Dong Jinyue and Xia Le: China Economic Outlook 2nd Quarter 2018

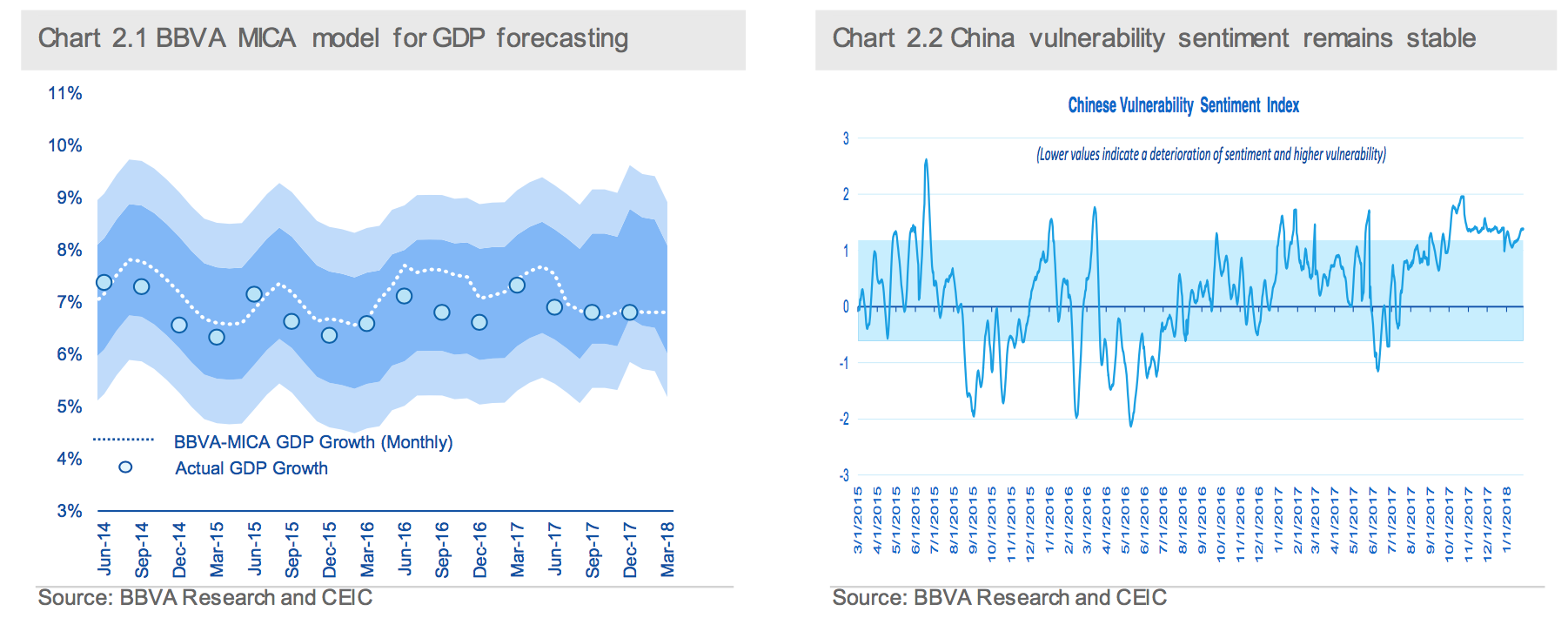

2018-04-29 IMI On the supply side, activity indicators indicted a robust momentum in growth during January -February (as the NBS reports the data outturns of the first two months combined). Industrial production significantly picked up to 7.2% y/y from 6.6% y/y of the last December (consensus: 6.2% y/y). Meanwhile, the different indicators of producers’ sentiment of March were mixed. China’s official manufacturing PMI significantly increased to 51.5 in March from 50.3 in the previous month (Consensus: 50.6). While the Caixin China Manufacturing PMI, which includes a survey sample tilting toward SMEs and exporters, slowed down to 51 in March (versus consensus 51.7) from 51.6 in the previous month (Figure 2.3). The divergence between the official PMI and Caixin PMI could reflect some headwinds to China’s export sector including the unexpectedly sharp RMB appreciation in Q1 and trade skirmishes with the US.

The demand side has mixed signals. Retail sales growth slowed to 9.7% y/y in January-February from 10.2% y/y in the previous month (consensus: 9.8% y/y). (Figure 2.4) The slowdown was led by auto sales, which grew by 1% y/y in February compared to a 5.2% y/y growth in July before the expiration of fiscal subsidy for passenger car purchase. The silver lining is the rapid growth of online sales, surging 35.6% y/y in the first two months of this year, substantially surpassing the aggregate retail sales growth at 9.7%, indicating that the rising new economy leads growth.

Meanwhile, fixed Asset Investment increased to 7.9% ytd y/y from 7.2% ytd y/y (consensus: 7% ytd y/y), indicating investment regains its momentum at the beginning of the year. (Figure 2.5) In addition, the growth of private investment increased to 8.1% ytd y/y in January-February from 6% ytd y/y previously. (Figure 2.6).

On the supply side, activity indicators indicted a robust momentum in growth during January -February (as the NBS reports the data outturns of the first two months combined). Industrial production significantly picked up to 7.2% y/y from 6.6% y/y of the last December (consensus: 6.2% y/y). Meanwhile, the different indicators of producers’ sentiment of March were mixed. China’s official manufacturing PMI significantly increased to 51.5 in March from 50.3 in the previous month (Consensus: 50.6). While the Caixin China Manufacturing PMI, which includes a survey sample tilting toward SMEs and exporters, slowed down to 51 in March (versus consensus 51.7) from 51.6 in the previous month (Figure 2.3). The divergence between the official PMI and Caixin PMI could reflect some headwinds to China’s export sector including the unexpectedly sharp RMB appreciation in Q1 and trade skirmishes with the US.

The demand side has mixed signals. Retail sales growth slowed to 9.7% y/y in January-February from 10.2% y/y in the previous month (consensus: 9.8% y/y). (Figure 2.4) The slowdown was led by auto sales, which grew by 1% y/y in February compared to a 5.2% y/y growth in July before the expiration of fiscal subsidy for passenger car purchase. The silver lining is the rapid growth of online sales, surging 35.6% y/y in the first two months of this year, substantially surpassing the aggregate retail sales growth at 9.7%, indicating that the rising new economy leads growth.

Meanwhile, fixed Asset Investment increased to 7.9% ytd y/y from 7.2% ytd y/y (consensus: 7% ytd y/y), indicating investment regains its momentum at the beginning of the year. (Figure 2.5) In addition, the growth of private investment increased to 8.1% ytd y/y in January-February from 6% ytd y/y previously. (Figure 2.6).

