Dong Jinyue and Xia Le: RMB Internationalization: what's the progress for BBVA footprint countries?

2023-11-14 IMIThis article first appeared on BBVA Research on November 13, 2023.

China's authorities initiated the course of its currency’s internationalization approximately 15 years ago, sparking optimism about the RMB’s future as a significant player in the international monetary system (IMS), commensurate with its status as the world's second-largest economy.

The path of RMB internationalization has been more challenging than initially anticipated. A number of unexpected shocks, such as stock market crash and RMB devaluation in 2015, the US-China trade war in 2018-19, and the Covid-19 pandemic starting from 2020, have disrupted the progress of RMB internationalization. Notwithstanding these unfavorable factors, the RMB managed to increase its visibility in the IMS over the past decade.

This note provides an overview of the recent developments in RMB internationalization. It specially takes stock of the RMB usage in the BBVA footprint countries, namely Spain, Mexico, Türkiye, Colombia, Peru, Argentina, Venezuela and Brazil. In so doing, we aim to shed light on the potential business opportunities in relation to the RMB.

RMB internationalization has gained momentum in the aftermath of Covid-19 pandemic

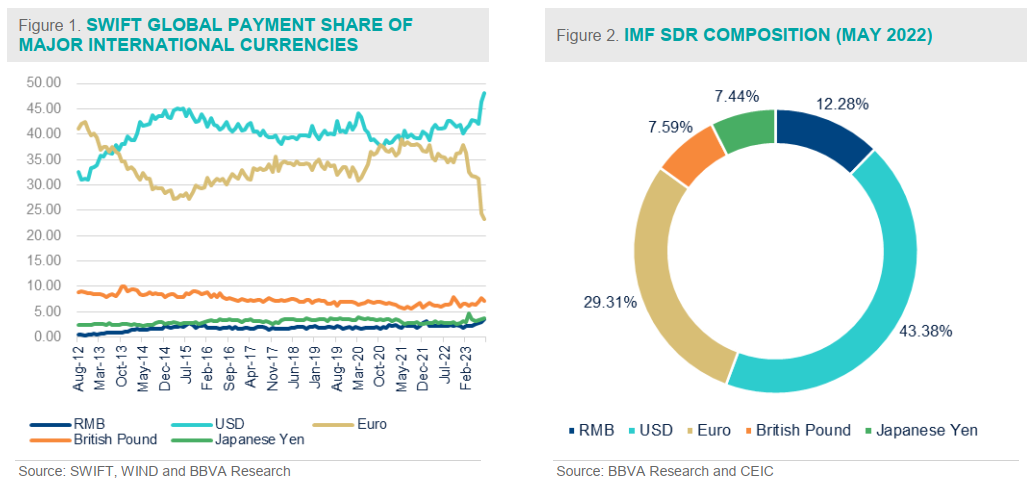

The RMB has managed to establish itself as an important international currency, although it still lags behind the USD, Euro, Japanese Yen, and British Pound in terms of the ranking. (Figure 1)

Among which, USD ranks first in terms of SWIFT global payment share of major international currencies, following that is EURO, GBP, Japanese Yen and RMB. However, in recent years, RMB and Japanese Yen’s ranking seems to converge according to the global payment share.

The International Monetary Fund (IMF) has endorsed the RMB's position by including it in the composition of currencies for Special Drawing Rights (SDRs) in 2016 and increasing its weight in the SDR currency basket in 2022. (Figure 2)

As revealed in the People’s Bank of China (PBoC) monetary policy conduct report of 2023 Q2, the RMB has become the No.1 currency in the country’s cross-border payments. In the first half of the year, the amount of cross- border RMB payments, including both inflows and outflows, totaled 24.5 trillion yuan, accounting for 57% of the gross cross-border RMB

payments over the same period.

Among them, 12.0 trillion yuan was actually received and 12.4 trillion yuan was paid. The total cross-border RMB payments under the current account totaled 6.3 trillion yuan, a year-on-year increase of 37% while the total amount of RMB payments stood at 18.2 trillion yuan, a year-on-year increase of 15%. Moreover, the amount of RMB cross- border payments under trade in goods and direct investment accounted for 23% and 70% of their gross payments in the same period, respectively.

All of the above evidences including the SWIFT global payment share ranking, the IMF inclusion of RMB into SDR basket and the RMB’s increasing position in China’s cross-border payment etc., all point to a fast progress of RMB internationalization in the aftermath of Covid-19 pandemic.

What’s behind the increasing RMB usage?

The increasing usage of the RMB in the aftermath of the Covid-19 pandemic can be attributed to a combination of factors.

