Hyun Song Shin:Can Central Banks Talk Too Much?

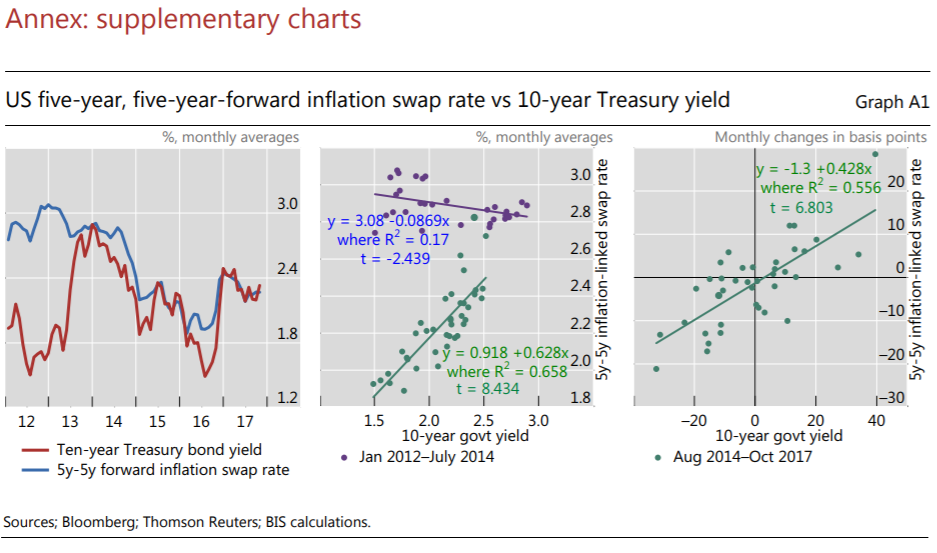

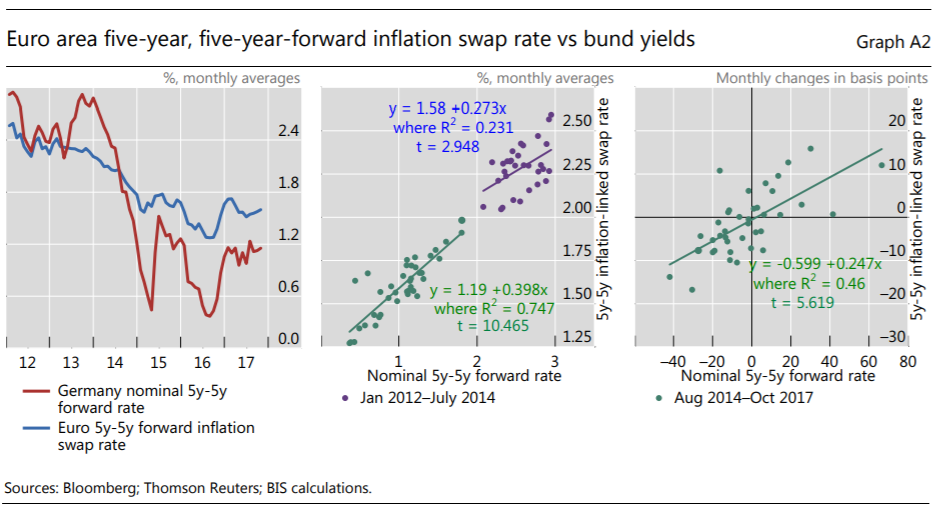

2019-09-10 IMI Most intriguingly, the inflation swap rate has begun to move in lockstep with the nominal yield itself. As I am at the ECB today, let me illustrate this with an example from the euro area. Similar results hold for the United States, and also when forward nominal yields are used (see Annex).