CPI up and PPI down

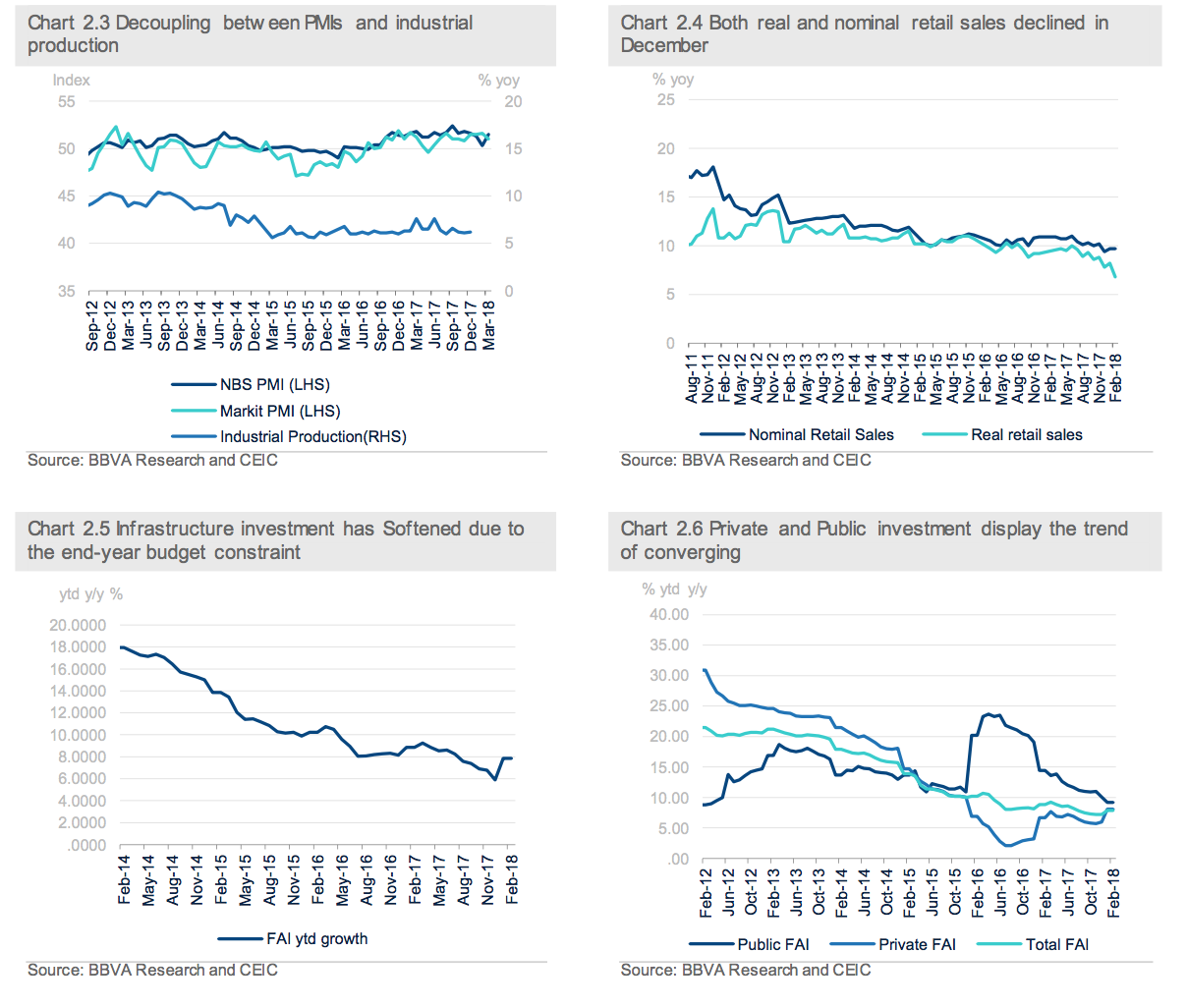

Headline CPI inflation picked up significantly to 2.9% y/y in February from 1.5% in the previous month, above market consensus of 2.5%. The uptick in CPI inflation was driven by food prices as their negative contribution to year-on-year price increase narrowed, mainly due to Chinese New Year (CNY) effect (the Chinese New Year of 2018 fell in February while the CNY of 2017 was in January) and bad weather. (Figure 2.7) In March, the CPI is expected to drop after the dissipation of the seasonal effect.

On the other hand, PPI decreased significantly to 3.7% y/y in February from 4.3% in the previous month (Consensus: 3.8%), as the shock from supply-side disruption eased off. (Figure 2.8) That being said, CPI and PPI were converging in February. In the future, we predict the convergence of PPI and CPI will continue this year. CPI is expected to trend up gradually after the food-prices rebound from the previous low level. Meanwhile, the PPI will gradually slow its pace as the supply-side reform dissipates. Thus, supply-side shocks caused by overcapacity elimination are likely to have diminishing marginal impact on price levels as investors have already factored it into their expectations.

CPI up and PPI down

Headline CPI inflation picked up significantly to 2.9% y/y in February from 1.5% in the previous month, above market consensus of 2.5%. The uptick in CPI inflation was driven by food prices as their negative contribution to year-on-year price increase narrowed, mainly due to Chinese New Year (CNY) effect (the Chinese New Year of 2018 fell in February while the CNY of 2017 was in January) and bad weather. (Figure 2.7) In March, the CPI is expected to drop after the dissipation of the seasonal effect.

On the other hand, PPI decreased significantly to 3.7% y/y in February from 4.3% in the previous month (Consensus: 3.8%), as the shock from supply-side disruption eased off. (Figure 2.8) That being said, CPI and PPI were converging in February. In the future, we predict the convergence of PPI and CPI will continue this year. CPI is expected to trend up gradually after the food-prices rebound from the previous low level. Meanwhile, the PPI will gradually slow its pace as the supply-side reform dissipates. Thus, supply-side shocks caused by overcapacity elimination are likely to have diminishing marginal impact on price levels as investors have already factored it into their expectations.

Monetary prudence continues with nuanced changes in regulatory tightening

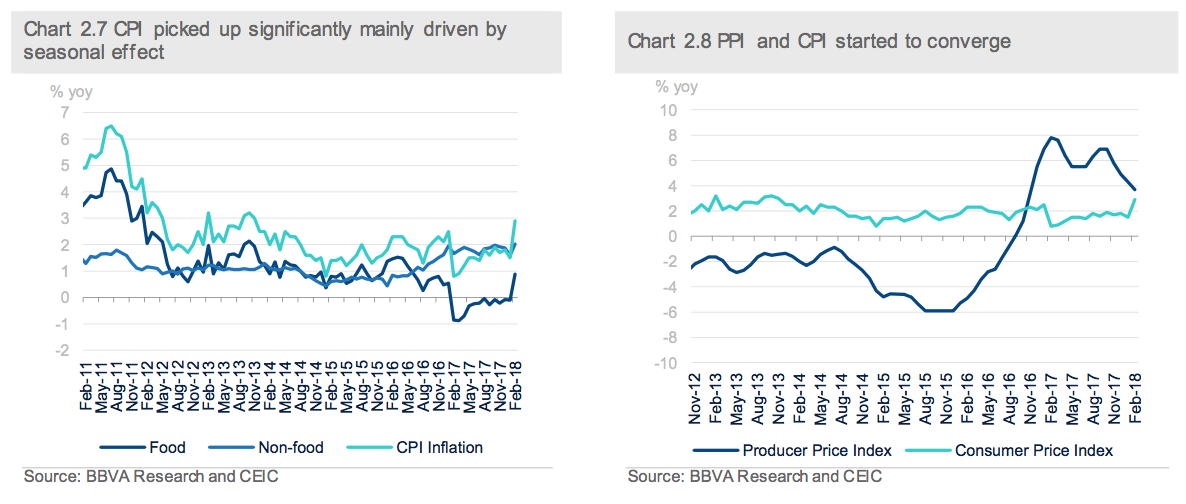

The continuing prudent monetary policy with tightening bias has maintained the effect to contain credit boom. M2 growth marginally increased to 8.8% y/y from 8.6% y/y in January (consensus: 8.7% YoY), which remains at a comparatively low level. (Figure 2.9).