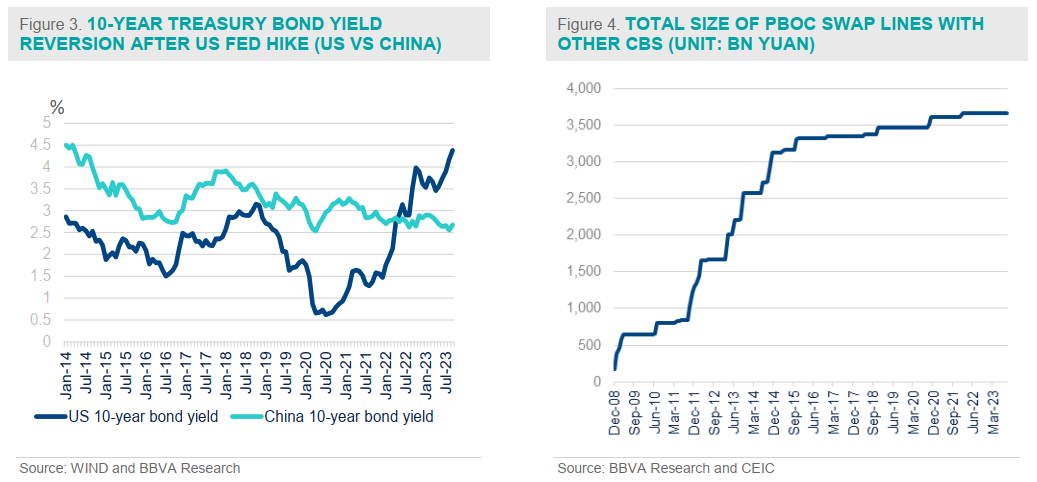

Firstly, the persistent high inflation in advanced economies has led their central banks to raise policy rates significantly since 2008. This has resulted in a substantial increase in the financing cost associated with international currencies such as the USD, Euro, and British Pound. In contrast, the financing cost of the RMB has remained low and stable, even after China's economic reopening.

Figure 3 shows the 10-year bond yield diverging between China and the US sovereign bond, which is very rare in the past decades when advanced economies conducted ultra-low monetary policy rate. (Figure 3) Consequently, many firms prefer to utilize the RMB for settling their cross-border transactions with China due to the cost advantage offered by the currency.

Second, the emerging risks of global financial fragmentation give new impetus to de-dollarization. Heightened geopolitical tensions have raised concerns about the possibility of global financial fragmentation. Ongoing geopolitical tensions in regions like Russia-Ukraine, the Middle East, the Korean Peninsula, and more recently, US- China relations have led to market worries about the potential weaponization of financial sanctions conducted by the US, in forms of the seizure of assets held by other central banks and the severing of connections between a country's financial institutions and SWIFT.

In response to these risks, an increasing number of emerging markets are seeking to reduce their reliance on existing global financial institutions, particularly in their cross-border payments that traditionally rely heavily on the USD.

For instance, some Gulf countries, including Saudi Arabia and the United Arab Emirates, are exploring the possibility of settling their crude oil exports in currencies other than the USD. In addition, the idea of creating a common currency for BRICS countries was also raised by Brazilian President Lula during the 2023 August summit in South Africa. In this context, the RMB emerges as an alternative solution for these emerging markets.

Last but not least, China's authorities have made significant efforts to build and enhance the infrastructure for RMB usage in cross-border payments. They established a Chinese version of SWIFT called CIPS to facilitate cross- border RMB transactions with other countries.

In addition, the People's Bank of China (PBoC) has signed 40 bilateral swap lines with other central banks to encourage foreign firms to settle their trade in RMB with China. (Figure 4) The PBoC has also designated more than 20 clearing banks in other countries to facilitate RMB transactions in offshore markets. These efforts have started to yield results, as evidenced by the increasing volume of cross-border RMB settlements. According to a report by the IMF, both of the mechanisms function to boost the RMB usage in bilateral trade.

Taking stock of RMB usage in BBVA footprint countries?