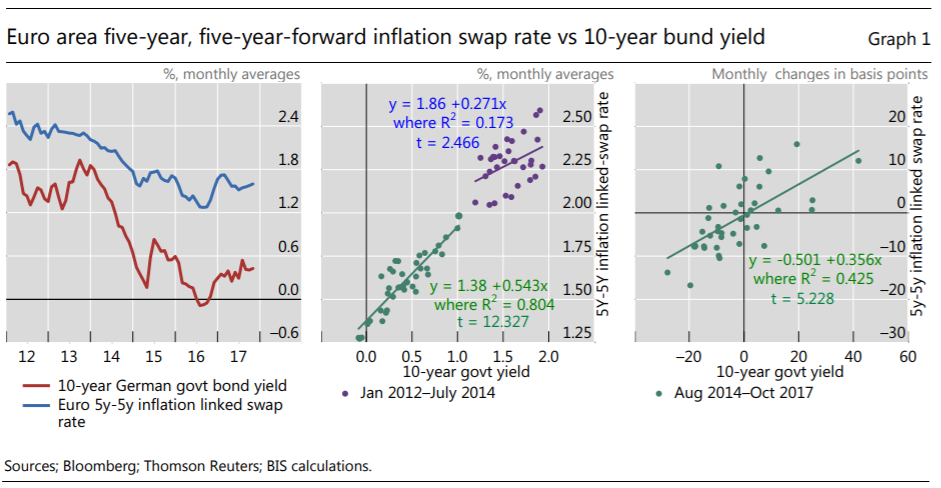

Graph 1, left-hand panel, plots (in blue) the five-year, five-year-forward inflation swap rate for the euro area, which is the cost of hedging inflation risk from year 6 to the end of year 10. It is a popular measure of medium-term inflation expectations. Notice how the five-year, five-year inflation swap rate fluctuates in lockstep with the 10-year nominal yield (in red). The two series come from quite different markets and ought to convey different information, and yet they have ended up conveying the same information. The scatter charts in levels (centre panel) and in one-month changes (right-hand panel) show how tightly bound the two series are.

One possible explanation for the co-movement – and there are others – is that it reflects in part the impact of central bank forward guidance. If the central bank lets it be known that the inflation swap rate enters future monetary policy actions, market participants will anticipate easier monetary policy when the inflation swap rate falls and chase nominal yields down. This type of front-running may be so effective that the central bank need not follow through with any actions of its own. Signalling its contingent plan of action would be enough. This is an example of Odyssean forward guidance, as discussed by Benoît Cœuré in a recent speech.

An open question is to what extent the decline in nominal yields has made the fixed payments received by inflation sellers more attractive to investors who value nominal bond-like payoffs. If so, this would be an additional element that binds the inflation swap rate with the nominal rate, and subject the swap rate to the same amplification forces that push around the nominal yield itself.

These developments should give us pause for thought when we approach the task of reading market signals. As commentators, we give a lot of weight to market signals. We personify the market and endow it with foresight. But the market is not a person. Prices are the outcomes of the interaction of many actors, and not the beliefs of any one actor. Speaking of the “market’s expectation” is fine as a shorthand for market prices, but we should be wary of falling into the trap of taking the shorthand literally and thinking of the market as a person you can sit down and reason with.

Experience has taught us that bond markets can move abruptly and “overreact” relative to the benchmark where the long-dated yield is the average of expected future policy rates. I discussed one of the possible mechanisms behind overreactions when I was last here in September. It was the mechanism driven by duration-matching by life insurers who chase long yields in an attempt to match the durations of their assets to their liabilities. In one of the charts, I showed how total holdings by German insurers of ultra-long bonds (remaining maturity greater than 20 years) had more than quadrupled since 2008. This was at a time when long rates were falling sharply, so that the demand curve traced a downward-sloping relationship between yields and holdings. The more expensive long-dated bonds became, the more the insurance sector was drawn to them.

To an outside observer, this perverse demand response would appear as if market participants’ preferences were changing with market prices themselves. Low rates beget low rates through the higher value placed on long-dated bonds, and high rates beget high rates due to the lower value placed on long-dated bonds. This perverse demand relationship gives greater impetus to the overreaction of bond markets.

If we accept that the empirical relationship between market-implied inflation expectations and nominal yields is endogenous, and is affected by central bank forward guidance, there are important monetary policy implications. When the bond market is subject to overreactions, central bank forward guidance becomes more potent, not least because of more vigorous front-running by market participants. However, this also means that the echoes of the central bank’s forward guidance are also amplified, reverberating in an echo chamber of its own making. In the worst case, the central bank may end up in a feedback loop where acting on signals from the market could distort those signals further.

