Wanda Tseng: Prospects for the Inclusion of Renminbi in the SDR Basket

2015-06-27 IMI determined exchange rates and capital account convertibility.

II. Progress with RMB Internationalization

In the aftermath of the global financial crisis, the Chinese authorities took systematic steps to promote the international use of the RMB. The speed of change has been remarkable in just a few years. The main initiatives taken include:

-Facilitating international trade denominated and settled in RMB;

-Expanding both offshore and onshore RMB-‐denominated investment

opportunities for global investors;

-Signing currency swap arrangements with other central banks and

encouraging them to hold RMB as part of their foreign reserves.

-Promoting the use of the RMB for regional infrastructure projects and official

development assistance.

Building on China’s central role in global trade, the initial focus was on expanding the use of RMB in cross-‐border trade settlements. Since beginning a pilot program in 2009, cross border trade settlement in RMB has expanded to cover all companies in China in 2012, allowing the RMB to flow back and forth from mainland China without restrictions as long as it is for trade settlement. Trade settlement in RMB surged from nothing in 2009 to account for over 20 percent of China’s merchandise trade.

In late 2013, the Society for Worldwide Interbank Financial Telecommunication (SWIFT) reported that the RMB vaulted ahead of the euro and the yen to become the second most widely used currency in global trade finance (measured by letters of credit). By this measure, the RMB accounted for 8.7 percent of global trade finance transactions in October 2013, compared with 6.6 percent for the euro, 1.4 percent for the yen; the dollar remains dominant at 81 percent.

The expansion of trade settlement in RMB contributed to a buildup of RMB deposits offshore, mainly in Hong Kong (which accounted for more than 80 percent of RMB trade settlement). Although personal RMB business was launched in Hong Kong SAR in 2004, when residents there were allowed to open deposit accounts denominated in RMB, RMB deposits really took off only after the introduction and expansion of the RMB trade settlement in 2009. From RMB9.2 billion at end-‐2009, RMB deposits in Hong Kong rose to over RMB 900 billion by end 2014. Globally, RMB deposits rose to RMB 1.6 trillion (mainly in Singapore and Taiwan, in addition to Hong Kong).

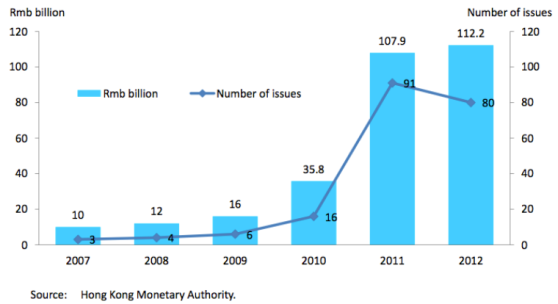

In view of the constraints presented by its relatively closed capital account and underdeveloped domestic financial markets, China has relied on Hong Kong as a platform for expanding the range of RMB denominated financial instruments to promote the RMB as an investment currency. There is now a wide range of offshore RMB-‐denominated financial products available in Hong Kong, including interbank lending, mutual funds, certificates of deposit, active spot and forward foreign exchange markets, RMB cross currency

swaps, insurance policies, and some structured products. Issuance of RMB-‐denominated bonds (dim sum bonds) in Hong Kong has increased sharply, from $0.9 billion in 2010 to $9.7 billion in the first eleven months of 2013. While companies in China or Hong Kong issued most of the bonds, a number of multinational corporations have also issued dim sum bonds.

determined exchange rates and capital account convertibility.

II. Progress with RMB Internationalization

In the aftermath of the global financial crisis, the Chinese authorities took systematic steps to promote the international use of the RMB. The speed of change has been remarkable in just a few years. The main initiatives taken include:

-Facilitating international trade denominated and settled in RMB;

-Expanding both offshore and onshore RMB-‐denominated investment

opportunities for global investors;

-Signing currency swap arrangements with other central banks and

encouraging them to hold RMB as part of their foreign reserves.

-Promoting the use of the RMB for regional infrastructure projects and official

development assistance.

Building on China’s central role in global trade, the initial focus was on expanding the use of RMB in cross-‐border trade settlements. Since beginning a pilot program in 2009, cross border trade settlement in RMB has expanded to cover all companies in China in 2012, allowing the RMB to flow back and forth from mainland China without restrictions as long as it is for trade settlement. Trade settlement in RMB surged from nothing in 2009 to account for over 20 percent of China’s merchandise trade.