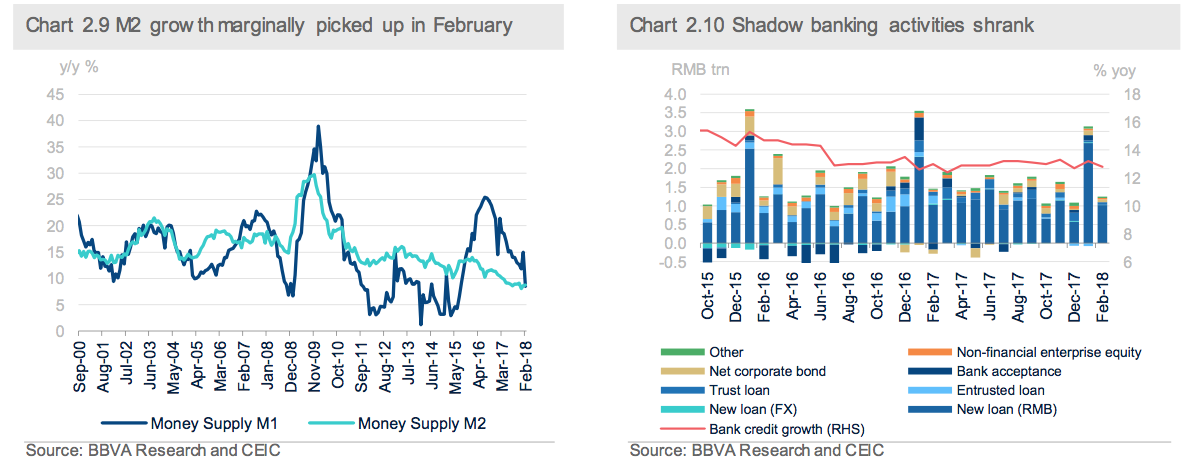

Meanwhile, the growth of new loans and total social financing also decreased significantly in February from the January readings. This is partly due to the seasonal effect, as the new yuan loans and total social financing always picked in January as banks release the lending quota at the beginning of the year. But they are still lower than the last year February readings. In particular, total social financing declined to RMB 1,170 billion (prior: RMB 3,060 billion; consensus: RMB 1,066.5 billion) in February and New yuan loans also dropped to RMB 839.3 bn (prior: RMB 2,900 billion; consensus: RMB 900 billion). (Figure 2.10)

The low credit data in February also reflected the effect of financial sector deleveraging as banks were forced to reduce their shadow banking activities off their balance sheets. (Figure 2.10) Meanwhile, enterprises and household also had lower capital demand due to the ongoing corporate deleveraging and housing market tightening. We predict M2 growth will maintain at a moderated level in 2018 as the financial tightening continues this year as indicated by the recently closed “two sessions”.

Some nuanced changes emerged at the front of regulatory tightening as the authorities sought to ensure the smoothness through the course of financial deleveraging. In particular, the authorities continued to keep high pressure on bank-related shadow banking activities while enhance banks’ capacity to withstand shocks from regulatory tightening by applying certain forbearance and encouraging banks to replenish their capital. Those measures include: (i) The “two sessions” did not set any figure target for M2, as the ongoing financial deleveraging might make the M2 more volatile. (ii) CBRC deployed regulatory forbearance by easing rules requiring lenders to set aside provisions against losses on bad loans and reducing the minimum NPL coverage ratio from 150% to 120%; in addition, CBRC also reduced the minimum LLR cover of total loans from 2.5% to 1.5%. (iii) PBoC encouraged banks to issue CoCo bonds to supplement capital ahead of the tighter international regulatory standards of TLAC that will come into effect from January 1st ,2019.

Monetary prudence continues with nuanced changes in regulatory tightening

The continuing prudent monetary policy with tightening bias has maintained the effect to contain credit boom. M2 growth marginally increased to 8.8% y/y from 8.6% y/y in January (consensus: 8.7% YoY), which remains at a comparatively low level. (Figure 2.9).

Meanwhile, the growth of new loans and total social financing also decreased significantly in February from the January readings. This is partly due to the seasonal effect, as the new yuan loans and total social financing always picked in January as banks release the lending quota at the beginning of the year. But they are still lower than the last year February readings. In particular, total social financing declined to RMB 1,170 billion (prior: RMB 3,060 billion; consensus: RMB 1,066.5 billion) in February and New yuan loans also dropped to RMB 839.3 bn (prior: RMB 2,900 billion; consensus: RMB 900 billion). (Figure 2.10)

The low credit data in February also reflected the effect of financial sector deleveraging as banks were forced to reduce their shadow banking activities off their balance sheets. (Figure 2.10) Meanwhile, enterprises and household also had lower capital demand due to the ongoing corporate deleveraging and housing market tightening. We predict M2 growth will maintain at a moderated level in 2018 as the financial tightening continues this year as indicated by the recently closed “two sessions”.

Some nuanced changes emerged at the front of regulatory tightening as the authorities sought to ensure the smoothness through the course of financial deleveraging. In particular, the authorities continued to keep high pressure on bank-related shadow banking activities while enhance banks’ capacity to withstand shocks from regulatory tightening by applying certain forbearance and encouraging banks to replenish their capital. Those measures include: (i) The “two sessions” did not set any figure target for M2, as the ongoing financial deleveraging might make the M2 more volatile. (ii) CBRC deployed regulatory forbearance by easing rules requiring lenders to set aside provisions against losses on bad loans and reducing the minimum NPL coverage ratio from 150% to 120%; in addition, CBRC also reduced the minimum LLR cover of total loans from 2.5% to 1.5%. (iii) PBoC encouraged banks to issue CoCo bonds to supplement capital ahead of the tighter international regulatory standards of TLAC that will come into effect from January 1st ,2019.

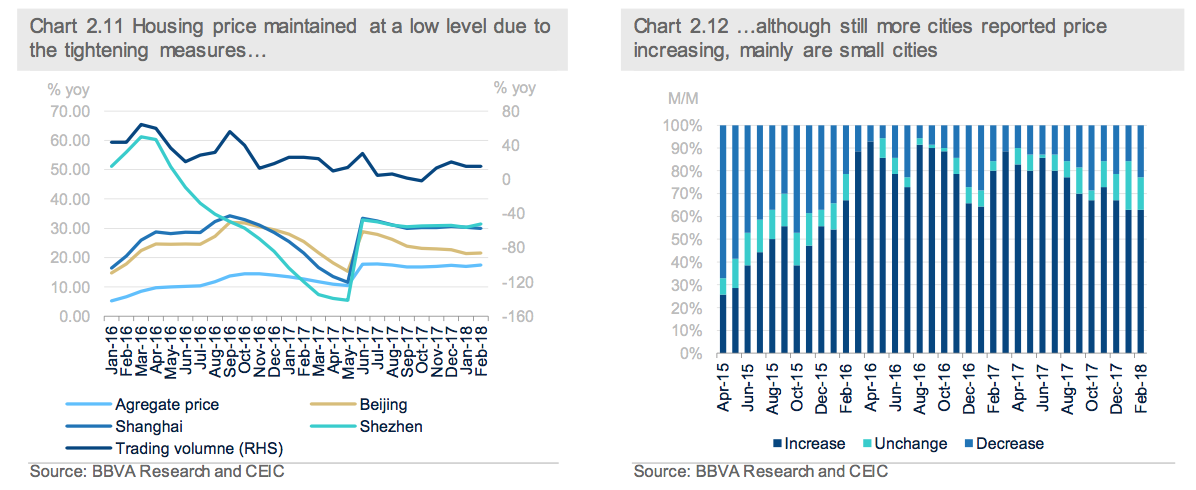

Housing markets continued to be sluggish due to the tightening measures

The tightening measures on the property market have effectively moderated price increases and frozen the trading volume in Tier 1 cities[3] (Figure 2.11). Although the housing price seems like to pick up a bit from the regional trough starting from mid-2017, it still remains at a sluggish level. On the other hand, there are still much more cities reporting housing price increasing than the cities reporting decreasing, mainly are smaller cities. (Figure 2.12) However, as more local authorities started to deploy tightening measures in cities other than tier 1, housing bubbles seem to ease further. We predict that housing price will be staying in the moderation region this year.