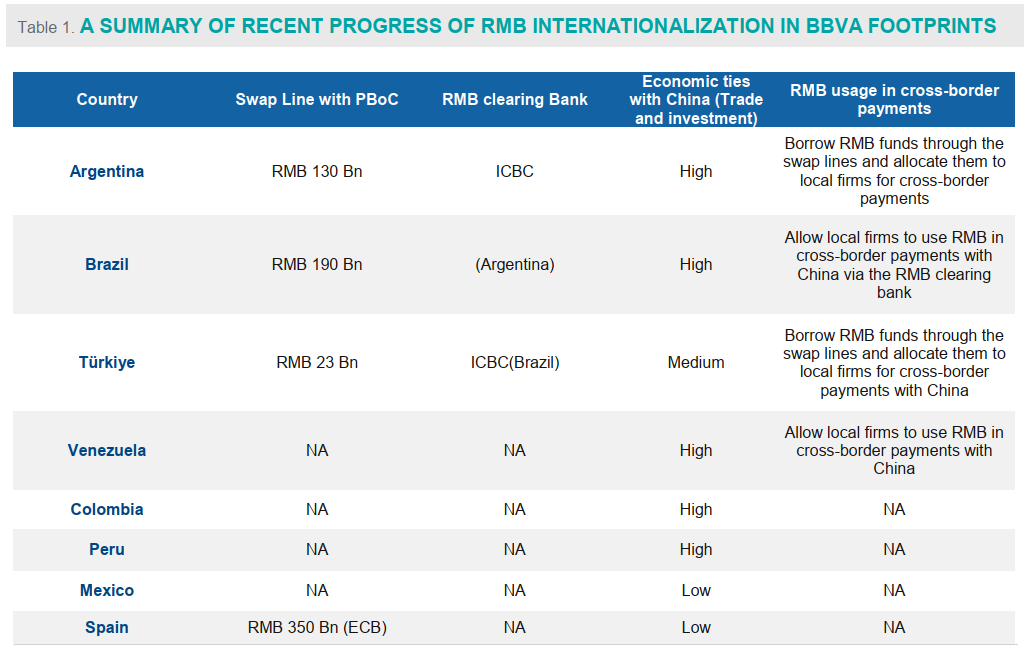

The level of RMB usage varies among the BBVA footprint countries. We first of all briefly summarize the RMB internationalization progress in these footprint countries in Table 1, including Argentina, Brazil, Türkiye, Venezuela, Colombia, Peru, Mexico and Spain. (Table1)

Four footprint countries including Argentina, Brazil, Venezuela and Türkiye actively seek to increase the RMB usage in their cross-border transactions for different reasons. Certain bilateral financial infrastructures have already been established between these countries and China, which are expected to play a more important role in facilitating the deepening of cross-border RMB usage in the future.

In the rest of footprint countries, bilateral financial infrastructure with China is missing. Colombia and Peru seem to have certain potential to increase their RMB usage in their cross-border payments given their close economic ties with China. However, they haven’t signed any swap line or had a clearing bank with China.

Both Spain and Mexico are featured by their traditional strong ties with other international currencies. Spain, as a member of the Euro Zone, has less necessity and incentive to use the RMB in its cross-border payments. Meanwhile, given the US strong influence on Mexico, including the country’s monetary system, Mexican government and firms might have little appetite for shifting part of cross-border payments into the RMB.

Argentina:

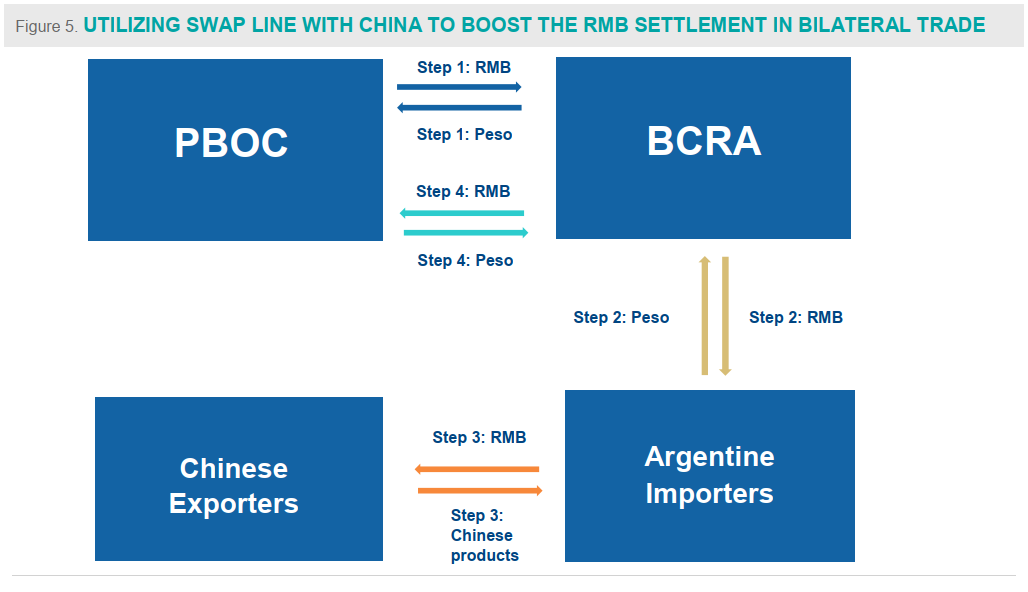

The ongoing currency crisis in Argentina presents an opportunity for the RMB to expand its usage in the country’s cross-border payments. With a shortage of other international currencies, the monetary authorities of Argentina have tapped their swap line with the People's Bank of China (PBoC), borrowing RMB funds to allocate to domestic importers for their cross-border payments. (Figure 5) Reports indicate that Argentina has borrowed approximately 35 billion Yuan, which accounts for 25% of the total size of the swap line.

