Steve H. Hanke: What Do the Great Depression and the Great Recession Have in Common?

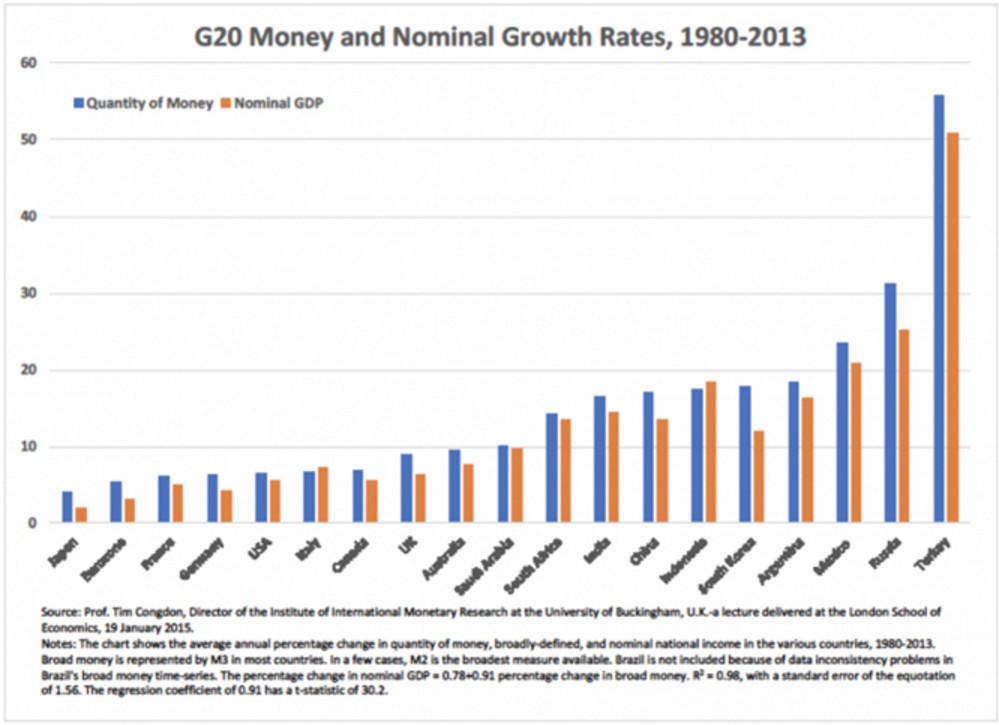

2017-08-28 IMI If we apply a monetary approach to national income determination for the Great Depression, we find that the money supply, broadly measured (M3), plunged by 40% in the 1929-1933 period. Milton Friedman and Anna Schwartz, in their famous work, A Monetary History of the United States 1867-1960, showed just how the blame for the Great Depression can be laid at the doorstep of the Fed. Yes, it was a central bank, a government institution, that was the cause of, and should have borne the blame for, the Great Depression.

Never mind. The Federal Reserve (the Fed) was not blamed at the time. Instead, capitalism was fingered, and in consequence we had the New Deal. Misguided government policies not only caused the Great Depression, but also resulted in a deeper and longer depression. As Robert Higgs summarizes in his book, Against Leviathan: Government Power and a Free Society, Washington D.C. compounded the monetary problems generated by the Fed. The New Deal created regime uncertainty. In the words of Higgs:

Roosevelt and Congress, especially during the congressional sessions of 1933 and 1935, embraced interventionist policies on a wide front. With its bewildering, incoherent mass of new expenditures taxes, subsidies, regulations, and direct government participation in productive activities, the New Deal created so much confusion, fear, uncertainty, and hostility among businessmen and investors that private investment and hence overall private economic activity never recovered enough to restore the high levels of production and employment enjoyed during the 1920s.

In the face of the interventionist onslaught, the U.S. economy between 1930 and 1940 failed to add anything to its capital stock: net private investment for that eleven-year period totaled minus $3.1 billion. Without ongoing capital accumulation, no economy can grow….

The government’s own greatly enlarged economic activity did not compensate for the private shortfall. Apart from the mere insufficiency of dollars spent, the government’s spending tended, as contemporary critics aptly noted, to purchase a high proportion of sheer boondoggle.

In the Great Recession, we witnessed the same pattern as we did in the Great Depression. The money supply, broadly measured (M3), was growing at a year-over-year clip of 17.4% in March of 2008. From that peak rate, it plunged to a negative 6.1% (yr/yr) in June 2010. With this plunge in the money supply, nominal GDP plunged, too. Both inflation and real growth came down hard—not because of market failure, but because of government failure.

4.Question: What were the contours of the key markers in the Great Recession?

Answer: Like the Great Depression, the government was quick to blame flaws in the capitalist system and the alleged excesses they created. Bankers and banks came in for a thrashing. To make the economy safe from these alleged culprits, the Dodd-Frank legislation was passed, Basel III was imposed, and a plethora of other regulations and mandates were introduced to the financial industry.