In late 2013, the Society for Worldwide Interbank Financial Telecommunication (SWIFT) reported that the RMB vaulted ahead of the euro and the yen to become the second most widely used currency in global trade finance (measured by letters of credit). By this measure, the RMB accounted for 8.7 percent of global trade finance transactions in October 2013, compared with 6.6 percent for the euro, 1.4 percent for the yen; the dollar remains dominant at 81 percent.

The expansion of trade settlement in RMB contributed to a buildup of RMB deposits offshore, mainly in Hong Kong (which accounted for more than 80 percent of RMB trade settlement). Although personal RMB business was launched in Hong Kong SAR in 2004, when residents there were allowed to open deposit accounts denominated in RMB, RMB deposits really took off only after the introduction and expansion of the RMB trade settlement in 2009. From RMB9.2 billion at end-‐2009, RMB deposits in Hong Kong rose to over RMB 900 billion by end 2014. Globally, RMB deposits rose to RMB 1.6 trillion (mainly in Singapore and Taiwan, in addition to Hong Kong).

In view of the constraints presented by its relatively closed capital account and underdeveloped domestic financial markets, China has relied on Hong Kong as a platform for expanding the range of RMB denominated financial instruments to promote the RMB as an investment currency. There is now a wide range of offshore RMB-‐denominated financial products available in Hong Kong, including interbank lending, mutual funds, certificates of deposit, active spot and forward foreign exchange markets, RMB cross currency

swaps, insurance policies, and some structured products. Issuance of RMB-‐denominated bonds (dim sum bonds) in Hong Kong has increased sharply, from $0.9 billion in 2010 to $9.7 billion in the first eleven months of 2013. While companies in China or Hong Kong issued most of the bonds, a number of multinational corporations have also issued dim sum bonds.

Dim Sum Bonds Issuance in Hong Kong

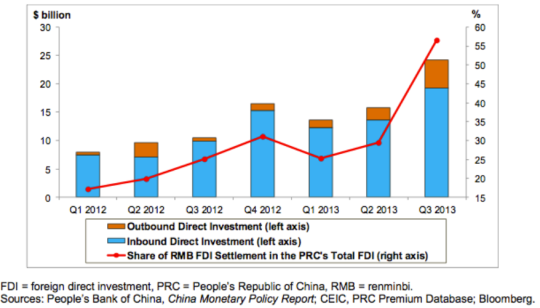

Onshore RMB-‐denominated investment opportunities have been expanded as well. In August 2010, the channels, through which offshore RMB could flow back to the mainland was expanded with the RMB Qualified Foreign Institutional Investor (RQFII) program. The RQFII allow central banks and qualified financial institutions to invest RMB directly in the onshore interbank bond market and equity market, subject to individual quotas. In addition, the RMB Outward Direct Investment (ODI) scheme was created in January 2011, allowing companies in China to conduct overseas FDI in RMB; the RMB FDI scheme was created in October 2011, allowing foreign companies to conduct FDI in China in RMB. Since then, through the third quarter of 2013, RMB-‐ denominated and settled FDI has, on average, accounted for about a third of China’s total FDI flows.

RMB Outward and Inward Direct Investment

Dim Sum Bonds Issuance in Hong Kong

Onshore RMB-‐denominated investment opportunities have been expanded as well. In August 2010, the channels, through which offshore RMB could flow back to the mainland was expanded with the RMB Qualified Foreign Institutional Investor (RQFII) program. The RQFII allow central banks and qualified financial institutions to invest RMB directly in the onshore interbank bond market and equity market, subject to individual quotas. In addition, the RMB Outward Direct Investment (ODI) scheme was created in January 2011, allowing companies in China to conduct overseas FDI in RMB; the RMB FDI scheme was created in October 2011, allowing foreign companies to conduct FDI in China in RMB. Since then, through the third quarter of 2013, RMB-‐ denominated and settled FDI has, on average, accounted for about a third of China’s total FDI flows.