On top of imposing home purchase restrictions, the authorities also use financial tools to contain housing bubbles, such as increasing the interest rate of mortgage loans. Moreover, the authorities particularly forbid home buyers from borrowing short-term loans to pay for their down payment, in a bid to keep household leverage at a manageable level. Altogether, although the housing market tightening measures helped to ease housing bubble and maintain financial stability, we believe that housing market cooling down will drag on growth this year.

Housing markets continued to be sluggish due to the tightening measures

The tightening measures on the property market have effectively moderated price increases and frozen the trading volume in Tier 1 cities[3] (Figure 2.11). Although the housing price seems like to pick up a bit from the regional trough starting from mid-2017, it still remains at a sluggish level. On the other hand, there are still much more cities reporting housing price increasing than the cities reporting decreasing, mainly are smaller cities. (Figure 2.12) However, as more local authorities started to deploy tightening measures in cities other than tier 1, housing bubbles seem to ease further. We predict that housing price will be staying in the moderation region this year.

On top of imposing home purchase restrictions, the authorities also use financial tools to contain housing bubbles, such as increasing the interest rate of mortgage loans. Moreover, the authorities particularly forbid home buyers from borrowing short-term loans to pay for their down payment, in a bid to keep household leverage at a manageable level. Altogether, although the housing market tightening measures helped to ease housing bubble and maintain financial stability, we believe that housing market cooling down will drag on growth this year.

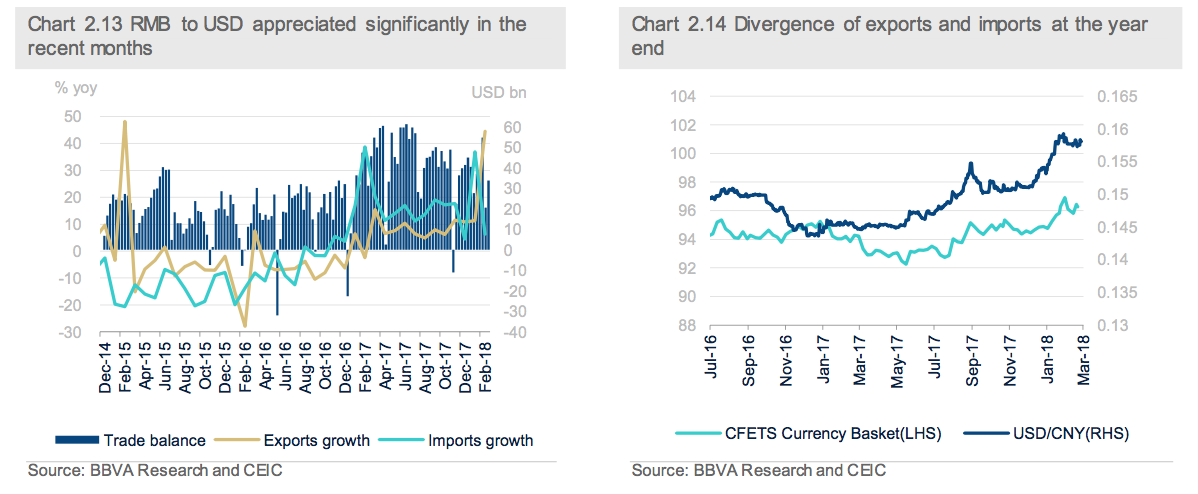

Strong exports supported growth but it will slow down due to the rising trade war risk

The performance of the trade sector has been very volatile in January and February due to Chinese New Year effects. The growth of exports (in USD terms) surprisingly increased to 44.5% y/y (versus consensus: 11% y/y) from the previous reading of 11.1% in February, while imports significantly dropped to a year-on-year growth of 6.3% (versus consensus: 8% y/y; prior: 36.8% y/y). As a result, the balance of trade expanded to USD 33.74 billion in February from USD 20.35 billion in the previous month. (Figure 2.13)

Importantly, the rising trade tension between China and the US has projected more uncertainties to the prospect of the external sector in the near future. Moreover, we believe the recently sharp appreciation of the RMB exchange rate could weigh on China’s exports to a certain extent.

RMB valuation regime: from capital-account-based to current-account-based

The RMB exchange rate experienced a sharp appreciation recently against the backdrop of a sluggish USD. Accumulatively, the RMB has appreciated by 9.6% against the USD since end-2016 and by 3% since the beginning of this year. As a result, the CNYUSD exchange rate has reached the historical low since the failed exchange rate reform of August 2015. It is also noted that the RMB appreciation during this period is not only against the USD but also against the CFETS currency basket, which was introduced in November 2015 as a benchmark of the RMB exchange rate. (Figure 2.14)

In addition to the weak performance of the USD, the strong rebound of the RMB exchange rate also benefits from the ever-increasing restrictions under the capital account. In particular, the authorities, starting from July 2017, took steps to control overseas investment of a number of high-profile financial conglomerates, including Anbang, Wanda, HNA etc. Moreover, the better-than-expected the macro economy also supported the RMB exchange rate. It seems like the current RMB appreciation could moderate the flare-up tension of the trade war between the US and China to a certain extent, while some market experts also interpret it as the authorities’ strategy to compromise to the US in order to avoid the escalation of the trade war.

With the capital account under tight grip, the recent movements of RMB mainly reflect current account changes. Based on the above, we revise our end-year RMB exchange rate projection to 6.40 from 6.75 previously, reflecting both recent strong CNY exchange rate and the new policy tendency.

Strong exports supported growth but it will slow down due to the rising trade war risk

The performance of the trade sector has been very volatile in January and February due to Chinese New Year effects. The growth of exports (in USD terms) surprisingly increased to 44.5% y/y (versus consensus: 11% y/y) from the previous reading of 11.1% in February, while imports significantly dropped to a year-on-year growth of 6.3% (versus consensus: 8% y/y; prior: 36.8% y/y). As a result, the balance of trade expanded to USD 33.74 billion in February from USD 20.35 billion in the previous month. (Figure 2.13)

Importantly, the rising trade tension between China and the US has projected more uncertainties to the prospect of the external sector in the near future. Moreover, we believe the recently sharp appreciation of the RMB exchange rate could weigh on China’s exports to a certain extent.

RMB valuation regime: from capital-account-based to current-account-based

The RMB exchange rate experienced a sharp appreciation recently against the backdrop of a sluggish USD. Accumulatively, the RMB has appreciated by 9.6% against the USD since end-2016 and by 3% since the beginning of this year. As a result, the CNYUSD exchange rate has reached the historical low since the failed exchange rate reform of August 2015. It is also noted that the RMB appreciation during this period is not only against the USD but also against the CFETS currency basket, which was introduced in November 2015 as a benchmark of the RMB exchange rate. (Figure 2.14)

In addition to the weak performance of the USD, the strong rebound of the RMB exchange rate also benefits from the ever-increasing restrictions under the capital account. In particular, the authorities, starting from July 2017, took steps to control overseas investment of a number of high-profile financial conglomerates, including Anbang, Wanda, HNA etc. Moreover, the better-than-expected the macro economy also supported the RMB exchange rate. It seems like the current RMB appreciation could moderate the flare-up tension of the trade war between the US and China to a certain extent, while some market experts also interpret it as the authorities’ strategy to compromise to the US in order to avoid the escalation of the trade war.

With the capital account under tight grip, the recent movements of RMB mainly reflect current account changes. Based on the above, we revise our end-year RMB exchange rate projection to 6.40 from 6.75 previously, reflecting both recent strong CNY exchange rate and the new policy tendency.