All of this raises the question of how the market interactions outlined so far will play out when central banks normalise monetary policy. The amplification channels that pushed rates down so effectively could equally work in reverse.

Some further evidence

We should be modest about how much we understand about the underlying market mechanisms. We need to shed additional light on the key questions.

One way is through models of the term structure of interest rates that break out the nominal yield into its components. These models should always be taken with a grain of salt, but they are useful as a cross-check of market developments against the predictions of workhorse macro models used at central banks. According to these models, risk premia have been displaying some very odd behaviour lately.

Most intriguingly, the inflation swap rate has begun to move in lockstep with the nominal yield itself. As I am at the ECB today, let me illustrate this with an example from the euro area. Similar results hold for the United States, and also when forward nominal yields are used (see Annex).

Graph 1, left-hand panel, plots (in blue) the five-year, five-year-forward inflation swap rate for the euro area, which is the cost of hedging inflation risk from year 6 to the end of year 10. It is a popular measure of medium-term inflation expectations. Notice how the five-year, five-year inflation swap rate fluctuates in lockstep with the 10-year nominal yield (in red). The two series come from quite different markets and ought to convey different information, and yet they have ended up conveying the same information. The scatter charts in levels (centre panel) and in one-month changes (right-hand panel) show how tightly bound the two series are.

One possible explanation for the co-movement – and there are others – is that it reflects in part the impact of central bank forward guidance. If the central bank lets it be known that the inflation swap rate enters future monetary policy actions, market participants will anticipate easier monetary policy when the inflation swap rate falls and chase nominal yields down. This type of front-running may be so effective that the central bank need not follow through with any actions of its own. Signalling its contingent plan of action would be enough. This is an example of Odyssean forward guidance, as discussed by Benoît Cœuré in a recent speech.

An open question is to what extent the decline in nominal yields has made the fixed payments received by inflation sellers more attractive to investors who value nominal bond-like payoffs. If so, this would be an additional element that binds the inflation swap rate with the nominal rate, and subject the swap rate to the same amplification forces that push around the nominal yield itself.

These developments should give us pause for thought when we approach the task of reading market signals. As commentators, we give a lot of weight to market signals. We personify the market and endow it with foresight. But the market is not a person. Prices are the outcomes of the interaction of many actors, and not the beliefs of any one actor. Speaking of the “market’s expectation” is fine as a shorthand for market prices, but we should be wary of falling into the trap of taking the shorthand literally and thinking of the market as a person you can sit down and reason with.

Experience has taught us that bond markets can move abruptly and “overreact” relative to the benchmark where the long-dated yield is the average of expected future policy rates. I discussed one of the possible mechanisms behind overreactions when I was last here in September. It was the mechanism driven by duration-matching by life insurers who chase long yields in an attempt to match the durations of their assets to their liabilities. In one of the charts, I showed how total holdings by German insurers of ultra-long bonds (remaining maturity greater than 20 years) had more than quadrupled since 2008. This was at a time when long rates were falling sharply, so that the demand curve traced a downward-sloping relationship between yields and holdings. The more expensive long-dated bonds became, the more the insurance sector was drawn to them.

To an outside observer, this perverse demand response would appear as if market participants’ preferences were changing with market prices themselves. Low rates beget low rates through the higher value placed on long-dated bonds, and high rates beget high rates due to the lower value placed on long-dated bonds. This perverse demand relationship gives greater impetus to the overreaction of bond markets.

If we accept that the empirical relationship between market-implied inflation expectations and nominal yields is endogenous, and is affected by central bank forward guidance, there are important monetary policy implications. When the bond market is subject to overreactions, central bank forward guidance becomes more potent, not least because of more vigorous front-running by market participants. However, this also means that the echoes of the central bank’s forward guidance are also amplified, reverberating in an echo chamber of its own making. In the worst case, the central bank may end up in a feedback loop where acting on signals from the market could distort those signals further.

All of this raises the question of how the market interactions outlined so far will play out when central banks normalise monetary policy. The amplification channels that pushed rates down so effectively could equally work in reverse.

Some further evidence

We should be modest about how much we understand about the underlying market mechanisms. We need to shed additional light on the key questions.