How did such a misdiagnosis occur? By ignoring the monetary interpretation of national income determination, the “Doctors” will always misdiagnose. Let’s look at what was happening: In the July 2008 - November 2008 period, the U.S. dollar soared by 25% against the euro, the price of gold plunged by 19%, and the price of oil dropped by 57%. Also, the consumer price index went from its elevated level of 5.6% per year in July 2008 to 0% in January 2009, and further dropped to a negative 2.1% in July 2009. All these price indicators should have signaled that the Fed was way too tight with the money supply reins during the early phase of the Great Recession. But, Chairman Bernanke and his colleagues, the central bank, failed to act. This does not represent a case of market failure. No. It represents government failure—the application of a misguided set of pro-cyclical economic policies.

For a detailed and correct diagnosis of the Great Recession, allow me to recommend a book that has just been released by Tim Congdon (ed.), Money in the Great Recession: Did a Crash in Money Growth Cause the Global Slump. Among others, I contributed the chapter on the U.S. “The Basel Rules and the Banking System: An American Perspective.”

5.Question: Where are we now?

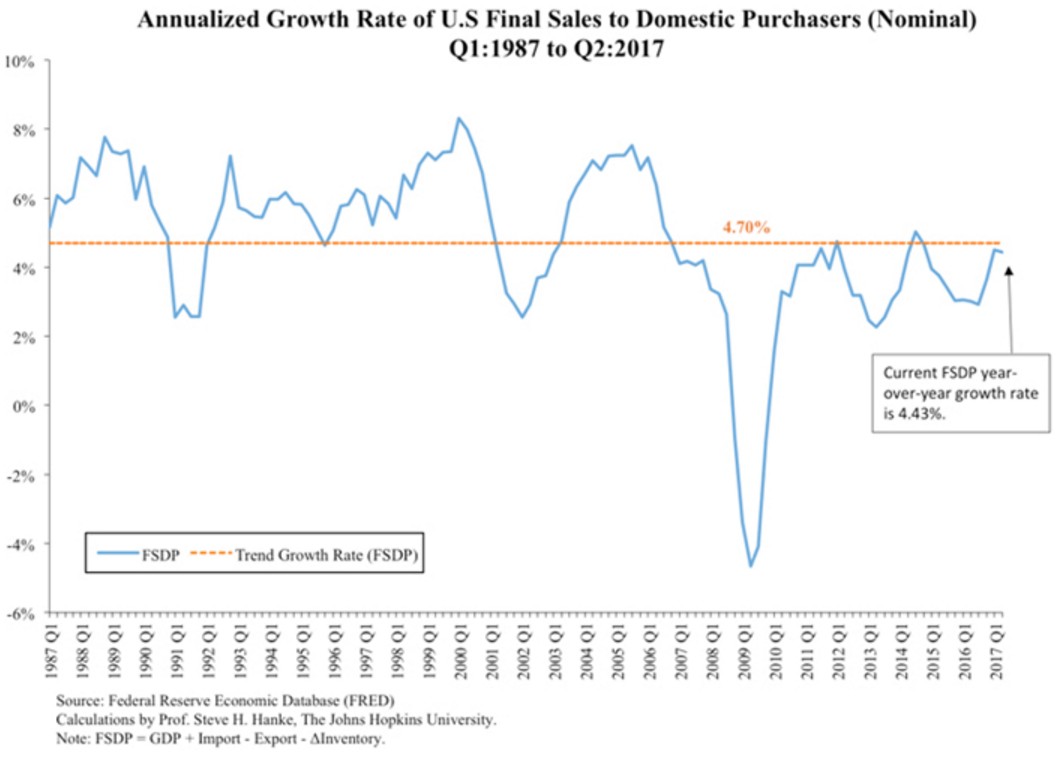

Answer: Aggregate demand, which is represented by Final Sales to Domestic Purchasers in the U.S. is shown below. As can be seen, we had the Great Recession, and we remain, ten years after the start of the slump, in a growth recession. We are growing, but still growing at below the trend rate of growth. Thanks to Washington’s regulatory zeal that has kept bank credit (the major contributor to broad money, accounting for over 80% of its total) squeezed. Yes, during a growth recession the U.S. has endured a credit crunch (read: thanks to government failure). If we look at the money supply growth, measured by M3, it remains “slow” and has been slowing down slightly, as the Fed starts a “tightening” cycle. In addition, there is a considerable amount of regime uncertainty in Washington, D.C. Both of these factors pose cause for concern. Indeed, there will probably be no “Trump Boom.”

If we apply a monetary approach to national income determination for the Great Depression, we find that the money supply, broadly measured (M3), plunged by 40% in the 1929-1933 period. Milton Friedman and Anna Schwartz, in their famous work, A Monetary History of the United States 1867-1960, showed just how the blame for the Great Depression can be laid at the doorstep of the Fed. Yes, it was a central bank, a government institution, that was the cause of, and should have borne the blame for, the Great Depression.