RMB Outward and Inward Direct Investment

Reproduced from Eichengreen, 2014

More recently, the Chinese authorities have further expanded RMB investment opportunities both offshore and onshore. These include the Hong Kong-‐Shanghai Stock Connect program, which allows global investors to buy Shanghai-‐listed shares through Hong Kong and domestic investors to buy Hong Kong-‐listed shares through Shanghai. While this program is subject to quota and other restrictions and trading has been slow, it nevertheless represents an important liberalization for portfolio investment. “Two-‐way cash sweeping” was another key reform introduced in 2013 with the creation of the Shanghai Free Trade Zone (SFTZ). This allowed companies registered in the SFTZ to remit working funds across the border and extend RMB intercompany loans to their offshore parent companies, subsidiaries, or affiliates.

Since 2009, China has signed RMB-‐denominated currency swap arrangements 29 countries plus the euro zone, totaling over RMB 3 trillion. These agreements are intended to provide foreign central banks with access to RMB liquidity and to encourage partner countries to allow RMB use by their banks and corporations. China has also joined in the regional Chiang Mai Initiative Multilateralization—a series of swap lines backed by foreign exchange pools amounting to $240 billion and the Initiative is working to diversify swap lines to include the RMB.

In 2014, China launched several initiatives to promote the use of the RMB in regional infrastructure projects and for development assistance. China established the New Development Bank with the BRIC countries with $50 billion in capital with the aim to invest in infrastructure and other development projects in member countries using local currencies. Also, China established a $100 billion Asian Infrastructure Investment Bank to help finance Asian infrastructure projects.

Since 2008, China has made substantial progress with RMB internationalization. The IMF’s Managing Director recognized this progress in a March 2015 press statement.1 While the RMB is not convertible on the capital account, progress with RMB internationalization has resulted in a gradual and cautious opening of the capital account. Furthermore, while the RMB exchange rate is not market determined, the IMF assessed in May 2015 that the RMB is “no longer undervalued,” suggesting that the RMB exchange rate has reached an equilibrium level consistent with market forces.2

III. How does the RMB measure against SDR inclusion criteria

To assess prospects for the inclusion of the RMB in the SDR basket, it is useful to consider the indicators for the “freely usable” criteria (that is “widely used” and “widely traded”) used by the IMF for a currency’s inclusion in the SDR basket:

Reproduced from Eichengreen, 2014

More recently, the Chinese authorities have further expanded RMB investment opportunities both offshore and onshore. These include the Hong Kong-‐Shanghai Stock Connect program, which allows global investors to buy Shanghai-‐listed shares through Hong Kong and domestic investors to buy Hong Kong-‐listed shares through Shanghai. While this program is subject to quota and other restrictions and trading has been slow, it nevertheless represents an important liberalization for portfolio investment. “Two-‐way cash sweeping” was another key reform introduced in 2013 with the creation of the Shanghai Free Trade Zone (SFTZ). This allowed companies registered in the SFTZ to remit working funds across the border and extend RMB intercompany loans to their offshore parent companies, subsidiaries, or affiliates.

Since 2009, China has signed RMB-‐denominated currency swap arrangements 29 countries plus the euro zone, totaling over RMB 3 trillion. These agreements are intended to provide foreign central banks with access to RMB liquidity and to encourage partner countries to allow RMB use by their banks and corporations. China has also joined in the regional Chiang Mai Initiative Multilateralization—a series of swap lines backed by foreign exchange pools amounting to $240 billion and the Initiative is working to diversify swap lines to include the RMB.

In 2014, China launched several initiatives to promote the use of the RMB in regional infrastructure projects and for development assistance. China established the New Development Bank with the BRIC countries with $50 billion in capital with the aim to invest in infrastructure and other development projects in member countries using local currencies. Also, China established a $100 billion Asian Infrastructure Investment Bank to help finance Asian infrastructure projects.