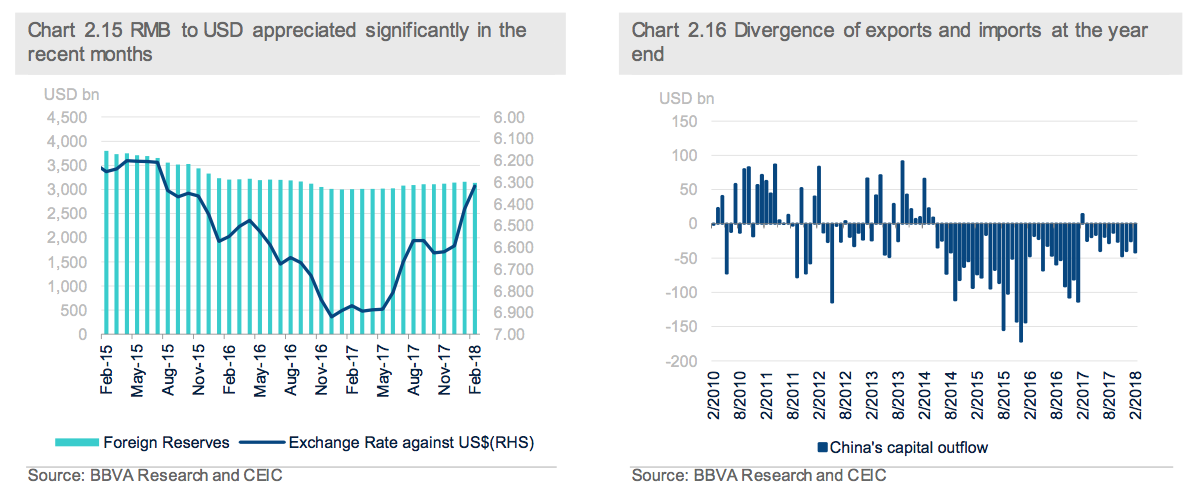

Temporary decline of foreign reserve could not be over-interpreted

Foreign reserves decreased to USD 3,134.48 billion in February, down from USD 3,161.46 billion in the previous month, the first time of declining from 12-month growth in a row. (Figure 2.15) In particular, we estimate that capital outflows amounted to USD 41.7 billion in February, up from USD 25.14 billion in the previous month. (Figure 2.16).

However, there is no need to over-interpret the temporary foreign reserve decline in February. One possible reason might be that the authorities have steadily relaxed OFDI in order to support the “One Belt One Road” initiatives. Altogether, we believe the “two –way” change of foreign reserve and capital outflow will be the main pattern in the future.

Temporary decline of foreign reserve could not be over-interpreted

Foreign reserves decreased to USD 3,134.48 billion in February, down from USD 3,161.46 billion in the previous month, the first time of declining from 12-month growth in a row. (Figure 2.15) In particular, we estimate that capital outflows amounted to USD 41.7 billion in February, up from USD 25.14 billion in the previous month. (Figure 2.16).

However, there is no need to over-interpret the temporary foreign reserve decline in February. One possible reason might be that the authorities have steadily relaxed OFDI in order to support the “One Belt One Road” initiatives. Altogether, we believe the “two –way” change of foreign reserve and capital outflow will be the main pattern in the future.

3. Will Trump’s trade war disturb the domestic reforms set by “Two Sessions”?

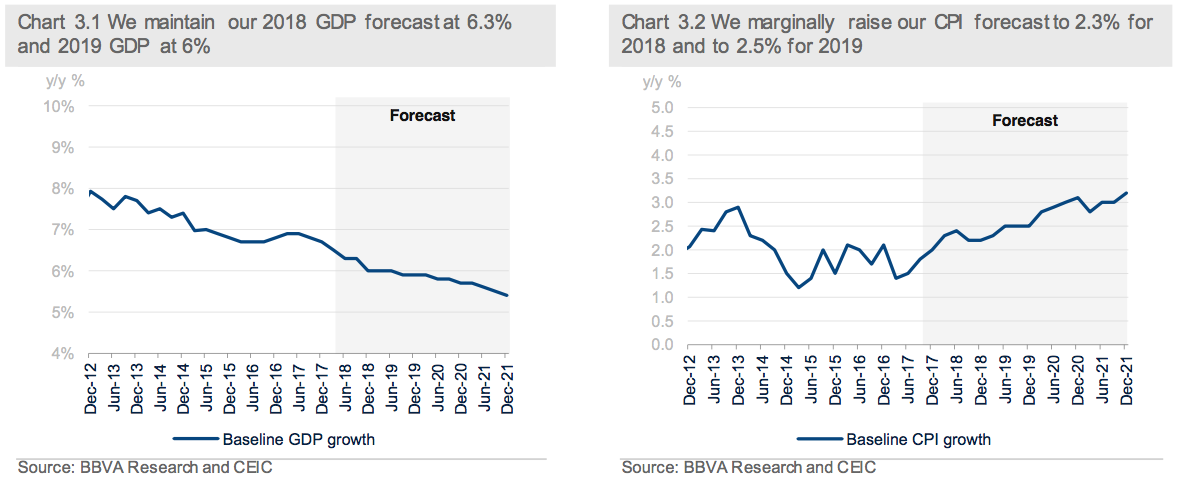

We maintain our forecasting for GDP growth while rising CPI prediction

China’s 6.9% growth in 2017 was actually better-than-expected, although the market predicts growth moderation under the framework of financial deleveraging and industrial de-capacity. However, we continue our forecast that signs of moderation will emerge this year due the authorities’ continuing policy tightening, including monetary prudence and regulatory efforts to curb shadow banking activities and overheating property market, together with the de-capacity in the real sector.

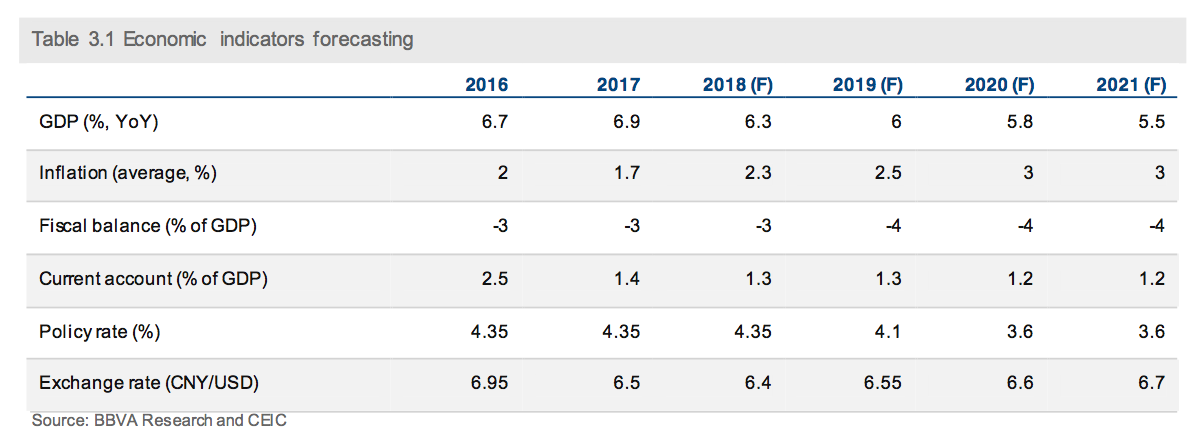

Accordingly, we maintain our 2018 growth forecast at 6.3% and 2019 forecast at 6%, reflecting the strong 2017 growth and mitigated financial risks. However, they are still somewhat lower than the market consensus (Bloomberg consensus: 6.5% for 2018 and 6.2% for 2019) and the authorities’ growth target of 2018 is 6.5% as well. Nevertheless, we anticipate that the authorities broadly maintain the policy mix this year over the concern of financial stability, in particular, a prudent monetary policy and a comparatively easing fiscal policy.

