, at the current stage, we believe that the so-called new infrastructure investment, such as 5G, Beidou navigation system and railway transportation etc., should be mostly led by private investment instead of local government, in a bid to improve the investment efficiency.

In sum, we believe the current policy mix is to make the fiscal easing play a leading role while monetary policy coordinates. It is desirable that fiscal policy will be deployed in a more targeted way. In this respect, the stimulus package is likely to include fiscal tax cut and fee reduction, issuance of special government bond and special local government bond, and support for new infrastructure investment. On the monetary front, the liquidity management tools should be used more proactively since the interest rate cuts are constrained by various factors.