Since 2008, China has made substantial progress with RMB internationalization. The IMF’s Managing Director recognized this progress in a March 2015 press statement.1 While the RMB is not convertible on the capital account, progress with RMB internationalization has resulted in a gradual and cautious opening of the capital account. Furthermore, while the RMB exchange rate is not market determined, the IMF assessed in May 2015 that the RMB is “no longer undervalued,” suggesting that the RMB exchange rate has reached an equilibrium level consistent with market forces.2

III. How does the RMB measure against SDR inclusion criteria

To assess prospects for the inclusion of the RMB in the SDR basket, it is useful to consider the indicators for the “freely usable” criteria (that is “widely used” and “widely traded”) used by the IMF for a currency’s inclusion in the SDR basket:

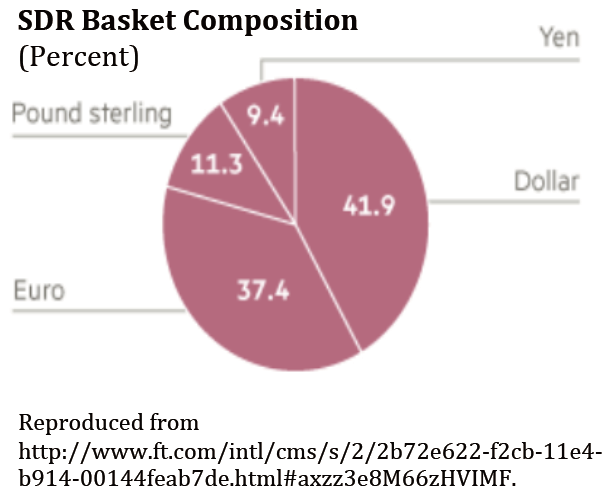

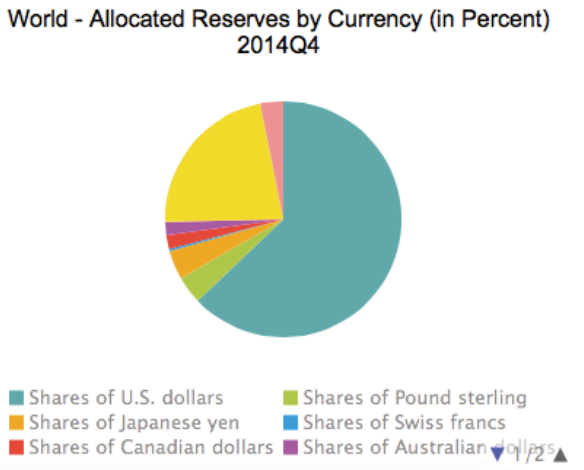

Currency composition of official reserve holdings: While an increasing number of central banks around the world reportedly have added RMB to their foreign exchange reserve holdings, data on the use of the RMB in global foreign exchange reserves are not readily available. According to the most recent IMF data, the share of reserves denominated in “other currencies,” which includes the RMB, in total “allocated reserves3” is about 3 percent at end-‐Q4, 2014; the U.S. dollar remains dominant at 63 percent, followed by the euro at 22 percent, and the Japanese yen and British pound at 4 percent each.

It would be useful for the IMF to release data on RMB holdings in total “allocated

reserves.”

A supplemental indicator of RMB use as a reserve currency is the number of central banks holding the currency. A survey of reserve managers shows that the RMB was held by 15 percent of the respondents (RBS, 2013). While the RMB appealed to some reserve managers, its lack of convertibility was often cited as an obstacle to investment. Within the next five to ten years, however, 37 percent of the composition of their foreign exchange reserves to the IMF (accounting for 53 percent of the world’s foreign exchange reserves at end-Q4, 2014). Respondents indicated that they would consider investing in the RMB.

Currency composition of official reserve holdings: While an increasing number of central banks around the world reportedly have added RMB to their foreign exchange reserve holdings, data on the use of the RMB in global foreign exchange reserves are not readily available. According to the most recent IMF data, the share of reserves denominated in “other currencies,” which includes the RMB, in total “allocated reserves3” is about 3 percent at end-‐Q4, 2014; the U.S. dollar remains dominant at 63 percent, followed by the euro at 22 percent, and the Japanese yen and British pound at 4 percent each.

It would be useful for the IMF to release data on RMB holdings in total “allocated

reserves.”

A supplemental indicator of RMB use as a reserve currency is the number of central banks holding the currency. A survey of reserve managers shows that the RMB was held by 15 percent of the respondents (RBS, 2013). While the RMB appealed to some reserve managers, its lack of convertibility was often cited as an obstacle to investment. Within the next five to ten years, however, 37 percent of the composition of their foreign exchange reserves to the IMF (accounting for 53 percent of the world’s foreign exchange reserves at end-Q4, 2014). Respondents indicated that they would consider investing in the RMB.