By categories, we predict consumption will contribute to around 4.5% (versus: 4.1% in 2017) for GDP growth, dominating investment’s contribution of 1.6% (versus: 2.2% in 2017) and net export’s contribution at 0.2% (versus: 0.5% in 2017) in this year.

Regarding inflation, we marginally increase our 2018 monthly average projection of CPI to 2.3% in 2018 and 2.5% in 2019 (Bloomberg: 2.3% for 2018 and 2.3% for 2019) mainly due to food prices pick up (Figure 3.2). Looking ahead, the CPI and PPI will finally converge in the long term. CPI is expected to trend up gradually after the food-prices rebound from the current low level. Meanwhile, the PPI will gradually slow its pace as the supply -side reform dissipates. That being said, supply-side shocks caused by overcapacity elimination are likely to have diminishing marginal impact on price levels as investors gradually factor it into their expectations.

3. Will Trump’s trade war disturb the domestic reforms set by “Two Sessions”?

We maintain our forecasting for GDP growth while rising CPI prediction

China’s 6.9% growth in 2017 was actually better-than-expected, although the market predicts growth moderation under the framework of financial deleveraging and industrial de-capacity. However, we continue our forecast that signs of moderation will emerge this year due the authorities’ continuing policy tightening, including monetary prudence and regulatory efforts to curb shadow banking activities and overheating property market, together with the de-capacity in the real sector.

Accordingly, we maintain our 2018 growth forecast at 6.3% and 2019 forecast at 6%, reflecting the strong 2017 growth and mitigated financial risks. However, they are still somewhat lower than the market consensus (Bloomberg consensus: 6.5% for 2018 and 6.2% for 2019) and the authorities’ growth target of 2018 is 6.5% as well. Nevertheless, we anticipate that the authorities broadly maintain the policy mix this year over the concern of financial stability, in particular, a prudent monetary policy and a comparatively easing fiscal policy.

By categories, we predict consumption will contribute to around 4.5% (versus: 4.1% in 2017) for GDP growth, dominating investment’s contribution of 1.6% (versus: 2.2% in 2017) and net export’s contribution at 0.2% (versus: 0.5% in 2017) in this year.

Regarding inflation, we marginally increase our 2018 monthly average projection of CPI to 2.3% in 2018 and 2.5% in 2019 (Bloomberg: 2.3% for 2018 and 2.3% for 2019) mainly due to food prices pick up (Figure 3.2). Looking ahead, the CPI and PPI will finally converge in the long term. CPI is expected to trend up gradually after the food-prices rebound from the current low level. Meanwhile, the PPI will gradually slow its pace as the supply -side reform dissipates. That being said, supply-side shocks caused by overcapacity elimination are likely to have diminishing marginal impact on price levels as investors gradually factor it into their expectations.

“Two Sessions” and policy outlook of 2018

On March 5th, 3,000 newly elected Chinese lawmakers convened at Beijing for about 10 days of parliamentary pageantry, the National People’s Congress (NPC). The NPC runs alongside a meeting of China’s top political advisory body, the Chinese People’s Political Consultative Conference (CPPCC). Together they’re known as “two sessions”. The “two sessions” were concluded in the middle of March. The meetings set up a series of economic targets of this year, in addition, it announced the authorities’ monetary and fiscal policy stance this year. Some government agency reform agenda, together with the new appointments of government officials, was also promulgated during the meeting.

First, the authorities set a series of economic targets for 2018, including:

· Growth rate: Around 6.5 percent this year, the same as in 2017.

· Income growth per capita will be almost together with the GDP growth rate.

· CPI: Around 3%, which is the same as of the previous target which should be treated as a cap as in the past.

· M2: No specific target figure announced this year as the ongoing financial deleveraging could make M2 growth more volatile.

· Unemployment rate: below 5.5% for the urban survey unemployment rate; below 4.5% for registered urban unemployment.

· Capacity cut: China to cut steel capacity by 30 million tons this year; to remove 150 million tons coal capacity

Regarding the policy side, monetary policy will continue to be prudent with some tightening bias this year and the authorities will continue to push forward financial deleveraging in order to prevent systematic financial risks. Fiscal policy will remain expansionary to offset the financial tightening and capacity reduction. However, the government announced to reduce fiscal budget to a certain degree so that fiscal budget to GDP ratio will be around 2.6%, which is 0.4% lower than the previous arrangement in 2017.

Moreover, China will implement some tax cut and will steadily push forward the legislative procedures of property tax. In addition, the authorities will lower import tariffs for vehicles and some consumer goods; will cut taxes for enterprises by 800 billion yuan (120 billion USD) this year and will lift thresholds for levying personal income taxes, without elaborating. Some other tax cut measures were also announced after the “two sessions”, including to cut value-added tax in manufacturing sector from 17% to 16% and to cut value-added tax in transportation, construction and telecommunication from 11% to 10%, with the estimated total amount RMB 240 billion in a year and will be implemented in May 2018.

In addition, some new changes also include restructuring government agencies. These changes include:

· Consolidated CBRC and CIRC into a new regulatory agency CBIRC and will be led by Guo Shuqing, who was also appointed as the deputy governor and Party Chief of the PBoC.

· The previous deputy PBoC governor Yi Gang was appointed as the new governor of PBoC.

· Both Yi Gang and Guo Shuqing will report to Liu He, the newly appointed vice premier for financial and industrial policy and a trusted adviser to Xi on economic matters.

· The local tax bureaus (LTBs) are to be emerged into the state tax bureaus (STBs), with the State Administration of Taxation taking the lead on tax system administration, with input from local governments.

First, the combination of CBRC and CIRC is aimed at resolving existing problems such as unclear responsibilities and cross-regulation. It gives authorities more clout as the government begins the second year of a crackdown on risks in the financial system such as riskier types of financing and shadow banking. The new merged entity will report directly to the State Council, although the function of making important laws and regulations of the CBRC and CIRC have been transferred to the People’s Bank of China (PBOC) as the central bank takes on a bigger role.

Second, by nominating Yi Gang as the new PBoC governor, China’a authorities, in particular President Xi and his close economic advisor Liu He, sent a strong signal that China will continue to push forward financial opening and liberalization as well as to link the domestic financial sector to the world. Meanwhile, Yi Gang’s long experience at the PBoC with close cooperation with the retired governor Zhou Xiaochuan can ensure the market of monetary policy continuity at the central bank level. Indeed, Yi Gang was educated in the US for his master and PhD degree and was a professor in the US. At his first speech as the PBoC governor, he clearly put forward his three primary tasks: (i) maintaining a prudent and neutral monetary policy stance; (ii) pressing ahead with the reform and opening of domestic financial sector; and (iii) containing financial vulnerabilities to avert financial risks.

Third, the reform of merging LTBs and STBs holds out the promise of much more user-friendly tax compliance in future, as the complexities of the existing dual tax system create many challenges for taxpayers. It remains to be clarified whether there will also be a rebalancing of the allocation of tax revenue between local and central government, in parallel with this administrative reform.

Last but not least, the “two sessions” also removed the two-term limit for the presidency in the constitution, paving the way to Xi Jinping to remain the power beyond 2023. Such an eye-catching move will undoubtedly incur negative comments from the international community and domestic liberal elite, but given the current political landscape in China, it is unimaginable for it to lead to any social unrest or political instability. Above all, the regime change at the top leader level should not lead to the change in the Party’s goal of achieving prosperous economy and its pre-set agenda. We therefore tend to interpret it as neutral to our pre-set China’s scenario. That being said, China is still able to maintain a decent growth rate at least over the next decade.