Currently, the RMB has become a crucial pillar for Argentina to maintain its international payments with other economies. However, this situation is expected to change once the new President takes office and initiates reforms in the country's monetary system. Nevertheless, the recent episode of RMB usage is anticipated to have a significant and far-reaching impact on the country. Familiar with the RMB clearing system, many Argentine importers are likely to continue choosing the RMB as their preferred settlement currency, even when alternative options become available.

In addition, Argentina is reported to pay part of the USD 2.6 billion owed to the International Monetary Fund (IMF) in October 2023 by RMB. It is further reported that the BCRA tapped its currency swap line with the PBoC to meet

its debt obligation to the IMF. (Figure 6) This constitutes another approach through which a central bank utilizes the swap line with China to ease its financial constraints.

Brazil:

The motivation behind the increasing RMB usage in Brazil stems from the government's strong desire to pursue de-dollarization. Brazilian President Lula has expressed support for de-dollarization on multiple occasions since taking office. In early 2023, the central banks of China and Brazil reached an agreement to trade in their own currencies, bypassing the need for the US dollar as an intermediary. China also designated the ICBC (Brazil) as the clearing bank for direct currency exchange in Brazil, allowing businesses in Brazil to exchange RMB for the Brazilian currency.

In October 2023, Bank of China, another Chinese state-owned bank, facilitated the process of RMB-based letter of credit discounting for Eldorado Brasil, a Brazilian paper pulp company. This process involves a short-term credit facility provided by banks, with the funds immediately converted into Brazilian reais and deposited into the company's account. This marks a significant milestone in RMB invoicing and settlements for Brazilian firms.

Additionally, Brazil has a swap line with China amounting to RMB 190 billion. However, there have been no reports indicating its utilization thus far.

Türkiye:

There has been a swap line between the Central Bank of the Republic of Türkiye (CBRT) and the PBoC since 2012. In 2020, the CBRT announced that it drew the swap line (with an unannounced amount) for Turkish companies to pay “.their import bills from China.” amid tightening international liquidity. In 2021, the swap line with China was expanded to by 23 bn Yuan to a total of 35 bn yuan. In the communique of swap line expansion, the CBRT pointed out that “The core objectives of the agreement are to facilitate bilateral trade in respective local currencies and to support financial stability of the two countries.”

Despite the authorities’ encouragement, the usage of RMB in their cross-border is still rare due to the strong inertia of international currency adoption. However, the swap line can function to help the CBRT to replenish its foreign reserves during the period of financial stress.

Venezuela:

Venezuela has close ties with China, in particular in the areas of trade and investment. It is estimated that Venezuela accounts for the largest share (44 percent) of China’s total aid finance in Latin America since 2005, or around USD 60 Bn.

Despite of US sanctions, China has been a key regular buyer of Venezuelan oil. Some experts estimated that China bought 110 million barrels, roughly 300,000 barrels per day (bpd) of Venezuelan crude in 2022. Given the country’s reliance on China, it is not a surprise that Venezuela’s authorities used the RMB to settle bilateral oil trade.

Conclusion

Based on the previous sections, we have observed that the usage of RMB in BBVA footprint countries serves two main purposes. First, it helps mitigate the shortage of other international currencies during periods of economic stress, as seen in the cases of Argentina, Türkiye, and Venezuela. Second, it facilitates a reduction in the dominance of the USD in a country's cross-border payments.

Considering China's close economic ties with South America, we believe there is significant potential to increase the usage of RMB in the region. This indicates that even countries like Peru and Colombia could potentially adopt cross-border RMB payments in the near future. However, for countries like Spain and Mexico, it is likely that they will continue to primarily rely on the Euro and USD, respectively, in their cross-border transactions for the foreseeable future.

The progress of RMB internationalization also hinges on China’s authorities’ attitudes. As widely known, China’s currency internationalization has been proceeding under a binding constraint that the authorities continue to grasp a tight control of fund flows under the capital account. The pace of RMB internationalization will be carefully “managed” for the purpose of financial stability, which is apparently a policy goal with higher ranking of priority to China’s authorities. For example, China authorities wouldn’t like to see that the BCRA tapped its swap line to pay off the IMF debt although they have to accept it given the currently grave situation in Argentina. Having said it, other countries might find it difficult to use their swap lines with China for the same purpose in the future.