Never mind. The Federal Reserve (the Fed) was not blamed at the time. Instead, capitalism was fingered, and in consequence we had the New Deal. Misguided government policies not only caused the Great Depression, but also resulted in a deeper and longer depression. As Robert Higgs summarizes in his book, Against Leviathan: Government Power and a Free Society, Washington D.C. compounded the monetary problems generated by the Fed. The New Deal created regime uncertainty. In the words of Higgs:

Roosevelt and Congress, especially during the congressional sessions of 1933 and 1935, embraced interventionist policies on a wide front. With its bewildering, incoherent mass of new expenditures taxes, subsidies, regulations, and direct government participation in productive activities, the New Deal created so much confusion, fear, uncertainty, and hostility among businessmen and investors that private investment and hence overall private economic activity never recovered enough to restore the high levels of production and employment enjoyed during the 1920s.

In the face of the interventionist onslaught, the U.S. economy between 1930 and 1940 failed to add anything to its capital stock: net private investment for that eleven-year period totaled minus $3.1 billion. Without ongoing capital accumulation, no economy can grow….

The government’s own greatly enlarged economic activity did not compensate for the private shortfall. Apart from the mere insufficiency of dollars spent, the government’s spending tended, as contemporary critics aptly noted, to purchase a high proportion of sheer boondoggle.

In the Great Recession, we witnessed the same pattern as we did in the Great Depression. The money supply, broadly measured (M3), was growing at a year-over-year clip of 17.4% in March of 2008. From that peak rate, it plunged to a negative 6.1% (yr/yr) in June 2010. With this plunge in the money supply, nominal GDP plunged, too. Both inflation and real growth came down hard—not because of market failure, but because of government failure.

4.Question: What were the contours of the key markers in the Great Recession?

Answer: Like the Great Depression, the government was quick to blame flaws in the capitalist system and the alleged excesses they created. Bankers and banks came in for a thrashing. To make the economy safe from these alleged culprits, the Dodd-Frank legislation was passed, Basel III was imposed, and a plethora of other regulations and mandates were introduced to the financial industry.

How did such a misdiagnosis occur? By ignoring the monetary interpretation of national income determination, the “Doctors” will always misdiagnose. Let’s look at what was happening: In the July 2008 - November 2008 period, the U.S. dollar soared by 25% against the euro, the price of gold plunged by 19%, and the price of oil dropped by 57%. Also, the consumer price index went from its elevated level of 5.6% per year in July 2008 to 0% in January 2009, and further dropped to a negative 2.1% in July 2009. All these price indicators should have signaled that the Fed was way too tight with the money supply reins during the early phase of the Great Recession. But, Chairman Bernanke and his colleagues, the central bank, failed to act. This does not represent a case of market failure. No. It represents government failure—the application of a misguided set of pro-cyclical economic policies.

For a detailed and correct diagnosis of the Great Recession, allow me to recommend a book that has just been released by Tim Congdon (ed.), Money in the Great Recession: Did a Crash in Money Growth Cause the Global Slump. Among others, I contributed the chapter on the U.S. “The Basel Rules and the Banking System: An American Perspective.”

5.Question: Where are we now?

Answer: Aggregate demand, which is represented by Final Sales to Domestic Purchasers in the U.S. is shown below. As can be seen, we had the Great Recession, and we remain, ten years after the start of the slump, in a growth recession. We are growing, but still growing at below the trend rate of growth. Thanks to Washington’s regulatory zeal that has kept bank credit (the major contributor to broad money, accounting for over 80% of its total) squeezed. Yes, during a growth recession the U.S. has endured a credit crunch (read: thanks to government failure). If we look at the money supply growth, measured by M3, it remains “slow” and has been slowing down slightly, as the Fed starts a “tightening” cycle. In addition, there is a considerable amount of regime uncertainty in Washington, D.C. Both of these factors pose cause for concern. Indeed, there will probably be no “Trump Boom.”

6.Question: Where should one invest?

Answer: This is always a difficult one to answer. That said, for the risk averse investor, I like Treasury Inflation Protected Securities (TIPS). Inflation expectations will eventually start to change from deflationary to inflationary, and when they do, TIPS, which are mispriced at the present, will generate a nice capital gain. For those with larger risk appetites, there are several special situations available. For example, one promising case is represented by distressed debt in India. Lastly, there are always mispriced equities out there for the picking. That is, if you have the right valuation methodology, which I think I do. Indeed, by applying my “Probabilistic Discounted Cash Flow Model,” which I have developed over the past 25 years, my class at Johns Hopkins, over the past two years, has been able to pick stocks that have generated returns that are almost double those of the S&P 500.

6.Question: Where should one invest?

Answer: This is always a difficult one to answer. That said, for the risk averse investor, I like Treasury Inflation Protected Securities (TIPS). Inflation expectations will eventually start to change from deflationary to inflationary, and when they do, TIPS, which are mispriced at the present, will generate a nice capital gain. For those with larger risk appetites, there are several special situations available. For example, one promising case is represented by distressed debt in India. Lastly, there are always mispriced equities out there for the picking. That is, if you have the right valuation methodology, which I think I do. Indeed, by applying my “Probabilistic Discounted Cash Flow Model,” which I have developed over the past 25 years, my class at Johns Hopkins, over the past two years, has been able to pick stocks that have generated returns that are almost double those of the S&P 500.