The rising “trade war” risk and its potential impact on China

Fears of a trade-war between the US and China are escalating. A ‘tit for tat’ protectionist trade rhetoric between two of the world’s dominant economies has unnerved investors and rattle financial markets amid concerns that the current trade skirmish, if it escalates into a full-blown trade war could upend global growth momentum and threaten financial stability.

The US President Trump has implemented a series of restrictive measures on China’s exports to the US since the beginning of the year. On top of imposing the tariffs on China’s exported solar panels, washing machines, aluminium foil, steel and aluminium in the previous months, the US also announced a list of 1,333 Chinese products exported to the US on which the US administration plans to levy 25% punitive tariff. Total value of these Chinese exports amounted to USD 50 billion in 2017.

China stroke back swiftly by announcing its retaliatory list of US exports with the same value of USD 50 billion and vowed to take “whatever it takes” to defend national interest.

Although both sides still appeared to play tough at the current stage, we deem that the chance of them to reach some agreement to avert a full-blown trade is still large. In particular, China has offered to buy more semiconductors from the US by diverting some purchases from South Korean and Taiwanese manufacturers, in an effort to help reduce annual USD 375 billion merchandise trade surplus with the US. Moreover, China also promised to further open China’s financial services sector and reduce Chinese tariffs on imported cars.

That being said, the risk of full-blown trade war with the USD is not in our base scenario although trade skirmishes between two largest country economies could linger for quite a while. In theory, these skirmishes should not have a large impact on China’s growth and even its gigantic export sector. For example, direct steel export from China to the US is not large, taking around 3.2% of the US total steel imports.

A more worrisome situation is Trump’s trade war might disturb the domestic reform progress. As re-emphasized in the “two sessions”, the authorities will continue to push forward the financial deleveraging and de-capacity in the real sector. The market worries that if the authorities might change their policy stance and stimulate domestic demand again if they exaggerate the change of a full-blown trade war. Fortunately, the authorities haven’t shown any sign in this respect.

All in all, we expect China and the US will eventually reach an agreement to avert a trade war despite recently escalated rhetoric. Moreover, China needs to push forward deleveraging in over-capacity industries as well as other important items on its reform agenda including SOE reforms, financial regulatory framework etc.

4. External risks are on the rise

External risks are on the rise recently. The external demand is subject to headwinds from rising trade protectionism from the US. Although till now there is still no specific clue whether the trade war will actually happen, market sentiments have already turned negative regarding China’s exports and exchange rate etc.

At the current stage, although the moves have fuelled fears that the situation could escalate into a full-blown trade war between the world's two largest economies, Chinese authorities, together with their US counterparts, have been actively seeking for solutions to avoid the trade war with the US. The current negotiations are surrounding the following perspectives: the US wants Beijing to reduce tariffs on American cars, increase spending on US semiconductors and provide greater access to the Chinese financial sector; also, the US wants China to do a lot more to open up its vast economy to US businesses and bring down the massive trade deficit between the two countries; in addition, Trump has set a target of cutting the deficit in goods with China by USD 100 billion. Thus, the probability of the trade war is actually depending on the negotiation result of the two sides.

By calculating the value-added part of China’s exports to the US, we estimate that among the USD 50 billion amount of China’s exports to the US which are subject to Trump’s tariff imposing, around USD 30 billion are value-added production in China (other USD 20 billion are from the upstream countries which have supply chain with China). This will lead to around 0.45% GDP decreasing with a rough assumption that net exports to the US will decrease by tariff-subjective amount.

We expect China will respond the trade protectionist measures in a relatively limited fashion which would limit the scope of the conflict of the two largest economies, although we need to cautiously watch the progress of this issue these days.

In addition, the large-scale US tax cuts have enhanced the U.S. position against other industrialized economies. And the US FED interest rate hike, although most part of which has been priced in among the market participants, might trigger rebalancing of the global monetary policy stance and a following-up interest rate hike globally as widely discussed in the market.

Risks regarding on growth are also from the domestic policy side. The on-going deleveraging in the real economy and financial sector, with its original intention of mitigating the over-capacity and financial instability respectively, might drag on growth in the medium term. These policy measures mainly include supply-side deleveraging as well as cooling down the housing market and shadow banking. Altogether, the authorities need to find a balance and choose an appropriate pace between pushing forward the deleveraging progress and maintaining a sustainable growth momentum. In this respect, market participants should guard against the risk of over-tightening stemming from the overconfidence of policymakers or the uncoordinated policy conduct among monetary, fiscal and supply-side policy initiatives.

[1] This is also verified by the CPB World Trade Monitor, January 2018, prepared by CPB Netherlands Bureau for Economic Policy Analysis - https://www.cpb.nl/en/figure/cpb-world-trade-monitor-january-2018

[2] The limited data available for February suggest that retail sales in developed countries will have held steady or fallen again, whereas emerging markets could show some growth since China and the rest of emerging Asia show signs of a slight uptick during the month.

[3] Starting from January 2018, NBS has cancelled the statistical indicators for the sales price of affordable housing and only compiled and released the sales price index f or newly constructed commercial residential buildings. No sales price index for newly constructed residential buildings was compiled.

“Two Sessions” and policy outlook of 2018

On March 5th, 3,000 newly elected Chinese lawmakers convened at Beijing for about 10 days of parliamentary pageantry, the National People’s Congress (NPC). The NPC runs alongside a meeting of China’s top political advisory body, the Chinese People’s Political Consultative Conference (CPPCC). Together they’re known as “two sessions”. The “two sessions” were concluded in the middle of March. The meetings set up a series of economic targets of this year, in addition, it announced the authorities’ monetary and fiscal policy stance this year. Some government agency reform agenda, together with the new appointments of government officials, was also promulgated during the meeting.

First, the authorities set a series of economic targets for 2018, including:

· Growth rate: Around 6.5 percent this year, the same as in 2017.

· Income growth per capita will be almost together with the GDP growth rate.

· CPI: Around 3%, which is the same as of the previous target which should be treated as a cap as in the past.

· M2: No specific target figure announced this year as the ongoing financial deleveraging could make M2 growth more volatile.

· Unemployment rate: below 5.5% for the urban survey unemployment rate; below 4.5% for registered urban unemployment.

· Capacity cut: China to cut steel capacity by 30 million tons this year; to remove 150 million tons coal capacity

Regarding the policy side, monetary policy will continue to be prudent with some tightening bias this year and the authorities will continue to push forward financial deleveraging in order to prevent systematic financial risks. Fiscal policy will remain expansionary to offset the financial tightening and capacity reduction. However, the government announced to reduce fiscal budget to a certain degree so that fiscal budget to GDP ratio will be around 2.6%, which is 0.4% lower than the previous arrangement in 2017.

Moreover, China will implement some tax cut and will steadily push forward the legislative procedures of property tax. In addition, the authorities will lower import tariffs for vehicles and some consumer goods; will cut taxes for enterprises by 800 billion yuan (120 billion USD) this year and will lift thresholds for levying personal income taxes, without elaborating. Some other tax cut measures were also announced after the “two sessions”, including to cut value-added tax in manufacturing sector from 17% to 16% and to cut value-added tax in transportation, construction and telecommunication from 11% to 10%, with the estimated total amount RMB 240 billion in a year and will be implemented in May 2018.

In addition, some new changes also include restructuring government agencies. These changes include:

· Consolidated CBRC and CIRC into a new regulatory agency CBIRC and will be led by Guo Shuqing, who was also appointed as the deputy governor and Party Chief of the PBoC.