One way is through models of the term structure of interest rates that break out the nominal yield into its components. These models should always be taken with a grain of salt, but they are useful as a cross-check of market developments against the predictions of workhorse macro models used at central banks. According to these models, risk premia have been displaying some very odd behaviour lately.

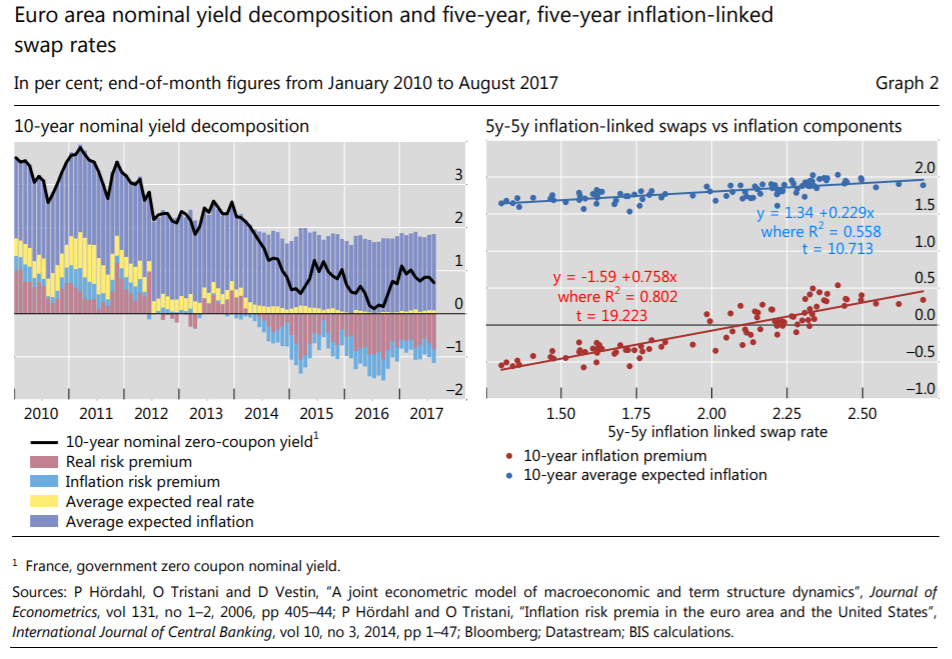

Graph 2, left-hand panel, breaks down the nominal 10-year yield into two components: the real yield and the inflation component. Both are then broken down again into the part driven by expectations and the part driven by the risk premium. Both the real term premium and the inflation risk premium are now deeply negative according to this model. Investors are now willing to pay to take on risk, even though they will lose money on average.

The inflation premium component – the inflation compensation not explained by expected inflation – has fallen a lot in recent years. This decline in the inflation premium chimes in with my earlier discussion on the reduced weight of inflation buyers in the swap market, such as through the diminished heft of defined benefit pension funds. In fact, we see from Graph 2 that the inflation premium turned negative in 2014, in tandem with the decline in the nominal 10-year yield.

The right-hand panel shows that the five-year, five-year inflation swap rate dances to the tune of the inflation premium (slope = 0.76) rather than expected inflation (slope = 0.23). If we take these results at face value, the information conveyed by the inflation swap market has less to do with expected inflation and more to do with other factors, including changes in the ecosystem of market participants in capital markets.

Can central banks talk too much?

So, what is the answer to the original question? Can central banks talk too much? I would broaden the question. Communication is a two-way street. There is the talking part, but there is also the listening part. A better question is: what is the best balance between talking and listening?

My answer would be that there is something of a tradeoff. More of one implies less of the other. If central banks talk more to influence market prices, they should listen less to the signals emanating from those same markets. Otherwise, they could find themselves in an echo chamber of their own making, acting on market signals that are echoes of their own pronouncements.

On the other hand, talking less is hardly a viable option. Central bank actions matter too much for the lives of ordinary people to turn the clock back to an era when silence was golden. Accountability demands that central banks make clear the basis for their actions.

Nevertheless, listening better is a skill that may have been underappreciated. Greater self-awareness of the central bank’s outsized role in the financial markets is a good place to start in redressing the balance. Listening better with greater self-awareness would provide central banks space to take a more detached position and make more informed decisions.

How many times have we heard the argument that the market is pricing in this or that action of the central bank, and that any deviation would upset the market? This type of argument neglects how market participants have become conditioned to the manner in which they interact with the central bank. Jeremy Stein put it well in his last speech as a Fed Governor. The more the central bank whispers in order not to upset markets, the more market participants lean in to hear better.

Predictability and gradualism may not be a virtue if market participants take them as a commitment not to pull the rug from under their feet while they build up leverage and risk-taking positions. Tobias Adrian and I argued in our 2008 Jackson Hole paper that predictability and gradualism may have been enabling factors in the build-up of leverage before the Great Financial Crisis.

Even if there is a more desirable equilibrium to the “whisper equilibrium”, the transition will be challenging. After all, the whisper equilibrium is an equilibrium precisely because market participants are leaning in to listen so intently, and the central bank feels it has no better response than to whisper.

Nor is it clear that the transition away from the whisper equilibrium to something more sensible becomes easier with time, as the risk of upsetting markets grows with the accumulation of risk-taking positions. In this respect, greater self-awareness in communication is a skill that central banks may need to deploy sooner rather than later.

Graph 2, left-hand panel, breaks down the nominal 10-year yield into two components: the real yield and the inflation component. Both are then broken down again into the part driven by expectations and the part driven by the risk premium. Both the real term premium and the inflation risk premium are now deeply negative according to this model. Investors are now willing to pay to take on risk, even though they will lose money on average.

The inflation premium component – the inflation compensation not explained by expected inflation – has fallen a lot in recent years. This decline in the inflation premium chimes in with my earlier discussion on the reduced weight of inflation buyers in the swap market, such as through the diminished heft of defined benefit pension funds. In fact, we see from Graph 2 that the inflation premium turned negative in 2014, in tandem with the decline in the nominal 10-year yield.

The right-hand panel shows that the five-year, five-year inflation swap rate dances to the tune of the inflation premium (slope = 0.76) rather than expected inflation (slope = 0.23). If we take these results at face value, the information conveyed by the inflation swap market has less to do with expected inflation and more to do with other factors, including changes in the ecosystem of market participants in capital markets.

Can central banks talk too much?

So, what is the answer to the original question? Can central banks talk too much? I would broaden the question. Communication is a two-way street. There is the talking part, but there is also the listening part. A better question is: what is the best balance between talking and listening?

My answer would be that there is something of a tradeoff. More of one implies less of the other. If central banks talk more to influence market prices, they should listen less to the signals emanating from those same markets. Otherwise, they could find themselves in an echo chamber of their own making, acting on market signals that are echoes of their own pronouncements.

On the other hand, talking less is hardly a viable option. Central bank actions matter too much for the lives of ordinary people to turn the clock back to an era when silence was golden. Accountability demands that central banks make clear the basis for their actions.

Nevertheless, listening better is a skill that may have been underappreciated. Greater self-awareness of the central bank’s outsized role in the financial markets is a good place to start in redressing the balance. Listening better with greater self-awareness would provide central banks space to take a more detached position and make more informed decisions.

How many times have we heard the argument that the market is pricing in this or that action of the central bank, and that any deviation would upset the market? This type of argument neglects how market participants have become conditioned to the manner in which they interact with the central bank. Jeremy Stein put it well in his last speech as a Fed Governor. The more the central bank whispers in order not to upset markets, the more market participants lean in to hear better.

Predictability and gradualism may not be a virtue if market participants take them as a commitment not to pull the rug from under their feet while they build up leverage and risk-taking positions. Tobias Adrian and I argued in our 2008 Jackson Hole paper that predictability and gradualism may have been enabling factors in the build-up of leverage before the Great Financial Crisis.

Even if there is a more desirable equilibrium to the “whisper equilibrium”, the transition will be challenging. After all, the whisper equilibrium is an equilibrium precisely because market participants are leaning in to listen so intently, and the central bank feels it has no better response than to whisper.

Nor is it clear that the transition away from the whisper equilibrium to something more sensible becomes easier with time, as the risk of upsetting markets grows with the accumulation of risk-taking positions. In this respect, greater self-awareness in communication is a skill that central banks may need to deploy sooner rather than later.