· The previous deputy PBoC governor Yi Gang was appointed as the new governor of PBoC.

· Both Yi Gang and Guo Shuqing will report to Liu He, the newly appointed vice premier for financial and industrial policy and a trusted adviser to Xi on economic matters.

· The local tax bureaus (LTBs) are to be emerged into the state tax bureaus (STBs), with the State Administration of Taxation taking the lead on tax system administration, with input from local governments.

First, the combination of CBRC and CIRC is aimed at resolving existing problems such as unclear responsibilities and cross-regulation. It gives authorities more clout as the government begins the second year of a crackdown on risks in the financial system such as riskier types of financing and shadow banking. The new merged entity will report directly to the State Council, although the function of making important laws and regulations of the CBRC and CIRC have been transferred to the People’s Bank of China (PBOC) as the central bank takes on a bigger role.

Second, by nominating Yi Gang as the new PBoC governor, China’a authorities, in particular President Xi and his close economic advisor Liu He, sent a strong signal that China will continue to push forward financial opening and liberalization as well as to link the domestic financial sector to the world. Meanwhile, Yi Gang’s long experience at the PBoC with close cooperation with the retired governor Zhou Xiaochuan can ensure the market of monetary policy continuity at the central bank level. Indeed, Yi Gang was educated in the US for his master and PhD degree and was a professor in the US. At his first speech as the PBoC governor, he clearly put forward his three primary tasks: (i) maintaining a prudent and neutral monetary policy stance; (ii) pressing ahead with the reform and opening of domestic financial sector; and (iii) containing financial vulnerabilities to avert financial risks.

Third, the reform of merging LTBs and STBs holds out the promise of much more user-friendly tax compliance in future, as the complexities of the existing dual tax system create many challenges for taxpayers. It remains to be clarified whether there will also be a rebalancing of the allocation of tax revenue between local and central government, in parallel with this administrative reform.

Last but not least, the “two sessions” also removed the two-term limit for the presidency in the constitution, paving the way to Xi Jinping to remain the power beyond 2023. Such an eye-catching move will undoubtedly incur negative comments from the international community and domestic liberal elite, but given the current political landscape in China, it is unimaginable for it to lead to any social unrest or political instability. Above all, the regime change at the top leader level should not lead to the change in the Party’s goal of achieving prosperous economy and its pre-set agenda. We therefore tend to interpret it as neutral to our pre-set China’s scenario. That being said, China is still able to maintain a decent growth rate at least over the next decade.

The rising “trade war” risk and its potential impact on China

Fears of a trade-war between the US and China are escalating. A ‘tit for tat’ protectionist trade rhetoric between two of the world’s dominant economies has unnerved investors and rattle financial markets amid concerns that the current trade skirmish, if it escalates into a full-blown trade war could upend global growth momentum and threaten financial stability.

The US President Trump has implemented a series of restrictive measures on China’s exports to the US since the beginning of the year. On top of imposing the tariffs on China’s exported solar panels, washing machines, aluminium foil, steel and aluminium in the previous months, the US also announced a list of 1,333 Chinese products exported to the US on which the US administration plans to levy 25% punitive tariff. Total value of these Chinese exports amounted to USD 50 billion in 2017.

China stroke back swiftly by announcing its retaliatory list of US exports with the same value of USD 50 billion and vowed to take “whatever it takes” to defend national interest.

Although both sides still appeared to play tough at the current stage, we deem that the chance of them to reach some agreement to avert a full-blown trade is still large. In particular, China has offered to buy more semiconductors from the US by diverting some purchases from South Korean and Taiwanese manufacturers, in an effort to help reduce annual USD 375 billion merchandise trade surplus with the US. Moreover, China also promised to further open China’s financial services sector and reduce Chinese tariffs on imported cars.

That being said, the risk of full-blown trade war with the USD is not in our base scenario although trade skirmishes between two largest country economies could linger for quite a while. In theory, these skirmishes should not have a large impact on China’s growth and even its gigantic export sector. For example, direct steel export from China to the US is not large, taking around 3.2% of the US total steel imports.

A more worrisome situation is Trump’s trade war might disturb the domestic reform progress. As re-emphasized in the “two sessions”, the authorities will continue to push forward the financial deleveraging and de-capacity in the real sector. The market worries that if the authorities might change their policy stance and stimulate domestic demand again if they exaggerate the change of a full-blown trade war. Fortunately, the authorities haven’t shown any sign in this respect.

All in all, we expect China and the US will eventually reach an agreement to avert a trade war despite recently escalated rhetoric. Moreover, China needs to push forward deleveraging in over-capacity industries as well as other important items on its reform agenda including SOE reforms, financial regulatory framework etc.

4. External risks are on the rise

External risks are on the rise recently. The external demand is subject to headwinds from rising trade protectionism from the US. Although till now there is still no specific clue whether the trade war will actually happen, market sentiments have already turned negative regarding China’s exports and exchange rate etc.

At the current stage, although the moves have fuelled fears that the situation could escalate into a full-blown trade war between the world's two largest economies, Chinese authorities, together with their US counterparts, have been actively seeking for solutions to avoid the trade war with the US. The current negotiations are surrounding the following perspectives: the US wants Beijing to reduce tariffs on American cars, increase spending on US semiconductors and provide greater access to the Chinese financial sector; also, the US wants China to do a lot more to open up its vast economy to US businesses and bring down the massive trade deficit between the two countries; in addition, Trump has set a target of cutting the deficit in goods with China by USD 100 billion. Thus, the probability of the trade war is actually depending on the negotiation result of the two sides.

By calculating the value-added part of China’s exports to the US, we estimate that among the USD 50 billion amount of China’s exports to the US which are subject to Trump’s tariff imposing, around USD 30 billion are value-added production in China (other USD 20 billion are from the upstream countries which have supply chain with China). This will lead to around 0.45% GDP decreasing with a rough assumption that net exports to the US will decrease by tariff-subjective amount.

We expect China will respond the trade protectionist measures in a relatively limited fashion which would limit the scope of the conflict of the two largest economies, although we need to cautiously watch the progress of this issue these days.

In addition, the large-scale US tax cuts have enhanced the U.S. position against other industrialized economies. And the US FED interest rate hike, although most part of which has been priced in among the market participants, might trigger rebalancing of the global monetary policy stance and a following-up interest rate hike globally as widely discussed in the market.

Risks regarding on growth are also from the domestic policy side. The on-going deleveraging in the real economy and financial sector, with its original intention of mitigating the over-capacity and financial instability respectively, might drag on growth in the medium term. These policy measures mainly include supply-side deleveraging as well as cooling down the housing market and shadow banking. Altogether, the authorities need to find a balance and choose an appropriate pace between pushing forward the deleveraging progress and maintaining a sustainable growth momentum. In this respect, market participants should guard against the risk of over-tightening stemming from the overconfidence of policymakers or the uncoordinated policy conduct among monetary, fiscal and supply-side policy initiatives.

[1] This is also verified by the CPB World Trade Monitor, January 2018, prepared by CPB Netherlands Bureau for Economic Policy Analysis - https://www.cpb.nl/en/figure/cpb-world-trade-monitor-january-2018

[2] The limited data available for February suggest that retail sales in developed countries will have held steady or fallen again, whereas emerging markets could show some growth since China and the rest of emerging Asia show signs of a slight uptick during the month.

[3] Starting from January 2018, NBS has cancelled the statistical indicators for the sales price of affordable housing and only compiled and released the sales price index f or newly constructed commercial residential buildings. No sales price index for newly constructed residential buildings was compiled.